This week I’m jumping into the inner workings of Social Security to answer a question about the impact of early retirement on how much Social Security early retirees will qualify for.

The usual question is: “Yeah but if you retire early you won’t get hardly any social security and you’ll be poor when you’re older. You should keep working till a reasonable age like 67 so you can earn a good Social Security payment”. Okay, grammarians, I confess. That’s not really a question but rather a complaint in the form of a declarative sentence followed by another declarative sentence.

The short answer is that the complainant has no clue how Social Security works, because early retirees typically qualify for really great SS benefits given how little they work. The long answer involves bend points and understanding the progressive nature of the Social Security system. And math.

The Social Security Formula

Determining the amount one will receive from Social Security is fairly simple when reduced to its parts. Here’s how it works:

- Look at an entire lifetime of annual earnings (anything that was subject to SS taxes).

- Adjust each year’s earnings to account for inflation.

- Take the highest 35 years of inflation-adjusted earnings and discard the rest of the earnings (if any).

- Divide by 420 (35 years times 12 months) to get the Average Indexed Monthly Earnings (“AIME” in SS speak)

- Run the AIME Monthly Earnings through the Primary Insurance Amount (“PIA”) formula or “bend point formula” (which returns between 15% and 90% of each dollar of monthly earnings).

- Adjust the Primary Insurance Amount up or down to account for taking SS early (at age 62), at regular age (67 for everyone born in 1960 or later), or late (at age 70) or any point between age 62 and 70.

If you take SS at your full retirement age (assumed to be age 67 here for the purpose of simplicity), then you’ll be getting the Primary Insurance Amount from Step 5.

There are a few more complications to the way SS is actually calculated, mostly involving how inflation is applied in the various steps and which index is used for inflation (Average Wage Index versus CPI-W versus the more commonly used CPI-U). These complications are more interesting to economists than to the average person trying to understand how Social Security benefits are calculated, so I’m ignoring them because the impact is relatively minor and not relevant to the basics of how SS works at the big picture level.

To recap, your SS benefit is proportional to the average of the top 35 years of earnings. As your average monthly earnings increase, your SS benefit will increase, although to a lesser extent as you pass the 32% and 15% bend points.

What are bend points?

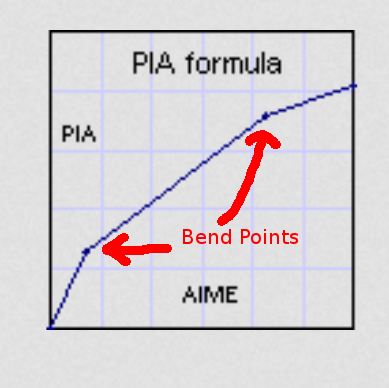

A picture is worth a thousand words (or at least a few hundred).

Bend points are the points in the Primary Insurance Amount formula where the rate of “payout” on an extra dollar of earnings decreases. Remember, Primary Insurance Amount is roughly the benefit you’ll receive at full retirement age (in today’s dollars).

Let’s take a look at the actual bend points in dollar terms to see what these bend points are all about.

For 2016, the two bend points are $856 and $5,157. When the Average Indexed Monthly Earnings falls below $856, the Primary Insurance Amount is 90% of the monthly earnings (AIME). For example, a $700 AIME generates a $630 PIA ($700 * 0.90 = $630).

When income falls between the two bend points, the Primary Insurance Amount equals 90% of $856 (the first bend point) plus 32% of everything over $856. For example, a $3,500 AIME generates a PIA of $1,616. Here’s the math: ($856 * 0.90) + ($2,644 * 0.32) = $1,616.

For AIME’s over $5,157, the Primary Insurance Amount is 90% of $856 plus 32% of $4,301 (2nd bend point amount minus first bend point amount), plus 15% of everything over $5,157. For example, the PIA on a $7,000 AIME = $2,423. Here’s the math: ($856 * 0.90) + ($4,301 * 0.32) + ($1,843 * 0.15) = $2,423.

Here’s the “payout” chart for various monthly earnings (AIME) amounts:

- AIME below $856 = 90%

- AIME over $856 and below $5,157 = 32%

- AIME over $5,157 = 15%

These bend points are analogous to income tax brackets because they are progressive in nature. Since we’re calculating a benefit instead of a tax, the rates are inverted. Instead of higher incomes paying more tax on the next dollar of earnings, higher incomes receive a smaller benefit on the next dollar of earnings.

The highest rate of benefit (90%) applies to the low income folks. Middle income folks are in the intermediate bracket with a moderate rate (32%). High income folks fall in the highest AIME bracket with the lowest rate (15%). That’s the nature of a progressive system – the worst off get the proportionally largest benefit.

Why earning more doesn’t pay off (much) when it comes to Social Security

Going back to the examples presented in the previous section, let’s look at how the Primary Insurance Amount increases as the monthly earnings increase.

- Below 1st bend point: AIME of $700 = $630 PIA (90% “payout”)

- Between 1st and 2nd bend point: AIME of $3,500 = $1,616 PIA (46% “payout”)

- Above 2nd bend point: AIME of $7,000 = $2,423 PIA (35% “payout”)

At $700 of monthly earnings, the monthly benefit is $630. Increase the monthly earnings by 400%, and the benefit increases by only 156% (to $1,616). Double the earnings again and the benefit increases just 50%.

By comparing the low income earnings with the high income earnings in this example, it’s a little more clear. $7,000 monthly earnings are 10 times the $700 monthly earnings, yet only generates a monthly benefit that is four times as great. Earning ten times as much while only receiving four times the benefits illustrates the progressive nature of the SS benefits formula perfectly.

The sweet spot is with the lower monthly earnings found below the first bend point of $856 where the benefit you earn is 90% of your earnings amount. Move up to the earnings range between the first and second bend points and you get 32% of each extra dollar of earnings (not great, but still something, right?). Go above the second bend point ($5,157+) and you only get 15% of each additional dollar of earnings (screw that!).

Understanding the Average Monthly Indexed Earnings (AIME)

Following me so far? If not re-read the last two sections because they are pretty dense.

The progressive nature of bend points and the average monthly earnings calculations are key parts to understanding how an early retiree fares under the SS benefits formula.

Let’s walk through some average monthly earnings examples. Remember, in SS parlance, the Average Indexed Monthly Earnings (AIME) represents the sum of the highest 35 years of income (indexed for inflation) divided by 420 (the number of months in 35 years).

Since the AIME takes an average of the incomes over 35 years, it doesn’t really matter whether the income occurs in a large dose over a relatively short period of time (like 10-15 years) or whether it’s evenly distributed over 35 years. Ignoring inflation, a person earning $70,000 per year for 10 years will have the exact same AIME as the person earning $20,000 per year for 35 years. The earnings for both people are $700,000 in total, $20,000 per year, or $1,667 per month. That $1,667 is the AIME.

In real life terms, an early retiree that worked as an engineer and averaged $70,000 per year over their 10 year career and then retired (not radically different than my own salary over my ten year working career before retirement) would have the exact same AIME as a fast food worker that earned $20,000 per year (about $10 per hour) over a much longer 35 year career.

It’s also worth pointing out the fact that Social Security only takes the highest 35 years of earnings (adjusted for inflation) into account. As a result, those working to a traditional age of 65 or 67 might be losing ten or more years of earnings history when the higher income years replace lower earning years from early in their career.

Consider the case of a person earning an inflation-adjusted $45,000 per year the first ten years of their career then working another 35 years making $55,000+ per year. For SS calculations, they will only end up with 35 years of earnings at $55,000+ per year and the $45,000 per year earned for ten years won’t matter at all in spite of paying SS taxes for those ten years!

