2020 is (finally) over. What to say? Overall it was a pretty good year for us. The complete lack of traveling wasn’t great. Wearing masks is no fun. But we persevered and survived and got to enjoy another year of early retirement.

In December, we enjoyed the moderate North Carolina winter weather and got outside a good bit. Not quite hammock weather but still good enough for hikes and bike rides. Christmas with family was an abbreviated affair compared to normal years, but at least we’re all keeping safe and healthy. There’s always next year!

In financial terms, December built on November’s successes with another all time high net worth. We saw a jump of $100,000 in our net worth to bring the total to $2,505,000. Our spending was rather modest at $1,851 while our monthly income was much larger at $20,699.

Let’s jump into the details from last month.

Income

Investment income totaled $15,143 in December. Our equity index funds and ETFs pay dividends quarterly at the end of March, June, September, and December. The last month of the year is always our biggest dividend income month because some of our equity funds and ETFs pay only once per year in December. Here’s more on our dividend investments.

Blog income totaled $1,567 for the month which was pretty average for 2020.

My early retirement lifestyle consulting income (“consulting”) was $682 for the month of December which represents five hours of consulting sessions. 2021 is already off to a great start for consulting with several repeat clients and some new business so far. I’m also looking at increasing rates a bit for 2021.

The “deposit income” totaled $3,131 in December.

The biggest chunk of deposit income was our $3,000 federal stimulus checks from Uncle Sam. Our kids really aren’t costing us very much this year given all the stimulus funding based on number of people in the household.

Another $100 in deposit income came from redeeming $100 in cash back rewards on a credit card.

The final $31 in deposit income came from cash back and incentive bonuses from the Ebates.com and Mrrebates.com online shopping portals (some of which was earned from you readers signing up through these links).

If you sign up for Ebates/Rakuten through this link and make a qualifying $20 purchase through Ebates/Rakuten, you’ll get a $20 sign up bonus (limited time only; normal bonus is $10 after a $25 purchase).

The “tradeline sales” income of $175 represents one tradeline sold a few months ago (payment lags by a month or two). This is quite a drop from my $1,000+ tradeline sales back in October but closer to the $200-300 per month I expect to earn on average.

If you’re interested in tracking your income and expenses like I do, then check out Personal Capital (it’s free!). All of our savings and spending accounts (including checking, money market, and five credit cards) are all linked and updated in real time through Personal Capital. We have accounts all over the place, and Personal Capital makes it really easy to check on everything at one time.

Personal Capital is also a solid tool for investment management. Keeping track of our entire investment portfolio takes two clicks. If you haven’t signed up for the free Personal Capital service, check it out today (review here).

Tracking spending was one of the critical steps I took that allowed me to retire at 33. And it’s now easier than ever with Personal Capital.

Expenses

Now let’s take a look at December expenses:

In total, we spent $1,851 during December which is almost $1,500 less than our regularly budgeted $3,333 per month (or $40,000 per year). Travel and gifts topped the spending categories for the month.

Detailed breakdown of spending:

Travel – $895:

We booked two new cruises in December for later in 2021. Each cruise required a $398 deposit to hold the reservation.

The first cruise is in June 2021 and it might happen if all the stars align. It’s cancellable until mid-March so we’ll see what happens with vaccines and case counts. If we don’t go on that cruise, we may start our planned summer road trip a couple weeks earlier.

The second cruise is booked for Christmas 2021 and I’m a lot more optimistic about that one!

We also spent $99 for the annual fee on a new Jetblue Plus credit card. We’ll end up with 100,000 Jetblue points after spending $6,000 in total. Even net of the $99 annual fee, the points are easily worth $1,000 or more in free flights!

If you want to score free travel or big cash back from credit cards, there are several cards currently offering 50,000 points or more. These points can be redeemed for $500 cash or $500+ in free flights or hotel stays. Compare travel and cash back credit card deals.

Gifts – $416:

Christmas time! We gave $360 in cash to our kids and various nieces and nephews. We also got a soldering iron for $6 for one of our industrious children because she likes to tinker.

