This week I’m dipping into the mailbag to answer some questions from a reader named Don about the Affordable Care Act subsidies and the income limits to watch out for if you don’t want to lose your subsidy or face an unexpected increase in health care costs.

In the past, I talked about the ACA (or “Obamacare”) making early retirement a lot easier where I went over two case studies. One case study was for an older couple approaching traditional retirement age. The second case study was my own situation of a family of five including three children.

On to today’s question! Don from Ohio says:

I’ve been a long time reader and really appreciate your perspectives and analysis. I currently work for a large corporation and I’m working with my wife to plan a second career that allows me to spend a bit more time with our 3 boys (6, 4 and 1). As we’ve looked into health care it looks like we’ll have some good options with a government subsidy (assuming we only produce enough income to cover our $65,000 annual spending). I want to get your thoughts and perspective on a couple items related to health insurance.

Don goes on to explain that he wants to start his own business using the knowledge he’s gained in his main career, and that his wife already works as a freelancer. The new business wouldn’t be full time at first, and would allow Don to spend more time with his family. Don also has significant financial investments, but not quite enough to declare their family fully financial independent yet.

Some might call what Don wants to do “semi-retirement”. Whatever you call it, it sounds like a great plan to cut back on work and still make enough to cover Don’s and his family’s needs.

Don’s first question:

Have you seen any good tables or charts that clearly shows what MAGI qualifies for what subsidies based on number of dependents? I’ve seen general summaries but I’m concerned I could report an extra couple of thousand in MAGI that causes thousands of extra dollars in health care cost. I’d love to have the right information to make effective cost/benefit decisions.

To answer the question, first let’s go over how the ACA subsidies work, then we’ll find that table you’re looking for. It’s unfortunately a pretty complex calculation to determine what your individual subsidy will be. Your household’s subsidy is determined by your MAGI (“modified adjusted gross income”), your household size, zip code and state you live in, and the price of the “second lowest cost silver plan” (SLCSP to borrow the IRS’s abbreviation).

Health Insurance Premium Subsidies

The ACA says you’ll only have to pay a certain amount of your income for health insurance, which can range from 2% of your MAGI up to 9.5% of your MAGI. The exact percentage of your income that you’ll pay is determined by the ratio of your MAGI to the federal poverty level (FPL) for your household size (check out Table 2 from the IRS instructions for Form 8962, Premium Tax Credit).

This “percent of FPL” is a critical concept in the Affordable Care Act. Too low or too high, and you won’t qualify for a subsidy. The percent of FPL also determines whether you qualify for extra cost sharing which can drastically reduce your out of pocket medical costs. As a result, you want to make sure your MAGI, and therefore your “percent of FPL” is high enough to qualify you for subsidies but not too high where your subsidy is tiny or gets eliminated completely. You also want to make sure your percent of FPL qualifies you for cost sharing subsidies if you’re near the 100% to 250% of FPL range.

For those not familiar with the federal poverty level, here’s a table for the 2014 FPLs that the IRS will apparently use for 2015 ACA subsidy calculations (they used the 2013 FPL table for 2014 taxes):

- Household size of 1: $11,670

- Household size of 2: $15,730

- Household size of 3: $19,790

- Household size of 4: $23,850

- Household size of 5: $27,910 ( <– that’s you, Don!)

- Household size of 6: $31,970

So what is Don’s “percent of FPL”? $65,000 MAGI income divided by $27,910 (FPL for a family of 5) equals 233% of FPL.

What’s Don going to pay for health insurance? When I look up 233% of FPL in Form 8962 instruction’s Table 2, I see Don will pay 7.46% of his MAGI toward the “second lowest cost silver plan” if he chooses that plan. That’s $4,849 on a $65,000 MAGI.

The subsidy that Don gets is the cost of the SLCSP minus the $4,849 he’s expected to pay for that SLCSP. Taking a look at Don’s healthcare.gov plans available to those in Ohio, I see the second lowest cost silver plan has a premium of $10,080 per year. This means Don’s subsidy will be around $5,231 per year. Oddly enough the healthcare.gov site says Don’s subsidy will be $5,088. That’s pretty close, but I’m not sure why there is any difference. Ultimately, when you file taxes each year you might get a little extra credit back or have to pay a little more if you took too much credit during the year.

The $5,231 subsidy can be used to pay for any plan including lower cost bronze plans. I found a bronze plan for Don’s family that would be $2,000 per year cheaper than the second lowest cost silver plan (although with a much higher deductible and copays).

Cost Sharing Subsidies, or How to Get a cheap Gold Plated Silver Plan

For those with MAGI’s in the 100% to 250% of Federal Poverty Level range, there are “cost sharing subsidies” that reduce copays, deductibles, and out of pocket maximums. These cost sharing subsidies only apply to silver level plans.

As MAGI increases, the cost sharing subsidies decrease. I won’t get into the fine details of how the cost sharing subsidies work, but they basically rewrite the silver plans to make them cover a higher percentage of the average policyholder’s medical expenses. A normal silver plan pays for 70% of the policyholder’s medical expenses.

With the cost sharing subsidy, silver plans will pay between 73% to 94% of medical expenses, depending on MAGI. For MAGI’s between 100-150% of the FPL, the plan covers 94% of medical expenses. For MAGI’s between 150-200% of the FPL, the plan covers 87% of medical expenses. For MAGI’s between 200%-250% of the FPL, the plan covers 73% of medical expenses.

The sweet spot to get the most benefit out of the cost sharing subsidy is a MAGI of 100% to 200% of the FPL. That translates to a MAGI of $27,910 to $55,820 for a household of five. In the 200% to 250% range, the cost sharing subsidy covers 73% of medical expenses, which is only 3% more than the 70% coverage of expenses under regular (non-cost sharing subsidy) silver plans.

Let’s take a look at what the cost sharing subsidy covering 94% of medical expenses get you. In my case, I can get a silver plan with $0 copays for primary care physician, $20 for specialty physician, $100 ER copay, $0 deductible, and $2,000 out of pocket maximum. The same plan without the cost sharing subsidies comes with $10 copays for primary care physician, $60 for specialty physician, $250 ER copay, $7500 deductible, and $12,500 out of pocket maximum.

That’s why I call the silver plans available to those with low MAGI’s “Gold Plated Silver Plans“. With heavy cost sharing subsidies that come with a MAGI of 100-150% of FPL, you end up paying almost nothing for frequent visits to the doctor’s office. Suffering from a few major medical events in a year won’t cost more than a few thousand dollars once you hit the out of pocket max.

Other “Percent of FPL” considerations if you have kids

If your MAGI is below a certain level, children may end up on Medicaid or CHIP (Children’s Health Insurance Program). That can be good or bad. The good news is that Medicaid or CHIP means very cheap or free health insurance for children insured under those programs. At our income level, we would pay $50 per kid per year up to $100 max for CHIP health insurance. I’m not sure if it’s universal in all 50 states, but Medicaid and many CHIP plans cover dental care in addition to health care.

The bad news with Medicaid and CHIP is that some parents fear limited access to doctors and medical facilities and don’t want the stigma of having their kids on Medicaid or CHIP.

