Taxes. It is our duty as patriotic Americans to keep our individual taxes as low as possible. I want to show you just how patriotic I am.

Over the years our income has grown steadily. Not long ago our combined incomes crossed into six figure territory. In 2013, our earnings peaked right around $150,000 from our jobs plus some dividend and interest income from our investment portfolio.

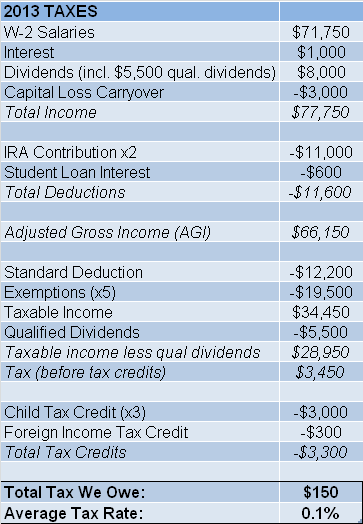

In my overview of my path to early retirement at 33, I briefly discussed our tax strategies and the benefits of a low tax rate. Our tax rate has stayed very low throughout the last few years. Two factors played a big part in allowing us to pay almost no federal income tax:

- Taking advantage of all available tax deferred savings options

- Having a bunch of kids (well, just 3, nothing too crazy)

Almost all wage earners can take advantage of tax deferred savings plans. Having a bunch of kids isn’t necessarily a great way to save a bunch of money, but I will demonstrate how having kids led to big tax breaks in our situation. On a $150,000 income, we pay 0.1% of our income in federal income taxes. Even without kids, our tax rate would have been under 4%.

You won’t find any clever or unique tax dodges here. No shady or questionable tax treatments. No one is committing federal tax fraud. We simply did the research and put a plan in place to maximize our tax savings.

Shrink Your Paycheck

This seems like backward advice, but do everything you can to make your take home pay as small as possible. Employers offer all kinds of opportunities to reduce your taxable income before you even get your paycheck such as:

- Retirement plan contributions (401k, 457 or 403b plans)

- Pension contributions

- Employee Stock Purchase Plans

- Employee Stock Ownership Plans

- Health Insurance

- Dental Insurance

- Flexible Spending Accounts (for health/dental or child care)

- Health Savings Account

Here’s how you make your income look tiny when you get your W-2’s during tax season. Our combined gross salaries (before any deductions) were around $141,000 in 2013. My salary was around $69,000 and Mrs. RootofGood’s salary plus bonus were around $72,000.

We took advantage of all the benefits offered by our employers. I worked for the government where I had access to a 401k and a 457. I found this unbelievable, but you can actually contribute the IRS maximum of $17,500 to EACH of these accounts. I chose to contribute the maximum of $17,500 into the 401k and the 457. I was also required to have 6% of my salary (or $4,200) withheld to fund my pension (which I never intended to take). The cash value of my pension contributions (without any earnings) can be withdrawn and rolled into an IRA when I would like to do so.

Using these tax deferred savings plans, I turned my beefy $69,000 salary into a puny $29,800 per year.

Mrs. RootofGood was lucky to work for an employer that offered really good benefits. She contributed the maximum to her 401k ($17,500) and also contributed $5,000 to her Dependent Care Flexible Spending Account (daycare for the little one), $6,450 to her Health Savings Account, and paid $500 for the year for health insurance (yes, per year!), and $600 per year for dental insurance.

Mrs. RootofGood’s $72,000 salary magically metamorphosized into a scrawny $41,950 W-2 salary.

At tax time, our W-2’s will arrive telling us that our total earnings (for federal income tax purposes) are $71,750. We basically cut our $141,000 gross salary in half for federal income tax purposes.

Even More Deductions

In addition to our earned income, we expect $9,000 in investment income from our taxable investments at Vanguard and Fidelity ($8,000 dividends and $1,000 interest).

We have $15,000 in capital losses from tax loss harvesting our mutual funds over the years (What is “tax loss harvesting”? – sounds delicious!). Each year we take a $3,000 capital loss write off against our other income ($3,000 per year is the maximum deduction).

Adding up our income (including the $3,000 capital loss), our total income for 2013 will be $77,750.

Our deductions include $11,000 in traditional IRA contributions (maxing out $5,500 into each IRA), and $600 in student loan interest payments.

Subtracting the deductions from our total income, we end up with an “Adjusted Gross Income”, or AGI, of $66,150.

But wait, there are more deductions! A $12,200 standard deduction plus $19,500 in personal exemptions ($3,900 x 5 people) further reduce our “taxable income” to $34,450.

The party doesn’t stop here. Out of our $8,000 in dividend income, $5,500 were “qualified dividends” that are tax free if you are in the 15% tax bracket or less (in 2013, that means $72,500 or less taxable income). We are in the 15% tax bracket with our $34,450 taxable income. In effect, we pay tax on $28,950 ($34,450 taxable income minus the $5,500 qualified dividends taxed at 0%).

Our total tax owed on $28,950 works out to be $3,450. Part of the income is taxed at 10%, part at 15%.

That’s not a bad tax bill considering we made $150,000 in 2013. But we still have to take a few tax credits.

We have three kids. In addition to having superhuman powers of massive cereal consumption, they also generate a $1,000 Child Tax Credit per Cap’n Crunch-stuffed mouth. That adds up to a $3,000 tax credit (that reduces our taxes owed dollar-for-dollar).

We somehow managed to pay $300 in foreign income tax through our international mutual fund holdings. Owning tiny slivers of luxury shopping centers and office buildings in Zurich, Shanghai, Singapore, and Dubai sounds totally sweet until you realize the countries you invest in are siphoning off tiny slivers of your income (they have Uncles too, just not named “Sam”). Fortunately, the federal income tax code, in its infinite generosity to the privileged few, allows a tax credit for any foreign income tax paid. Poof – another $300 in income tax liability gone!

Our tax liability went from $3,450 before subtracting tax credits to a bottom line tax bill of only $150. Yes, that is right folks. Through our Houdini-like usage of tax-defying strategies, we managed to earn $150,000 and pay only 0.1% tax.

I am always a little dumbfounded around tax time. The tax code seems strange and convoluted, and I don’t think a family with our level of earnings should have such a small tax bill. But hey, that’s the law!

The tax savings don’t stop with a tiny 2013 tax bill. We also managed to contribute over $74,000 into tax deferred savings plans that won’t be taxed until we withdraw them at some later date (if we ever pay tax on the withdrawals at all!). Tax deferred accounts are the gift that keeps on giving year after year. Note that we had $9,000 in investment income in our taxable accounts, and we had to pay tax on part of it. We have over $10,000 income in our tax deferred accounts that we don’t pay tax on each year (the tax is deferred – that’s why they call the accounts “tax deferred” I think).

Out of curiosity, I re-ran the tax calculations to see what our tax burden would be if we didn’t do any tax planning. Our tax liability would increase to $19,883. Good thing we know our way around the tax code!

I Don’t Have Kids, So I Can’t Pay 0.1% Taxes Like Mr. RootofGood

Unfortunately, if you don’t have any little booger-encrusted tax deductions running around your house, you’re gonna pay more taxes. Sorry to tell you this, but you are subsiding me and my burgeoning empire of miniature RootofGoods. I thank you, and also want to offer my condolences.

The good news is that you could still pay under 4% of your income in federal taxes if you use all of the deductions and tricks that we did.

I re-ran our tax situation assuming we have zero kids. Aside from the utter peace and quiet throughout our house, a few other things change. The $5,000 Childcare Flexible Spending Account deduction goes away (as does the childcare expense itself!). The personal exemption drops by $11,700 to only $7,800. The child tax credit goes to $0.

After losing all of these deductions and credits, we would end up paying $5,655 in federal income tax on our $150,000 income. That works out to a 3.8% average tax rate.

Moral of the story: have 3 kids, save $5,500 in federal income tax. However, kids can be pretty expensive, so don’t have kids for the income tax benefits alone. They are cute though. And they can fetch beers on command.

Readers, did I miss anything? Have you been able to keep your tax burden low while earning a hefty paycheck?

Need help keeping track of expenses and investments to prep for tax time? Use the same personal finance tools that I do. And you’re in luck because it’s free! Check out Personal Capital today (review here).