The remaining $50 was a cash gift to the family of a cousin in California that passed away in December. Cambodians give cash instead of sending flowers.

Groceries – $327:

Grocery expenses were less in December than normal months where we spend $500 to $600. This is mainly due to using up a Walmart/Sam’s Club gift card purchased a couple of months ago.

Healthcare/Medical/Dental – $64:

Our 2020 healthcare premiums were $123 per month thanks to very generous Affordable Care Act subsidies that we receive due to our low ~$40,000 per year Adjusted Gross Income. The benefit of being “poor” on our tax return.

We had already paid the December 2020 premium in November, and our new 2021 insurance premium of $135 was also paid during November. So we didn’t have any health insurance spending in December.

Both of the adults in our household bought dental insurance since the premiums were less than the actual dental care reimbursements we received during 2020. The premiums total $64 per month for the two of us.

We chose not to renew the dental insurance for 2021 because we anticipate dental needs to be less than they were in 2020.

Entertainment – $60:

A $60 Netflix gift card that should last us several months. I bought this online at Target on a Google Pay promotion that offered $21 cash back on any $50+ Target purchase. I have to wait 30 days to withdraw the cash back.

Utilities – $52:

I used a prepaid debit card loaded with cash rewards from our health insurance company to pay for most of our $130 water/sewer/trash bill, $47 gas bill, and $63 electricity bill. The net cost was $52 for all of those bills.

Restaurants – $38:

A big box of Bojangles fried chicken, biscuits, and fries were $38. Great comfort food!

That’s it for restaurant spending other than using up some Taco Bell promo gift cards obtained in November.

Cable/Satellite – $0:

We pay $18 per month for a local reduced rate package due to having a lower income and having kids. 30 mbit/s download, 4 mbit/s upload.

I used a rewards card from our health insurance company to pay the $18 internet bill for December, so the net cost to me was $0.

Gas – $0:

Another month of no gas purchases. The car is down to a half tank so we’ll probably have to fill up in January or February.

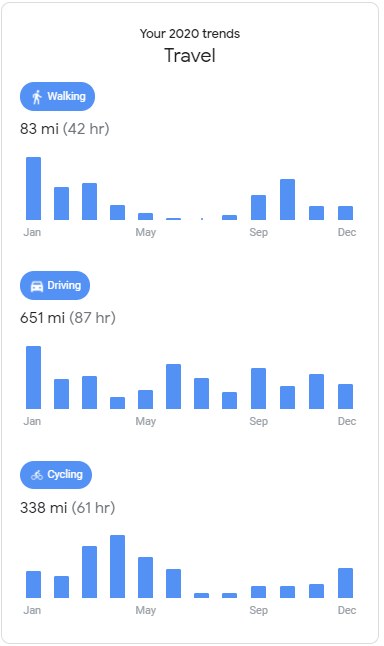

Google Maps sent me a helpful (and slightly creepy) summary of my 2020 transportation trends. I drove 651 miles in 2020 compared to a bit over 400 miles combined walking and biking. And the non-motorized transport is undercounted because I don’t always carry my phone with me when I’m biking or walking. But the driving mileage is pretty close for me. We just don’t drive very much in general, and even less in 2020 given the events of the past year.

Total Spending for 2020 – Year to Date

Our spending totaled $28,466 for all of 2020. This is about $11,500 less than what we budgeted in our $40,000 annual early retirement budget. The main contributor to underspending the budget in 2020 was the near-complete lack of travel during the year. We budget $10,000 per year for vacations and we didn’t spend anywhere near that much.

We did have a couple of big, lumpy multi-thousand dollar expenses this year. Mrs. Root of Good’s root canal was almost $2,000 even after factoring in the insurance reimbursement. And we spent a net of $3,250 on a new water heater.

The good news is that we budget for these big expenses every year, so it’s no big deal to pay for these “unexpected” costs. We expect them to occur on a fairly regular basis over the several decades of our early retirement.

