Welcome back to Root of Good for a frosty winter monthly update! We kept busy around the house during January with a lot of indoor activities while it was cold outside. Throughout the last month, we completed the planning and booking for our two month summer trip through Poland. I bet we looked at more than 1,000 airbnbs and hotels during our search for lodging. More on that in the “Travel” section down below.

At the beginning of the month, we celebrated New Years with family. We all got sick with flu-like symptoms during the early part of the month so we’ve been nursing ourselves back to health since then. It’s nice to not worry about missing work due to being sick, and having to come back to an office inbox with 1,000 unread emails.

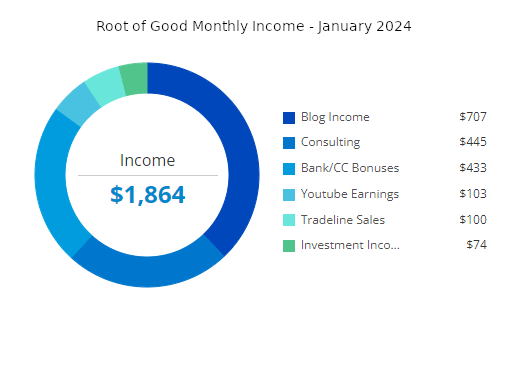

On to our financial progress. January was a decent month for our finances. Our net worth declined slightly, by $10,000, to end the month at $2,956,000. Our income of $1,864 slightly exceeded our spending of $1,828 for the month of January.

Let’s jump into the details from last month.

Income

Investment income totaled only $74 in January. Our equity index funds and ETFs pay dividends quarterly at the end of March, June, September, and December. As a result, we had a much smaller than normal amount of investment income last month. Here’s more on our dividend investments.

Blog income totaled $707 for the month. This is the “new normal” for blog income since I only post on here about once per month. I am glad to have other streams of income to provide for our family’s living expenses.

My early retirement lifestyle consulting income (“consulting”) was $445 last month which represents 2.5 hours of consulting. That’s enough to cover more than half our monthly grocery bill.

Tradeline sales income totaled $100 in January. February’s tradeline income should be even better because I’ve had a ton of new tradeline sales in the past few weeks. I ramped up my tradeline sales a few years ago and discussed it in a bit more detail in my October 2020 monthly post and in my July 2021 monthly post. Most years I make around $4,000 to $6,000 in exchange for lending out my stellar credit report history from half a dozen credit cards.

======================

Tradeline Sales

The company I use, Boost Credit 101, has temporarily opened enrollment for new tradeline sellers for the month of February, 2024. If you are interested in selling tradelines too, here is some more info.

Right now, Boost Credit 101 takes credit cards issued by the following banks:

- Alliant Credit Union

- Barclays

- Discover

- Huntington Bank

- PNC

- Chase

- Elan/Fidelity (10+ year old cards only)

- US Bank (10+ year old cards only)

Personal credit cards only (no business cards).

I’ve used Boost Credit 101 for several years and from my research and personal experience they are the best and most reputable tradeline selling company.

If interested in selling tradelines, please email investorsupport @ boostcredit101.com and make sure to mention that “Root of Good” sent you their way if you want me to get a little referral bonus from them (or don’t mention me if you don’t want to!).

Include this info when you email Boost Credit 101:

- Lender and card type (Example: Barclays Arrival, Chase Freedom)

- Opening date (month and year)

- Credit limit

- The statement date (aka closing date, this is not the same date as your payment due date)

- Address associated with the tradeline card

A few caveats about tradeline sales: for the cards you are selling authorized user slots on, you’ll need to keep your utilization of your credit limit to less than 10% of your total credit limit. So if you have a $20,000 limit, then you cannot have a balance higher than $2,000 when the statement closes.

The other concern is cancellation risk. Be aware that your credit card account could be closed for adding too many authorized users. Or the card issuer could close all of your accounts if you have multiple cards with them, even if you’re only selling tradelines on one credit card. It hasn’t happened to me (yet!) but it’s a risk that needs to be disclosed to you.