Root of Good Recommends:

- Personal Capital* - It's the best FREE way to track your spending, income, and entire investment portfolio all in one place. Did I mention it's FREE?

- Interactive Brokers $1,000 bonus* - Get a $1,000 bonus when you transfer $100,000 to Interactive Brokers zero fee brokerage account. For transfers under $100,000 get 1% bonus on whatever you transfer

- $750+ bonus with a new business credit card from Chase* - We score $10,000 worth of free travel every year from credit card sign up bonuses. Get your free travel, too.

- Use a shopping portal like Ebates* and save more on everything you buy online. Get a $10 bonus* when you sign up now.

- Google Fi* - Use the link and save $20 on unlimited calls and texts for US cell service plus 200+ countries of free international coverage. Only $20 per month plus $10 per GB data.

Lucky you. We do not have access to a 457, pension, health savings account, nor does my wife have access to a 401(k). Consequently our AGI is high enough that IRA contributions aren’t deductible and our child tax credit is phased out.

Lucky or smart, I can’t say. Part is luck. Part is the fact that I look for benefits like these in employment opportunities. Access to a 457 and a 401k and being able to max out both was a total surprise I found out about after I took the job.

And the pension – I would have done just about as well not contributing to it at all and eating the tax bill. I’ll get back my 6% contributions without any interest or earnings on them. So my money sat there for almost 3 years when I could have invested it and obtained a ~10% return each year.

You are right though, once you hit a certain AGI level, you get phased out of all kinds of deductions and credits. It is all very convoluted to figure out what the impact of, say, earning an extra $10,000 might be on your tax situation. It unfortunately isn’t as easy as saying “I’m in the 25% bracket, so I’ll make $7,500 more and pay $2,500 more in taxes”. You might lose a few thousand more dollars in deductions or credits on top of your tax burden (making your effective marginal tax rate jump to 50-60%).

The $300 foreign tax credit is still tax paid to other governments so I suppose your total income tax paid is $450 and not $150. I guess it might have been a good thing your qualified dividend wasn’t much bigger because I think those credits aren’t refundable credits meaning you can’t get a refund if you are due more credit than causing your U.S. tax to go to 0. There was a small window of opportunity where state government can create a 401(k) plan. The states that didn’t take that opportunity do not have 401(k) plans and have a 401(a) defined contribution plan instead where you are stuck with whatever percentage of contribution you declared when you were hired (no changing percentage until you switch departments at least). The old federal rules on 401(a) plans have 15% maximum contribution and many state plans didn’t change that so even if you had the means to contribute more, you couldn’t. But fortunately, 457(b) plan is still there so it is still a combination of 401(a) plan plus the 457(b) plus a small defined benefit plan based on years of service. I prefer the Roth approach as much as possible especially with Obamacare charging health insurance based on income (it’s a hidden tax worth about 15% flat rate for those in 200% to 400% federal poverty level which is hardly the rich). Tax deferral can only do so much as required minimum distribution rules kick in at age 70 1/2. By virtue of more easily converting small amount of money to a Roth than after the balance is much bigger, it usually pays to start with the Roth even though you’ll pay tax upfront. How much Social Security Income is taxed based on base income calculated by adding 1/2 of social security income + other taxable income. The arcane calculation sometimes leads to very high tax bracket for social security income earner. But if you had the Roth, that income is not counted in the social security base income calculation. Roth IRA do not have required minimum distribution for the original owner and the beneficiary spouse. Medicare Part B and drug coverage premium is also based on income. Some of these thresholds have not been indexed to inflation so this can be a problem later on. Still feel like all these deductible IRA and pretax retirement plan was a good choice? The kids will grow up and eventually not be in your tax return. One of the spouse will die at some point and cause the income brackets to shrink along with the threshold for social security tax and medicare tax and also Obamacare premium. Unfortunately, I have only tax deferred options right now and I’ve been pestering my employer to add the Roth option on the 457(b) plan for 7 years sense it was made available by federal legislation.

I’m still happy with my choice of focusing on the tax deferred retirement plans. Massive tax savings while working and I’m currently converting those assets to Roth status each year while paying basically no tax. Maybe I get screwed when I’m 67 or 70 and on Medicare, drawing SS, and facing RMDs and have megamillion dollar traditional IRA and 401k balances. If so, I’ll have more money than I’ll ever need and therefore I’ll feel like I won the game!

Just started reading these blogs. Fascinating. It’s just different fir everyone. I make more than you and your wife combined. My wife gave up a tenured teaching position 15 years ago to raise our now 3 kids. After 15 years she is now reverting the workforce. But if she had stayed working I figure we gave up in excess of $1mm in income and benefits. Now at 43 we will put the pedal to the metal again with the saving. Hope to be out by 52.

Not sure what investment vehicles you are using in retirement, but you are appear to be too young to have experience a secular bear market (maybe a cyclical) in your investing years.

While I admire your savings approach and tax hound skills, you are extremely short sighted when it comes to deferred taxes and how much you benefit from it now versus the future (unknown but currently taxes are historically low).

The tax savings you bank on now could come back to beat you in the future. With the threat of social security and other long accepted entitlement programs becoming insolvent, we’ll all be paying a lot more in the future (well, maybe less for me since I’m a lot “longer in the tooth” than you). Like a previous poster, in my case I prefer using the Roth approaches where I know what I’m paying now. Then I can let it grow without too much worry.

And while growing your “megamillion dollar traditional IRA and 401k balances”, pray that we don’t go through a secular bear market….. (assuming you’re still putting it in investments that realize that kind of growth).

I’m old enough to have seen, witnessed, lived through such cycles. It “aint’ pretty”. I can tell by your writings that you are oblivious this could ever happen. Good luck and be prepared. You sound like smart guy.

Again, kudos on the savings and tax planning, but there is still a lot more to come.

How can you invest in an IRA when you are putting money in 401(k)? Don’t you have to pick one?

No! Isn’t that awesome?

There are income limits to contribute to IRAs and receive tax deductions for those contributions. But if you are below the IRA limits, and you have access to a 401k at work, you can contribute to both!

Last, there are also creative yet legal ways to contribute to IRAs if you are above the income limits (backdoor IRA and mega backdoor IRA)

Wow, that’s amazing! How does your government pay for services such as roads,education, police protection, healthcare, etc.? If everybody has such a light tax burden, I just don’t see how it adds up!

Roads – gas tax and tolls

Education – local, state and fed $$ (I pay a fair amount of state taxes in the thousands, and half my county property tax pays for education)

Police – municipal expense, a big part of my city property tax bill (37% to be exact)

Healthcare – mostly the feds, you got me there!

It adds up because there are a lot of others out there paying a ton more taxes than me. Some because they can’t get these tax breaks, others because they are oblivious to the concept of tax planning (or don’t think the sacrifices are worth it?).

I have to clear up that common misconception: Gas taxes and tolls only pay for about half of road maintenance in the USA. The rest comes from general tax funds. This number is more like 80-90% in other countries with sensible (read: high) gas taxes.

Also, I want to point out that a lot of the taxes you’re avoiding today are deferred, not eliminated. Realistically, living on as little as you do, you won’t pay much/any tax on those savings when the time comes, but still in some economic sense they’re still there.

You are right, user fees (like gas tax and tolls) pays for roughly 1/2 the road maintenance and construction in the US. Here’s a handy link summarizing transportation funding in the US: http://www.transportation-finance.org/funding_financing/funding/

I’m not sure I would describe the other 50% of funding as coming from the general fund (ie general personal or corp income tax returns). AASHTO says 16%. Maybe 20-25% if you include their “other” categories and some bond proceeds if the bonds are being serviced out of the general funds (like our “appropriations” bonds on toll projects in NC – debt service is paid for out of the general fund I believe, in addition to “revenue” bonds being repaid from the tolls charged to drivers on the toll roads).

Unfortunately I have yet to find a way to avoid property taxes and sales tax! Other than having cheap cars and a cheap house and not spending much money.

Yes, my taxes are definitely “deferred” on roughly 2/3 of my investment portfolio. You are right that we won’t pay a large tax bill with moderate withdrawals each year. Particularly while the kids are still in the house. We couldn’t, for example, pull a half million out of an IRA to buy a beach house without some very ugly tax bills (which we would have to withdraw hundreds of thousands more to pay those tax bills!)