Looking ahead, college costs for our kids will start in a bit over two years. We have over $70,000 saved in 529 accounts and expect to get a decent amount of financial aid as well based on our low incomes. Recent changes to the federal student aid formula will help out even more.

We will also be purchasing a second vehicle in 2021 when our oldest daughter gets her driver’s license. I expect it will cost around $5,000 to $6,000 for a lightly used sedan.

Overall, our spending has remained under control for the seven full years of early retirement. There haven’t really been any big surprises so far. Hopefully the rest of our lives remain just as financially “boring”!

Monthly Expense Summary for 2020:

- January – $2,682

- February – $2,618

- March – $1,600

- April – $1,324

- May – $4,692

- June – $2,311

- July – $3,035

- August – $3,468

- September – $1,830

- October – $1,624

- November – $1,437

- December – $1,851

Summary of annual spending from all years of early retirement:

- 2014 – $34,352

- 2015 – $23,802

- 2016 – $38,991

- 2017 – $31,708

- 2018 – $29,058

- 2019 – $25,630

- 2020 (whole year) – $28,466

Net Worth: $2,505,000 (+$100,000)

Stocks went up again; net worth went up again. It seems like a story that kept repeating itself in the latter half of 2020.

December saw a slow but steady rise in equities and we benefitted from the trend like many of you. It’s starting to feel bubbly, but feel free to ignore me because I’m not actually shifting anything in my portfolio (yet).

I’ll rebalance my portfolio in the next month when I make my solo 401k and IRA contributions for 2020. I’m still targeting a 90%/10% equities/bonds asset allocation.

At our current $2,505,000 net worth, we are approximately $250,000 richer than we were at year-end 2019. That’s a pretty decent year-over-year financial gain!

Life update

It seems popular to bash on the year 2020 as something horrible. It definitely had it’s down times. We have all been cooped up way more than normal. Travel proved difficult. Uncountable deaths across the nation and the world including in our own extended family.

But to me, it’s just another year. While we can’t prevent all of the “downs” in life, we can certainly set ourselves up to have a lot of “ups”.

I’m thankful for all the “ups” we enjoyed last year. The pace of life slowed down and “local” became the focus.

Since we spent a lot more time at home, I was able to read a ton more books in 2020 and play more computer games. I even built my own computer. Hiking in the woods and biking along the river replaced our normal overseas trips to Mexico, Southeast Asia, the Bahamas and elsewhere.

What keeps my spirits up? I know that the tough times of 2020 will not last forever. We’re already seeing progress as vaccines roll out slowly across the country. It may take another 6 to 12 months but eventually life will return to normal.

Until then, all we can do is make smart choices, be patient, persevere, and appreciate the all the good things in life.

Who’s looking forward to 2021?

Want to get the latest posts from Root of Good? Make sure to subscribe on Facebook, Twitter, or by email (in the box at the top of the page) or RSS feed reader.

Root of Good Recommends:

- Personal Capital* - It's the best FREE way to track your spending, income, and entire investment portfolio all in one place. Did I mention it's FREE?

- Interactive Brokers $1,000 bonus* - Get a $1,000 bonus when you transfer $100,000 to Interactive Brokers zero fee brokerage account. For transfers under $100,000 get 1% bonus on whatever you transfer

- $750+ bonus with a new business credit card from Chase* - We score $10,000 worth of free travel every year from credit card sign up bonuses. Get your free travel, too.

- Use a shopping portal like Ebates* and save more on everything you buy online. Get a $10 bonus* when you sign up now.

- Google Fi* - Use the link and save $20 on unlimited calls and texts for US cell service plus 200+ countries of free international coverage. Only $20 per month plus $10 per GB data.

Looking forward for 2021 but I do think 2022 will the year that all of this will be behind us. Nothing will probably change anytime soon.

Vaccines are going pretty slowly and Europe looks like mayhem.

Oh well, I guess we must go through tough times to enjoy the good 🙂

Cheers!