Since we will probably end up with CHIP insurance for our children, I checked the dental and medical provider databases to verify that we wouldn’t have to find new medical professionals. Nope, we’re good. Our family doctor (and the other 10 doctors in his practice) and dentist both accept Medicaid and CHIP. So do 140 other medical providers in our county.

If we needed lots of medical care or specialists, then the limited network of Medicaid/CHIP doctors might be a problem. But we rarely visit the doctor outside of annual physicals, so whatever limitations on provider networks and coverage isn’t a big deal. That could change at any moment, and we can always change our insurance coverage once per year during annual enrollment if CHIP fails us and we need broader networks or more comprehensive coverage.

In North Carolina, children over age six qualify for CHIP at MAGI’s between 134-211% of the FPL, with Medicaid available for income levels below that range. It’s not exactly a poverty level program since families of five earning up to $59,000 per year are eligible for CHIP benefits.

For Don in Ohio, kids are eligible for Medicaid at MAGI’s up to 206% of the FPL. For Don’s family of five, that works out to a MAGI of $57,500. So Don would have to reduce his income just a bit to get down to $57,500 if he wanted to qualify his children for Medicaid instead of regular health insurance.

Avoiding the Perilous Subsidy Cliffs

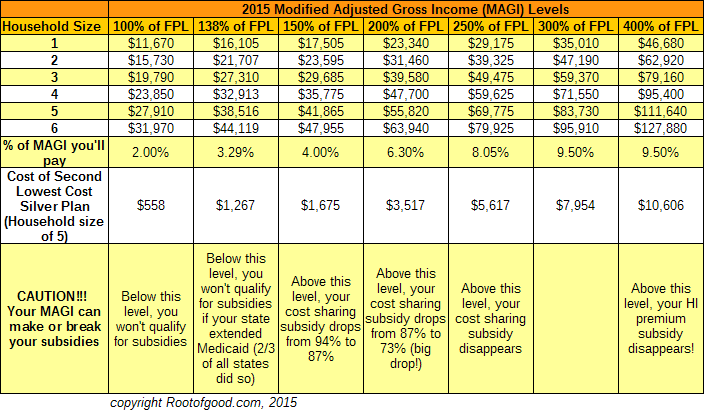

Don, here’s the chart you are looking for. I made it myself.

This chart shows what you’ll pay for health insurance at different income levels. It also shows the income levels where the various subsidies weaken or disappear.

- Below 100% of FPL: you won’t qualify for any subsidies

- Between 100% and 138% of FPL: you won’t qualify for any subsidies if your state is in the two-thirds of all states that extended Medicaid

- 138-150% of FPL: You’re getting huge premium subsidies and qualify for large cost sharing subsidies with 94% of medical expenses paid on Gold Plated Silver Plans

- 150%-200% of FPL: You’re getting significant premium subsidies and qualify for moderately large cost sharing subsidies with 87% of medical expenses paid on Gold Plated Silver Plans

- 200-250% of FPL: You’re getting significant premium subsidies and qualify for slight cost sharing subsidies with 73% of medical expenses paid on Gold Plated Silver Plans

- 250%-400% of FPL: You will probably still get health insurance premium subsidies though they may be small for young people at the upper end of the income range. You’ll never pay more than 8.05% to 9.5% of your MAGI for health insurance.

- 400%+ of FPL: No subsidies for you, Mr. Deep Pockets!

At $65,000 income, Don’s MAGI is 233% of the Federal Poverty Level for a household of five. Since Don is over 200% of FPL, he won’t get the juiciest cost sharing subsidies (87% of expenses paid just below 200% of FPL vs. 73% of expenses paid at 233% of FPL). But Don will still get a significant subsidy toward his health insurance premium (over half of the premium will be covered by the subsidy).

If Don wanted to get his MAGI below 200% of the FPL to $55,820, he could get access to the cost sharing subsidy and pick up one of the Gold Plated Silver Plans with an 87% medical expense coverage. However, it would also likely put his children on Ohio’s Medicaid program for children.

Don, It really boils down to how hard you want to tweak your income to save some health care dollars, and are you okay with your kids being on Medicaid. If either of the adults in your household have major medical issues (or they arise later), that 87% Gold Plated Silver Plan could come in handy. However you should definitely verify that you’ll have access to your preferred doctors and hospitals if your kids end up on Medicaid for kids.

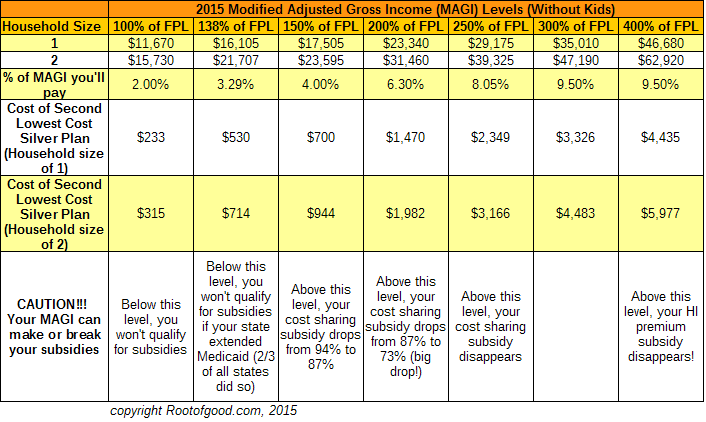

For my other readers who don’t have kids or whose kids are already out of the house, here’s the same chart adjusted for households of one or two people.

On to Part 2 of Don’s question:

2. Given we only really need $65K (I know, that’s a high number for you!) in income to live off of my plan has been to funnel any extra income to a solo-401K. This keeps MAGI lower and continues very affordable health care. Of course if we are fortunate to produce a significant amount more we might just have to deal with the higher health care costs. Am I missing anything here? Seems straightforward to me.

You pretty much have it figured out, Don! If you need to live off of $65k per year and manage to earn that from a combination of your and your wife’s self employment income, then you are set. If you don’t need any extra income above that level to fund your lifestyle, then a solo 401k is a great way to shelter extra income from taxation and to keep that income out of your MAGI that goes into the ACA subsidy calculations.

I started a solo 401k for Root of Good (it seriously says “Root of Good 401k Plan” on my Vanguard documents) for exactly this reason. I don’t necessarily need the income today since I have taxable investments to fund my living expenses, so I put everything I earn from the blog and other side hustles into the solo 401k. Contribution limits are pretty high at $18,000 per year plus 25% of your business income up to $53,000 total.

If you earn $65,000 per year and wanted to hit a lower income target in order to increase your premium subsidy or get below 200% of FPL to snag one of those 87% or 94% Gold Plated Silver Plans, the solo 401k or traditional deductible IRAs are great ways to shrink your MAGI.

———————–

I’d like to thank Don for his great questions. It was a good opportunity to go over the details of the Affordable Care Act’s subsidies and the impact of changes in AGI on those subsidies. If you’re able to control your AGI to some extent, you can save a lot of money by being mindful of the AGI breakpoints. Don’t fall off the cliff!