Good luck with tradeline sales if you go that route. And thank you if you mention that “Root of Good” referred you to Boost Credit 101!

======================

Okay, back to the rest of my income for January:

For January, my “deposit income” dropped to zero. In most months, I get a small amount of cash back and incentive bonuses from the Rakuten.com and Mrrebates.com online shopping portals (some of which was earned from you readers signing up through these links).

If you sign up for Rakuten through this link and make a qualifying $25 purchase through Rakuten, you’ll get a $10 sign up bonus (or more!).

In January my bank/credit card sign up bonus income spiked to $433. I cashed out 43,300 American Express Membership Rewards points into my Amex business checking account to snag this bonus. These points were earned almost a year ago but I was holding them in reserve in case I found a good use for them with Amex’s travel partners. I didn’t, so I converted them to cash in my checking account before closing my Amex Business Platinum card during January.

Youtube income was $103 last month. Youtube only pays out when you hit $100 in accumulated revenue. Recently, my Youtube earnings have been slightly under $50 per month on average, so I only get paid every two or three months.

Here is the Youtube channel for the curious. It’s random travel videos, birds, kids, and a couple of DIY videos. There are only a few main videos that bring in most of the traffic (and revenue!).

If you’re interested in tracking your income and expenses like I do, then check out Empower Personal Dashboard, formerly known as Personal Capital (it’s free!). All of our savings and spending accounts (including checking, money market, and five credit cards) are all linked and updated in real time through Empower Personal Dashboard. We have accounts all over the place, and Empower Personal Dashboard makes it really easy to check on everything at one time.

Empower Personal Dashboard is also a solid tool for investment management. Keeping track of our entire investment portfolio takes two clicks. If you haven’t signed up for the free Empower Personal Dashboard service, check it out today (review here).

Tracking spending was one of the critical steps I took that allowed me to retire at 33. And it’s now easier than ever with Empower Personal Dashboard.

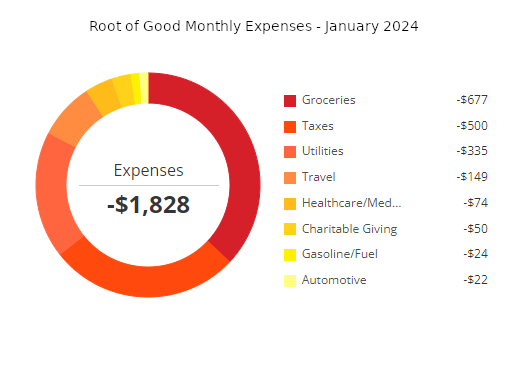

Expenses

Now let’s take a look at January expenses:

In total, we spent $1,828 during the month of January which is about $1,500 less than our regularly budgeted $3,333 per month (or $40,000 per year). Groceries and taxes were once again the highest two spending categories for the second month in a row.

Detailed breakdown of spending:

Groceries – $677:

I am surprised we spent so little during January. We loaded up on the $3.99/lb london broil sale at the grocery store last month and filled our freezer with at least 25-30 pounds of lean beef.

Based on our monthly grocery spending, it looks like prices at the grocery store have leveled off in recent months. Inflation is over I guess?

Taxes – $500:

I paid the fourth quarter estimated taxes of $500 to the State of North Carolina during January. They charge a 2% service fee for paying with a credit card. I included that $10 service charge in “travel” spending. Paying taxes with a credit card helps us hit the spending requirements for all of these credit card sign up bonuses we get.

Utilities – $335:

We spent $40 on our water/sewer/trash bill. Part of this bill was paid with rewards cards from our health insurance company, so the bill was smaller than usual.

The natural gas bill, which provides heating and hot water, totaled $118 for last month. We used the heat a lot as it got colder last month.

I paid $178 for two months worth of electricity bills.

Travel – $149:

We paid $10 in service fees to use a credit card to pay our $500 state income tax for the fourth quarter. I add that $10 into the travel category of spending because the big income tax payments on a credit card really help us hit those spending requirements for big sign up bonuses.

The remaining $139 of travel spending came from the taxes for half a dozen “free” flights booked using frequent flyer miles.