The advice to “keep working till you’re 67” completely ignores the fact that the earnings in your later years might not increase your Average Indexed Monthly Earnings by very much since you’ll be replacing some years of earnings instead of adding your new earnings on top of your first 35 years of earnings. In some professions with relatively flat earnings over a full career, you might be earning about the same (in real terms) right out of college and 40 years later.

Pharmacists, for example, don’t make a lot more later in their career compared to entry level salaries. Tacking on ten years of extra work might add just a couple hundred dollars to the Average Indexed Monthly Earnings. A pharmacist with a full 35 years or more in the workforce would likely be in the 15% payout bracket (above the second bend point), which means a couple hundred dollars added to the AIME equates to an extra $35 per month in benefits. Work ten more years as a pharmacist just to earn $35 more per month from SS? Somebody needs to check their meds if they think that’s a swell idea.

What this means for the early retiree

Let’s take a look at my actual earnings as reported by the Social Security Administration (you can access your online SS account here). They roughly match the salaries I reported in my now-viral Zero To Millionaire In 10 Years post and the wages I earned dating back to the early days of my near-minimum wage jobs during high school and the better paying jobs I had during undergrad and law school.

In addition to my annual earnings, this table also shows the inflation adjustment factors and my annual earnings adjusted for inflation.

To understand the inflation adjustments, take a look at the 1996 Average Wage Index Factor. It’s 1.794. This means the 1996 earnings are actually worth 79.4% more in today’s dollars. In my case, the $519 I earned in 1996 is equivalent to $931 earned today. Adjust all my years of earnings to account for inflation, and it increases my total lifetime earnings from $616,783 to $707,497. That’s over $90,000 in increases due to inflation.

Out of the 19 years covered in the chart, I have earnings for 17 of those years. Since I have less than 35 years of earnings, every single year of my earnings will count toward my Average Indexed Monthly Earnings.

My total earnings adjusted for inflation are $707,497. Dividing by 420 gives me an Average Indexed Monthly Earnings of $1,685. Applying the Primary Insurance Amount formula gives me a monthly benefit of $1,036 at age 67 ( ($856 * 0.90) + ($829 * 0.32) = $1,036 ). On an annual basis, I will receive $12,432. Since Mrs. Root of Good has a similar earnings history, she’ll be entitled to roughly the same benefit. In total, our family will receive around $24,000 per year in Social Security benefits. That’s roughly two thirds of our $32,400 annual retirement budget!

As you can see, Social Security benefits can provide a subsistence level of income, or a generous supplement to other retirement income, even for an early retiree that works at a full time job less than 15 years.

Some claim Social Security will change over the next three decades before I can start drawing benefits. I predict any changes will be marginal. My benefit might not be quite as high or I might have to wait till age 68 or 70 to collect full benefits. If you disagree, let’s check back in with each other in 32 years and see how things turned out.

Now that I’ve determined I’ll get around $1,036 per month in SS benefits, let’s do some experiments.

What if I work another ten years at roughly my old salary of $70,000 per year (in today’s dollars)? That would double my lifetime earnings to about $1,400,000. Dividing by 420 gives me an AIME of $3,333. After applying the Primary Insurance Amount formula, I would be entitled to a benefit of $1,563 per month at full retirement age. That’s nothing to sneeze at. At age 67 I would get an extra $527 income per month with annual cost of living adjustments for the rest of my life. Not exactly life-changing, but if Mrs. Root of Good and I both put in ten more years, our SS would cover our entire retirement budget.

But I would have to work ten more years. Just to get $527 of additional income from SS. 32 years from now.

No thanks. I think I’ll stay early retired.

Taking this experiment even further, what if I worked until age 67 and ended up with at more than 35 years of earnings of $70,000 per year (assuming I never received more than inflationary raises, which is a believable scenario if I stayed in my old job with the State)? My monthly benefit would go up to $2,248 per month.

That would be 34 additional years of work and all I would get is slightly more than double the benefit I qualify for right now. Again, no thanks. It would be pure insanity to work another 34 years just to double my SS benefit.

If I did want more income for retirement, I’d focus on working and saving more in my investment portfolio until I hit my new target and not rely on working longer to get a higher Social Security benefit.

When does it make sense to work longer just to get more Social Security?

In general, it doesn’t make sense to work longer just to qualify for a higher Social Security payment. However, there are two cases where it might be worthwhile to work a little longer for SS benefits.

The first situation is if you don’t have the minimum number of credits (or quarters) to be eligible to collect Social Security. You need 40 credits to draw SS benefits. You can earn up to four credits per year, which means you can acquire 40 credits in as little as ten years. In 2016 it takes $1,260 of income to earn one credit (up to four credits maximum per year). In other words, it doesn’t take a lot of income to earn four credits per year.

For some extremely early retirees that might not have worked for a full ten years, it makes sense to have at least a little earned income throughout the rest of their lives so that they qualify for Social Security, even if the benefit is modest. Another huge benefit of earning 40 credits is that you will qualify for free Medicare Part A coverage at age 65 (which would otherwise cost $400+ per month). Regular income from a part time job would work, as would 1099 income from freelancing (you pay your own self employment taxes in the latter case).

Even if you don’t have the 40 credits, it might not matter since you can qualify on a spouse’s (or ex-spouse’s) record if they have the required 40 credits.

The other situation where it makes sense to work longer for SS benefits is the case of a low income earner that retires early. This hypothetical person would likely be an extremely early retiree living on a modest budget.

Jumping back to the “What are bend points?” section, recall that the Primary Insurance Amount formula is very progressive in nature. In the lowest earnings bracket, you get 90% of your earnings back in the form of a benefit increase. Go above the first bend point and your payout rate drops to 32% for every extra dollar. To be in the Social Security sweet spot, make sure your lifetime earnings take up all that space below the first bend point in the 90% payout territory.

By back-calculating things a bit, the lifetime earnings to max out that 90% payout space is $359,520 (for 2016). This could be $35,952 of earnings per year for ten years or roughly $72,000 for five years or around $18,000 for 20 years. If you haven’t earned at least that much, then you could work more and significantly increase your SS benefit.

What have we learned?

Let’s face it. Most of you didn’t read this whole article. Heck, I barely read the whole thing and I wrote it! So hopefully you’ll at least read this part where I recap the key lessons of Social Security for those retiring early.

- Social Security is a progressive social insurance program. You can work very little and still receive a benefit. Working at a high salary for many years won’t give you a proportional increase in benefits compared to the SS taxes you pay into the system.

- It doesn’t matter whether you earn a little bit for 35 years or a lot over a much shorter period of time. The SS benefits formula takes the highest 35 inflation-adjusted years of earnings and adds them up to determine your benefit.

- Working longer than 35 years might not increase your benefit at all. And if it does increase your benefit, the increase might be small since additional years of working beyond 35 start “erasing” lower earning years in your work history.

- If you haven’t worked at least ten years before retiring, you might not be eligible for SS benefits, so consider working a little bit to earn enough credits to qualify for SS (and Medicare).

- If you retired extremely early or earned very little during your lifetime, you might not be in the SS Sweet Spot. Make sure your lifetime earnings put you near the first bend point (about $360,000 total for 2016).

- When random strangers tell you to work a few extra decades just so you can increase your SS benefits by a modest amount, ignore them. They most likely don’t know about bend points, AIME, PIA, or really anything about how SS benefits are calculated.

For our own early retirement financial planning, we don’t have to get anything from SS to enjoy a successful retirement, but we expect it will be there in some form or another.

Did you learn anything new about Social Security today? How do SS benefits factor into your retirement planning?

Root of Good Recommends:

- Personal Capital* - It's the best FREE way to track your spending, income, and entire investment portfolio all in one place. Did I mention it's FREE?

