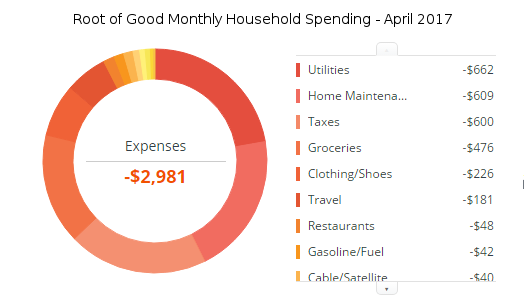

This year is flying by so far! Now that we are one third of the way through 2017, our financial picture for the year is becoming clearer. And it’s a good picture so far. Our spending for April remained below budget at $2,981 while our income of $3,321 slightly exceeded our expenses. Our portfolio and other assets continue their upward trajectory with a $34,000 gain bringing our total net worth to $1,805,000.

This time of year is one of the prettiest in North Carolina, with moderate temperatures perfect for exploring the outdoors. Or lounging in the hammock on the back porch. The past month has been incredibly busy for us with school events, time with family and friends, tackling some issues around the house, and entering the final stages of planning and preparation for our nine week summer vacation in Europe (we leave in about a month).

Income

Our investment income was $241 in April. The majority of our mutual funds and ETFs pay dividends quarterly in March, June, September, and December. During other months investment income tends to be much smaller. The $241 is mostly interest from our roughly $100,000 investment in our money market account and bond fund. Also included in that total is a small dividend payment from a mutual fund. I have no clue why they paid out in the middle of the quarter.

Blog income, shown as “other income” in the chart, returned to a more normal $2,193 in April after dropping to $508 in March. My early retirement lifestyle consulting took off during April with a half dozen clients seeking advice during the month. Total consulting income climbed to $836 for the month. This is busier than I would like to be long term, so if this level of interest continues I’ll probably raise rates from $125 per hour to $150 per hour in order to trim back my hours per month devoted to consulting. It’s really cutting into my video gaming / Netflix / hammock time and I’m afraid of losing my official “Early Retired” status if I work so much. Though the consulting continues to be a personally rewarding and intellectually stimulating pastime.

The $49 in Deposits includes cash back rebates from the Ebates.com and Mrrebates.com online shopping portals. If you sign up for Ebates through this link and make a qualifying $25 purchase through Ebates, you’ll get a $10 gift card like I did. When shopping online, I always check to see if I can score some extra cash back by using one of those online shopping portals (and it usually pays off!).

If you’re interested in tracking your income and expenses like I do, then check out Personal Capital (it’s free!). All of our savings and spending accounts (including checking, money market, and five credit cards) are all linked and updated in real time through Personal Capital. We have accounts all over the place, and Personal Capital makes it really easy to check on everything at one time.

Personal Capital is also a solid tool for investment management. Keeping track of our entire investment portfolio takes two clicks. If you haven’t signed up for the free Personal Capital service, check it out today (review here).

Expenses

Now let’s take a look at April expenses:

We came in just under our budgeted $3,333 per month (or $40,000 per year) during April with total spending of $2,981. Where did the money go?

Utilities – $662:

In addition to paying the monthly water bill and natural gas bill, I also prepaid about $500 extra in order to meet the spending requirements on our pair of Chase Sapphire Reserve Cards. I just received one set of 100,000 bonus Ultimate Reward points for one of the Sapphire Reserve cards and I should get the other 100,000 bonus points in a few days. I had to spend $4,000 per card within three months, which is a stretch for us given our low spending of $1,000 to $3,000 during most months.

The 200,000 Chase Ultimate Rewards points can be redeemed for $3,000 of travel if booked through the Ultimate Rewards portal, or transferred to a ton of different airline and hotel partners, which in turn can be redeemed for a dozen or more hotel nights or several international round trip plane tickets or up to eight domestic plane tickets. Even if you don’t travel, 200,000 UR points can be cashed in for $2,000 instant cash back. Credit card sign up bonuses are great, aren’t they? FYI, the 100,000 Chase Sapphire Reserve offer is gone, but there is an 80,000 point bonus for a Chase Ink business card. Sell stuff on ebay? That’s a business!

Home Maintenance – $609:

This was the worst month of homeownership ever.

After noticing the electricity bill unexpectedly doubling last September, I assumed an inefficient air conditioner was the culprit. So I planned on having the HVAC system checked out this spring. $220 later and we have a clean set of coils on the outside compressor unit and an extra pound of R-22 refrigerant added to our system (and picked up a $17 discount for paying in cash). I haven’t needed to run the AC much given how cool it’s been this April and May, so I’ll probably have to wait till June to see if it helped with the electricity bill. I’ve done a bit of DIY air conditioner maintenance before but didn’t want to illegally recharge my own AC system (or blow it up accidentally).