Where do the Affordable Care Act exchange and subsidies fit in your early retirement plans? Are you benefiting from the ACA right now?

photo credit: flickr user Bernt Rostad

Root of Good Recommends:

- Personal Capital* - It's the best FREE way to track your spending, income, and entire investment portfolio all in one place. Did I mention it's FREE?

- Interactive Brokers $1,000 bonus* - Get a $1,000 bonus when you transfer $100,000 to Interactive Brokers zero fee brokerage account. For transfers under $100,000 get 1% bonus on whatever you transfer

- $750+ bonus with a new business credit card from Chase* - We score $10,000 worth of free travel every year from credit card sign up bonuses. Get your free travel, too.

- Use a shopping portal like Ebates* and save more on everything you buy online. Get a $10 bonus* when you sign up now.

- Google Fi* - Use the link and save $20 on unlimited calls and texts for US cell service plus 200+ countries of free international coverage. Only $20 per month plus $10 per GB data.

Excellent in depth analysis! We are actually going through the process right now of figuring out how much it will cost for us to switch our insurance to the health care exchange system. The spreadsheets you made are extremely helpful. It’s ridiculous how overly complicated they have made the process of figuring out how much health insurance costs and obtaining it.

Thanks, hopefully it’ll help you. It certainly helped me figure out the sweet spots I might want to aim for (like 199% AGI or 249% AGI or whatever).

And wow is it ever complicated. I had to walk through the premium tax credit form and instructions to figure all this out.

Awesome analysis – it really got me thinking. In a few years when we FI, we will need to get insurance on the ACA, and right now, it is the biggest unknown in our budget. Without health/dental, we think we need about $45k to be happy, but we currently estimate health/dental costs at $10k for our family of 4. I really need to do an analysis like this for our situation! I do get quite frustrated with how complicated it seems to be…

Pre-ACA I was budgeting $10-12k for health insurance with a lot of unpredictability. With the ACA it seems like I can predict it pretty well assuming the ACA doesn’t radically change.

Wow very in depth. I haven’t thought about it too much yet, because I don’t plan on being financially independent for another 11 years or so. And we all know these laws / rules will change a bunch of times from now to then whenever different political parties gain power. Hopefully there is still some sort of subsidy once I get there, or maybe I’ll have a big enough nest egg where I won’t care 🙂

I bet we’ll have something. Whether it’s the ACA, something similar, or something totally different remains to be seen.

Thank you for this great write-up. It’s helpful to have some numbers and analysis to think about. Great work here.

Great write up on a very complicated topic. An additional fact to know is that if you estimate your income too low you do not have to pay back the cost sharing benefits, only the difference in premium subsidy. Don could estimate his income at 200% FPL to qualify for the 87% cost sharing and he would not have to pay back the difference in medical copays to 70% if he had a great year and ended up being at 250% FPL.

Definitely something to keep in mind if you’re near the thresholds. You can take a few hundred $$ off your estimated AGI and fall to the next lowest bracket for cost sharing subsidy purposes.

And there’s a limit to how much of the premium tax credits you’ll have to repay too.

Your post prompted me to investigate the difference between AGI and MAGI, which I’ve never really looked at. Am I correct in my understanding that a solo-401k contribution reduces MAGI, but an IRA contribution does not? (IRA contributions get added back in when going from AGI to MAGI)

MAGI and AGI are almost the same. MAGI = AGI plus untaxed SS benefits, tax exempt muni bond interest, and non-taxed foreign earned income.

So if you live and work in the US, don’t get any SS (most don’t under age 62 or 65 anyway), and don’t have muni bond interest, MAGI equals AGI in general.

Very nice

In addition to the RoG 401k would there be advantages to having the RoG Healthplan?

For Don, would the EITC also come into play? And would there be a sweet spot, not too much income not too little, with a maximum tax benefit? (Max combined EIT Credit and ACA Subsidy)

Jeremy – agree with the need for analysis on EITC. The challenge with the EITC is that investment income of over $3,400 kills your EITC. Thus, in the $65,000 scenario you could get below the EITC income level by deferring income to a solo 401k but you’d likely need to cover what you deferred (to get down to the EITC level) with investment income. I might be misinterpreting rules but seems you’d need to pull from cash savings or basis vs. gains to make it happen in this scenario.

Hmmm… RoG healthplan! Yes! I forgot about that. I think I can deduct health insurance premiums once we are on the ACA as long as I’m self employed (ie the blog and/or freelance writing income continues). I’ll have to look into that more closely though. Form 1040 instructions refer me to Publication 974 and that leads to many many pages of complexity.

As for the EITC, I think Dan did a good job answering. Odds are that interest and dividend income will top the $3400 limit that destroys EITC eligibility. And I think IRA conversions look like pension/retirement account income and also go against the investment income limits for the EITC, so a Roth IRA ladder would be a no-no to qualify for the EITC. It sucks that us millionaires can’t get a few more (thousand) in gubmint benefits, but kudos to the drafters of the EITC because it does a great job of weeding out wealthy looking people without an asset test.

It looks like you’ve already done 95% of the analysis for the Self-employed health insurance deduction (it all overlaps the table you created above)

I gave up researching once I got to “Iterative Method”.

As I recall, the self employment HI deduction reduces AGI which changes the ACA subsidies available which changes your subsidy which changes the cost of your SE HI which changes the deduction and hence your AGI… repeat ad infinitum and that’s the rabbit hole we created. 🙂

I saw something about “simplified method” that can be used instead of the iterative method. My experience with the word “simple” and the IRS is that it’s usually a misnomer. So more research is needed in this area.

I see my ploy to get you to do this research for me has failed

Arghhh, foiled again!

Fantastic article! It’s nice to see such in-depth analysis that breaks things down so well. This is particularly relevant to my wife and I given we are thinking through the same thing. Keep up the good work!

Thanks, Dan! Glad it’s helpful for your family too. 😉

It’s almost counter intuitive that someone with such large assets but low cost of living qualifies for the healthcare premium subsidies. Maybe they knew it could happen, but figured that it’s not common enough to close the loophole.

My question is on your analysis of Don’s subsidy, which is based on the cost of the Silver Plan. You calculate his subsidy at $5,231 due to the requirement to spend $4,849 of his own money. Then you say he could use the $5,231 subsidy on a lower cost Bronze Plan. The way I understand it is that his subsidy would be smaller if he chooses a cheaper plan. His requirement to spend $4,849 stays the same, so his subsidy goes down by $2,000. Am I wrong?

I don’t think the ACA ever intended to give subsidies only to low income people. Subsidies are available up to 400% of the federal poverty level, a threshold much higher than virtually all of the other traditional public benefits or “welfare” programs like medicaid, food stamps, etc.

For example, our family could have an AGI over $111,000 (and have a much higher gross income before retirement contributions) and still qualify for ACA subsidies. Where I live, $100,000 or $150,000 gross income affords a pretty decent lifestyle.

As for the second part of your comment, the subsidy is what it is. It remains the same regardless of whether you buy a cheaper plan or more expensive plan. We have a few bronze plans available to us for $0 per month or something tiny like $21/month for exactly this reason. The only exception to that rule is that you don’t get a refund back if you buy a really cheap bronze plan. If Don’s subsidy is $5,231 and a bronze plan is available with $5000 per year premiums, Don will pay nothing for premiums on that bronze plan, but won’t get a refund of the unspent $231 subsidy.

