August showed us how net worth can fluctuate wildly while income and expenses remain fairly stable. August also reminded us that investments in the stock market don’t always go up.

Our net worth reversed course from the previous six months of generally upward momentum and crashed by $74,000 to $1,470,000. That sounds like a scary sum of cash to lose in one month but I’m not worried at all.

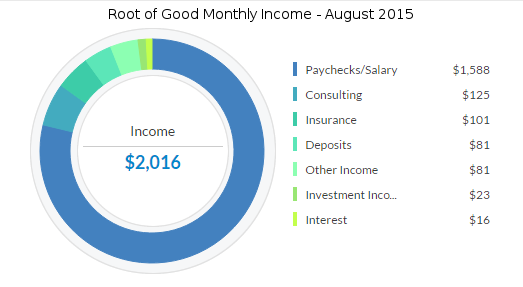

Income for the month was lower than normal at $2,016. Expenses of $1,701 were slightly less than our anemic August income. We’re finally settling back down into our lives here in Raleigh after spending June and July out of the country on an incredible seven week journey through Mexico (with three kids!).

Income

August yielded only $39 of investment income and interest. However, the second quarter of 2015 produced a total of $7,500 in investment income. Our next big dividend season is the end of September and early October at the end of the quarter but we’ll probably earn less than $7,500 in dividends for quarter three.

Blog income, shown as “other income” in the chart, was a paltry $81. Don’t worry too much because the readers are still showing up. I didn’t get a big check deposited until late on August 31 so it showed up in the account on September 1 and won’t get included in income until the September financial update comes out. A few other income sources didn’t exceed the thresholds to pay out during August but they will pay in September. I’m expecting September to be an above average month for Root of Good blog income.

Freelance writing income totaled $125. While not a ton of money, I also don’t devote a lot of time to this activity. It’s more than enough to pay for the whole month’s grocery bill for one person in our household, so nothing to sneeze at.

The “deposits” income of $81 represents cash back rebates and referral bonuses from the Ebates.com online shopping portal. I’m all about sharing the wealth, so if you sign up through this link and make a qualifying $25 purchase through Ebates, you’ll get a $10 gift card. You can also refer your friends and family to the Ebates.com shopping portal, get a bonus when they sign up, and give them a free $10 gift card. Win win win situation for everyone!

Mrs. Root of Good was back at work for most of the month of August after being on a three month paid sabbatical since May (hence the paycheck/salary income in the chart). We have big news to share regarding her job and early retirement but it’s still being sorted out, so no official news today (sorry for the teaser!).

If you’re interested in tracking your income and expenses like I do, then check out Personal Capital (it’s free!). All of our savings and spending accounts (including checking, money market, and five credit cards) are all linked and updated in real time through Personal Capital. We have accounts all over the place, and Personal Capital makes it really easy to check on everything at one time.

Personal Capital is also a solid tool for investment management. Keeping track of our entire investment portfolio takes two clicks. If you haven’t signed up for the free Personal Capital service, check it out today (review here).

Expenses

Now let’s look at August expenses:

August’s $1,701 in living expenses is only 63% of our targeted $2,700 per month (1/12th of our $32,400 per year early retirement budget). We spent the most on groceries because we were still in replenishment mode after being away for almost two months. The $809 grocery expense includes a $242 prepayment for three months of school lunch money for two kids.

The $325 utility expense was a prepayment on our city water/sewer/trash bill. I had to meet the $3,000 spending requirement on our Chase United Mileage Plus credit card to qualify for the 50,000 mile sign up bonus, and prepaying a few months of the city water bill is an easy way to get some instant spending on something we routinely use. Read on for more on credit card bonus point hacking.

Our automotive expenses of $238 covers the annual vehicle safety and emissions inspections, property tax, licensing, and registration for our two cars. Cutting back to one car would save us half that fee every year. But I’m still not sure if we want to drop to one car.

Restaurant expenses of $131 includes one work lunch with a friend for Mrs. RoG and $120 in gift cards for Domino’s Pizza*. We spent about half of the gift cards to order pizza for our kid’s birthday party and for another meal just for our family. The remaining balance we’ll use throughout the rest of the year. Our local grocery store offered $20 off when buying $100+ of gift cards, so I “saved” $20 on groceries by buying gift cards to a restaurant we routinely visit throughout the year.