Just for fun you may want to include the “inflation tax.” Yes this is a real tax as stated by Ben Bernake and famously Ronald Reagan stated it was the worst of taxes.

So if your assets are say 700 K (home and investments), a 3 % inflation tax would be in the 21K range.

This tax is perhaps the hardest to avoid. I’m open for avoidance suggestions. I suppose not having real estate assets and investing via a currency that is not inflated each year would help. But I have no idea what currency that might be or if that is even feasible?

Nice blog by the way!

Thanks for stopping by Bob!

They only way I fight against inflation is by owning stocks. Long term they tend to beat inflation. It shouldn’t be too surprising if you consider what inflation is fundamentally. When prices of goods and services creep up 2-3% per year, we, as consumers pay more. But on the flip side, we, as capitalists own those companies that are selling the goods and services at inflated prices. As a result, their revenues inflate as prices go up. In the end, it’s sort of a wash for equity investors.

Inflation is definitely a force to be reckoned with, and one of the stealthy killers of early retirement dreams (ie if you make 7% per year, you are only making 4% per year in real terms after 3% inflation). But from a macro level, yes, inflation is a hidden tax on wealth. If you aren’t beating inflation, you’re losing value in real terms. It’s one of the reasons I keep very little in cash/nominal bonds/CD’s. Rates barely beat inflation.

I know I’m jumping in on this conversation ~27 months late, but I have an important inflation-related distinction to share. Bob asserts that seignorage (inflation tax) on $700k worth of home + investments would be $21k (based on 3% inflation). This is not the case as inflation only impacts currency… other assets (e.g., property) ARE NOT subject to inflation tax because the land doesn’t lose value as a result of inflation (ΔM).

Let me explain with an example. Assume you have $500k in currency (cash, cash equivalents, stocks, bonds, et cetera) and a $200k house. Rapid inflation occurs and the monetary supply is devalued by 50%. The currency is now worth half its original value ($250k) but the house hasn’t lost any value—it will appraise for double ($400k) after the inflationary period.

All that said, I don’t know of any legal strategies to avoid real estate taxes. But… property might be a valuable asset to hold if you expect the US to enter a period of very high inflation.

Not to go too deep into fiscal causes of high inflation, but this would occur if (1) lending institutions deem the US incapable of loan repayment and impose higher interest rates and (2) domestic tax increases are not enough to cover the debt service. In this situation, in accordance with the government budget constraint (G = T + ΔB + ΔM), the government would be forced to print money to pay it’s debt…

Because many others of us are paying for it in taxes, but about half the country doesn’t pay income tax at all. Also, the government in its infinite wisdom spends more than it takes in – to the tune of around $20 trillion in debt now, and climbing.

Yes, it is a shame since Clinton ended with $0 debt at the end of his term. When Bush decided to begin the Iraq war, our national debt has done nothing but climb. Very sad, indeed.

A $0 DEFICIT, not a $0 debt. Clinton balanced the budget; he didn’t pay down the debt.

He didn’t balance the budget. It was accounting tricks.

We made too much money in 2012 and couldn’t take advantage of many deduction/credits.

This year we should be able to do much better.

I have never heard of the 457 plan. It sounds like a great deal.

Do you use a tax accountant? I’m pretty sure you can’t max out 401k ($17,500) AND contribute ($5500) to a traditional IRA.

Sorry to hear you made too much money in 2012! 😉

457 is apparently very similar to 401k in all practical aspects except withdrawal rules. We can withdraw at any time, and just pay ordinary income tax on withdrawals. 457s are often available to government employees and teachers. I figure it makes up for crappy pay and otherwise lackluster benefits (in my state at least).

I prepare taxes by hand. There is an income limit to be able to deduct the IRA contributions if you also have a 401k. I think it is around an AGI of $100k. Below that you can do 401k to the max and $5,500 IRA. For you and your spouse!

Great post and thanks for sharing! I’m totally surprised that we can fund both a 401K and traditional IRA, provided our AGI is below a certain threshold. I have always thought I’m not illegible for traditional IRA, because I already max out my 401k. It just seems too good to be true! I’ll have to check this out.

It’s definitely true! As long as your AGI is below a certain threshold, you can fund both a 401k and a deductible traditional IRA.

I still don’t see how your AGI is below the threshold. Money paid into a 401k still is part of your AGI for the year. Kudos to you if you haven’t got caught, but I don’t think you are allowed to deduct your traditional IRA deposits with the numbers you report.

401k contributions come out of the paycheck and it is never included in “Earned Income” from your W-2 that gets listed on line 7 (??) of the 1040. AGI is very specifically defined on the worksheet to determine whether the IRA contributions are deductible.

Thanks for the response, though my comment did not really warrant it being so stupid (I got a bit confused with where stuff gets pulled out of AGI…obviously).

Justin, the real magic (I think) is that your family of 5 lives on $72,000 per year. Most people would be very, very tempted to use the money for consumption now rather than save it for later! Kudos to you.

Our spending is actually way less than $72k/yr. We pay a ton in payroll taxes, and only the health, dental, childcare, and HSA deductions let us avoid payroll (SS+Medicare) taxes. There’s probably $10k in payroll taxes that comes out of our $72k/yr. And we were able to save some of that $72k in IRAs and a taxable brokerage account. But yes, the ability to take advantage of these deductions arises out of not spending a lot of money!

Hi Justin. I just found this, but was curious if you could share roughly how your money is spent during the year in large buckets? For example 20% housing, 10% food, etc… Sorry if that is too much personal information. I always find that interesting (lifehacker has had a few articles about that but never show the tax situation). Thanks!

I don’t have percentages but here’s the actual breakdown of actual spending and our forecasted spending in retirement (which is based on actual spending plus fun money):

Historical Spending: https://rootofgood.com/root-of-good-household-spending/ $24,000 per year core expenses plus some work related expenses and a soon to be paid off mortgage payment

Retirement budget: https://rootofgood.com/developing-a-retirement-budget/ $32,000 per year

Great stuff, Justin!

It still amazes me that people spend so much time trying to beat the market indices but then ignore things that are actually within their control, like taxes, that could “earn” them tens of thousands of extra dollars every year.

Forget the star mutual/hedge fund manager and get a good tax accountant instead (or better yet, learn the tax code yourself)!

Excellent post and thanks very much for the link 🙂

Tax savings are certainly low hanging fruit. Probably the next best wealth builder tool after “save a bunch of money”. Fund selection is probably 3rd, then asset allocation 4th. Maybe those latter 2 tie for 3rd??

And you are welcome for the link! You are my number 4 traffic generator today – people are finding me from my comments on your site. If you ever want to add me to your blogroll I would be ecstatic (since I would be next to some rockstars on that list!). I’m going to add you to mine when I get a chance. I think we fall in the “financial independence” niche of the personal finance blogosphere, so the fact that your readers find my articles interesting isn’t too surprising.

What is the best way to learn the tax code?

I learned by filing my own taxes and preparing them by hand (still prepare them by hand in fact). I don’t have a good book to recommend on learning taxes, but walking through the 1040 tax form line by line might be useful to see what is AGI, what’s taxable income, how the standard deduction vs itemized deductions work, where tax credits fit in (refundable vs. non-refundable).

Then once you have an understanding of the basic tax framework, you can understand more advanced tax concepts and where they fit in to the bigger framework. Take the traditional IRA – your adjusted gross income has to be low enough to take the deduction, so you have to figure out how to get a lower AGI if you want to save even more in taxes.

I was pretty excited to see this as I hate taxes until I realized the $150,000 income was split between two people! Doh.

Either way, nice job paying so little. I think I paid over $100,000 in federal income taxes alone for the past 10 years! But alas, I don’t get treated special at all by the government. In fact, I think the IRS treats people who pay more taxes worse b/c they want MORE taxes.

I’m doing my best to pay nothing like you!

It’s a lot of work to not work not pay taxes. Wait, that doesn’t sound right.