Confusing I know. But the main point here is that you first determine what you “ought” to spend on the second lowest cost silver plan based on AGI, which determines your subsidy amount. Then buy whatever plan works best for your family.

Wow, great in-depth analysis. I’ll check with you again before Mrs. RB40 quits her job. 😉

One question – so the adults can get on Medicaid if they’re at 100% FPL, right?

If we take a year or two off to travel, we probably will fall down to that range.

Joe, it depends on whether your state extended Medicaid. I think yours did, but ours (NC) didn’t. And if your state extended medicaid, you can get on medicaid at 138% of FPL. If you’re relatively healthy, it’s probably not a bad plan (though the quality of medicaid plans vary by state).

Holy cow there is a ton of great information to digest in this article. Thanks for sharing Justin, this is a question that I have for myself and need to re-read this article a few times to make sure I understand it all!

In any of your research did you come across how MAGI gets adjusted (or doesn’t) if one member of your household is insured outside of the marketplace? Healthcare.gov gave me a predicted subsidy but it seems like I somehow got less premium than expected. Mostly curiosity at this point.

I’m not sure how that works. So the marketplace says you’ll get some kind of subsidy even if another member of your household has non-exchange insurance?

I know you’ll settle up any differences in subsidies come tax time, but getting it wrong could be a big surprise financially if you have to repay some of the subsidy.

I did a touch more research last night (my interest is what would happen if I quit working on January 1). I don’t know if I’m right on this, but I think I am. Because my husband is a student and has access to a student healthcare plan he can choose that plan or the marketplace plan (without penalties).

In my fake scenario, if he chooses marketplace then our subsidy levels are based off of a household of 3, but if not, our total income is applied to a household of 2, but one of those 2 (my son) ends up on medicaid. At a low enough income (such as the level of income provided by our rentals + my husband’s stipend), we end up paying next to nothing no matter what scenario I choose, but there is no avoiding having at least 2 and maybe 3 different healthcare plans.

This exercise helps me remember why I did not pursue my PhD in economics. Economists and politicians make a poor pairing.

Ok, I think I understand your situation better now. Since your husband has the option to take the student healthcare plan, it’s not employer provided coverage. So you could both apply for exchange HI or just you alone (plus a kid) could apply.

And regardless of whether you apply through the exchange, your kid could qualify for CHIP/medicaid based on your household AGI.

You can also reduce income if necessary by getting a plan with a health savings account (HSA). See here: http://obamacarefacts.com/health-insurance/health-savings-account-hsa/

I’d like to shop around on healthcare.gov to see what hsa plans are available with a premium subsidy. What’s the secret to getting around their roadblocks since it’s not active enrollment season?

Anyway, thanks for this post! This will be great reference material once I retire. Assuming, of course, the “Supremes” don’t kick the ACA to the curb this summer.

Thanks for the heads up on the HSA. We’ll probably go with a gold plated silver plan as long as we’re in the sweet spot of heavy cost sharing subsidies. But at some point a plan w/ HSA might make sense.

As for getting to the plans, I had to google for the link because it’s not available directly from healthcare.gov apparently. But here it is: https://www.healthcare.gov/see-plans/

You should be able to put in your zip, then income and HH size and get to view the available plans.

Going with your example for 2015 subsidies, the IRS will use the 2014 FPL to calculate your number, but what year’s MAGI will they use? I imagine this would also be 2014 since that would be the latest record? If so, could this significantly affect those who are in their first year of FI and getting their own health care for the first time? That is, if they calculate your MAGI based on your last year working (2014), which was significantly higher than your MAGI in your first year FI (in which you will only be withdrawing enough to cover cost of living), then you may not get any subsidies.

The MAGI used is for the current year. So this year’s subsidies are based on 2015 MAGI. Of course none of know what our MAGIs are for 2015, so it’s some estimate. You could use last years MAGI, or when you apply, tell the exchange that you’re retired (or “not working”) and estimate your income. I’ve heard some folks say they got a little push back from the exchange about having zero income or only investment income, but it’s usually something you can get approved after a little paperwork.

In any event, you “true up” your subsidies when you file taxes in April of the following year. So estimate too little or too much MAGI and you may get more or less subsidy through your tax form and the Premium Tax Credit form.

Great POST!!! Thanks for all the detail.

You’re certainly welcome! Hope it helps.

It always frustrated me on the MMM forum how people were talking negatively about ACA. ACA is going to be instrumental in many people’s FI.

Going without Health Insurance is probably the biggest risk one could take into early retirement and ACA makes insurance accessible to basically everyone and much more affordable for people without standard employment.

I actually go into pretty great detail about how risky being uninsured is for someone with FI aspirations in this thread:

http://forum.mrmoneymustache.com/off-topic/will-i-ever-be-able-to-get-health-insurance/

Take home is basically being uninsured has basically an infinite downside so paying less (or more) for insurance that the insurance company cannot kick you out of when you need it and without yearly/lifetime maximums is absolutely a good deal.

In fact, many people are planning to retire after ACA that previously would have held their job solely for secure coverage. Also, the law has been costing much less than projected. Despite being controversial, so far the law has been win, win, win, all around.

I view health insurance for those on the path to FI not as an insurance that improves your access to health care, but rather as insurance to protect your assets if you do need expensive care. So yes, the ACA is a huge benefit for the middling wealthy people seeking or possessing FI. You can go through life knowing you’ll have access to insurance without paying more than about 10% of your income as long as you don’t make more than 400% of the poverty level income.

For the vast majority of folks who aren’t on the path to FI, they still benefit greatly versus the old days of having silly stuff like asthma or a broken bone considered a pre-existing condition and reducing the scope of HI coverage or making you ineligible for HI coverage at all. There are certain groups that pay more today versus under the pre-ACA system, but I haven’t seen any good real life examples of someone who’s genuinely unable to get HI today.

Great write up. Very informative. I didn’t know many of these Subtleties.

Thanks! Glad to share what I know!

great info. Unfortunately I am also in Ohio, so I want to get a plan in the 150-200% range, but then that qualifies my son for Medicaid, and he has health issues, I have some serious research to do before I go part time. I don’t know enough about Medicaid in Ohio, but it kind of scares me knowing my sons health issues.

Thanks again.

Definitely research the medicaid option before committing to it. I don’t know a lot about our medicaid plan for kids here in NC, but I’ve known many people on it and never heard horrible complaints (beyond general complaints that all insurance gets). Make sure your docs accept the medicaid and whatever other facilities or treatments are covered. Our NC Children’s HI program has an online provider listing/directory so I was able to verify our primary care docs participate.

I’ve left a couple messages, and am waiting to hear back from Ohio Medicaid, but from talking it over with my doctors/hospital, they all agreed that it is great coverage, and would not see any issues for my son if we were to go on it. I’ll continue to do more research, but I’m glad to hear this.

I know currently I max out my out of pocket each year, which costs me about 11k/year, and my plan through my employer is about $400/month. So, just by going part time and getting my own insurance potentially saves me about $200/month, and over 11k/year.