- Interactive Brokers $1,000 bonus* - Get a $1,000 bonus when you transfer $100,000 to Interactive Brokers zero fee brokerage account. For transfers under $100,000 get 1% bonus on whatever you transfer

- $750+ bonus with a new business credit card from Chase* - We score $10,000 worth of free travel every year from credit card sign up bonuses. Get your free travel, too.

- Use a shopping portal like Ebates* and save more on everything you buy online. Get a $10 bonus* when you sign up now.

- Google Fi* - Use the link and save $20 on unlimited calls and texts for US cell service plus 200+ countries of free international coverage. Only $20 per month plus $10 per GB data.

There is another factor that may affect your your older readers. The NAWI multiplier for the late 1970’s and most of the 1980’s has a significant effect on the contribution to your earnings base in those years. The fewer the years worked, the greater the impact. The salary for the entry level jobs I held in the early 1980’s today is significantly less than the salary I received back then, indexed up by the NAWI factor. Do the worksheet calculations year by year and compare the indexed earnings to what the job actually pays today. For my entry level jobs in the early 1980’s, the indexed difference is 25 percent in some years.

The other important factor applies to high earners. There is a maximum amount of Social Security you can receive. Once your salary exceeds the FICA maximum, you are credited only for that maximum. For those of us that exceeded the limit later in our careers, the extra dollars did not increase the wage base or the PIA.

Those are both important topics that to some extent impact some SS beneficiaries.

I was trying to keep it simple here just to provide the big picture formula SS uses to calculate the benefits, and mostly ignore the details of inflation since I think that complication detracts from the understanding. But as always, if you want an exact estimate of your eventual SS benefit, go to SSA.gov and pull up your account (linked in the article), check out the indexing factors they use, and do the full analysis for your own particular situation.

For those hit by the earnings cap ($118,500 in 2016), they are probably already beyond the first bend point anyway, so it doesn’t make much sense to keep working just for the SS benefits. It’s useful to know about it for planning purposes, and it’s already reflected in the historical earnings SS provides in your statement or in your online account.

Great article. Like you, I researched this topic for myself recently as well.

I think the point about earning ~$350K during your lifetime is especially important and it’s a really good deal. I looked at that point from a Rate of Return perspective. A person earning $350K would pay $21,700 (or 6.2%) in social security taxes. At age 67, they would receive ~$9,000 in social security income. That’s a 41% Rate of Return! To be sure that doesn’t take into account the years you have to wait to get that return, but it’s still a really good deal for early retirees and aspiring early retirees like myself.

If that same person lived to age 87, they would receive a total of $180K in social security income despite only paying that initial $21,700 in social security taxes.

That’s a great point. It’s a pretty good rate of return ignoring the time delay in receiving benefits. The optimal thing to do would be to earn $5k per year for 7 years then earn close to the $118,500 limit for 3 years right before age 67 (if this were even possible given the demands of eating and needing a roof to sleep under!). Pay in $21,700 in taxes over those 10 years, then start collecting $9k/yr. This scenario isn’t realistic but it would maximize your return on SS taxes.

For someone like me that has to wait 30+ years to collect, I would probably be better off sticking those SS taxes (which are double if you have self employment income like I do now and did in 2014) in an index fund.

First of all, these figures are off by 50%, because someone pays another 6.2% in SS taxes. For self employed folks like me, it’s us/me who pays it. Otherwise the employer pays it (but it’s no doubt factored into your salary). So the return isn’t nearly what it seems.

Second, Justin why does it matter when or how your income is earned or broken down, since, as you yourself correctly noted Andy reiterated several times, it doesn’t matter how or when the total income is earned, since it’s all averaged?

Third, as noted in the first comment above, you neglected to mention a HUGELY important fact in the overall picture: the earnings cap. You should revise your article so as not to mislead folks who don’t read the comments and will mistakenly infer from what you write that they will get infinitely (in the literal sense) more SS benefits in accordance with how much more they earn over a lifetime.

In other words, since you don’t mention the cap, many readers might assume that they will receive an additional 15% in benefits corresponding to AIME amounts over $5,157, when that is definitely not accurate.

Otherwise, great stuff, and I still appreciate your work on this and found it helpful.

Thanks for running through the SS calculation. I’ve been thinking about tax strategy lately and SS falls into that category. I always considered SS to just be a bomust for us since we’ll retire early once our passive income surpasses our expenses. So in theory our passive income will be more than enough. That means SS will be fun/travel/college tuition/investment/donation money. Time to look up where I stand and crunch the numbers to see what I can get.

This is mostly how we view SS. Icing on the cake for surviving 30 more years! It’s a decent back up plan in our case, but most likely we’ll just spend it on something fun or pass it down the line to the next generation.

Ensuring you have enough earnings to fill the 90% bracket is about all that matters in the scheme of things when you have enough of a nest egg saved up. I personally see anything I get from Social Security as a bonus in the end. Since Mrs. C. earns a very low yearly income in order to stay with the kids most of the time (she varies between $5K and $12K) she will certainly have a much better ROI on her Social Security than me. You did a great job of illustrating the point that once you pass that second bend point it really makes no sense to work for the sake of increasing Social Security earnings.

And your Mrs. C will most likely qualify on your record too, so her earnings might not push her above half of your benefit level anyway (depending on her income in earlier years).

Nice review, and thanks for the homework. Now we have to start figuring out how this would apply for us here in the Netherlands.

Obviously the idea is to make sure we don’t need any social security, but it may just provide that little additional risk coverage in shortfalls from the investment portfolio in the far far future. So it’s part of the overall risk assessment for financial independence / early retirement and should be addressed.

Thanks Justin!

It would be neat to compare the Dutch old age pension scheme with the US’s Social Security just to see which one is more progressive.

Our typical pension plan that you earn by working for the government or for employers isn’t progressive by design – it’s just number of years worked times some measure of what your salary was in recent history times some percentage. Lower income workers don’t receive proportionally more in benefits (in general).

I’d like to point out that I appreciate you mentioning Social Security isn’t going anywhere, it may change, but it won’t disappear. I was familiar with the formula but this was probably the best analysis I’ve read about it and also the best set of practical examples to understand its outputs. Thanks!

I’ve recently found an interesting perspective of counting your social security as a bond in your asset allocation. Basically value that bond piece using discounted cash flows from social security starting at your retirement age. I find that perspective intriguing since at the end of the day SS is nothing more than a government bond. It’s a modern day “consol” if you know what I mean..

If I had to guess, people in their 30’s today will probably get 75%+ of the benefits you are actually promised today. Small changes around the edges might eat away some value but I don’t see it disappearing completely (it’s too effective at keeping older people off the streets and out of some of the welfare lines).

Thinking of it as a bond definitely makes sense. The same can be said of a govt or corporate pension. A steady stream of guaranteed income over time. Like a consol as you say. For those who retire very early, it’s hard to really count it for much in terms of asset allocation since the payment starts so far in the future (the net present value of those streams of payments being worth almost nothing with a reasonably high discount rate). At a 6% real discount rate, our combined future SS is worth just $4,000/yr today.

Awesome…I was just trying to figure this out for my ER plans yesterday!

This was really interesting. I see that I had no idea how SS worked. Thank you for writing about this!

Justin,

What are the SS benefits for a spouse that doesn’t have 40 credits? At what age do they qualify for benefits, and what are the spouses benefits if the 40 credits are not obtained?

Great article by the way – appreciate the knowledge you’re sharing.

Thanks

Vick

Here’s a page at the SSA that explains how spousal benefits work. Basically, your spouse doesn’t need to have worked at all to qualify for benefits on your account. The spouse can take SS benefits whenever they would normally qualify to claim benefits (reduced benefits at 62, full benefits at 67 for almost everyone today).

Thank you Justin – perfect!

A couple of Spousal SS tidbits:

* Assuming your spouse did not work, he/she will get 50% of your bene

* If the spouse did work and his/her bene is greater than 50% of yours, you and spouse get NOTHING extra. You’ve been screwed for working all those years. Thanks Uncle Sam.