I thought we had spent a ton more on travel in the past month but it turns out pretty much everything was booked with points and miles. Or I paid with a credit card in the first few days of February so those travel expenses will show up next month.

Our two month summer trip to Poland is fully booked now. We reserved 65 nights of lodging for a total of $6,385, or an average of $97 USD per night. Of that total, about $4,400 was booked with Airbnb credits we got for free last year through our Chase Ultimate Rewards points.

We still owe about $2,000 for five different stays this summer. Those amounts will be paid in June or July closer to when we arrive at the apartments. Or we will pay in person for the two short stays we have booked at a castle and a palace.

We booked apartments with two or more bedrooms, or two hotel rooms everywhere we’re staying in Poland this summer. Most of the time we’ll stay in one place for a week or slightly longer. Weekly stays usually come with a discount of 5-15% compared to the nightly rates.

I paid a small amount in early February to put a hold on a rental car. We’ll get a rental car for our two month trip for about $1,000 in total.

Get free travel like us

If you are interested in getting free travel from your credit card like I do, consider the Chase Ink Unlimited or Chase Ink Cash business cards (my referral link). Right now, the Chase Ink business cards offer an above average $750 Chase Ultimate Rewards points that can be redeemed instantly for $750 in cash. Mrs. Root of Good and I each picked up another new Chase Ink card during January. The bonuses keep on rolling in the door!

Chase is pretty liberal when it comes to “what is a business”. If you sell stuff on eBay or Craigslist or do some odd jobs occasionally then you have a business and could get a credit card as a “sole proprietor”.

I use the 75,000 Chase Ultimate Rewards points by transferring them to my Chase Sapphire Reserve card (also offering a 60,000 point sign up bonus right now). With the Sapphire Reserve card, I can get 1.5x the points value by booking cruises, flights, hotels, or rental cars through their travel portal. Or 1.25x value by reimbursing myself for groceries. That turns the 75,000 points into $1,125 of free travel or $937.50 of free groceries. For example, I used 165,000 Chase Ultimate Reward points to pay for the $2,475 in taxes, fees, and gratuities on my two fall cruises. Or I can transfer those Ultimate rewards points to over a dozen travel partners’ airline/hotel programs like United, Southwest, or Hyatt.

Southwest Companion Pass deal – time to act now!

I picked up a pair of Chase Southwest cards during November. I timed my spending on these cards to trigger the sign up bonuses in the first part of January 2024, and thereby earned a Southwest Companion pass in early January that will be valid through December 2025. The Companion Pass is valid for the year you earn it plus the following calendar year.

The Companion Pass basically grants a free flight for your companion when you book flights for yourself (with points OR with cash). This means Mrs. Root of Good is flying free with me on Southwest for all of 2024 and 2025!

Right now is a great time to get these cards since you’ll get almost two full years of the Companion Pass.

Note that these cards have an annual fee (but they offer a lot of free points each cardmember anniversary so it offsets about half the annual fee). And you can apply for both cards on the same day if you want.

Referral links if you’re interested:

Chase Southwest Rapid Rewards Performance Business card – 80,000 SW miles ($199 annual fee) – select the “Performance business” card option

Chase Southwest Rapid Rewards Plus card – 50,000 SW miles ($69 annual fee)

For $268 in annual fees, we’ll get ~130,000 SW miles (plus an extra 10,000 mile head start toward the Companion Pass qualification), and the Companion Pass that offers buy-one-get-one-free Southwest flights for 2 years. Just pay taxes on the free ticket (usually $5.60 per one way segment in the USA). That’s about $3,600 worth of free flights for the two of us.

Healthcare/Medical/Dental – $74:

Our current 2024 health insurance is free, thanks to very generous Affordable Care Act subsidies that we receive due to our low ~$48,000 per year Adjusted Gross Income.

Our 2024 dental insurance plan costs $37 in premiums per month. We picked a plan from Truassure through the healthcare.gov exchange. The dental insurance does a good job of covering routine cleanings, exams, and x-rays plus most of the cost of basic procedures like fillings.