Anyway, best of luck at avoiding taxes! Definitely some big savings to be had if you don’t mind dancing a little jig. As a small business owner, I think there are tons of ways to shelter income:

SEP IRA

Self Employed 401k: https://www.fidelity.com/retirement-ira/small-business/self-employed-401k/overview

And for the fancy people, defined benefit pensions for one!

Unfortunately our $150,000 income is all we made in our best year, and part of it came from taxable investments. We never made the big bucks from W-2 jobs (compared to I-banking salaries for example).

Yeah, I’m definitely working hard to be poor in the government and public’s eyes actually. Stealth wealth!

Perhaps it is our patriotic duty to pay as little to no taxes as possible so that the government can take care of us. The $100,000 in federal taxes was paid per year and not over 10 years, so I feel I’ve paid my fair share.

I can only contribute $50,000 of a $200,000 income to a SEP-IRA. Which means I still have to pay taxes on $150,000 = ~ $35,000.

But, at the end of the day, I’m not complaining. It’s fun to figure out how to pay less taxes.

I’ve been terrible about optimizing our tax strategy, but like you I’m amazed how low our taxes end up being every year. This is my first year without a “job” so it’ll be interesting to see how things work out.

Have you thought about doing Roth IRAs instead of traditional? Seems like you’d be locking in a pretty low tax rate on those, although I’m not sure what your state tax is.

State tax rate is 7% unfortunately. I always do traditional IRA’s when I am eligible to deduct the contribution. I will be able to convert from Trad IRA to Roth IRA in retirement, and don’t plan on paying high taxes on the IRA withdrawals.

In fact, I need a certain level of income (somewhere around $32000 to $40000) to qualify for the Obamacare subsidies. Below a certain income level, and we wouldn’t have enough income to qualify for subsidies. And our state (NC) didn’t extend Medicaid, so we would be left paying the full insurance premium. My strategy years ago of contributing to trad IRA’s instead of Roth’s had nothing to do with Obamacare (obviously), but it worked out to our great advantage to have trad IRA’s that could be converted in order to generate taxable income to qualify for Obamacare.

Thx for the great info. Can you direct me to a primer on Obamacare considerations as one looks to retire early?

Here are two I’ve written:

Avoiding the ACA subsidy cliff (and managing your income to qualify for nice subsidies).

Our experience applying for (and receiving) $125/mo ACA family coverage with $0 deductible.

Thank you for sending me that info…I will review. I appreciate it!

Isn’t the ESPP you list a post tax deduction? You listed it as decreasing your taxable income

Thanks for bringing up the ESPP, as I debated about whether it belongs on the list of “opportunities to reduce your taxable income before you even get your paycheck”. I ended up including it. It doesn’t fit the mold of most of the other ways to reduce your taxable income, but it is still a way to receive compensation from your employer today, and not pay tax on that compensation until some future date (possibly when you are retired and in a lower tax bracket).

I have never had the option of an ESPP, so I had to research the issue a bit. Here’s my understanding of how it works tax-wise. XYZ corp gives you the option to purchase 100 shares at, say, $20 when shares are trading at $22. You buy 100 shares for $2000, and sell them two years later for $3000 ($30/share). You then pay the tax for the tax year in which you sold them as follows: ordinary income tax on $200 (the difference between the purchase price ($20) and the open market price at the time you were granted the option to purchase the shares ($22) ); long term capital gains on the other $800 in gains. In my tax bracket, the long term cap gains rate is zero.

If I participated in the ESPP and bought and sold as explained in this example, I would say that’s a way to keep my W-2 income low but still get some compensation from your employer. I would end up paying at my regular 15% tax rate on $200 (2 years in the future) and 0% (the long term cap gains rate) on the other $800 in income.

Maybe that’s not much different that simply buying the shares of XYZ corp at the market price of $22 and selling to get LT cap gains status, but I kept it on my list since I wanted to draw the slight tax advantages to the attention of any employees that might read this article and have skipped over the ESPP in the past. The company is giving you free money, and you get to defer taxes for at least a couple years on some of the free money, and any gains are generally taxed at favorable cap gains tax rates.

The ESPP is complicated. For more details on taxation of ESPP stock sales, check out the IRS’s publication here: http://www.irs.gov/publications/p525/ar02.html – search on “employee stock purchase plan” to jump to the right section.

Isn’t ESPP taken out after taxes?

Yes, it is. But there are tax benefits to participating in the plan, so I included it in this article. See my reply here: https://rootofgood.com/make-six-figure-income-pay-no-tax/#comment-356

I consider tax evasion to be a moral activity. 🙂 Not always the right thing to do, but moral nonetheless.

You mean “tax avoidance”, right? 🙂 Tax evasion is never the right thing to do. Tax avoidance is totally legal and more or less encouraged by the IRS (they will certainly help you understand the minutiae of the tax code if you get a knowledgeable representative on the phone).

There is nothing morally wrong with tax evasion, either, it’s comes with penalties. I hope you know the difference between immoral and illegal.

Sorry for the typo. Should be “it just comes with penalties.”

I have a problem with tax evaders. I’d say it’s morally wrong because you’re short-changing the system we all rely on for support (I’m not just referring to social safety nets and welfare; also things like national defense, border patrol, FEMA, etc).

Wow, talk about tax efficiency…very impressive! My wife and I are teachers who use every available account to reduce our taxable income: 457, 403b, traditional IRA, HSA, and teachers’ pensions. We also contribute to an ESA and 529 plans. We only have one child, but you’re correct that it’s very easy to come in under 4% effective federal income tax rate. It’s always nice to see money end up on our side of the ledger. Great article.

Ed

Awesome breakout of showing how with a little effort and thought, you can avoid paying most income tax. Everything you did is perfectly legal and I applaud you for your efforts. My fiance and I have done everything we can to minimize our income taxes for this year since we will be married by year end.

Are you retired? You show two salaries and two 401ks. Both factors lead me to conclude you’re still working.

I ask because you focus on tax deferred investments to reduce your tax bill. This is fine, but it also makes it more challenging to retire early (and by retire, I mean not have to spend your time making money) since you won’t be able to access those tax deferred funds without penalty.

I appreciate the information on tax minimization, but I am curious how you handled the reduction to after tax earnings and your ability to generate sufficient passive income for financial independence during your pre-55-60 years.

Hmmm, good question. Would love to know about the passive income too given there is no active income anymore. Always a fascinating topic.

If you click my website, I’ve laid out my passive income streams in early retirement. I still am only half way to my target.

Sam

Thanks for sharing. I’ll be spending down the taxable portfolio and that will get us to our late 40’s. Then 72t withdrawals plus a couple other things to get us to 59 1/2.

I just retired a couple months ago, but due to vacation pay out, paychecks lagging 2 weeks behind when I worked, and a few other things, my earned income is basically for a whole year of working. Next year the income will be about 1/2 2013’s income.

I’m working on a series of blog posts that outlines withdrawal strategies for pre-59 1/2 early retirement spending.

The answer in a nutshell is that we have a large taxable portfolio that amounts to roughly 1/4 our total portfolio that will support us for 10-15 years, and we can also access tax deferred money using the “72t rule” or Substantially Equal Periodic Payments”. Here’s a link to a similar question and my response discussing the 72t rule. https://rootofgood.com/a-simple-way-to-retire-15-years-earlier/#comment-268

We can basically pull ~4% from our tax deferred accounts each year without paying a penalty (just ordinary tax).

I get asked this question often enough that I need to put together a good post on accessing funds before 59 1/2, because it is relatively easy to do. You don’t have to wait till 59 1/2 to access those funds, and missing out on the tax deferral benefits is a bad thing generally.

I expected you would mention 72t distributions. It would be helpful if you went through your own expectations in a post as easily understood as this one.

This calculator (http://www.bankrate.com/calculators/retirement/72-t-distribution-calculator.aspx) indicates that you have to be 35 to even start your SEPP, and it indicates a draw of about 2-3% of your principal.

The allowable withdrawals each year are tied to interest rates, which have been historically low for a couple years. Since the recent uptick, I think you can get closer to 3-4% now vs. the 2-3% previously. I’m not aware of a minimum age required to start SEPPs. I think the bankrate calculator assumes it is impossible to retire before age 35, so the calculator has the min. age set to 35.