“It’s temporary” – that’s what I tell myself anyway 🙂

Just discovered your blog today. Binged in a big way.

Very inspiring and great to see what an amazing life you’ve managed to forge for yourself.

I look forward to following.

Glad to have you as a new reader!

Thank you for the update. Your family is a great example on resiliency and having fun while you do it. I have been sharing your stories and blog down here in the Gulf Coast, hoping the message will reach families that can know that FI with families exists with the right habits and attitudes. HAPPY NEW YEAR !!!!

Thanks for sharing our journey with others!

Happy new year to you, too!

Congratulations on another great year, Justin. I like your perspective on 2020. It was the best of times for many (particularly on the economic front), but the worst of times for many as well (deaths from Covid, the regular flu, etc). In many respects little changed for Deb and me; we traveled as much as ever, although more inside TN that normal due to quarantines elsewhere, went out to eat often since we were one of the states that didn’t confine people as much, and even went to the movie theaters and other venues throughout the crisis. All in all a pretty normal year but we are not oblivious to the hardships that others had.

Congratulations also on the financial front. Let’s face it, for those of us in retirement it is critical to keep that going well, since it dictates the lives we will lead and to a certain extent the kids throughout their lives as well. 2020 offered many opportunities with the steep downturn in the Mar/Apr timeframe followed by a tremendous uptick for the rest of the year. While the majority of our assets are in index ETFs, I did play the options hard last year with one account set up for that purpose, and it worked out well. Largely because of my trading our bottom line for 2020 went up 40+% from Jan-Dec, which is my best investing year ever. So far 2021 is working out too, and I expect the economy to do well again as stimulus money is thrown at the populace, and businesses that have been raked over the coals in 2020 begin to rebound. So as far as 2020 and the returns I realized it reminds me of the old adage that even a blind squirrel finds an acorn every now and then.

BTW, we had three cruises cancelled and rebooked out in 2020, and just had our first one cancelled on us for April. So now we have one in later 2021 and two in 2022, and a cruise credit we will have to make a decision on as far as when to book another. Never thought we would have all these trips cancelled but it is what it is. Continued best wishes to you, your family, and your readers.

It sounds like you had a really good year too!

That’s too bad about the cruises. We’re waiting to see what happens with our June 2021 cruise right now. They’ve cancelled through March/April time frame so I anticipate May/June cancellations will happen in the next month perhaps. Unless everything gets much better on the case counts in the USA! Looking good in that regard this past week or so.

It seems like even during non-pandemic times, you were mostly doing things around the house or in your area of nature. Well that, and a bunch of big, well-planned international vacations.

I noticed that we have more things like a day at the Launch trampoline park or karate class for the kids. Those things add up for us in many years, but not as much in 2020.

We got Takenoko as well as Splendor on a Wal-Mart deal for $19. I needed to hit both to get the free shipping as I don’t typically shop online there. Without the deal, I think it would be around $80-85 worth of games at retail – wow that’s a lot. We haven’t played either yet, so thanks for the mini-review on Takenoko.

Congrats on another great financial month and year.

Nice! I saw Splendor on sale alongside Takenoko but Splendor didn’t look as interesting so I skipped it. How do you like it? Takenoko has been a blast so far!

I squirreled away Splendor for next year. We had too much for this Christmas already. We still haven’t played Takenoko yet either. If it’s good, I’ll let you know through Twitter DM or something.

Thanks for sharing your successful year. Well done indeed.

Thanks!

In spite of COVID-19, 2020 was a good year for me also. Being retired, I was able to spend a lot of time outdoors hiking and camping. Fortunately, no one in my immediate family got sick, but I empathize with families who were affected. The stock market increase was also beneficial for my investments. Good luck in 2021!

Good to hear you had a good 2020. Sounds like you made the most of it!

Justin;

I enjoy reading your blog… But every year your spending goes down and your net worth increases.. Can’t you loosen the purse strings a bit? What are your 5-10 years spending plans?

BTW, I am retired and much older than you……….

I feel the same..Although it is a good lesson and example of staying the course.