* You can have several spouses collecting 50% benes, as long as they don’t have their own benes, and each was married to you more than 10 years.

SS has always been a mystery to me so this was extremely helpful. I’d like to run the numbers for myself — where did you find the Average Wage Index Factor for each year to calculate the Annual Earnings Adjusted for Inflation column?

I found it: https://www.ssa.gov/oact/cola/awifactors.html

Yep, that’s it. Pop in your retirement year and it gives you the historical AWI factors so you can build your own spreadsheet. They used to have a detailed SS estimator too but I didn’t see it during my research for this article.

Nice article Justin. I will definitely refer people to read this when they bring up the SS thing.

I agree that SS won’t change much. I have assumed that when the outflows are greater than the inflows AND there is no reserve (last I saw 2030 was the estimate) that benefits will be reduced by 30% or so. I don’t think that equates to the sky is falling like the media wants us to believe. Maybe they will increase the employer portion to help push that out, but I am not going to lose sleep over it.

You’re right. It’ll be a long time before outflows outpace inflows and the reserves are depleted. Small tweaks push that “failure” point out even further. And even if SS benefits get cut by 30%, you will still get 70% of it. 70% is still a lot higher than the 0% than many predict. 🙂

Great post as always. I was playing on the SSA website and coming to very similar personal conclusions that working longer doesn’t pay off in terms of proportional benefits to social security. I’ll definitely bookmark this page for future reference. Love your posts since we’re in similar life situations with a few kids and one main income. Hopefully, we’ll join you in the ranks of the early retirees in a few short years. Keep up the great work.

Thanks for the kind words. Always nice to find someone similarly situated as you.

After hearing other people talk about SS I was under the same impression that my SS benefit would be very small or that I wouldn’t even qualify for it if I only worked 10-15 years and retired in my 30s. A few months ago I made a spreadsheet with my earnings history and expected future earnings and made a graph of my benefit vs. years worked. It sure does taper off with more years as you have shown in the article!

Since early retirees save a high percentage of their income their budget is a lower percentage of their income. The SS benefit is based off a percentage of income so that covers more of your budget when you weren’t spending all your income like most people do.

The little graphic depicting the bend points from the SSA is conveniently not to scale. The benefits “bend” much more than that graphic would make you think (the lines are not at the right slope for the percentages). I bet this intentional to make you think your SS taxes are increasing your benefit more than they actually are!

I hadn’t thought about the bend point image but you’re right. That’s straight from the SSA so I can’t take credit for the silly scale they used.

The slope should be 0.90 on the first segment, 0.32 on the middle segment then 0.15 on the right-most segment. Which means the slope on the first segment should be 6x steeper than on the right-most segment. Oops, SSA. 🙂

The relative slopes aren’t that far off but the absolutes are. A 0.9 slope should stay below the diagonal. Here’s a quick redraw with appropriate axis scales. Feel free to use it if you like: http://imgur.com/a/G5KNn

Solid analysis! I might make one minor correction to your takeaway #2 (“It doesn’t matter whether you earn a little bit for 35 years or a lot over a much shorter period of time”). This is true unless earnings in a given year are above the Social Security taxable maximum (for example, above $118,500 for 2015). Unless I’m mistaken, earnings above the cap each year do not factor into your benefit.

That said, I completely agree with the overall takeaway: delaying your ER plans to increase your Social Security payment is crazy!

Oops, I see you already addressed this in the comments above.

Thanks for pointing that max SS cap out.

One of your best articles, and it’s incredible that I haven’t seen this covered on other financial blogs. I’ve been wondering on this myself, and this finally got me to do the math and put a number on that since I’m just a few short years away from ER, and 30 years from taking delayed SS. Thanks!

Hey, no problem! I haven’t seen this kind of analysis anywhere else either so I ran the numbers and put the results out there for public consumption. Glad to help.

This article proves that boring can be interesting. Thanks for the med joke half-way through. It propelled me all the way to the end.

Thanks! I know it’s a lot of words and math, but sometimes it’s worth the effort (and levity helps).

Thanks for the run-down. Social security is something that is complicated around here. I work part-time and am self-employed, so my lifetime earned income is low, but I do get credits every year. My husband doesn’t pay into social security, so he doesn’t even come close to enough credits. I don’t know how to maximize our potential… do something every year in his name that gets him credits? I work for longer and he gets my benefits? Tough call with very little in the system.

If your plan is to retire very early, I wouldn’t work too much extra just to get the benefits other than just getting the 40 credits for one of you. Other than that, it’s probably a complicated answer that would require some modeling in your situation.

Am I missing some obvious place on the website where it tells me how many credits I’ve earned so far? I see my income report, but since I’ve made very little a lot of those years, I don’t know how to translate it directly into credits.

Hmmm… I’m not sure where they actually show you how many credits you’ve earned. I couldn’t find it from looking around the site.

Nuts! I’ll just have to guess. Thanks for the info and help. You are amazing, as always. Thanks for charting the path so clearly for those of us following. 🙂

I discovered if you download your full report, it shows your credits.

The PDF statement you download from the SSA website details how many credits you have already earned. If you are over 40, it simply says “you’re eligible for retirement benefits”.

Your husband will still qualify for a spousal benefit even if he has never paid into social security. His benefit will be half of whatever yours is.

As of 2015, your total earnings is 707,497. I am assuming when you calculate this when you are 67, this will be significantly higher even when you are retired because the inflation factors would have gone up. So your monthly benefits will go up. Is this correct?

Is the best way to look is the benefit you calculated is in today’s dollars and will be adjusted upwards based on COLA?

How come the inflation adjustment factor for 2009 is higher than 2008?

All I see when I login to SSA is my earning record, where are you getting the inflation adjustments from?

The $707k total earnings will be worth about the same amount in the future since they index all those years of earnings for inflation (using their Average Wage Index). So I might end up having $1.4 million in total earnings when I’m 67, but it will still be worth about $707k in 2015 dollars.

Yes, look at today’s benefit in today’s dollars and just know that you’ll get about the same benefit in the future (in today’s dollars).

In 2009, the Average Wage Index must have dipped during the severe economic downturn going on at the time (lower salaries probably). The way they calculate the AWI is a little complex but you can read at the SS site if you want to see how it’s calculated.

Check out Kate’s comment here for a link to the SS index data.

Great Thanks. One of the articles to be filed away. Great work

We ignore SSI for future planning, but mostly because politically we would like to see it means tested with increases in income for those with fewer assets and decreases for those with more assets. So I’d hate to be at a point ever where we plan on it as part of our income and but then want to vote for these changes that would hurt us if we had depended on the income. Will any politician ever be brave enough to champion such means testing? That’s another question entirely….

Nooooo!!!! That’s another layer of bureaucracy we have to pay for! 🙂

I’d rather means testing, if any at all, be tied to AGI or something. Much cheaper way to test. There would still be ways around it, but aren’t there always?

I am totally against this approach. Not to side track the conversation here but punishing people who are responsible and have saved/work hard is a bad idea. Our income tax is already progressive and we have seen that benefits like Social Security and Health care are progressive as well. We should not punish people who have saved in-spite of these policies.

It is already practically means tested since SS payments are included in taxable income. The more you make in the future, the more you´ll pay. The tragedy is that the top 1% will have almost no earned income other than SS while the very affluent will have earned income plus SS. This is silly but no more so than a hedge fund manager paying little to no income tax today . . . .

It is already ‘means’ tested since it is a progressive insurance program. i.e. lower paid workers get a larger return on what they put in versus higher paid workers.

Plus where do you draw the line for the means (income/assets) testing. I would have to agree and maybe most reading this article, that Bill Gates and Warren Buffet don’t need to collect SS, but WB has been quoted as saying something to the effect that “he paid into it so he’s going to get something out of it.”