I paid two months of dental insurance premiums in January so our total medical/dental spending was $74.

Charitable Giving:

A friend and neighbor had his construction van raided by some thieves that did a lot of damage and stole all his work tools. His family set up a gofundme so we dropped $50 in there to help him get back on his feet. Can’t work hard and be self-sufficient if you don’t have the (literal) tools to do so.

Gas – $24:

A tank of gas for our new car totaled $24. The new car is more fuel efficient so we should spend a little less on gas on average.

Automotive – $22:

Our middle child just acquired her teen driver’s license in January. The DMV charged $22 for the license. We are excited because we don’t have to drive her to her college classes any more.

Cable/Satellite/Internet – $0:

We generally pay $18 per month for a local reduced rate package due to having a lower income and having kids. 30 mbit/s download, 4 mbit/s upload. Right now the cost of the internet service is temporarily reduced to $0 due to the “Affordable Connectivity Program”.

Spending for 2024 – Year to Date

We spent $1,828 for the first month of 2024. This annual spending is about $1,500 less than our $40,000 annual early retirement budget. I haven’t increased our annual budget for inflation in a decade, so at some point I need to revisit the budget numbers.

So far, so good for 2024. I don’t think it will be a horribly expensive year as we don’t have any major projects planned for the house. Our summer plans have us staying in Poland for two months and it’s one of the more affordable developed nations in the world.

The only wildcard for 2024 spending is another new used car. We have two cars right now but we may need to acquire another one depending on what our oldest two kids end up doing in the fall for college or internships.

Monthly Expense Summary for 2024:

- January – $1,828

Summary of annual spending from more than a decade of my early retirement:

- 2014 – $34,352

- 2015 – $23,802

- 2016 – $38,991

- 2017 – $31,708

- 2018 – $29,058

- 2019 – $25,630

- 2020 – $28,466

- 2021 – $31,740

- 2022 – $29,449

- 2023 – $37,865

- 2024 – $1,828 (through 1/31/2024)

Net Worth: $2,956,000 (-$10,000)

After two months of six figure gains in November and December, we lost a small amount ($10,000) in January to bring our net worth to $2,956,000 at month-end. We still hover just below the magic $3 million mark! I have a feeling we’ll hit that number at some point in 2024.

For the curious, our net worth reported above includes our home value (which is fully paid off). However, please note that I don’t consider my home value as part of my portfolio for “4% rule” calculation purposes. I realize folks ask me about that every month so I just wanted to state that here for clarity.

Life update

January flew by, didn’t it? We were really busy doing trip planning and research during the latter part of the month. Being a travel agent for yourself is almost like a full time job. But I enjoy the thrill of the hunt: finding a good bargain, and looking forward to staying in a diverse set of lodgings all summer.

We booked a few short stays in several different interesting places just to enjoy the ambiance. We actually rearranged our schedule a bit to snag the last two nights of availability for a small castle atop a hill in southern Poland. Our stay includes free access to their “starvation room / dungeon” and the place might be haunted. So there’s that to look forward to! And at only USD $50 per night, it was hard to turn down.

Since we didn’t travel anywhere during January, we tried to make the most of the occasional warm, sunny winter days. Now that there is frost on the ground early in the morning, our daily walks usually happen in the late morning once the sun is out and the temperature warms up a bit.

On our walk this morning, we saw a lot of trees already starting to bloom. They know what we know: spring is just around the corner!

Well folks, that’s it for me this month. See you again next month!

Who’s ready to thaw out when spring comes?

Want to get the latest posts from Root of Good? Make sure to subscribe on Facebook, Twitter, or by email (in the box at the top of the page) or RSS feed reader.

Root of Good Recommends:

- Personal Capital* - It's the best FREE way to track your spending, income, and entire investment portfolio all in one place. Did I mention it's FREE?

- Interactive Brokers $1,000 bonus* - Get a $1,000 bonus when you transfer $100,000 to Interactive Brokers zero fee brokerage account. For transfers under $100,000 get 1% bonus on whatever you transfer

- $750+ bonus with a new business credit card from Chase* - We score $10,000 worth of free travel every year from credit card sign up bonuses. Get your free travel, too.