That’s great news! The medicaid for kids option gets demonized a lot, but it turns out to be a decent option for many. And your cost savings will be great!

Just wanted to let you know that we use your post all the time in thinking about our ER budgets, and have referred a bunch of folks over here. I’m sure I’ve reread this post at least once a month since you posted it in May. Thank you for putting together this incredibly useful info!

That’s great to hear! I’ve referred to it a number of times myself, especially the table with the various AGI %’s and thresholds.

Great write up. As a former tax CPA, I find this calculation as one of the most complicated and hard to predict as many obtuse tax calculations. Its too bad they have not made it easier to figure out. Your chart is a life saver.

Ok my situation is really bizarre. We do real estate projects that hopefully blossom about every 3 to 4 years. That leaves us with little or no income in certain years putting us in medicaid. I am not really wanting to go onto medicaid as I am concerned a major illness would propel me into a smaller pool of medical options. Therefore I am oddly finding that I must manufacture income in the low years to avoid this situation. Most of my funds are in low income money markets to use on my projects. I have some losses as well. I am considering converting an IRA balances to a Roth to get to balance. Also, my itemized deductions will result in most of the income covered without much tax in my slow years. I assume the healthcare credit does not require you pay tax to get it. If so, I may need to increase my income more. Crazy complicated.

Definitely do the Roth conversions from a traditional IRA. Great way to generate income when you need it for ACA subsidy purposes. Check out the whole article on Roth IRA conversion ladders if you haven’t seen it.

I currently qualify for cost sharing subsidies with a silver plan. It looks like a great deal. I’m worried though that if my income increases (I’m self employed, hoping to grow my business) I will be switched to a regular silver plan with a very high deductible and max out of pocket. I’ve been researching for several hours and still haven’t found a good answer. What happens if a few months into the year I see an increase in income? Can I still stay with the same plan? Will I be able to move to a gold or platinum plan? I really don’t want to have a plan with very high out of pocket maximums.

You won’t be forced to switch plans in the middle of the year unless you report your new increased income to the Exchange. You’re supposed to but I don’t know that there’s a penalty for not doing so. But next year when you sign up and use your higher income, you might not qualify for the cost sharing subsidy-eligible silver plan.

Thanks!

Another answer to self employed is to invest in more Sec 179 assets before end of year to sop up excess income.

Also take a nice holiday around Chrissy time! (don’t earn any more!)

Given how little I do already, it would be hard to do any less. 🙂

Good idea on the sec 179 assets. We picked up a new camera for the blog at the end of 2015 (in case you haven’t noticed a marked improvement in the image quality on the blog).

I experienced the “pushback” you described. We are “empty nesters” and were curious as to what the ACA had to offer with subsidies, Met with a “navigator” not once but twice. Took my 2014 taxes and 2015 & 2016 projections. We derive our income from rentals and investments. Due to vacancies last year was a tough year and income suffered. First she tried to put us in Medicaid. I was uncomfortable and then she gave us “pushback” and her subsidy estimate was much less generous than my calculations. Then wanted me to produce my BIRTH CERTIFICATE. After much thought I decided to stay with my “grandfathered” health plan for the time being. Any reference material you’d recommend? My calcs come up with pretty significant savings. Thanks for the informative article.

I don’t have any advice on fighting with the exchange people. I’ve only applied for my mother in law and they didn’t have any problems approving her application and subsidy (as far as I know). But her household had only Social Security income.

I’ll enjoy our own ACA application in 2016 once we lose Mrs. RoG’s employer provided health insurance. I’m sure it will be fun. Fortunately our 2015 AGI should be very close to my target AGI of $42,000 to get the sweet gold plated silver cost sharing plan at 149% of FPL.

Thanks for the reply. I did learn a lot. The biggest problem I see is the deductible and how they are counted. Some plans offer aggregate and others separate when it comes to the deductible and that’s a pretty big deal in our case anyway. My hope is to learn more about linking one of these plans to an HSA account. It is my understanding the monies in these accounts are treated just like an IRA when one turns 65. It was startling how the Navigator was trying to “push us” into Medicaid. Medicaid has been expanded here and it is my understanding the State benefits when it places folks on Medicaid instead regular health insurance because the funding comes from the Fed….who knows. I wonder if going thru a broker would have helped? The crazy thing is the subsidies were significant…maybe next year….Thanks for your response….Happy Holidays!!

Medicaid generally has a lot lower copays/deductibles than the metal plans on the exchange, though not much better than the gold plated silver plans with 94% cost sharing subsidies.

I don’t think source of funding (state vs fed) comes into play because the feds are paying it either way (fed tax credit via Advanced Premium Tax Credit versus 100% paid medicaid tab through end of 2016).

Lots of moving parts though, so it definitely makes sense to spend some time analyzing your situation and seeing what works best for you in terms of cost, coverage, networks, and tax advantages. And one plan might be better one year, whereas another makes more sense in the future.

Hmmm… You may just be right about the Fed dollars….and that it really makes no difference as they just pay out of “different buckets”… Our challenge is prescription drugs. DW takes quite a few and it gets “pricey”. My hope, is to get a plan to deal with the drugs costs as well as to take advantage of the subsidies and cost sharing. In addition, the plan we have now is a “grandfathered plan” which I’m told…”days are numbered”. I want to be able to make an “intelligent choice” and not be forced to make a “hasty decision” if/when my plan is discontinued. And this plan just had a 25% increase though we had very few claims. This “health insurance calculus” is challenging….Any insight you can provide in future blog posts is appreciated…..

Thank you so much for this post! I just re-read it again and have a question: my current FI plan involves a lot of domestic travel. At least for the first few years I’m not planning to have a home base in any US state, but instead visit with relatives and use multiple AirBnBs and month long apartment rentals. Do you know what that would mean for ACA coverage?

I read about something called a Multi-State Plan, but it looks like it would be more expensive than a single state plan (compared to what’s available on the marketplace in Seattle, WA where I currently live). However, If I did establish residency in one state (by paying a friend’s electric bill or something) I read that I would then most likely not be covered in any other state if I got into an accident and needed immediate care. Do you know the nuances of these rules? Any help you could provide would be very much appreciated.

Keep up the fantastic work!

Check all the plans on the exchange that you qualify for. Many, possibly most, won’t have great out of state networks, or may not have out of state networks at all. What that means is you’ll be out of network and may have no real coverage for non-emergency medical needs outside of your home state network. Medical emergencies are required to be covered by the ACA, but you could still get a significant bill for amounts above what your insurance company would pay (“balance billing”). You might be able to get travel insurance to cover you better.

But all the plans are tied to where your state of residence is. If you move (or “move” 😉 ) then you would apply for plans based on your new zip code.

I don’t have any great advice on how to get cheap nationwide coverage, but it’s a concern for us too since we will likely be on a plan with a limited network mostly in state and we would like to do more domestic travel outside the state.

Thank you so much for the advice! I’ll look into all possible plans and travel insurance. I can let you know what I come up with in case it will help your family as well.