* If you think Domino’s sucks, order a steak and chicken pizza with the garlic parmesan white sauce when they run their 2 topping large pizza for $6 deal and get back to me.

The $91 gas expense includes filling the tank a few times and a large replenishment charge on our EZ-Pass toll account.

Entertainment expenses of $64 reflects the cost of a pool pass for about six family admissions to our city pools and water park. These should last us another month or two with occasional visits to the pool and water park.

Medical/dental expenses of $21 include a dentist visit and a prescription.

The “other income” expense of $15 covers the rootofgood.com annual domain name registration fee at Hostgator.

Home improvement expenses of $4 covered a new pair of toilet tank bolts to replace the old ones that rusted away and caused a small leak. Fortunately this happened while we were back at home and not while we were gone for those seven weeks in Mexico. I also used a gift card to buy $15 worth of replacement rubber faucet seats and faucet innards for both our showers since they started to leak simultaneously. I guess the rubber inside the faucets dried out from lack of use while we were gone for almost two months.

Using the gift card, I also picked up a couple pairs of outdoor work gloves and a $0.14 nut to repair the kids’ swing set. Just a continuation of my DIY habit that saves us a ton of money throughout the year. More on my DIY philosophy next week!

Credit card sign up bonus hustling

We’ve applied for these cards in 2015:

- Chase British Airways Visa x2 (50,000 bonus BA avios points each)

- Barclays US Airways card x2 (50,000 bonus AA/USAir points each)- now the Barclay AAdvantage Aviator card

- Chase United Mileage Plus Business Card x2 (50,000 bonus United points each)

- Chase United Mileage Plus Personal Card (55,000 bonus United points)

That’s 355,000 bonus points plus many thousands of additional points for meeting the $2,000 to $3,000 minimum spending requirements on most cards. By my reckoning, 355,000 points is worth roughly $7,000 in free travel.

I wanted to point out that I reached the limit with Chase and they denied my request for a United Mileage Plus Personal Card however they approved Mrs. RoG’s application for the same card. Apparently Chase wondered why I applied for two other airline miles cards with them and a third card from Barclays within the previous 3-4 months. Legit question! And one they probably won’t ask when I apply for my next Chase card in the not too distant future.

It’s about time to crank up the credit card bonus offer machine again since it’s been four months since my last credit card application. I’m eyeing a 75,000 bonus point offer for the American Express Business Rewards Gold card or a 30,000 point offer for the Amex Starwood Preferred Guest Business card. Decisions, decisions…

Check out some of the airline, hotel, or cash back/points credit card offers if you would like to get free flights, hotel nights, and other rewards. It won’t take long to accumulate enough points and miles to travel the world for free, even if you have a family like us.

Credit card bonus point offers are a key part in our strategy to stretch our travel budget as far as possible. It’s how we take extended international vacations on our $5,400 annual travel budget for a family of 5.

Year to date expenses

At $16,539 year to date spending, we are five thousand dollars under the $21,600 budgeted for the first eight months of 2015. For the year, we’ve spent an average of $2,067 per month for our family of five including a seven week vacation in Mexico.

We are on track to significantly under spend our $32,400 annual budget as long as no major unexpected expenses pop up later in the year. With a $5,000 budget surplus, we can cover a lot of unexpected mishaps in the last four months of the year and still do okay overall.

Monthly spending for 2015 to date:

- January 2015 – $2,548

- February 2015 – $903

- March 2015 – $2,443

- April 2015 – $4,549

- May 2015 – $849

- June 2015 – $3,089

- July 2015 – $498

- August 2015 – $1,701

Net Worth: $1,470,000 (-$74,000)

In July we celebrated month #5 in the $1.5 Millionaire club. We dropped below the magical $1.5 million threshold in August.

Losing $74,000 in a single month should be scary. It seems like a lot of money. In reality, we’re only as poor as we were seven months ago in early February. And I felt pretty good about our net worth back then.

Here’s an excerpt from our February 2015 Financial Update where I discuss the $74,000 gain we experienced during that month.