- Use a shopping portal like Ebates* and save more on everything you buy online. Get a $10 bonus* when you sign up now.

- Google Fi* - Use the link and save $20 on unlimited calls and texts for US cell service plus 200+ countries of free international coverage. Only $20 per month plus $10 per GB data.

“Of that total, about $4,400 was booked with Airbnb credits we got for free last year through our Chase Ultimate Rewards points. ”

Did you buy those with points through the Chase portal? Sorry if it is a stupid question; I am new to this whole world of credit card points and am looking for a credit card that I can use the points for Airbnb.

Thanks,

Steve

This was a “Pay Yourself Back” category on the Sapphire Reserve at one point. Back in 4th quarter of 2022 I believe. 1.5x redemption to pay yourself back for airbnb gift cards bought at airbnb.com. I’d love it if that category of Pay Yourself Back ever returned since we just spent about $4k in airbnb gift cards for this summer’s trip.

How do you fit everything into your freezer? do you use a food saver vacuum? I know you’ve mentioned you have the top freezer. I can never fit everything in there, so we have a chest freezer in garage. I see a lot of bloggers mentioning the southwest companion pass, but they doesn’t seem to have a lot of direct flights, most have a layover. Are you just using the flights for one way, and then using another airline to finish the leg of your journey? I’m new to travel hacking and I prefer direct flights, but I guess for travel hacking you need to make some accommodations to get the value.

I’m ready for spring.

I have 3 freezers, one on my main side by side fridge in the kitchen. Then in the basement is a standard top freezer, bottom fridge (Here in Minnesota, this is affectionately know as the “Beer and Deer fridge). Beside that, I have a chest freezer that can accomidate the side of beef that I buy from my cousin in Montana every couple of years. Everything is in the food saver vacuum packaging, either from the butcher or me, except for the ground beef, which comes in plastic wrapped 1lb bags.

I just squeeze the air out and use regular ziplock freezer bags. Works pretty well to keep things compact. Just have a regular freezer-over-fridge. About 21 cu ft, of which maybe 5 cu ft is the freezer. We stack things in pretty tightly and neatly which helps keep a lot of food in there. And we have to cycle through it somewhat often to avoid freezerburn (a downside of not having a chest freezer).

Southwest – yes, connecting flights are problematic at times. It’s a struggle – do I save $150-300 by getting the free companion ticket or pay full price to avoid an extra 2-3 hours of a connecting flight? Of course another benefit is Southwest is super easy to cancel and rebook for free. And rebook for a price reduction if the cost of a ticket drops later on. I monitor and rebook some tickets maybe 2-3x/wk and save about $10-15 worth of points each time I rebook as prices fluctuate.

One of the few downsides of being frugal, you don’t spend nearly enough to qualify for those rewards, $4,000 in 3 months is a lot, if your housing is not included, and $10,000 for some cards is crazy. But if you are planning big annual expenses like that it can work. I just love those bank and brokerage bonuses.

We struggle to hit the minimum spend at times. I try to put everything on the card, such as property taxes or income taxes, which helps.

How was your auto insurance costs impacted by the new teen driver? Mine went up almost $1.5k/year just for adding a teen driver.

I have not seen the rates for the 2nd teen driver. But the first teen was not too bad. About $800 I believe, for the whole year. And at the 1 yr anniversary of licensure, they dropped the rates a bit and sent us a refund check for the lower premiums!

Do either of your older kids have a career plan?

I am guessing they also eat meals on campus, at work etc. Buy themselves clothes? Do you feel like it distorts your spending totals at all? Self-sufficient is good and I am not saying this as a criticism. I just know that the three weeks over the holidays that I spent with our 18 old college student involved the consumption of more food.

When older offspring was in college he lived in an off campus apartment and had grants covering his entire tuition. We deposited a set amount into his checking account monthly from a small 529 and he paid his own rent, utilities, groceries from that. We insured his car and paid for his phone service. He is a full self funded human now. He is still on our phone because the fourth line is free. He pays for Spotify for the whole family. Otherwise not financially comingled.