It would be a good start to say AGI on a tax return that is over 7 figures would be phased out of SS.

I could understand means testing and reducing benefits for those with super high current income, but I think it is unfair to basically punish those of us who were frugal enough to save our earnings instead of blowing every dime.

I mean, how would you like to pay extra taxes every year just because you currently own assets? Not that we don’t do that now; consider property taxes etc. But think about maybe paying another 15% to the government annually, calculated on your entire net worth, and get back to me.

For employees that aren’t covered by Social Security (for example local government employees with a pension) the Windfall Elimination Provision changes the calculation. I did some research to see how it affects my SS and the formula is actually pretty simple. If you have less than 20 years of substantial earnings for SS, the rate before the first bend point is reduced to 40%. If you have 30 years or more of substantial earnings you get the full 90% and in between 20 and 30 years there’s a adjustment of 5% per year. An interesting footnote is that apparently any federal job counts as substantial earnings, so low ranking service members should get an adjustment for those years.

Yes, the WEP complicates things a bit, but it’s just modifying the coefficients in the PIA formula as you mention. I didn’t want to dive too far down the rabbit hole of exceptions to the general SS rules because there’s no going back once you go down there. 🙂

Interesting to see how retirement benefits differ between countries (and it will also be interesting to see how they change over the next 20+ years). The Canada Pension Plan benefits are calculated in a somewhat similar way to SS, but the maximum possible payment is just over $10k/year–it looks like you’re already set to receive at least that amount. Canada also has some other means-tested retirement benefits that can pay another $7000+/year; these are nice for the early retiree since they depend on residency rather than average lifetime employment income.

A while ago I went through a similar exercise to determine how much I can expect to receive from the Canada Pension Plan (thanks for the nudge to update my spreadsheet!), and how much additional benefit I’d get from continuing to work. I came to the same conclusion as you–the increase in benefits isn’t worth it. For me, an additional year of maximum self-employed contributions costing almost $5000 only amounts to a $20-$30 increase in inflation-adjusted monthly payments, depending on the age that I start receiving CPP. If I invested that $5k at a 4% real rate of return, I’d receive $16/month starting now, and I’d have the $5k to pass onto my heirs.

Note to Canadians: there is/was a CPP calculator on the Service Canada website, but it assumes that you will continue to work until you take your pension. If you want a more accurate calculation, there are some instructions here: http://retirehappy.ca/how-to-calculate-your-cpp-retirement-pension/

Thanks for the data on the Canadian system. There are a number of Canadian readers on here that I’m sure will benefit.

This was a fantastic post – tremendously helpful with a dash of good humor! I’m 40 and planning on retiring before 50. I normally try not to count too much on social security when doing my calculations just because it’s such an unknown (but hey – what isn’t?!).

I’m in agreement that SS will probably not go away but might change slightly. I like that you mapped everything out – it’s good to know that working a lot longer doesn’t really make all the difference in the world because I’m with you… can’t see working that much longer just to increase my benefits.

All the best to you!

— Jim

Thanks, glad you found it useful Jim.

SS has always been a source of frustration for me, since for many years my income put me comfortably above the maximum SS taxable income limit. So for the success I achieved (I was in commission sales) I will be penalized, firstly by having a much higher amount of tax taken out of my paychecks, and then receiving much less SS proportionally than others who were not as successful. And people wonder why many have such a mistrust of government and its financial schemes?

As for those pushing for means testing, we already have a progressive tax system that penalizes those who make more for the benefit of those who do not. How much more do we want to continue to take away from those who have a little more, to give to those who have less? Note that I am not talking about the super high income earners (although I do not begrudge them their success, if it is legitimately earned.) I am talking about those in the middle to upper middle class who find themselves doing well, and doing those things like saving that need to be done by all. Continue to take away from those individuals and their families to reward those who oftentimes do not put out the same level of effort, and see how long before many of the former group say the heck with it and do all they can to put themselves in the camp of the latter group.

The good news is that your SS taxes (the 6.2%) stop at the max SS income limit ($118,500 for 2016). So yeah, you’re still paying a lot of that 6.2% tax and not getting a whole lot more than someone earning half your salary, but at least you aren’t paying 6.2% all the way to $150k or $200k or whatever you made. The regular income tax brackets will take care of that for you though. 😉

Agreed on the means testing. If you pay in, you should get back something. If you want more $$ for the federal treasury, just increase the tax rates by a percent or two on those you would means test out of benefits. Cheaper to implement than a new SSA division that’s in charge of tallying your assets.

Isn’t this entire blog about how a guy from the former group has intentionally put himself in the latter group?

Isn’t everyone trying to do the same? 🙂

Not exactly. I have said since I was in my 20’s I would one day go get in line and work the system but I can’t pull the trigger. Whether I am a hard worker or trained monkey is a matter of perspective. I am trying to stop thinking that I can make a positive difference to the collective and just get in line. It was obvious 25 years ago that was the only sane choice. Still, I can’t do it.

Minimizing pointless consumption and consumerism is the positive message of this blog and others. All of us living a life designed to leach maximum value out of the collective is as unsustainable as unrestrained consumerism. I would guess that parasitic corporate behavior by peers and bosses is why many here hope to retire early. We should aspire to more than becoming the best citizen parasites that we can be.

This comment made me think for a while, thank you. A couple of counterpoints:

1) Don’t hate the player, hate the game. As in, its kind of the fault of the government for creating a system that can be gamed.

2) As mentioned, most likely, if all the money that was contributed to SS was instead given to a person aspiring to FIRE, they would likely do better than SS would.

3) Myself (and from what I gather alot of this crowd) plan to donate a good chunk of their excess wealth later in life. So, yeah, I’m ok with gaming the gov’t system a little and then in turn doing something I think is worthwhile with it.

Its kind of a tangent to a tangent, but I don’t like SS and wish someone could figure out a way to get rid of it responsibly. If everyone was like “us”, there would be no point in having SS.

I agree with Keith, that the continued movement of people moving to be supported or given greater benefits by the government will soon be larger than the ones that are financing the system(s) with their taxes. It is a house of cards that will come crashing down. When this will happen? Who knows, but it is definitely going to get worse before it gets better.

I myself had considered what Keith had proposed, stop working for a living and get in line with the others and work the system. My biggest issue (besides having morals and a good work ethic) is that I don’t want to live that way.

Just to be clear, I am not saying Justin is one of those people. I am not talking about people who use the library because their taxes paid for it. Or people that are able to live off their savings and get an ACA credit because their income is low enough.

I am talking about able bodied people who refuse to work cause they can get food stamps or some type of disability payment for not working, yet be able to do physical activity more demanding than a lot of jobs. People with the attitude that, ‘why should I look for work, I can get unemployment for x amount of weeks. When that runs out I’ll look for work.’

Too many benefits that were put into place to actually help people get back on their feet have been mutated into permanent sustainability for others.

When calculating the total lifetime earnings for AIME, do you include earnings above maximum amount used to calculate social security deductions, or simply the 105k (or thereabouts) on which SS is assessed?

Thanks!!!

Just the amount up to the max ($118,500 for 2016).

Great stuff here. I knew the math was very skewed in that way, but never actually ran the numbers myself. It’s worse than I thought!

I was surprised too when I finally ran the numbers for the different scenarios. I always intuitively knew it was heavily skewed in favor of low-ish income workers, but to see just how much is revealing.

This is sensational! Thank you. I had looked into SS quickly because if all goes to plan I won’t work 10 years and will not receive all 40 credits. I’m trying to decide if working full time just to hit 40 credits will be worth it for me or if I will be able to make it up with random work after retirement (always a possibility 🙂 ). Thank you for pointing out the SS intricacies that honestly baffle me when I visit their website. And pointing out how SS works with married couples. My partner is planning to work more than 10 years and we have talked about marriage. All very interesting. Thank you again!