We lost $8,000 in net worth during January. We gained $74,000 in February. That means we’re up a net of $66,000 for the year so far. To put that amount of money in perspective, it’s two years of our early retirement living expenses. Will the gains hold in March? Who knows. The value goes up and down. Gaining $74,000 is only slightly more pleasurable than losing $74,000 (which almost happened in September 2014).

Since we tend to spend between $1,000 and $3,000 in most months, a $74,000 gain is almost meaningless in terms of day to day spending. We haven’t made any changes to our spending habits so far.

Replace “gain” with “loss” and we have:

A $74,000 loss is almost meaningless in terms of day to day spending.

We’ve seen $74,000 monthly fluctuations in net worth before (in the positive direction) and this won’t be the last time our net worth moves by a big number many multiples of our annual expenses.

For now, we’re going to keep spending like we always have. We have over a year’s worth of living expenses sitting in cash. We won’t have to worry about selling any investments for well over a year given our stream of dividend income and blog-related income to supplement our cash savings.

The month started off nice and boring (just how I like it financially) and then in the second half of the month the markets fell apart. It wasn’t entirely a waste since I made $5,000 in about 30 minutes by taking advantage of the Mini Flash Crash of 2015.

That opportunity to make quick easy cash probably won’t repeat itself soon, so I’ll stick with my advice from the July 2015 Financial Update since it’s a bit of timeless wisdom:

As for which way the markets are headed, I can’t say. No one can. Stick with a solid asset allocation and skip expensive money managers and you’ll do much better than the average retail investor over the long term.

Did August’s volatility make you panic and sell everything? Or did you double down and pick up some shares at a steep discount to prices over the last six months to year? Are you worried yet?

Want to get the latest posts from Root of Good? Make sure to subscribe on Facebook, Twitter, or by email or RSS reader (in the column to the right).

Root of Good Recommends:

- Personal Capital* - It's the best FREE way to track your spending, income, and entire investment portfolio all in one place. Did I mention it's FREE?

- Interactive Brokers $1,000 bonus* - Get a $1,000 bonus when you transfer $100,000 to Interactive Brokers zero fee brokerage account. For transfers under $100,000 get 1% bonus on whatever you transfer

- $750+ bonus with a new business credit card from Chase* - We score $10,000 worth of free travel every year from credit card sign up bonuses. Get your free travel, too.

- Use a shopping portal like Ebates* and save more on everything you buy online. Get a $10 bonus* when you sign up now.

- Google Fi* - Use the link and save $20 on unlimited calls and texts for US cell service plus 200+ countries of free international coverage. Only $20 per month plus $10 per GB data.

While my numbers are nowhere near yours, I haven’t been worried about the share market fluctuations at all. From what I can see, the companies that I own are still paying the same dividends that they were before, and so this just presents another buying opportunity (as soon as I can get some more cash to invest!).

I’m not sure whether my attitude would change if my shares lost $74k in a month, but I’d like to have enough wealth to even be able to experience that sort of decline in the first place!

I’ll be curious to see how our 2015 dividend total compares to 2014. I don’t expect it to change greatly. Historically dividends don’t fluctuate nearly as much as share prices.

I haven’t looked at the 401K since we did the taxes. Don’t care since the dividends are being reinvested. I am so sure it took a beating. I will look at the end of the year, but like you say..no need to panic. It was way overdue. Sure you’ll be back up to the 1.5 club again soon. I did put in a limit order, but it did not execute. I might set another just for the heck of it though.

Wow, not peeking at the 401k all year? That’s a great way to avoid the fear and panic of watching investments swing wildly.

I noticed your medical expenses are really low. Do you carry health insurance?

I’m pretty sure that it’s provided by Jason’s wife’s employer.

As Mary guessed, it’s currently provided through Mrs. RoG’s employer. It’s taken out of her paycheck pre-tax so doesn’t actually show up here in the expense report (but theoretically should I guess?). It’s $75 per month for family coverage.

We’ll be switching to a healthcare.gov exchange plan once she leaves full time employment and expect the premium after the subsidy to increase slightly to $100-120 or so. I included the medical insurance premiums in our annual budget, and they will show up in these monthly expense reports once we are paying for the insurance out of pocket.