Younger offspring lives on campus and it is more expensive but he had a more lucrative summer job than his brother ever did. He has web of financing sources, his own savings/current income , grant money, loans, 529 and a bit we have cash flowed. We have just give him a lump sum at the beginning of the semester and he figures it out from there. I think being more hands off and letting them figure it out themselves has been an important part of the process.

The 2 kids in college career plans: 1 is in 4 yr university now, studying business. About 1.5 years remaining till graduation. She’s looking for internships for summer and possibly PT business-related work during school year. No specific focus yet on HR, finance, accounting etc so she’s still thinking about that.

2nd kid graduates community college and has about 2 years left when she transfers to a 4 year school. Comp Sci is the plan and business with a concentration in IT/data analytics is the backup plan. We’ll see where she ends up and what she studies based on acceptance letters.

Both kids live at home with us (they are 17 and 18 years old right now), so most of the costs are actually paid by us. We do self-reimburse for some room and board out of the 529 as we can. Tuition and books are paid from their very generous financial aid reimbursements, so I don’t include books and tuition in my expenses any more (for now!).

The kids pay for some stuff themselves, and we will migrate more toward that going forward, especially if they end up moving out. I like your approach and will do something similar – lump sum or monthly allotment to cover most things everything and let them figure out some details and decide how much/little to work and where to get spending money from.

One of your kids is only 18 and only has 1.5 more years left of college?!? Baller! She must have knocked out a bunch of online credits?

She’s about to turn 19 in a month or so. Lots of credits from doing half time community college during 11th grade, plus some AP credit. And she graduated HS a year early as well.

Beautiful shot of the red shouldered hawk!

I love London Broil, you got a deal, way to stock up. I could eat that twice a week off the grill!

We load up every 4-6 weeks when it goes on sale for 3.99

I am glad to have other streams of income to provide for our family’s living expenses????? Man you have 3 f million dollars!! Why you sound so poor ?

Oh, does that sound poor? Don’t know!

Lol, if this is being poor, sign me up!

I’ve got a few questions about TL sales:

If you join now with one card and they stop taking new customers can you add an additional card later to sell?

Does it matter how long you’ve had the card? I’ve heard that you should have them 1-2 years before selling TL’s to “season”.

Is there a certain brand of cards that you’d recommend? I’ve heard some allow you to put limits on AU’s to reduce any risk with selling TL’s

If you join now with one card and they stop taking new customers can you add an additional card later to sell? – Generally yes, but it depends on how good/in-demand the subsequent card is.

Age of card matters. 2+ years generally earns the most, and the older the better (aka it’ll sell authorized user spots more frequently bc it’s in higher demand)

For preferred cards, the tradeline sales company has some internal limits they will suggest to avoid card shutdowns. And specific guidelines for each issuer for how long to keep the authorized users on the cards. Some cards only need 2 months, whereas Chase is 4 months because they are more sensitive to shutting down accounts.

Are you comfortable with using Chase cards? Their sign up bonuses have been juicy such as the Sapphire and SW companion pass that its hard for me to take that risk of shutting those down potentially forever. The rest of the banks, I’m pretty indifferent about but don’t have the 2+ year history yet.

I think Chase’s shutdown is ~2 years then you can open new cards again (probably subject to the normal 24-48 month exclusion periods after getting your last bonus for those cards that have time restrictions like CSR/CSP).

Is it worth it? Hard to say for sure but a few thousand dollars per year is pretty persuasive. 70-80% of my tradeline sales revenue comes from Chase cards. And the BoostCredit101 company that I use restricts the Chase cards to 4 months active authorized user before you remove. And only 2 at a time, so there’s a pretty strict velocity limit of ~6 AU adds per year (and typically a little less velocity since you’ll have a 1-2+ month gap between AU’s on average).

I’ve heard stories of creditors calling the sellers of TL’s going after the AU’s. Have you had to deal with this? I know you’re not responsible for their debt, but its something annoying to have to deal with.

Nobody has called here looking for creditors. I think we’ve received a couple pieces of mail for these AU’s (I assume) but it looks like junk mail that they probably got added to some list for.