I think that the reason for their spending continuing to be so low is primarily because Justin’s family has learned how to disconnect spending from being happy. They don’t need to spend more than they do now to be happy, and they don’t believe that spending more wouldn’t make them happier. This is pretty much the antithesis of the ‘American philosophy’, which views happiness as directly proportionate to the amount of money one spends.

Couldn’t agree more, William. The wife and I have been retired for 12 and 7 years respectively, and while our investment assets have increased quite a bit during that time, our yearly expenses have actually been dropping. I find things each year to cut out (for 2021 it will be the streaming TV service, saving ~$700/year. We’ll stay with paying for Prime and Netflix, and HBO Max that we get for free). We enjoy our lives and travel a lot, but we just don’t need to spend more. Now we will make a purchase or investment now and then that enhances our lifestyle, such as buying the lot next to us that went up for sale in Q4/2020. We didn’t want another house on the acreage there and we want to leave it heavily wooded. So we might buy something like that but as for ongoing expenses they are not going up.

We’re young and able bodied today so we DIY a lot of stuff and can handle the very slight adversities of “cheap travel”. At some point we will outsource a ton of stuff by necessity (or laziness!) and spend more on travel and other comforts.

We also have 3 kids to put through college and the price tag looks to be cheap for at least 2 of them. But we’ll see. There’s also buying 2nd cars so the kids have something to drive (or 3rd or 4th etc cars as needed 🙂 ).

Markets are also at all time highs so our $2.x million could become $1.6 million pretty quickly (like it did for a bit in 2020!).

And we still have 4-5 decades of life left. So I’m just being prudent for now. Spending will definitely pick up when we can actually travel safely and easily. And things will break around the house and require more spending on that front too I am sure. No rush to spend it all now – we have time!

Love the tradeline sales aspects. I made 4k this year with just one card. I have to see about hopefully getting more. Congrats on the continued success.

Your spending level is inspiring. I always look at if for reference for our family of 4 (even though you have an additional kid). I forget that you don’t have mortgage/rent until I get to the end, when I ask myself, why are my numbers so different?! Even with your extra kid, and lower expenses in NC than CA, I still have some work to do. But our net worth increased 375k in 2020, so we’re getting closer. One of these days I’ll schedule some early retirement consulting. Cheers to 2021!

Nice. Could you also post your 2020 total income snapshot from PC? That is very interesting to us

I updated the post with a “2020 total income” snapshot!

The blog income for the month was $1,567, which you say was a typical month, but in the yearly snapshot the the total annual blog income was $3,801?

Something is off. 🙂

2020 was a year of change for all of us. 🙂 I added a separate “Blog Income” category late in the year. Prior to October-ish timeframe, all the blog income was reported as “Other Income” in the chart. Looks like $20k-ish income overall from the blog itself in 2020.

I would LOVE IT if you could do a post (or expand upon) the “new federal financial aid formula”.

I’ll have to read up on it more myself. I haven’t seen the final details, just that they changed the way they calculate it if your AGI is in the lower range. And it’s a lot better funding for most people from what I saw.

Thank you for a wonderful newsletter.

You’re welcome, Angela!

Can you explain this a little more now or in a later posting? I’m overwhelmed with how to pay for college and steps I need to take now to position us for good aid.

Recent changes to the federal student aid formula will help out even more.

I’ll try to get something together in the future!

Bring on 2021! You and your family are in a position I would love to be at in another 10 years time! I enjoy following along with your journey, looking forward to hear more about your family roadtrip!

Hopefully the road trip happens! 🙂

I’m incredibly impressed at how you guys continue to keep your living expenses so low. Your blog definitely inspired me to look into ways to cut my grocery bill and reading some of your older posts helped us save a ton on groceries, thank you!

Congrats on another successful early retirement year and love the attitude and outlook!

Glad it helped! Best wishes to you for 2021 as well!