I’ll work on an article, as there is true magic in the rule of 72t.

The Rule 72t is great. I wrote about in this past May and it’s linked in the Website section.

I’d probably hold off as long as possible Justin. Are you seriously considering withdrawing down principal from your taxable portfolio to live? I’d just feel bad doing that now. How about just living off your wife’s income and letting her work for a couple more decades instead?

A post with numbers will probably help address all questions.

Thanks,

Sam

Sam, Mrs. RootofGood said working another few decades is a no-go for her. Good idea, but I don’t think it will work out!

Yes, we plan on consuming the principle in our taxable accounts (and doing Traditional to Roth IRA conversions each year).

We would also be keeping our hands off our deferred and Roth type accounts for 10-12 years. Imagine letting three quarters of your investments sit back and grow for 10-12 years. Pretty good odds they will double in that time period (with a 6%+ real rate of return).

I look at our investment portfolio overall. Taking 3% or so from an overall portfolio (even if that comes from consuming the principle in a sub account) is a very sustainable practice.

Great inspirational post! I’m featuring it in my latest roundup.

awesome write-up. the government is such a piece of shit.

This made me laugh… The government are a piece of shit because with some planning you can pay nearly zero percent tax on a six figure household income? 🙂

Brilliant article by the way. We don’t have anywhere near the amount of little tricks and loopholes here in the UK, although you have inspired me to do some more research on the subject.

The main annoying omission is that there is no equivalent to the 72t rule, as far as I am aware, which makes piling all of your wages into the tax deferred pension accounts we have a bit pointless for an extremely early retiree wannabe

Some here never want to touch retirement accounts till full retirement age of 59.5. So they might save save save in tax deferred “pension” accounts (401k/IRAs for my predominately US based readers) and call it quits around 50 and do some part time work and live off taxable savings for a decade or so. Perhaps that translates across the pond to the UK?

Yep thats not a bad strategy to be fair and would work if you wanted to retire “semi early” at around 50 I think. I don’t really know of anyone in that age bracket that is doing that though… everyone around my Mum and Dad’s age I know have simply worked full time up untill they decided to retire, some a bit earlier than others but I don’t think I know anyone who has done so at anywhere near age 50.

The other thing we have is ISA’s which are tax free investment vehicles: the caveat being that you can only put 10K(ish) per year into them per person. The other thing is you have to pay tax on your earnings before you put the money in them. We also have something called a “SIPP” which to be honest I don’t know much about, so as mentioned before, further research needed.

I am currenly in the 40% tax bracket, plus we have around 10% National Insurance (I think you call this social security?) payments, which boils down to a fairly big chunk of my (or anyone’s really) wages coming out each month before I even see it (no option to defer till the end of the year unless you are self employed). The last month for example worked out as 27% of my paycheck coming out, and as far as I know there is no way you can reduce this as once again it is automatic (barring becoming self employed or starting up a business… which I am looking into of course 🙂 )

Then you have Council tax on top of that (property tax): which if you think about it you are paying for twice as you have to pay for this out of your after tax wages, what a swindle! Plus you can’t offset mortgage interest against your tax bill. On the plus side we have free healthcare etc… so no need for health insurance, plus a few other bits n bobs I can’t really think of right now. I am sure on the whole it nearly works out evens. 🙂

A quick summary: It’s a complicated subject, as it is in the USA, but if you can master some of the techniques and methods (legally!) available then you can avoid paying tax where you don’t really need to. (I would imagine that 90% of people do not bother though).

Cheers again for an eye opening and thought provoking article,

Andy

That’s a bit rougher than our “direct” tax rate in the US, but we also have state taxes (like North Carolina’s at 7%). So a professional (who does little tax planning) might typically pay 25% fed, 7% state, 7.65% Social Security. Basically 40%.

We still have property taxes, but ours are only $1550/year (about 1% of house and car actual values). In some places like New York or Massachusetts I have heard reports of $6000-10,000 per year property taxes.

And for health insurance, my former employer charged $8000 per year for family coverage of not so great insurance. And that was the State of North Carolina! The health insurance would have added another 12% “tax” to my salary in effect.

So yes, it works out “evens” But don’t tell anyone we’re socialists here in the US like the Europeans 😉

I know this is like 5 years later but I’m in Illinois and my property taxes are about $14,000 on a house worth $350k. Just so the Firestarter gets the idea that this tax varies WIDELY.

Hey RoG,

I really like this post and referred to it in another Mr. Money Mustache forum post about the 457b and how you can double your limit.

I realized, looking at the numbers yet again, that you might be eligible for the Saver’s Credit.

Exact details on the form: http://www.irs.gov/pub/irs-pdf/f8880.pdf

Even if you aren’t eligible in 2013, it’s probable that you’ll get to eligibility after finishing work. Even if you are at the upper edge ($57,500 for married filing jointly in 2012 http://www.irs.gov/pub/irs-pdf/p590.pdf), you are eligible to get a credit for 10% of your retirement account contributions – at $200, that would zero out your $150 in federal taxes. It’s nonrefundable, though, so it would only zero you out.

Thanks for sharing! I’ll have to cruise over to the Mr Money Mustache forum to add my $0.02.

We have always been very close to qualifying for the Retirement Savings Contribution Credit but usually exceeded the threshold by a few thousand dollars. We did get it for a few years, I think during college or soon after.

I’m pretty confident we’ll get at least $200, maybe $400, in 2014 with just Mrs. RootofGood’s salary on the 1040. Another hidden tax on earning money – phaseouts of all these awesome little credits.

I’d like to pay as little in taxes as I legally can, but taxes confuse the crap out of me (and I don’t have anything complicated going on – yet!). So, I am really glad that Living Rich Cheaply linked to this article, because when I have more time, I’m going to have to get a dictionary and look up everything you mentioned above. I am single making a bit less than the maximum limit for the second tax bracket (15% for under $36,000), and when I look at what I’ve paid in taxes over the year, it stuns me. I changed my W-4 with-holding from 0 to 1 earlier this year because I don’t care about how big my return is – I want more money now (why let the government borrow it for free for a whole year when I can invest the extra amount for a better return throughout the year?). Depending on how much money I still get back in my 2013 return next year, could I increase that 1 to a 2 for an increase in savings? Thank you for posting this article!

I have always tried to owe roughly zero and get no refund when I file taxes in the spring. You got it – why give the government a free loan of your money. The only thing to watch out for is the “underpayment penalty”. It’s kind of complicated to explain here, but there’s a penalty if you have your withholding set too low during the year and you end up owing a lot in April when you file. So definitely tweak your withholding numbers to try to get your refund down to zero, or maybe owe a couple hundred dollars at most. But don’t set withholding allowances too high because you might not withhold enough to avoid the underpayment penalty.

Here’s a little more reading if you want to get the nuances of the underpayment penalty: http://www.irs.gov/taxtopics/tc306.html

My career currently has me in the position where I will be well qualified to be a school district treasurer or city finance director in a few years. I was wondering about your experience with the publilc pensions. (I currently work at a private sector cpa firm which audits these entities, so right now I have a 401k.)

I know these pensions are tremendous deals with the only hangup being if you don’t stay in public employment for 25-30 years, you get screwed. Hence all the middle aged clients I meet with retirement countdown calculators on their desks. I was trying to do research on the different pension funds I would possibly be a part of and it boils down to https://www.opers.org (catchall for public employees) or http://www.ohsers.org/ (school employees other than teachers). It seems like PERS offers a refund with interest and SERS literally only offers you a refund. We have another fund in Ohio strictly for teachers, which I wouldn’t be a part of, STRS, which apparently offers a defined contribution plan but I can’t find anything about that on SERS or PERS.

Obviously you aren’t an expert on all pension plans nationwide but I see you mentioned you don’t get interest back from your contributions in an earlier comment so I wanted to pick your brain on how you evaluated the pros and cons of working a job which requires membership in one of these plans.

The employer contribution rate is tremendous here in Ohio (14% from the employer, also 10% from the employee) and the salaries, at least for school district treasurer, are quite competitive. And at a lot of school districts I audit I see their contracts are written to “pick up” the employee portion as well. So it’s a great deal, but I don’t know if I could do it for 30 years.