Did you ever set up to funnel the income into a solo 401, or sep IRA/

Yes, I usually max out my solo 401k and Roth IRAs from “side hustle” income including tradeline sales income.

So have you sold 2x tls on multiple chase cards at the same time for years with no issue or have you added any further limitations to try to prevent shutdowns?

Yes, selling on 2 chase cards for each of us now. My pair of almost 20 yr old Chase cards sells really well. The tradeline company feels having 2 AU’s at a time and keeping on the acct for 4 months at a time is a reasonably safe way to avoid shutdowns. I’m trusting their data/analysis to some extent, so hopefully it works out. And it’s been a few yrs of doing this, though 2022-2023 was a relatively slow year and I didn’t have sales constantly. That changed in late 2023 and now they’re selling very well.

Those egg rolls look delicious!

Are you paying for your kids college? Did you do any 529s?

it’s been cold here too! Of course I’m probably a wimp compared to some when it comes to cold.

It’s showing 49 outside right now.

So far the kids’ college is a money-maker. Always a surplus of financial aid. So the kids get more shares of VTSAX 🙂 We do have 529s and I’ve been able to withdraw small amounts to cover some expenses.

Beautiful post as always. Southwest portion talks about $270 (approximately) for one year. As you talking about two years worth shouldn’t this be $540 (two years worth of fees) ??

Keep posting and motivating us as always

The companion pass is earned and valid for up to 2 years whether you have those credit cards or not. I plan to cancel after the first year is over before paying the next annual fee.

Wow, please share the egg roll recipe!

I’m jealous of your trip to Poland because I’m half Polish and have wanted to visit for ages. Been learning Polish too which is an incredibly difficult language with something like 7 different cases. Every word seems to have a ton of different endings depending on…. well, everything.

I plan to study Polish a little but do not expect to learn very much 🙂 Looks difficult!

To confirm I am Polish and from Poland and it is genuinely a difficult language. There is always some exceptions. Plus it feels like tounge twister sometimes on very long words.

It’s really tricky. Too many sh-ch-z-w sounds all blended together!

I just started Duolingo for Polish last night and it is more challenging than I thought. I am confident I can learn to read Polish a little bit, at least enough to understand some signs and restaurant menus. And the pronunciation rules are not too hard (I’ve learned those for other Slavic languages like Croatian and Slovenian so there is some overlap and some same vocabulary like for food items).

At least I should be able to count to 10, ask for water, bathroom, say please and thank you, as a worst case scenario 🙂 I figure that will put me in the 95% percentile for foreign tourists visiting Poland.

Thanks for the update. Sounds like you have a nice trip to look forward to

You have said previously that some is in retirement accts and some in the accessible accts. do the divideds from the accessible accts cover your general expenses or do you have to sell/withdraw some as you go?

I’ve read you can withdraw from retirement but it takes 5 yrs so not quick.

We are collecting the dividends from the taxable accounts and that plus my other side hustle income from the blog and other things usually adds up to enough to live on. And we sell a little bit of investments if we need some more spending money. No need to withdraw from our retirement accounts so far.

I enjoy reading your updates, Justin.

A couple of questions:

(1) Somewhat of a follow up to a question from last month. You mentioned that you have very little in 401k plans. I assume you did max out your 401k contributions during your working years. Where did you transfer those funds after you retired?

(2) Can you talk about your vision insurance? Do you have it? If so, how much is the premium? What is the coverage?

401k – Mrs Root of Good’s 401k was rolled into her IRA at Fidelity. It was easier to do that since the 401k was already at Fidelity.

My 401k from work, I also rolled into Fidelity (which was easy because it was already there). And my new solo 401k at Vanguard where I store Root of Good related earnings, I rolled most of it to trad/Roth IRAs at Vanguard. My plan is to transfer those IRA balances around to get some juicy sign up bonuses at other brokerage firms.