Overall, we lost a lot of money, but I don’t see it as a loss. The loss in portfolio value finally prompted my husband to rebalance his portfolio which was previously very complex managed fund, which he took under his own wing a year or two ago (but didn’t change). Now our money is allocated to fewer funds, with lower fees, and just enough diversification to keep us happy.

That’s a great feeling to simplify your portfolio to something that makes sense. I did that a year or two after starting full time work and learning about the low cost index funds and asset allocation. Sooooo much easier once you get things figured out.

Can you provide more posts on your credit card churning as you start applying for cards?

I’ll try to post more on churning in the future. I have a record of all the cards I applied for since 2013 so that might be an interesting article.

The wife signed up for the Chase British Airways cards too, she’s planning us a vacation to Hawaii next year. She also signed up for the American Express Starwood preferred cards for the both of us because of the increased sign up bonus. Who knows..but if it saves us money and she gets me a free flight, it was well worth it? Not sure how many credit cards Mrs. Budgets has taken out in my name. :/ Haha

Have a good week!

Mrs. RoG doesn’t know how many I’ve applied for in her name. I don’t either but I’m sure it a large number. 🙂 And yes, free flights and hotels are great.

Wow. I’m impressed by your spending. I mean, for a family of five, you spend about the same as me alone. That’s some serious budgeting skill there.

I’ve been sleeping well too even though I lost some money in August and about broke even for the year. I’m just starting out on my financial journey and am still working but I hope one day I’ll be able to quit my job and retire to travel like your family, hopefully before I reach 40.

Keep up with the good work.

We fly the frugal flag proudly over here. 🙂

When markets move unpredictably is when asset allocation can help (although admittedly, it limited my exposure to the upside in the past). I’m also getting out of the ‘blogging game’ as a welcome relief . I enjoyed it, but need to focus on my job and to get back to my roots in more sophisticated and personal investment strategy (not broadcasting and second-guessing my asset allocation, since it is conservative now that I’m FI). I’m in the minority, not needing to grow my assets other than to keep up with inflation, and have a deep appreciation for the ‘Loss Aversion’ literature 🙂

Sorry to see you leaving the world of blogging!

Congrats on reaching enough assets to not need to worry about growth. We’re mostly there but I’d rather continue growing it to beat inflation.

Interesting how you don’t seem to be really phased about market swings once you’re FIRE. Before I left my 9-5ish job a few months ago, I was in front of a computer all day and naturally ended looking at CNBC worrying about what would happen. Now I’m FIRE, voluntarily working a few hours a week at a non-profit and building my house myself the other days using cash and 0% credit card offers instead of a construction loan/mortgage. I look at the markets once every few weeks now. Other than the email reminder from personal capital telling me how much the portfolio has gone up or down, I don’t really notice much.

I was the same way. When I was always in front of a computer at work, I’d check in on the market pretty often just to fill the time between 9 and 5. Now, I don’t have to be in front of a computer all day so I don’t check on investments nearly as much. Not knowing whether it’s up or down at a given moment certainly helps alleviate the fear.

Justin,

Super impressive expenses, as always. I agree on the Dominos, they’ve successfully navigated the waters of the restaurant industry to completely change their food and image.

How the heck will you meet those minimum spends for those 7 cards. That seems like almost a year of spending at your current rate?

Eric

2 of the cards had no minimum spending (just make any purchase). The other five varied from $2-3 thousand. So maybe $12 or 13 thousand total spending required?? That’s a little less than we’ve spent year to date. I also ran about $4,000 through my Bluebird card to “manufacture spending”. It’s a little complicated but basically I buy Visa gift cards at walmart, transfer the balance to the Bluebird card, then repay the credit card with that bluebird balance. I end up paying $9-10 per $1000 “spent” that way on gift card fees but it gets the spending done and lets me earn 2% on other purchases using my regular Fidelity Amex.

What is your “bluebird” card?

Amex has a reloadable prepaid spending card. You can add certain visa gift cards onto the bluebird card (at money center kiosks in walmart for example). So I walk into walmart, buy $500 visa GC for $504.95 or so, walk to the money center kiosk (also labeled as an ATM) and add the $500 visa GC balance to my bluebird. Then I go home and pay the credit card bill with my bluebird card. It’s a little more involved than that but not too much. Google it for more info.

As always, very impressive number on expenses. Haven’t had Dominos in a while but I’ve always been impressed with their price. For your reward credit cards, do you cancel them after a certain period of time?