Another interesting fact I thought I’d add in, I had an accounting professor at a state university who was a **national expert** on accounting for pension liabilities.

He told us in class that he personally had opted for the defined contribution plan from STRS, which I’m sure he was in a teeny tiny minority among his peers. What does that tell you.

Makes sense to me. You don’t have to analyze the solvency of your state or your pension plan. In my state, the legislature sets the cost of living adjustment for retired pensioners. It has been 1% per year lately (against 1.6% CPI-U inflation). Slow boiled frog…

The main benefit of a defined contribution plan to me is the portability. You can walk away from your employer whenever you want and take your money with you. I can’t imagine being stuck at the same place for 30 years.

I just shut my mouth about the pension at my state job. The lifers were in it for the pension and the shine of the golden handcuffs blinded them. The newcomers didn’t feel like analyzing the plan and determining the odds of them making it for 30 years, so they just figured it was a valuable benefit.

The reality is that all of the employees that leave before qualifying for a pension heavily subsidize those that stay. When I leave and forfeit my pension, that 13-15% my employer put in on my behalf accrues to the benefit of all plan participants that retire and get the pension. That’s why they can pay such cushy pensions. It’s basically a pyramid scheme looked at a certain way.

I didn’t get a chance to review the specific pension plans you linked to. When I was reviewing my options for employment with a governmental entity, I ran through the calculations of what it would take to get a pension. Options were pretty bleak for someone who makes a mid career jump from private to public employment. Our plan in NC has a five year vesting period. That was the maximum length of time I planned to work at my employer.

Once you vest, you get interest on your contributions since you started contributing. Then, if you quit you can withdraw your contributions and your interest (ie forfeit your pension and take a lump sum of what you contributed plus a small amount of interest). Or you could leave the money in the plan and take a horribly reduced pension at full retirement age (60 or 65 in my plan – I forget). I was looking at $100/month at age 60 or 65 or $25000 or so lump sum at age 35 (if I made it for 5 years). Doing the math, withdrawing the lump sum is by far optimal (equates to getting a zero rate of return for 30 years I think – and not getting diddled by the legislature if they change pension rules/calcs). Probably somewhere around 10-15 years of service it might make sense to stay in the pension system (if you trust the legislature and pension plan to be solvent for a few more decades).

Our plan required 6% employer contributions. The state kicked in around 13-15% per year (changed based on the whims of the legislature).

I was planning on early retirement all along, so I considered the pension worse than worthless. It was actually a detriment since I didn’t get to invest the money in anything and didn’t get any interest for a few years. I missed out on a 20% return for the 3 years I worked at the state. At least I saved some on taxes on the contributions…

So my advice would be to factor it into your employment decision, but if you are on track to retire early, it might not add much to your retirement plans. And 30 years is a loooong time to devote to a job. I’ve seen the zombies walking the halls at my employer just ticking off the years. Like prisoners. “I’ve got 9 more years” “Oh, you’re lucky, I still have 10 year 4 months left”. Ugg! What a horrible existence doing something you don’t like for another 10 years on top of 20 previous years of mediocrity. Explains why we get some of the results we do from the government.

When I said “I don’t know if I could do it for 30 years,” what I really meant was “I have absolutely zero intention of doing it for 30 years.” So yes, the “golden handcuff” situation really is a negative when I consider this career direction. Still, the pay is good especially when considering the relative lack of overtime.

Digging further it looks like my state has passed some pension reform law that says that the retirement system “may enact” a defined contribution plan and that “after that plan is created, employees will be allowed to choose between the traditional pension and that plan.” But I didn’t see any deadline for establishing that plan. So it’s going to be a few years for me anyways if I do this, I’ll just wait and see I guess.

I know what you mean about the “8 years 6 months 13 days left” people. Golden handcuff is really an amazingly apt description.

Sounds like you were in the same position as me – knowing you weren’t going to be able to take advantage of the sweet pension. I decided on the particular position in government for factors other than the pension, that’s for certain. Almost zero overtime was one of them.

I know I’m a little late to this discussion…but this is exactly my situation! I have OPERS and I am forced to put in 10% of my pay while my employer matches it at 14%. I am not vested until 10 years. My plan is to retire early after I am vested because I can’t work here forever. I work with people who really do count down the days. After my first day here they said “Well, only 29 more years, 11 months and 30 more days!” I can’t do that. So it sounds like I can take a lump sum after 10 years? That sounds like a good plan. I wish I could talk to HR about it, but I’m too nervous. haha I’m 25 and I just past year 2…8 more to go! lol

Renee, you probably want to research your plan a little more. I would read up on OPERS website, then call them if you have more questions. I wouldn’t be afraid to call the pension folks, since it’s doubtful they would ever talk to anyone at your organization. Here’s the contact info for OPERS: https://www.opers.org/about/contact/

Here’s a start on your research:

I found this tasty nugget here: https://www.opers.org/members/traditional/benefits/refunds.shtml

“REFUNDS

You are guaranteed full recovery of all contributions you have made to OPERS. Upon leaving all public employment in Ohio, you may apply for and receive your accumulated savings.

As a member participating in the Traditional Pension Plan, you may receive your accumulated contributions, interest on those contributions and, if you have five or more years of qualified service credit in the Plan, an additional amount that is determined based on your years of service credit.

If you have at least five years of qualified service credit, the amount is 33 percent of your eligible contributions. If you have at least 10 years of qualified service credit, the amount is 67 percent of eligible contributions. Eligible contributions are the contributions you made to the Plan and any amounts paid to purchase certain types of service credit. ”

It sounds like your plan is way better than my plan. Stay 5 years and you get your contributions back plus 1/3 of all contributions in addition. Say you put in $30,000 during your 5 years, you get back $40,000. Put in 10 years, you get back contributions plus 2/3 additional. If you contributed $60k in 10 years, you get back $100k! In a way it is like they are paying interest on your contributions. The takeaway from this news is that you might only want to stay 5 years to get the 1/3 additional return (if you have better competing alternative employment opportunities).

Renee, were you not able to join OPERS’ defined contribution plan? https://www.opers.org/members/member-directed/

It seems like you might be out of luck now, though… I think the decision has to be made immediately upon starting employment, but you never know, they might allow you to switch if you get on it ASAP.

yay Ohio!!

Nick and Renee, I too have the OPERS Defined Benefit plan. Justin did a great job of quoting the basics. You can always take out the 10% that you are required to put inches you leave your public job. The 14 % match can be taken at 33% after 5 years or 67% after 10 years. However, if you don’t need to touch this amount, you can let it grow even after you leave employment. I have 5 years and am hoping to only work about another 5. But I don’t plan to touch this pension until I am 65 years old. This does two things for me. One I only have to save money to get me from 40 (age I plan to retire) to age 65. And two, at age 65 I am guarenteed an income for the rest of my life. Since I don’t pay I to social security with my public employment,and who knows it may not be around in 30 years, this is just another one of my saving strategies. I also put into my 457b, which I can withdraw from once I leave my job, and my husband maxs out his 401k. I hope this is helpful.

Thanks for the response, Mama Breeze!

I was wondering what you would do in this situation. I am trying to choose whether to put more into my 401k or pay more toward my student loans.

I am currently putting $1000 a month into my 401k, and paying $2500 toward my loans (rates ~6%). For next year, I could either max out my 401k and pay a little less toward the loans per month, or keep the 401k and loan payment amounts the same.

At my tax rates I save 29% or so federal + state on my 401k contributions, which is what makes it a tough decision. I’d like to retire around 40-45 and will likely have a much lower effective tax rate than 29%.

You may want to set up a spreadsheet and dig into the details a little more for your specific situation.

My gut says max the 401k and take the 29% instant tax savings (and deferred taxes while the funds remain in the 401k). Each year you have only a certain 401k contribution potential ($17500 for 2013) and it is use it or lose it. In a few years, you might be earning more and want to save 29% in taxes on more than $17,500 but find you have no other tax deferred savings options (although check out Roth IRA’s). In addition, maxing the 401k (which in your case means contributing an extra $5500/yr) will save you $1600 in taxes. You can put that $1600 tax savings toward your student loan!

You are right about your retirement tax rate – you may pay zero or close to it.