You can get half of your partner’s SS if you marry, so you might not have to worry about working extra to qualify on your own record. Although it’s pretty easy to pick up a credit or two with some extremely part time work. A little more than $5,000 of earnings gets you 4 credits in a year.

Oh wow – $5,000 is nothing! I’ll do some more digging, but knowing that I think I’ll stick to my current timeline and worry about getting the extra credits post-FI. Thank you!

Thank you so much for posting! Way better than the SS calculator on their website.

Justin – great analysis and another enlightening post. Thanks!

I just received a note in the mail from the SSA. At age 25, I’ve earned 33 credits. Technically, I need only to work 2.25 more years to get my full credits. Working through high school and college was a great idea!

That’s awesome. Looking at my earnings, I think I earned 15-16 credits by the time I finished law school in 2004 (age 23). Goes to show it doesn’t take a ton of earnings to pick up a few earnings here and there.

Handy write-up MrRoG! My situation is pretty similar to yours (a few kids, similar asset size, etc), and I plan to RE this year. In truth, I never tried to include SS into my past ER calculations. Anything coming from SS I classified as a ‘bonus’ that might not happen. I think most ER peeps have a similar view…67 is just so far away and the world filled with so much change.

That way of looking at it probably makes sense. When modeling your early retirement finances, the first few decades are the trickiest anyway.

This is a much better explanation than I was able to find on the SSA website.

I’d be eager to read a ‘Part 2’ on how SS is calculated for married couples and best strategies for drawing SS.

Maybe I’ll tackle that Part 2 sometime in the future!

Aimee is a real pain the ass(AIME+PIA haha).

Good one! 🙂

If I understand correct, lifetime earnings of $360K max out the 90% bracket. Lifetime SS taxed earnings of $2.166M max out the 32% bracket. And lifetime SS taxed earnings of $4.147M max out the 15% bracket.

The payout at 67 for $360K is about $770 monthly as discussed before.

The payout at 67 for $2.166M is about $2.15K monthly

The payout at 67 for $4.147M is about $2.85K monthly (maximum possible benefit)

That sounds about right. Might be a little bit of variance due to inflation and rounding.

Absolutely brilliant article! One I will definitely pass on to others and refer to again and again. I logged in to the SSA website and was happy to see that I earned enough “credits” aready to qualify for medicare and SS even if I don’t work again (I am a stay-at-home mom right now with no plans of working in the near future). I read the whole article and found it super interesting. I guess that means I’m a nerd 🙂

Glad you made it through the whole article. 🙂 Definitely some worthwhile nuggets in there.

Seen a few comments to this effect, but wanted to add my own:

I read a lot of FIRE articles that are starting to echo, but I really learned something today! Everyone talks about SS in a nebulous (often opinionated) way, but you really laid out a clear article about how it actually works.

Thanks for writing an easy to understand intro article. I’m glad I looked up from converting my SEP IRA into a solo 401k so I could backdoor a Roth long enough to finally figure out how SS works, lol.

I bet reading this article was more fun than doing that SEP IRA conversion to a 401k! Ha ha…

Wow, great overview of a complicated topic. When it comes to the government…IRS/SSA…it’s always complicated! I think most people in the early retirement camp probably aren’t really even counting social security in their calculations, and it’s just icing on the cake. And many others don’t even think it’ll be around when it’s time to collect. I think it will be around, though they may have to make some cuts to it. I definitely wouldn’t stay around to maximize my benefits, as you’ve shown that it is minimal. Now with my pension, it is a pretty significant difference. If I leave after 20 years when I turn 45 (in 10 years) versus if I leave at 55 after 30 years…there is a difference of about $35,000 a year. It is tough to take such a big hit especially since we plan on staying in a high cost area…but wouldn’t I enjoy my freedom more…hmmmm. We’ll see how it goes.

It usually makes financial sense to stick around longer to max out the pension. My old plan with the State was the same way. You get basically nothing with less than 10 years, a small pension after 20, and a really nice pension with 30 years. I always told coworkers that eventually they should make a choice to either stick around past 15-20 years or find a better, higher paying job elsewhere and ditch the pension (if their goal was to maximize lifetime compensation).

De-lurking to say, “Wow!” This is the most detailed and clear explanation of this stuff I have ever read almost all of. (Hey, I majored in English) Since I began teaching public school late in life, my quibble is with the 12+ years of my youthful private sector income from which SS was duly deducted and from which I shall never benefit. It doesn’t seem right, although your explanation of the progressive nature of SS was very compelling — maybe it should be seen as a contribution to my fellow Americans? Which I should gladly, happily, donate since I’m clearly snorking away at the public sector trough, as one of my friends happily put it.

I don’t, in fact begrudge it (much) but maybe you can explain the thinking behind this? Also, awesome blog! Even though it’s a bit late for us to retire early it is inspiring to read your funny, well-written piece. Thanks!

Are you saying you won’t get any SS benefits in spite of working and paying into SS before your public school teaching experience? That doesn’t seem fair for sure!

Yes, as I understand it, this is true in many states, including CA, where I live. Not sure what the the rationale for this is. Our pensions are part of the giant CALSTRS so we forfeit any SS earnings. Well, I will try to think of it as charity . . .

I’m not counting on SS in any of my future financial plans. Do I expect something to be there when I turn 65? Yes I do, but I’d rather it be a surprise than to count on it. Once I’m 65 I’ll hopefully have a big enough nest egg where this money will just pad my inheritance/giving ability.

Not a bad plan! At least you won’t be disappointed if the SS benefit gets cut more than expected.

10 years.. that was my key metric. If I could get 10 years of work and paying FICA, then I would get my bonus money when I’m in my 60s whoo hoo!

You are right. I didn’t read the entire article. But your final point is spot on 🙂

You’ll be rolling in the COLA’d dough in your 60’s!!

I would like to see a discussion of how you view the waiting till full retirement age versus taking at 62 decision. My take is a dollar today is worth more than a few more dollars in the future for any particular individual since mortality is an individual issue not a statistical one. Of course, if you ¨lose,¨ in this case, you can laugh each pay day as you will still be alive and will have had more money when your knees were still usable (and hip or whatever else). What do you (and you all) think?

I’m not really sure there is a clear winner in the 62 vs 70 debate. Obviously, if you’re unhealthy at age 62, the odds point toward taking it as soon as possible to maximize your lifetime benefits. If you’re still healthy and don’t need the money, waiting to 70 is a better deal.

Not knowing how healthy we’ll be at age 62, my tentative plan is to wait till 70 to collect SS so that we’ll have a solid stream of COLAd income for the rest of our lives at that point. It probably won’t matter a bit in our situation since I figure we’ll have 2-3x or more than what we have today since we are spending so little of our portfolio.

But I see your point – take as much as you can as soon as possible (bird in the hand and all that). I tend to apply the same logic to paying taxes – keep the cash in your hand as long as possible and delay tax liability.

Justin, AWESOME write-up on an incredibly confusing topic!!! 🙂

I’m getting ready to retire (after turning 60) in a few months from federal service (60 is the earliest I can retire given my age and time in service). I can start collecting my federal pension as soon as I retire (which is only about $30K p/y). But Social Security has always been a question mark for me. I get my annual S.S. statement that shows how much I’ll receive monthly if I start collecting at 62 ($1,777), 66 ($2,539), or 70 ($3,426).