I’ll also run the numbers to see the chances of something happening to me in another state that needs immediate care. I’m sure it’s minuscule – especially since I’ve never broken a bone, don’t drive a car and rarely do dangerous recreational activities. I might just need a backup plan that involves self-insuring in a sense for unlikely accidents. Thank you again!

Please do share what you find out. It’s a missing piece in our travel puzzle so I’m curious how you’ll address the risk in your own plan.

Great in-depth analysis! We are within a couple of years of me going part-time or switching over to starting my own business, so this is very near and dear to my heart. We are a family of 4, and I ran through various estimates using the .gov website. I didn’t know the “behind the scenes” calculations, but it was pretty clear to me that if you got much above $50k income, the subsidies dropped off quick! I love the idea of a self-funded 401K for your side business to get you MAGI down to the target level. This is an “awesome” hack to make the numbers work and take full advantage of the subsidies offered. Thanks for the amazing tips and analysis!!

What happens if you miscalculate and go under into the medicaid land on accident? Will it catch up to during tax time? Will you have to pay back all the subsidies you got throughout the year?

If you go under the threshold, you might lose eligibility for subsidies. It gets a little complicated since you settle up on your 1040, but the amount of subsidies you must repay are limited by your income (which would necessarily be low to put you in the situation of “income too low to qualify for ACA subsidies”).

Thanks! If my income is too low and I know I am going to trigger medicaid could I convert an IRA to a Roth to bring up my income?

Absolutely. That’s my plan to make sure our income is always high enough to received the ACA subsidies.

Nate is living the “nightmare” I was afraid COULD happen with Obamacare. When I met with the rep from Obamacare she was VERY evasive on the “penalties” if your income was too low. Kind of a “kick the can down the road” stance. It seems to me they really don’t know. I was afraid that my income would not be what I had predicted and then I would incur the penalty and have to pay back the subsidy money. In addition, I would then be placed on Medicaid which can be very challenging in this neck of the woods as a lot of doctors aren’t accepting new Medicare patients. IMHO…it shouldn’t be this hard….and the fact that your income can be “too little” and would not be eligible for subsidies would be funny if it wasn’t so sad…

All this talk about Medicaid on here, but I thought that Medicaid (for adults) had asset restrictions as well as income restrictions? Is this just outdated information, or does it differ by state? I had always heard about the Medicaid “spend-down” to lower one’s assets in order to qualify…

With the affordable care act, the states that expanded medicare to cover adults got rid of the asset test requirement. So in some states medicaid has no asset test. In NC it still comes with an asset test.

For kids nationwide, there is no asset test for medicaid (as far as I know).

Ok ….stupid question. Now that our new admin is hell bent on cutting ACA why wouldn’t early retires who live in those states that expanded Medicaid that do not have asset test requirements just show income up to that Medicaid limit? For example from the calculator you linked to, a family of five could earn up to 39k with no medical premiums? Am I missing something?

Thx again for your work explains this topic!

People do exactly that. If adult medicaid is good in their state, some folks will manage their AGI to be just low enough to get totally free medicaid. For us, it’s not an option (North Carolina is a non-expansion state so we have to be broke and very very low income to get medicaid). However it’s pretty easy to snag a really good regular insurance plan for nearly free here. Ours is $16/month for a plan that’s more flexible than medicaid and only slightly more expensive ($100 deductible vs $0 with medicaid).

Thank you for your comments on this..have a great day!

Good post – I learned a lot from the insight , Does someone know if I might find a fillable IRS Instruction 1040 example to use ?

Hmmm, not sure I’ve seen any of the 1040 instruction’s forms in a fillable PDF format.

Does anyone know how to research costs of a plan, and what it gets you, from healthcare.gov without going through an entire application? Thinking about the hypothetical in a few years and not interested in filling out the entire app.

I’ve always been able to put in basic information and get an estimate pretty quickly. I think this link will work to get you that: https://www.healthcare.gov/see-plans/

So people whose income is below $11,880 get no benefits at all? Isn’t that the opposite of what ACA was meant to do? Shouldn’t they be getting the most help?

Yeah, pretty much in some states. They’re screwed. But in those states that extended Medicaid to low income people, they are actually getting decent coverage (but it’s not great in some states according to some).

One of my biggest gripes about the ACA is that the poorest don’t have coverage in the states that chose not to extend Medicaid (like North Carolina). My mother in law, for example, finally became “wealthy” enough to get health insurance this year once she filed for social security. Previously she was too poor to qualify for subsidies (she now pays $9 per month).

Thanks for the article. Does contributing to my 401k through my employer work the same as the solo 401K. My children don’t qualify for CHIP because I am $4,000 over the limit. I would rather put the money in a 401K, and get my children better health insurance through the CHIP program.

Your income will be reduced if you put $ in a traditional 401k just like a solo 401k so you can possibly get your income below the threshold to qualify for CHIP. Just make sure you aren’t double dipping in the 2 401ks and exceeding the $18000 contribution limit – that’s the total across both plans for the employee contribution. Employer contributions for the solo 401k can be over that amount of course.

Thanks for your reply. I’m now trying to fill out the CHIP application and don’t know how to answer the questions. It asks for tips and wages (before tax). I assume I put in the amount from my W2 from line 1, which doesn’t include my 401k contribution. The next question asked is “How often are you paid, average hours worked each week, and hourly wage.” Anyone who does math will see that line 1 on my W2 and the answers to the above questions won’t match. There is another question asked ” If you pay for certain things that can be deducted on a federal income tax return, telling us about them could make the cost of health coverage a little lower.” Do I add in my 401k here? I really appreciate your help, I don’t know why these things are always so confusing.

I’m sorry I can’t be more helpful. I struggle with this stuff too. I do my best and hope I get it mostly correct. The case worker processing the application will contact you to verify income most likely. I’d say the “how much you are paid” is the gross amount. Sure, why not stick the 401k in as a deduction? Worst case they will eliminate that deduction when they review your documents. Amazing how manual the process is in spite of them processing tens of millions of these CHIP/medicaid apps each year (plus tens of millions of ACA apps!).

I don’t know how this works if you can’t know what your income will be. For example, suppose I lost my job at the end of February. I’d have approximately 16K in gross income up to that point. But there were 401k and HSA deductions from my paychecks, so my actual taxable income would be less. Then over the course of the year, I’d probably get around 5K in dividends from my taxable investment accounts. So, at this point, my income estimate is up to 21K not counting deductions on March 1. If I were to apply for insurance through healthcare.gov, based on only this income, I’d get a decent subsidy.

Then, assume I’m unemployed for the rest of the year until I manage to get another job on Sept 1 and I earn another 32K before the end of the year. My income for 2017 is now 53K. Do I need to pay back all the subsidies? What about the discounted co-pays? The lowered deductibles? Do they go back and re-calculate everything and send me a giant bill?

You fill out the healthcare.gov application based on your current income. When I filled it out I knew roughly what our income would be including 1 month of Mrs. Root of Good working.

If your income changes during the year you can update your application to increase or decrease the subsidy you receive.

At tax time, you file and true up the subsidies you’ve received throughout the year based on your MAGI (which is often the same as your AGI). If you owe a bunch because you took too many subsidies during the year, you’ll pay some or all of the overage back through your taxes.

Great blog post!