Good luck. Sounds like you have some massive earnings potential with $3500 per month going toward non-consumption activities.

The only way I might “juice” your finances would be to seek out lower rate borrowing. Something I have done in the past with great success was 0% balance transfer offers for credit cards. The game doesn’t make sense for me any more (I used to borrow at 0-2% and put in the bank at 5%+). But for you, you can float some student loan balances on there and pay 0-3% per year and avoid 6% interest. Be careful that you understand the terms of repayment because managing cash flow can be tricky. But the savings can be decent. A large balance dropped on credit card balance transfers at 2% average interest/fees would give you a net 4% interest savings = $2000/yr saved in interest on a $50k balance. Check out the “credit cards” link under recommendations at the top of the screen if you want to see some zero or low interest rate credit card offers. Just make sure you understand “the system” before you jump in!

Other sources of cheap borrowing are car loans and mortgages. You could possibly pay 2-3% instead of 6%, although I wouldn’t buy a new car or new house just to get low interest rates. If you already own a car or house, however, you could possibly cash out some equity at low rates.

Thanks for the input, I think I will end up maxing out the 401k. Maxing it out vs. doing the $1000/mo will only be a $320 difference in take home pay, I can handle that.

As for the balance transfers, I am already in the churning game, so I don’t want any more hard pulls for balance transfers. Between my girlfriend and I, we’ve gotten about $4000 worth of flights, hotels and statement credits so far this year, with a lot more still sitting in points/miles. If I can make my travel budget close to zero and still have some great vacations, I’ll take it. If the credit card offers dried up, I probably would do what you recommended.

Good choice re: 401k maxing.

You sound like us! Free travel is pretty sweet. I’ve become a credit card snob and won’t even apply for a cash back bonus of less than $150-200 or so. Glad to hear you already have the “extract wealth from credit cards” on an efficient course. 🙂

What about Alternative Minimum Tax? Surely your AMT is greater than $150. Shouldn’t you be paying that instead?

I think we missed the AMT by $15,000 or so. Our AGI in the chart is $66,150 and there’s a $80,800 AMT exemption for married filing jointly. For kicks, I put $82,000 AGI plus a little foreign tax credit in the IRS’s online AMT calculator and it says I would have to fill out the AMT form to see whether I owe AMT.

Great point about the AMT though, since some might be close to AMT in a slightly higher income situation.

Ah, I forgot that AMT is based on AGI and not gross income. Thanks for the explanation!

Unfortunately, I don’t have access to a 401(k), pension, HSA, or 457. Any tax avoiding ideas? I’ve been contributing the max to a Roth IRA. I’m single with no children. Can a 529 be opened for yourself? This post is motivating, to say the least!

You can definitely open a 529 for yourself, but it’s usually best to spend the funds on education (eventually). You can always change the beneficiary in future years if you plan on having kids or want to help out nieces/nephews.

If you are self employed, there are tools like the SEP IRA and solo 401k that can allow additional tax deferred savings.

Great informational article. Since we don’t have kids, I don’t think we’ll be getting additional deductions. 🙂 Too much responsibility for the lifestyle we want to live currently! 😛

Hi Justin,

I saw above that you talked about how to use credit cards to lessen the load of student loans. I’m getting married in July and combined we’ll have about 74k in student loans (majority at 6.55%), and combined we’ll be bringing in about 80k pre-tax. My plan was for both of us to contribute the minimum necessary to get our full 401k match from each of our companies, and put the rest towards paying off the student loans asap. Is this the best approach? Also, I was wondering if you could explain the credit card system you used for your student loans. For the credit cards I have, the interest on cash advances is 25% APR. Is the idea to max out the cash advance on one card, and use another card to transfer the balance which could be as low as 0% with some intro rates? I’m not sure if I’m understanding that right or not. Thanks for your help!

You have the basic idea – find cards with 0% balance transfer offers with low fees (usually 2-4%). You could get a slight advantage in interest rate compared to your 6.55% rate. I don’t know if it has changed lately, but the credit card companies used to simply write a check to you for a “balance transfer”.

Or the credit card company (for your new card) will simply write a check to your old credit card, thereby creating a credit balance on your old card. You can then call the customer service for your old card and request a check for the amount of the credit balance.

It’s a dangerous game since you have to pay the balances off before the 0% rate expires (usually within 12-18 months). If you are interested in searching out a couple of cards, check out the “Credit Cards” link I have above under recommendations. One card I know that offers 18 months 0% on balance transfers is the citi simplicity card, but you can search through all the different cards at the “Credit Cards” link. The Barclay Arrival Card (look in the upper right corner of Root of Good or at the “Credit Cards” link) also offers 0% for 12 months, and $400 cash toward travel. So you can save on interest and get free travel! And your wife-to-be can apply for her own set of cards as well.

Thanks Justin. I’ll have to play around with it a little more and see how much it’ll help me. I actually do have the Barclay Arrival Card, and redeemed the rewards for our honeymoon. And it turned out to be $440 towards travel because they give you 10% back on points redeemed for travel. Not too shabby!

That’s impressive. So you lower your tax burden and increase your savings rate at the same time. Win win!

Absolutely! Save more, pay less taxes. And shelter the saved money by adding it to IRAs or 401ks.

Have you considered whether you can claim the dependent care credit in addition to your dependent care FSA? The FSA allows you to set aside 5,000, but the credit is available for costs up to 6,000 (2 or more kids). You’re allowed to max your FSA and take the credit on the extra 1,000.

Our child care expenses weren’t high enough to also take some dependent care credit, so I haven’t investigated it. I think you have it right though – you can do the dependent care credit for up to $6,000 (or whatever the number is this year) for any amounts not paid out of the FSA, after subtracting what you put in the FSA.

But I thought you couldn’t get the FSA tax benefits PLUS the tax credit. Isn’t this double dipping?

Ryan has it right (above). You can do $5000 in dependent care FSA then up to $1000 will count toward the dependent care tax credit. $5000 + $1000 = $6000 which is the max you can count toward the tax credit (but basically $6000 minus what you contribute to FSA). Can’t double dip on that $5000 put in the FSA.

Oh man, this article just made me discover that my state employed wife can contribute to a 457, and that we could have been doing so instead of her 401k all along. So now this means that I am indeed NOT currently maxing tax advantaged space. Just started investing in taxable last month because I thought I was at that step. ALSO this means that now that I have opened and started contributing to the 457 that our AGI is down into deductible IRA territory. Contributing to traditional instead of Roth is not something I pictured ever doing while I was in the 15% bracket, but doing that exact thing is really the correct choice for an early retiree assuming existing tax law.

Thanks so much for this blog post. You really helped me.

Wow, so you’re due for some big tax savings by maxing the 457 and thereby gaining access to a deductible traditional IRA? Congrats! You can mail me my 10% cut of the tax savings if you’re feeling generous! 😉

How do you get IRA contribution deductions when you exceed the AGI cap?

You have to be below the AGI caps. We are below the AGI caps because all the workplace tax deferred contributions lower AGI. Our AGI tends to be around $70k (roughly half our gross income).

Although I 100% endorse this post, I definitely hope people don’t think that the government doesn’t get its unjust due. My effective tax rate (federal,state,local) is over 35%. Sure, I was still using a Roth 401k instead of a traditional like I am now, but I by no means did anything grievous to get to these numbers. Anyway, most people likely understate their tax burdens by a considerable amount. Things to remember when considering taxes:

1. Don’t forget about FICA and Medicare Tax. The total tax for anyone’s base salary is 15.4%. This is straight off the top with no easy way to get around it (minus an HSA). Employees split this with their employer’s yet the fact remains, this is money all employers are willing to pay for their employees.

2. Don’t forget about Property taxes. 2-3 k might not seem like a lot in relative to a 200-300 k house, but marked against one’s income it is quite another thing. If you are a renter, you are still paying this as well through higher rent prices.

3. Sales Tax can be brutal on large purchases like cars and is like a death by a 1000 cuts when applied to yearly expenses. This number is easily over a 1000 for most families.

4. Inflation is a never ending tax. If the powers at be decide to reward their rich banking friends with more Federal Reserve notes via QE, the purchasing power of your income is lowered into perpetuity. As a side note – inflation is often abused by the government in that growth in productivity and efficiency are used to offset the effects of inflation. Even with prices on general goods unchanged, a person can still experience inflation in that without the interference of government debt/central banks, they would have experienced deflation.