Now I always “read” that S.S. statement as saying if I collect at 62 I get this much, if I wait to 66 this much,… Now that I’m getting close to retirement I guess I’m just reading things a little more thoroughly and I noticed it said “if I continue working until 62…, 66…, 70…”. I had never noticed that “continue working” part because I wasn’t sure how your monthly payment was calculated until I read your post. Now I see that the payout is based on the high 35, formulas, and bend points! So I guess I got inspired and went up to SS and downloaded the inflation factors into a spreadsheet and entered my annual wages from my S.S. statement to match the years and got these results:

High 35 annual wages adjusted for inflation factors = $2,847,249 (amazing cuz I never thought I made that much money!!!)

AIME (of the hi-35) = $6,779

PIA (using 2015 factors and formulas) = $2,390

So my PIA calculation of $2,390 is not to far off from the $2,539 that the S.S. statement says (plus I’ve still got 2015 earnings to add to the pot so maybe that will bump it up a bit).

Now to the really BIG question! I have always planned to stop working completely at 60 and live off my small pension and my 401K/IRA savings until I could collect on the S.S. benefits of $2,539 at age 66 instead of taking S.S. early at 62 and only getting $1,777. But I’m wondering now, is my S.S. “expected benefits” going to start decrementing each year now because of not working after 60 (no earnings being added to the pot – this is where that “continue working” phrase might be getting ready to bite me!!!) so that it actually might be possible if each year decrements a bit that at 66 my monthly payout might not be much more than the amount that I would receive if I claimed at 62 (and I would have missed those 4 years of payout at basically the same that I’ll get at 66).

Do you see my dilemma? How do I find out if my payout will actually decrement from 60 on if I no longer work (and add to the pot)? The answer to that will be what decides whether I start collecting at 62 or hold out til 66. Any ideas on where I could find that answer?

Many thanks, and I really enjoy your website!

Hey Rick, great question. I think they are basing the projected SS payments on you working till full retirement age (66 or 67). So you might have 6-7 more years of earnings to add to the SS earnings history, but you would likely be “replacing” some earlier, lower earning years. As a result, your total lifetime earnings might not be significantly higher. In any event, your earnings in the past are yours and you’ll get the benefit you calculated (assuming the math is correct!).

Since it’s just a little lower than the projections provided by SS “if you keep working until…” then it makes sense. You’re in the highest bend point category so more earnings don’t add much to your benefit. You don’t have to worry about your future benefit decreasing if you quit working now. It’ll be about what you calculated when it comes time to collect.

Hope you’re right! 🙂

Thanks for the quick reply!

Great article. I downloaded the calculator and did multiple projections. I am 61 and have been retired for a little over two years. I have more than 35 years of income but only entered the top 35 as that is all that social security will look at. I am leaning towards taking social security at 62, $1357 instead of $1800 at 66. The difference is losing over $65,000 of income for that 4 year period. I’m not sure at what age I would break even if I waited to take my SS at a later date but I would have to be well into my seventies. It’s a difficult decision. If anyone has any pros or cons or have already made that decision I would appreciate some insight.

I’ve read that the decision to take it early, regular, or late pays the same given average life expectancy. If you’re healthier than average, then it pays to take it later. Sicker than average, take it sooner.

Justin – great article. When you originally posted I made a note to go back and read this when I had the time to take it all in. Finally got around to it and was happy to understand the “why” behind the projections and calculate our own numbers. I agree that Social Security will be there in some form once we are older (I’m your age) so it’s worth considering in the model. Thanks again!

Thanks, Dan.

Awesome article! As wife and I move through our 50s, trying to model the effect on potential SS of dropping to part-time work for X number of years or retiring early at age Y — this is exactly the info we need to make an informed decision & plan, so thank you for that.

It’s remarkable how few people understand the difference between *working* till age 67 (or whatever) and *not filing for benefits* till age 67 (or whatever), and also remarkable how few articles about SS planning make that distinction clear in whatever advice they’re expounding.

Thanks!

I agree – SS isn’t well understood by the vast majority of folks. I got tired of the “well you won’t get any SS because you only worked for 10 years” comments so I did the math and threw some numbers on a page for others to see. 🙂

At the end of 2016, I will have 34 years of full-time earnings — I have some part time work prior to that which has an insignificant contribution to my benefit.

If I work to the end of 2017 (35 years of full-time earnings), I’ll increase my benefit by $14-20/month, depending on when I file.

I may have reasons to work OMY, but increasing SS is not one of them!

Ha ha, oh so true. You’re at that point where an extra year of earnings does almost nothing to increase your benefit in any meaningful way.

I just found out that this article is not accurate anymore. I know someone that just checked to see about retiring. 2 years ago, they were told that they would be getting about 1200 a month if they retired at 62.. 1400 and change if they continued working until they were 65/66. They have gotten no letter from the SS telling how much they would get in the past 2 years. so they checked up on it again. They were told that their income now is only going to be something like 800 a month.. that is about 400 dollars LESS then what they would have gotten if they went on it 2 years ago. and if they continue working until they are 66, they will get about 900. over 500 less a month.. and the reason that they were given why it dropped so much. Obama put a bill through to take money away from people retiring or going on disability now, to pay for these foreigners that are coming over. Also, they were told that they are now only counting the first 40 hours that you work.. If you work 80 hours a week, 2 full time jobs, they only include the higher 40 hour job and you get NOTHING for the other full time job. Needless to say that they are, being nice, very mad, because they continued working to get more, and now they found out that they are going to get less.. Not because they earned less. In fact, they are making more now then they ever have, so their pay should be going up, not down. Nice to know that our own president thinks more about people from other countries then he does of our own people.

Which specific parts of the Social Security laws and regulations changed when “Obama put a bill through”? I don’t see that my article is inaccurate in any way but I’m always interested in being as accurate as possible!

As for your 40 hour comment, that isn’t true. SS counts your total earnings up to $110,000 or so (whatever the current limit is) no matter whether you work 5 hours per week or 80. There is an issue with working 2 full time jobs – you might be paying more SS tax than you should but you can get it back at tax filing time.

As for foreign workers stealing all the SS money, it’s actually quite the opposite. Many undocumented immigrants will “borrow” an SS number to qualify for employment. They then pay lots of SS taxes on someone else’s record and aren’t able to file for those benefits when they get to retirement age. Maybe the SS number’s owner files on those earnings, but because of the way the funding formula works, odds are they will be at a higher pivot point and getting proportionally less benefits. There’s also the population and demographics advantages of immigrants. Completely legal immigrants are propping up our SS system by having babies who will eventually pay into SS and immigrating here and working legally. So next time you see an immigrant, hug them and say “spasiba”, “gracias”, “danke schoen”, or something to that effect.

This information came directly from someone that works for SS.. The person that I know, called to find out about early retirement.. The place that they work, is going under, so they wanted to see about starting their benefits a year or two early. I personally saw their letter from the SS office a couple years ago, and it stated that if they went on it then, at 62, which is the earliest, that they would get around1200 a month.. if they waited until 65, they would get between 1400 and 1500 dollars.. they just checked within the last month, and they were told that their income, if they retired now, would be about 800.. when they asked why it was so much lower, they were told it was because the administration changed the way that they do things.. It was changed within the last couple of years.. and when asked, but shouldn’t it be higher, since they are working so much more now.. That person is working about 70 hours a week.. They were told that they, in the recent past (No exact date was given) changed the amounts that they accept for income, and they now, will only take into account the first 40 hours worked, the higher paying 40 hours, and everything after that, they no longer count towards you SS.. They were also told that these new immigrants that are coming over, are being given benefits from day one, and they are given money to live off of.. They are taking the money from SS to give to these people.. I honestly believe it, because my mom went down to get some blood work done for her cholesterol about 2 weeks ago, and she had to wait hours to get her blood work done.. the reason being.. 5000 immigrants were just flown in from another country.. Non could speak English, so there was a translator there. She listened to what was being said, and what she was hearing was that, first, these immigrants were given priority and they people at the center were told to take them in first, as they came in, and to put everyone else on hold.. Some of those people were getting mad, and started getting rude with the people there, because they had to wait just a couple of minutes.. Mind you, this is after my mom was already sitting there waiting for over an hour.. Second, all this blood work was being paid for by the current administration, free of charge to them. and I do not mean state level either.. Third, after they left there, they were going straight down to the immigration office and they were being signed up so that they could get fee benefits.. that is what they were saying.. These are all things that we have personally seen, things that we have personally heard, and have been told by from different places.. Like the SS office. Also, taking into consideration that the economy absolutely sucks around here.. there is no work to start off with.. Most of the major employers around here have all gone out, or majorly downsized.. So I doubt that those 5000 immigrants, that can not speak even a word of English, are actually going to be holding down jobs to put into someone elses SS benefits.