I usually cancel before getting hit with the annual fee. Sometimes I’ll take a waiver of the annual fee for year 2 if they offer some points to keep the card another year (Amex seems to do this more than Chase, BofA, etc). There are a few cards that are really good in general like Barclay Arrival at 2.2% effective cash back for travel and the Starwood Preferred Guest Amex (though their annual fee just went up from $69 to $99 I think). We don’t currently have any cards with annual fees.

The upside to canceling 6-9 months after getting the cards is that you can sometimes apply for the same card again after a year or two. Rules are highly variable so do some googling and read the T+C’s closely if you are applying for the same card again.

My Dominos recommendation: Sausage, bacon, black olive, with traditional crust and sauce. Monday through Thursday with pick up the cost is $7.99 plus tax in our area. 🙂

I am amazed that you are able to live a comfortable lifestyle with fun travel for only $32k per year! Granted, the credit card hacking for points and miles is the key strategy.

We are holding steady with our normal contributions to our employer retirement plans, not attempting to time the market.

That pizza combo sounds awesome. Bacon makes everything better. 🙂

Took a pounding in the markets as did most during August, but I’ve been through many ups and downs over the years, and this was par for the course. Did not pick up any individual stocks, but did sell a put option on Disney out into January, when the Star Wars phenomenon will be raging. I pocketed a quick $2500 or so for what I consider to be little risk. We’ll see.

Domino’s is pretty good. We haven’t ordered from them in awhile, but whenever it is being served anywhere we find it to be of good quality. Guess we have had too many choices of good quality supermarket-bought pizzas on sale to avail ourselves of the chains.

We’re able to get Domino’s for the same price as the $6 take n bake pizzas from the deli, so we usually go for the fresh baked instead of the bake at home. Although I did score some sweet $0.40 Totino’s frozen pizza this morning and eight of them served the five of us plus two friends that are over. Not a bad lunch for $3.20.

Looks like things went well for you all. Will you be in charlotte for fincon? Would love to meet.

I’m not planning on going to Fincon but I’ve thought about driving up for a day just to meet up with some people. We’ll see how motivated I am next week.

74K sounds like really a lot but compared to what you have in equity, it isn’t too crazy. 74K drop can mean sudden growth of 200K. This can happen relatively quickly if the market keeps volatile. My net worth dropped as well but not as much as yours but I wasn’t worried as well. I wasn’t too happy as I did not have available cash to deploy. 🙂

Keep up the good work!

BSR

Maybe this market downturn will stick around a while and you can find some cash to deploy. 🙂

Mrs. Dragon and I are currently working our way through the spending limit on one of the Chase BA cards and the idea of pre-paying utilities is really smart. I’d never even thought about doing it myself, even though I’ve seen you mention it a few times before this post. One quick question, do you normally just make a payment online for more than your bill, or do you call the company and tell them you are going to pre-pay? Thanks for the clarification on this, and keep up the good work!

I pay extra online. If the monthly bill is for $100, I’ll just pay $300-400 or whatever and it’ll leave me with a credit balance on the account. So far I’ve never encountered any utilities that won’t allow pre-payment.

August was pretty quiet for me, like yours. I didn’t put too much money to work in August besides the normal 401k contributions and a small IRA contribution. I have and will put a lot of money (at least to me) to work this month due to maxing out the 401k and a bonus. Great job keeping your expenses so low!

Those automatic contributions were invested at nice low points. Congrats!

We also saw quite the drop in our net worth in August. Although I am never happy to see the market go down I always stay the course and continue to add per usual. Great job keeping your expenses well below your target!

Great job on sticking with the investments. That’s a big part of what got me to early retirement – continuing to invest through the 2008-2009 crash.

How can you not worry about a drop of this magnitude…just teach me how for God sake…I almost die every time I see something like this and on the other hand I know that I must be invested in FIRE so..it’s just that this feeling sucks so badly

I just don’t pay attention to it. I guess we’ll still be pretty wealthy whether we have $1.7 million in the stock market or $1 million. Not a lot of difference in our daily life. Long term, a serious drop and lack of recovery would impact us, but over the short term, a 30-50% drop wouldn’t be that important.