What happens if you have a baby, say, in December? Since the 400% FPL threshold changes dramatically, would this be prorated, or retroactive for the whole year?

You settle up at tax time. I think it’s based on your household size as of 12/31/2016, but I’d have to dig through the Premium Tax Credit form to see for sure. If so, that 400% of FPL will jump up quite a bit with the addition of a new baby.

How does the “Gold Plated Silver Plan” thing work if your income changes?

When I go to the “see the plans” link ( https://www.healthcare.gov/see-plans/ ) and put in $23,000 as my income (not actual), I see “Extra Savings” on the Silver plans. I assume this is what you’re referring to when you say “Gold Plated Silver Plan”.

So, assume I worked part of the year and made $40,000 and then was laid off. If I sign up for a plan with my income of $40,000, I don’t qualify for the “Extra Savings”. But what happens if I then decide to try to retire early and my income the next year is only $20,000, say from dividends and capital gains? Do you have to re-apply if your income changes to get a different policy with the “Extra Savings”?

Or assume a different scenario where the first year my income is actually $20,000 and the second year, I get a part-time job that bumps my income up to $40,000. What (if any) mechanism kicks me out of the “Extra Savings”?

The “Extra Savings” are discounts on the amounts you pay to doctors and other medical service providers. If you file your taxes and you find yourself above the level that qualifies for those “Extra Savings”, it’s not like the individual providers can track you down and demand the difference back.

There must be something I’m missing about how this works.

You can get on the Gold Plated Silver plan if your income is low enough when you apply. I’m not sure what happens if your income drops during the year – I suppose you could contact the Healthcare.gov folks and update your income to see if you can get on a lower-cost plan or one with heavy subsidies.

Looks like the subsidies are going to be in danger…

Yes and no. Trump’s executive order eliminates the subsidy that was paid to insurance companies but doesn’t eliminate the Cost Sharing Reduction itself. So if an insurer offers a silver exchange plan and your income is in the <250% FPL range you'll still get CSR's (it's just that the insurance company is going to bake the cost of the CSRs into their premiums somehow). How this plays out is yet to be seen. Might see more insurers withdraw from the market. Might see successful lawsuits that make CSR subsidy payments continue. Might see actual legislation to fix this (perhaps as a compromise with other stuff thrown in).

I can't quite figure out the advantage of this exec order. Is it a Hail Mary? Hoping this destroys ACA enough to make Congress come back to the negotiating table, forced to figure out a replacement? It's certain to cause fear and doubt short term, which equals higher premiums and fewer plans on offer (a huge loss if you're paying 100% of the premiums for your insurance!).

Isn’t the reason Trump stopped paying that it is illegal to keep offering the subsidies? Weren’t they supposed to end in 2012, and wasn’t Obama and then Trump continuing to pay them illegally past that point, doing so because the insurance companies were losing money and the whole market would collapse if they didn’t? If I’m right, Congress really needs to either come in an change the law or the payments need to stop. The President can’t just decide to change the law.

The reason Trump stopped paying cost sharing reduction subsidies is, in my eyes, very simple. He wants to destroy the Affordable Care Act.

We can debate the legality of the CSR payments and I don’t think there is a clear answer. A federal district court said, yes, they are illegal. The case was (is??) pending before a federal court of appeals. In other words, you have one guy saying they are illegal but a whole series of appeals before it’s settled case law (Fed appeals court, en banc sitting of fed appeals court, Supreme Court, possible ventures back to dist court for further fact-finding, then run it back up the ladder to appeals ct, Supremes, etc). And the main defenders of the legality of that law are the ones saying it’s now illegal and deciding not to pay it!

“Congress really needs to either come in an change the law or the payments need to stop. The President can’t just decide to change the law.” – Definitely agree with this part of your comment. ACA needs some legislative tweaking to make it work better. The EO CSR payments were a patch to make it work till legislative fixes could be put in place.

I quit work two years ago to take care of a sick parent, I am living on my savings I rolled my 401 K into a traditional IRA, I plan on signing up for insurance on the exchange for 2018. Since I don’t need the income from a IRA withdrawal I plan on making a partial conversion to a Roth IRA around $15000 will this count as MAGI for ACA subsidies.

Yes, conversions from trad. IRA to Roth IRA count as income (MAGI) for ACA subsidy purchases.

This is amazing information and will take a few readings for me to absorb all. One question: From an internet site linked to Obamacare and calculating tax credits it says to calculate your MAGI add back in IRA contributions.

My SE household income has never qualified my husband and I for a subsidy. This year my husband is retiring, we have hired on an employee and I hope to reduce my work load. Thus my hope we might qualify for a subsidy on the marketplace Bronze Plan.

Because of reduced income we have not funded ROTH IRAs this year but have funded our SIMPLEs. After reading your information in this link I was considering the tradional IRA to up deductible expenses however to determine my household MAGI I have to add back in deductions for IRA contributions.

Do you have government info for subsidies that says otherwise?

MAGI is a confusing term because the IRS calculates MAGI differently for different purposes. For the ACA, you do NOT add IRA deductions back to regular AGI. In your case, trad IRA and SIMPLE IRA contributions will reduce the MAGI income used for calculating ACA subsidies (assuming you’re below the income limits where trad IRA contributions are deductible more generally).

William Krick, above, said: “The ‘Extra Savings’ are discounts on the amounts you pay to doctors and other medical service providers. If you file your taxes and you find yourself above the level that qualifies for those “Extra Savings”, it’s not like the individual providers can track you down and demand the difference back.

There must be something I’m missing about how this works.”

Justin’s reply to William’s full comment responded to the scenario where income decreases during the year, but not what happens if your income goes up. I’ve lived this experience more than once over my time as a Marketplace customer, and I believe this really is the sweetest of sweet spots in the ACA. Here’s how it’s worked for me:

My wife and I are real estate agents, and do enough business to make a decent living but still qualify for ACA subsidies. Because our income can vary widely year-to-year depending on the market and the success of our promotional efforts (and on the advice of our accountant) each year when I reapply for health insurance, I project our income at the low end of our expectations and within the threshold to qualify for the Silver Plans’ cost-sharing benefits. As Justin has spelled out in this post, cost-sharing saves a family significant money in reduced copays and deductibles—a very helpful protection of cash flow for our business as we have family members with ongoing health issues that require ongoing medication and regular doctor visits.

Last year (and in one previous year) our income ended up exceeding the threshold for the cost-sharing component, had we known at the start of the year what our income would be. But the income situation during the year was fluid enough, and the increase came late enough in the year, that I did not report any changes to Healthcare.gov mid-year. On our 2016 Form 1040 then, we ended up needing to repay the maximum $2550 of the advance premium tax credit we’d received. But the excess PTC we actually got was more than $3800, so this was a net benefit of $1250+, not counting the savings we derived from cost-sharing. And there is no mechanism for the IRS, insurers, or providers to reclaim those cost-sharing benefits. As William pointed out, the logistics of that are highly impractical.