In short, there is now way to eliminate taxes in a mainstream work life. Your best bet is to lower spending and save in tax advantage accounts, but in no way are you sticking it to the man.

Even with RoG’s amazing saving to tax advantage accounts and children to lower his federal/state tax bill, I doubt his total tax burden (all in) was less than 15-20%. Good, but still quite a lot of money (20-30 K) that one forks over to the state.

You are certainly correct! I like to brag about our ultra low federal tax rate because it’s very easy for many middle class folks to mitigate or completely avoid federal taxes.

Your observation that we are still paying 15-20% in taxes is very astute. On roughly $150k gross for 2013, we paid:

– $8600 in FICA/medicare (plus another $8600 the employer paid on our behalf)

– $2500 state taxes (7% marginal rate, going to 6% next year but with fewer deductions)

– $250 federal income tax (ouch – thought we would only pay $150 – I was off a bit)

– $1400 property tax (on a $150k home) – actually a steal since we get free tuition in elementary school x2 kids!

– $620 sales tax – 2% groceries, 6.75% all other goods

– $180 gas tax – user fee? We drive on roads and they do have operating costs

That’s $22,150 total. Or just under 15% of our gross. I didn’t even get into hidden excise taxes or import tariffs, or built in tax costs (fuel taxes paid by truckers driving our goods to the store for example), or fees like car registration and inspection.

We get a lot back from the government. It’s hard to say if it’s $22,150 worth this year alone. Probably not. But those FICA/medicare taxes will drop big time in 2014 and be gone completely in 2015 or 2016. After that, our taxes will fall almost 90% to under $3000. Just our Obamacare subsidy alone will be worth thousands per year, so we will be a net recipient of government largesse starting in 2015-2016 or whenever we go on Obamacare.

While you are working, taxes take a big, seemingly unfair chunk from your productive efforts. But when you are young or old, or early retired, the bite is much gentler.

As far as talking getting back from the government what they took from you, I don’t really have a huge problem with that. You spent many years as a productive member of society and were charged a pretty penny for it. The problem with this type of thinking though:

“We get a lot back from the government. It’s hard to say if it’s $22,150 worth this year alone. Probably not. But those FICA/medicare taxes will drop big time in 2014 and be gone completely in 2015 or 2016. After that, our taxes will fall almost 90% to under $3000. Just our Obamacare subsidy alone will be worth thousands per year, so we will be a net recipient of government largesse starting in 2015-2016 or whenever we go on Obamacare.”

Is that this is your personal situation doesn’t reflect the mathematical reality of these larger social systems on a whole. Yes, one individual can find niceties that fit their personal situation and might be able to navigate the system to a slightly negative to neutral outcome like yourself. However, these sorts of systems (especially one like obamacare,ss,medicare,etc) are disastrous when viewed through the lens of the productive majority that feed into it. For instance, If a person making 50k annual salary were to save 15.4% for 40 years instead of paying payroll taxes, they would have 731K in real dollars!!! Sure some people might not save the money, but this is the yardstick the government needs to be measured against none the less.

Believe me, I’ve done the calcs on what I would have had if I saved my SS taxes, and it’s not fun thinking about what I would have. But as a counterpoint, I’ve seen SS help older people who didn’t save a lot for retirement (sometimes for reasons largely outside their control).

My thoughts on the give and take that’s part of living underneath a government. A cynical view: redistributing wealth keeps the masses from storming the gates of the richest few. I’m not one of the “rich” (with a NW barely in the 7 figures) but who knows when the unwashed masses will decide it’s their turn to be wealthy and help themselves to the wealth of others (by force or by a 51% majority vote to enact confiscatory taxation). Keep giving them bread and circuses, right?

A more egalitarian view: we have enough wealth that we, as a people, can afford to stick a few social safety nets underneath those who need it from time to time. It’s obviously highly debatable as to who needs help and for how long, and what conditions or expectations we should place on those people.

In the meantime, I say take your lumps in stride. The US is a pretty awesome place to live overall, warts and all. You pay your dues for a while, then you let others pick up the reins. You can lobby and fight for changes to make the system better (in the streets or at the ballot box), all the while living the best life possible given the constraints of the system that is in place right now.

what if my employer does not have 401k how can i reduce federal tax

Deductible traditional IRA contributions, tax efficient investments, other workplace saving plans (health savings account or flexible spending account for medical). Those are the easy ones.

can me give me some of the tax saving investments

VFIAX or VTI held in a taxable brokerage account. Both are tax efficient investments from Vanguard and are good core holdings in an investment portfolio.

Depending on what tax bracket you are in, you will pay between 0% and 15% on the dividends each year and there won’t be any capital gains (most likely).

You won’t get a tax deduction when you invest, but long term it’s hard to beat the tax savings of funds like I mentioned.

I have some of my investments in VTSAX. Is that less tax efficient than the funds you mentioned (VFIAX, VTI)? They seem like pretty similar holdings, but I hadn’t considered tax efficiency. I have some vtsax in a taxable account (and some in a non-taxable).

VTSAX is similar to VFIAX in terms of tax efficiency, and possibly even a tiny bit better. VTSAX (Vanguard Total Stock Market Index) is perfectly appropriate in a taxable account and is one of the best funds for taxable accounts honestly.

I’m confused by your HSA listing. Did you somehow use that to cover your health insurance? If so, how? My HSA is ridiculously limited. Every time I try to use it, my claim gets rejected and I have to fight tooth and nail to prove it’s valid. As such, I’ve reduced it to like $200 per year.

Disregard. I read that it couldn’t apply to an employee sponsored plan.

I guess you solved your own question, but I’ll comment about HSAs vs FSAs. My experience with FSA’s has been mixed – often times I experienced difficulties getting reimbursed with one plan sponsor, but with another sponsor, no problems at all. For the HSA, I’m the only one reimbursing myself, so I would never deny my own claims! 😉 But seriously, you’re only accountable to the IRS as to whether they are qualified medical expenses, and there is no custodian for my HSA (held at Fidelity).

My husband makes $110,000. His employer matches only $2000 a year into a Roth IRA but it doesn’t get taken out from his check. We have 4 kids and an income property. Any thing else we can do to lower taxes if his employer doesn’t offer anything?

Health savings account? Flexible spending account for childcare or medical/dental expenses? 529 contributions (if your state offers a tax break – mine doesn’t any longer).

Don’t forget you can both max out IRA contributions even if you don’t have any earned income. That’s $11,000 per year. Your husband’s income of $110,000 would mean you probably make too much to deduct traditional IRA contributions. Adjusted Gross Income of $96,000 or less lets you contribute the full amount to a traditional IRA and deduct it all. You can still deduct a portion of the IRA contribution up to AGI’s of $116,000. That would mean a small tax break for you if your AGI is lower (things like health insurance, HSA, and FSA all lower your AGI, so it might be a lot less than $110,000).

Great stuff. You may want to re-read instructions regarding the IRA deduction, though. I’m pretty sure that if you participate in your employer sponsored plan (e.g. 401k) you can no longer claim the deduction for IRA contributions. You can still contribute, but only with after tax money…

Cheers.

I always follow the worksheet in the instructions and qualified for traditional IRA most years. Just have to get the AGI below the thresholds to qualify.

What would have been your tax rate if you had chosen to reinvest your 8k of dividends?

I might be misunderstanding the question, but my taxes would be the same whether I reinvest the dividends or take them as cash. Buying a new investment doesn’t have any tax implications (as far as I know), and only when dividends are paid or investments are sold are there tax impacts.

I read your sheet as you took the dividends as cash, therefore being classified as income. If you had just reinvested them then you would have reduced your taxable income by $2500 (8k-5.5k).

I also see that you wrote Child Credit x3. Isn’t the child credit a flat 3k and not on a per child basis?

Dividends are taxable whether you reinvest or not. And most of my dividends are tax fee (ie qualified dividends) although they do increase the AGI (just not taxable income).

Child tax credit is $1000 per kid, subject to some rules.

Are they tax free because they are from a Roth Account?