Vision insurance – don’t have any for the adults in the house. Kids have it through their health insurance plan. Haven’t had a need for glasses/contacts since Lasik so haven’t been to a vision-specific provider in a while. We would pay cash and shop around for a low cost cash rate. I’ve heard Sams club/costco/walmart optometrists are fairly inexpensive, but have not looked into it personally.

I enjoy reading your monthly updates, I’m amazed that you can find all kinds of creative ways to make money. It seems like other than dividends going to your bank account rather than being reinvested, you haven’t had to touch your investments since retirement (i.e. sell stocks)?

If you ever have the time/energy, I think a post where you zoom out (rather than just look at the month) would be super helpful. For example, how have you tackled student loans since retiring? How will you cover the tax bomb after they’re forgiven? Have you been able to do ROTH conversions? Top ways for making money in retirement (i.e tradeline sales, credit cards, bank bonus, etc.). It would be helpful to see a bigger picture of your financial life since retirement IMO 🙂

Thank you!

“It seems like other than dividends going to your bank account rather than being reinvested, you haven’t had to touch your investments since retirement (i.e. sell stocks)?” Yes, mostly just spending the dividends. We’ve had to sell a little bit of investments a few times for living expenses.

The “zoom out” big picture article would be a good one! It’s overdue, and perhaps I can work on that this spring.

Could you please comment on if you carry an umbrella liability policy, and why or why not? Thank you.

No umbrella but I used to have one. They dropped me without explanation and I never bothered finding another one. I do max out the liability on my home and auto and have $1M and $0.5M on those 2 policies.

Rationale = I’d exhaust my brokerage accounts subject to judgments while fighting any potential claims from others. Might not be much left to recover if someone were to sue me! Varying levels of built-in protection for IRAs and 401k type accounts as well if judgment creditors come after those account types.

I’ve been using Personal Capital for so long but have noticed issues with account syncing lateley. Are you experiencing the same? It’s so frustrating that I’m considering switch to something else. it’s the Fidelity that takes days and days to update and it always shows a previous day value.

I think I actually have all my accounts syncing properly right now. So no complaints! But over the years there have been plenty of times when a login wasn’t working and it would take a while to update.

Are all three kids going to Poland this summer? Or are the older ones staying home and working? Just curious.

Only 2 kids going with us. The oldest one will stay in Raleigh. Not sure if she will work or attend school or both (she is looking for an internship and summer classes are a possibility too).

1,000 unread emails?? You’re so lucky….think about 7,500 of them after 2 weeks off

Fortunately I never had it that bad. I’d set up some auto-sort filters to get rid of a lot of that mess! That’s 500 emails per day! More than one per minute of your working day.

Wow. Just love these. So real. So interesting and inspiring to read these. Thank you for sharing them!

My husband planned to temporarly retire for about two years and go traveling. He works for a major company and is an awesome employee (wife has to brag lol). They didn’t want him to leave so he got permission to take longer vacations. We spent five weeks island hopping in Hawaii and had a great time. He also picked out several different types of lodging including some hostel type places. We had never been to Hawaii and really enjoyed it.

Sounds great! We did that a bit in 2014/2015 when Mrs. Root of Good wanted to travel more. They just gave her more time off to retain her as an employee in the meantime. She got an extra unofficial paid 5 weeks off in 2014 by asking for it.

Do you know of any good blogs that talk about withdrawal strategies for 401K and other retirement incomes while only a few years away from getting social security and Medicare, for minimal taxes? thanks

Wow Justin that net worth figure is just amazing and you retired at 33 with a family! Incredible achievement 🙂 Just wow..

Thanks!

I am curious as to how you used UR’s for cruise taxes, etc. Did you book through the Chase Portal, or is there another way ? I have been having difficulty finding a good redemption for the UR’s, other than

transferring them to Hyatt or United. Thanks, and I really enjoy reading your blog.

I had a hard time but it finally worked for Holland America cruises. You have to call up the Chase Travel folks and book cruises manually. And then they had to call Holland’s reservation # and talk to their casino staff to do the booking. Apparently that’s a rare thing to accomplish as most folks report not being able to do this. Other “free” casino cruises, I haven’t tried to book through Chase UR travel portal and use UR pts. I just pay out of pocket.