What a great update! It is amazing to see how you guys are so frugal with the many gift card and deals you have gotten in this month. Like the Netflix one or even the ones from your health provider. It is always great reading how your investments improve and how you guys keep your spendings down. 2021 will be a great year!

Yeah it’s pretty fun collecting all this free money that finds its way to me! 🙂

Justin – Welcome to 2021 and thanks for the Dividend link! I must have missed that at some point when going through your past posts – super helpful!

No problem! I don’t necessarily focus on dividend investing but they come regardless when you have regular index funds. And of course they make up a decent chunk of our required annual cash flow to fund living expenses. And we have discussed the tax benefits too I know!

Hi Justin, your blog has been life changing for me and my family. It helped me to handle our finances such that now work is optional. It has given us more time with our kids and reduced stress levels. As a longtime reader I wanted to say thank you for posting this information. It has helped me see the world in a different way. Wishing the best for you and your family in 2021!

You are certainly welcome! Best wishes for 2021 to you, too!

What a nice blog you have here Sir. I am definitely learning a lot and lots of helpful promotions too.

I hope to keep reading more of your posts. I am working hard towards early retirement and you are my idol!

Cheers!

Would that equate to less than 10% return on your 90% equities portfolio for 2020? Assuming other assets such as home (should have also risen in value) are included in net worth, and you spent less than earned so put some $ into it also?

Yes, roughly 10% gains. Maybe 11-12% but I didn’t track it closely. I hold a lot of international stuff so I didn’t get the full gains of the average US Market index fund in 2020.

I always am inspired seeing your updates, consistency with budgeting, and just your general positive outlook on life. I will say that $5K-$6K may be tough in today’s used car market, the asking prices seem detached from reality to me. Good luck!

I haven’t looked at used car prices lately. Hopefully I’m not too shocked! At least we have the $$$ if it’s 1-2k more than anticipated.

Hey Justin, I’m interested in how your thought process went when building a computer. Did you hustle for used parts on craigslist/ebay or did you just look for decent deals from retailers and leverage your cashback extensions?

I’ve had my current rig for 4.5 years and it was about $630 total for everything in the tower (https://pcpartpicker.com/list/ghfmRT) And I just sourced pretty basic parts at pretty reasonable prices and used my local Microcenter for $30 off the MOBO/CPU combo.

But since you’re a bit of a deals guru I’m wondering what you considered when buying parts (and what you built, if you don’t mind me asking!)

Here’s the build. https://pcpartpicker.com/list/fPQQXv

More on what went into it here: https://rootofgood.com/august-2020-early-retirement-update/

Basically, I used PC Part Picker and 1 more site to figure out reasonably good prices for everything. It’s not barebones but it’s not a super powerhouse build either. Hopefully it’ll be upgradeable for a few years if I want more power. I didn’t snag any great deals, but parts were also pretty hard to come by. Lots of covid-related shortages apparently. I think everything priced out to just under $600 per PC Part Picker and prices have gone UP since then!

Justin,

Which tradeline company are you using?

I’m using 2 different ones for right now. Still evaluating them for the time being to see which one I prefer and can recommend.

This is an awesome post. Would you mind giving me the link to your YouTube channel.

Here is the link to my channel.

I love your blog, but one thing is not clear to me: you have a teenage daughter and still manage to keep your costs so low? Doesn’t she wasn’t the same things as her friends? My children were very money conscious until they turned 14 and saw their friends wasting money everywhere: expensive gears and dresses, electronics etc.

How do you cope with that?

They get many hundreds of dollars from us for Christmas, birthday, good grades etc. So they’re free to waste it just like their friends do (if they want!). They also get the fact that some parents spend/waste more $ on their kids than others.

If you don’t mind helping a fellow FIREE, could you please explain a bit how do you go about estimating your taxes and paying them in advance?

I’m going to take quite a hit this tax season with income from ETFs and some Div Stocks I own outside retirement accounts and since the brokerage companies do not withhold taxes like employers do, I’m confused and a little concerned about penalties and stuff like that from the almighty IRS. I’d greatly appreciate a post or comments on that.