A few years ago, I would have agreed with you, because that is how it “was” done, a couple of years ago.. But, not now. My mom, which is also around that age, and in about the same situation, was thinking about retiring too, and after she heard about this, she called up, and verified what was being told.. She was told the same thing.. So that is multiple people, both told the same things, and both from the main SS office too. I find it hard to believe that these people in the SS office, are all lying to the people for no reason. There may be “some” people that do that, and help out for the better, like you state.. but, that is probably minor compared to the number of immigrants that are coming over by this “current” administration. And this kind of info is not coming from just one or two places.. We have heard this from many different organizations, many different people, and many places.. Some first hand, some second hand.. This has all started within the past few years.. Also, all of these people that we are hearing about getting all this stuff paid for.. They are not coming from south of the border.. nor are they coming from places like Germany, Italy, and those kind of places either. They are coming from “other” places.

I have no problems with people coming over here, and living here. What I do have a problem with is when these people are coming over here, and it is being paid for, and they are given a free ride.. and the places that they are getting the money from, is from hard working people, and their tax dollars. Also, from what I have heard, this kind of stuff is being kept quite, and not advertised.. and this is all coming from the current administration’s orders. Do I believe them.. If it was just one or two people, I would say to check things out.. But we are seeing too much first hand.. and hearing too much first hand too..

I hope your friend gets their SS straightened out. With any luck the person at the SS got it wrong (which I believe) and your friend will be pleasantly surprised. 🙂

well, I wish that was the case, but my mom talked with some other people about it where she works, and they checked into it, and she said that they were all told the same thing too.. My mom works for a company that is being run by idiots.. When you have executives, and the whole list of them have almost nothing but a list of companies that went bankrupt on their list, and brags that they were a “smooth talker because they were a DJ for their collage radio station”, well, that does not leave much confidence in how the company is being run. Well, they decided it was better to send the jobs for the company over to the Philippines and to get rid of people here.. They have not made it official, but we all know that they are going to close this location down, just like they already did with a few other ones. Because of that, quiet a few of the people working there are older people, and retirement age, as in the 60’s. So quiet a few of them have checked into getting their SS because of the job situation in the area, and where they work. That is why a lot of them have checked into it.. Figuring that they can just go on SS if the place closes.. That is what they “thought” at least.. Some are in their 60’s, but not 66 yet.. and they all found the same things that we were told. Like I said, I wish that was not the case.. but I have not found one person that has checked into this year that has been told differently.

I forgot to add.. That person makes no where near the 100k mark either, so it has nothing to do with making too much money on why part of it may not be counted.. But then again, if they were making that much, then they would not need to be working 2 jobs either..

This is simply not how Social Security works. Every calculation is in dollars earned. They do not measure in time increments like 40 hours a week. And as Justin’s article pointed out, the Social Security income is always a slope upward (until $118,000/yr, when Social Security stops taxing income and stops paying out additional earnings.)

Working more always pays you MORE. Anything else is hearsay from a friend of a friend who didn’t do the calculations with accuracy and precision.

I will say this. I agree that working more does pay more.. That I do not disagree with. and the over 40 hours may have been told right, or wrong, I have no idea.. What I was saying is that since Obama took over, things have dramatically dropped in how much you get paid. You can say that they miscalculated all you want.. But I am going directly by what SS has sent out.. Not by what a single person has calculated or said..

My mom was told that she would have been making just over 1200 a month at 62, around 1500 a month at 65 a few years ago.. She is now 63, almost 64, and she checked into it again, and is now being told that she will get about $900 a month if she retires now, at 63.. but will get just under 1200 if she waits until she is 66. The first numbers were what she was given 3 or 4 years ago. The second set of lower numbers is what she was given within the last month. I personally saw both of the letters, so I am not going by anyone’s words here. I am going by actual letters sent by SS. You can try justifying it all you want about how they are wrong, but facts are facts.. and those kind of decreases when you are making more and more each year, not less, are not justified by any means.. You have to take into consideration that my mom has not made anywhere near minimum wage either. Last year, she averaged about 3 times minimum wage..

Someone she works with just checked into retiring, and found that she was only going to get about $600 a month on SS.. That is not a living wage.. My problem here is, anyone that has worked their whole life, and has only made minimum wage, should get at least around that when they retire. $600 is less then half of what you make working at minimum wage. I think it is BS that someone that who has worked all their life, can not even make enough to just pay their bills when they are 70 without an extra job. You can believe what you want, but I personally saw the letters.. So I have no one’s word to go by, only letters from SS when it comes to pay out for my mom.

Social security was never designed to replace your working income, merely to supplement your retirement savings. For those whose SS income is extremely low there is the Supplemental Security Income (SSI) program. Income levels for SSI are $733 per month for an individual and $1100 for a couple in 2016. For the worker who will only receive $600 per month in SS income they could potentially receive an additional $133 per month in SSI income which will also include medicaid coverage. You cannot have more than $2000 in assets to qualify for this program. Currently the average SS payment is about $1300 per month which means half make less than that and half make more. The smallest SS income I saw when I worked at DCF was $ 12 per month for a surviving child, the next smallest was $81 per month for a 62 year old. Social security sends out benefit statements each August to those who do not have an online account. Estimates are based on current and projected income and assume that the individual will work continuously until retirement age. Zero income years and lower salary years will alter and for the self employed (contributions) can affect payouts. Estimates become more accurate as the individual ages but nothing is guaranteed until you actually apply. The statement also provides a list of each years reported income for you to check and report any discrepancies to SS. In addition, Medicare is not guaranteed unless you work the required quarters. It is up to the individual to educate themselves and prepare for their future. You can go to SSA.gov and read up on all these programs and their requirements.

“You cannot have more than $2000 in assets to qualify for this program.” That is one problem right there. Someone I know got laid off a while back and had some medical problems that he needed medication. He was definitely low enough in pay to get medicaid, but because he owned a 10 year old car that was worth over $2000, they told him that they would not help him get medicaid. They told him to sell his car, then after that money was gone, then come back and apply again.. The car was worth about $3000. There goes the assets.. But, I know other people that have been told the same thing because they own their own house, etc. too. Personally, as long as you do not have an extreme amount of properties, etc… They should still help you out here.

I know that you need a certain amount that you have to work too. If I remember right, you have to average having a minimum wage job for about 2 years of your life, working 40 hours at it to qualify. I could be a little off there, but when you take things into account, that is not much.

I actually forgot about SSI, but even still, that is not that much more. I am not saying that you should get thousands of dollars at a start on SS.. But, in this day and age, a lot of people have drained their retirements (being laid off, etc), or living off of minimum wage have nothing to put into it. That seems to be more the biased these days, then jobs that pay a decent wage with retirement packages that allow you to put some away for retirement. But then again, most people these days do not look ahead either, so some it is there own fault. Plus, add in that most good paying jobs from 30 to 40 years ago were mostly jobs that men did. That puts a major disadvantage to women who did not work a lot, or make a lot, from that time frame too. It all can hurt your total pay.