Our situation may be somewhat unique, as we can reasonably project our income on the low side because 100% commission work like ours can fluctuate so widely, and we happen to have a track record of income within the ACA subsidy window, but I thought I’d share our scenario as it might be helpful to a handful of folks who come across this post as they research healthcare options. And of course, I’m subject to contradiction from Justin, who is far more of an expert than I am. But it was nice to come across this post which confirms and matches my experience navigating the Healthcare Exchange over the past four years.

That’s the way I understand it works. You get the cost sharing subsidies in the form of lower copays and deductibles and there’s just no recovery mechanism to get those back. As an example, our copays are $5 with a CSR insurance plan. They would probably be $25 with the regular non-CSR insurance plan that our plan is based on. But if I end up 250%+ of FPL at year end and repay a lot of the premium subsidy, that doesn’t mean that the doc will come back to me and collect the $20 extra that I should have paid for copay (because the doc got that $20 from the insurance company and the ins co won’t recapture it).

Great info..thanks.

Great article with much useful information. The only thing that concerns me is that the ASA plan covered by this article is the Silver Plan. What about someone who is retiring (early) from a corporate job that offers a terrific health insurance plan? I would want the equivalent type insurance plan through ASA. Even with subsidies I’m sure that type of coverage (with a low deductible, equivalent to my annual $2500.) would cost a tremendous amount of money. This is my greatest concern which ultimately will impede my ability to retire early/FIRE.

We have a $125 deductible on a silver plan with Cost Sharing Reduction. Needless to say that’s WAY better coverage than we ever received from any corporate plan or government employer plan. If you really want one of the low deductible plans, just budget for it. Or even better, simply plan on self insuring just a bit more than you’re used to and pocket the premium savings.

Hi Justin,

Thank you for the article and samples. I’m in AZ in a county where there is only one choice for a carrier through the ACA. While applying for coverage, we originally omitted reporting our investment income and ended up with a good premium and reasonable coverage, however, our providers didn’t accept it. Once we increased our expected income to include investment income, the premium skyrocketed and the coverage decreased dramatically. Although we are healthy, my husband has gone back to a corporate job, for the insurance coverage as well as to stay relevant in his field.

My question for you is how your premium is so low with an investment portfolio over $2m? North Carolina is beautiful, but relocating to decrease HI premiums isn’t part of the plan. 🙂

Income is what matters for the ACA, not portfolio size. We only generate about $40,000 per year of adjusted gross income which leads to tiny premiums for a family of 5.

As for availability of providers, North Carolina might not be any better. We switched to the lowest cost ACA plan and it came with a different network of doctors. I had to switch but I like the new doc better! And the limited network of doctors and providers has been an issue forever. Even with really good employer provided health insurance, we had to switch docs in the past.

This is one of the best explanations of the ACA subsidies I have found, and for that, thank you!

One recurring question I have is that the ACA estimates use your income for the current year. What happens in subsequent years, when your income level could change (more or less)?

Also, since I assume you still pay the premiums to the insurance company, how is the subsidy amount mediated from healthcare.gov to them?

Thanks,

Mitch

You estimate your next year’s income when you apply during open enrollment each fall. Then at tax filing time you true up the credits you received vs what you are actually entitled to.

As for how the ACA advanced premium tax credit is handled, the insurance company receives it automatically as a payment from the fed government each month. So my bill looks something like: Premium due: $1,045 / APTC paid by govt: $1,009 / Amount due from customer this month: $36.00. I pay $36 and that’s all I have to pay out of pocket for premiums each month.

Glad to see others have done this research also. Been on a ACA plan for several years now since we are aging and lost good paying jobs during the Great Recession. Two things I would like to ask. First, I deduct my 401k and traditional IRA contribution from my under 30/40k income, however the ACA questions specifically say under deductions “IRA contributions (if you don’t have a retirement account through a job) can not be deducted”. I do this and see no reason why not? Second, what happens to continued eligibility if you underestimate your income year after year since my capital gains have been increasing with the stock market? I do adjust my estimated 401k/IRA amounts to get us into silver brackets , but I’m always 10k to 15k over my estimate each year. Do not what to lose access to ACA and feel almost guilty selecting a income bracket that is justified, but I know it is going to be very hard to stay inside with unknown investment returns, unless the market tanks this year.

Not sure about the IRA deduction question. Deductible IRAs definitely reduce your MAGI when you settle up on the tax form, and it should be captured in the data you provide to healthcare dot gov somehow???

The exchange might start asking for documentation if you consistently under-estimate your income, then report higher income on your taxes every year. I haven’t done that so far (usually within a few thousand $$ of estimate vs actual), so I can’t say from personal experience.

Hi Justin – in a “Whatever happened to Don?” update it’s Don (AKA “Dan”) reporting in. I did end up quitting my job but continued in a much more flexible self-employed consulting role. I’ve been at it about 2.5 years and since my wife and I are both self-employed, and don’t receive a subsidy (because I’ve continued enough work to carry a solid income) we’ve had to look at health insurance alternatives. We spent a year with a plan that cost about $1,200 a month (for me, wife and 3 boys under 10 y/o). After much research we transitioned to Liberty Healthshare last year. We ended up documenting our entire experience on our blog. There are pros and cons and needless to say it hasn’t been perfect. For this year our ACA compliant plan is over $1,300 (roughly 2x the cost of our mortgage and property taxes before we paid it off)! Given some Liberty inefficiency and the option to hold short term health insurance longer in Ohio we are actively researching and considering short term plans from United Healthcare this year. I’ve also documented our analysis and research on the site. Thanks again for all you do…happy annual enrollment season to all!

I’ll have to check your site out! I’m curious but hesitant about the health share plans. Seems like they’ll work well if you don’t really have huge medical needs but might not be there when you really need them.

This is wonderful – is there an updated version for 2019? Thank you, Mary

No update for 2019 but I need to get that done! Take a look at healthcare.gov and you can find more accurate #’s for current incomes.

This is going to sound really stupid, but I am really new to the ACA stuff. If I qualify for a subsidy, does that mean I just pay the difference somehow each month, or that I pay the full amount, then get the money back on taxes the next year?

You specify how much of the subsidy you want applied to your insurance premiums each month. You can take the max subsidy or take just a little or none at all. You have to file taxes and that’s when you figure out if your subsidy was larger or smaller than what you should have actually received and then you may have to pay back some of it. So beware of that come tax time if you end up making more than what you report to the ACA exchange!

Justin, is there any chance you could update this article for 2021?

I’ll try to work on it at some point!

Fantastic!! Thank you so much!

Yes, would be great if you could update based on the ARP passed in early March.

Hey, It will be applicable in 2021 during covid19 insurances peoples?

Hi Justin! How would you recommend balancing income from Roth Conversions, dividends, and capital gains (withdrawals to fund expenses in early retirement) without going over the cliff? We are a family of three and our annual expenses are $39,000. We currently receive a little over $10,000 in qualified dividends a year. I plan to stop working this year and my husband might continue a little longer so we don’t plan to get on the ACA until he retires too. While he is still working and we’re all still on his insurance, would you recommend that I start my Roth conversions after I quit my job? Once my husband leaves his job, then I worry about the income from our dividends, conversions, and capital gains pushing us over that slim limit. Any tips you can provide given what your experience has been balancing those income sources? Thanks Justin!