Right around the time of the AC repair, our main sewer line completely clogged up. Not knowing where to start with the repair, I called my trusted neighborhood plumber. The proposed fix was a $750 installation of a cleanout near the foundation of my house (as long as I dug the two tons of dirt out of the hole myself; $100 extra if they dig it). So I got out the shovel and started digging. I eventually struck gold – a buried cleanout cap a couple feet down! They were able to use that cleanout to snake the main drain and remove what might have been roots from the sewer line about 50-60 feet from our house. It’s a mystery because there aren’t any large trees anywhere near that part of the yard. It might be that 45 year old sewer pipes clog up due to slow accumulations of gunk. By the end of it, I was still out of pocket $389, but at least now I know I have a cleanout available if it happens again, and I might try renting an industrial drain snake to DIY the cleaning since it looks pretty straight forward (though dirty).

Then the lights started flickering. I called the power company and they came out to determine the problem. Our meter base housing was busted and their power line from the transformer also had issues, so they shut off our power for the whole day while they installed a new meter base. They still haven’t returned to replace their line to our house, so in the meantime we have a mystery device – a “service saver” – sitting next to our electric meter that provides the neutral necessary for proper electrical service (the electrician said it was “some kind of transformer but he’s not really sure how it works”). We have power so that’s good enough for me.

I found out I could power our refrigerator and our router using a 100 foot extension cord plugged in at the neighbor’s house. While the refrigerator was pulled away from the wall, I decided to clean the coils in the refrigerator. So. Much. Dust. I’m not really sure how it was able to operate, and I assume this is why many refrigerators fail prematurely. Hopefully I’ll get around to vacuuming out the coils while brushing them clean with a toothbrush more than once a decade.

I tackled a leaking sink drain line. Unsuccessfully. So I’ll be heading to a home improvement store in May to get the parts to replace the drain line (or at least the one leaky connection).

All of this was a huge distraction in my efforts to get quotes to replace our roof. As this post goes live I’ve received over a half dozen quotes and should be selecting a roofing contractor soon. The costs came in exactly as expected – just over $4,000 on the lower end and just over $8,000 on the high end. We’ll definitely end up using one of the guys that quoted under $6,000 (which includes a few upgrades like chimney repair/replacement, additional/new gutters, and redoing the roofs on the porch and shed). Insurance already paid $3,300 and should pay another $1,100 once all the work is complete, so out of pocket costs will be limited to roughly $1,500 or less.

Although we tackled a ton of home repairs in April, and the costs are slowly mounting, it’s okay. We explicitly budgeted for all of these major and minor home repairs with a long term capital replacement plan of roughly $1,500 per year. The roof is listed in the plan at $4,000 on a 20 year replacement cycle. Major plumbing repairs listed at $1,000 every 10 years. The one big shocker will be the hot water heater since I’m planning on converting to a tankless wall-mounted installation to bring things up to code once the current 40 gallon tank water heater dies. The plumber estimated $2,300 to do that, and I’m only carrying the water heater replacement expense at $700. Oh well – can’t get it right every time.

This isn’t the first time everything decided to conspire against us at once. Over three years ago I wrote about the other time all the things broke at one time.

Homeownership certainly has its share of ups and downs.

Taxes – $600:

State and Federal estimated income taxes (minus the 2016 tax refunds received). Since we no longer have paychecks that withhold taxes for us, we have to make small quarterly estimated tax payments to avoid an underpayment penalty at tax filing time each year. We owe very little tax in early retirement, but it’s still higher than the $150 per year we paid while working full time earning $150,000 per year!

Groceries – $476:

Another slightly below average month for grocery spending. We’re trying not to buy more food than we’ll consume before we leave for Europe in mid-June, so our “stocking up” efforts are near zero these days. I would like to leave the fridge and freezer as empty as practicable in case we lose power or the refrigerator dies while we are away.

We threw a birthday party for our five year old and our nephew who turned one. We had around 30-35 guests and provided a Mexican buffet. All those groceries plus a case of beer are included in our $476 monthly grocery budget. The other family that joined us brought papaya salad, pad thai, and chicken wings.

Clothing/Shoes – $226:

A new pair of shoes for all of us so our feet will be happy while vacationing in Europe. A miscellany of shorts, shirts, and socks. Mostly in preparation for our Europe trip but things we’ll wear day to day at home too.

After I wore my new shoes for a while and completed a five mile walk/hike, I realized the new shoe has a tiny spot that causes friction on one toe. So I went crazy and dropped another $40 (after requesting a $5 discount for a tiny imperfection in the stitching on one shoe) on a SECOND pair of new shoes that are even more comfortable. I’ll be taking the more comfortable shoes to Europe. We’ll be doing five miles of walking or more on some days, and I really don’t want to suffer through uncomfortable footwear.

I’m working on loosening up the purse strings (since we can afford it) and spending where it makes sense and brings value.

Travel – $181:

We’re slowly completing the final bookings and reservations for our big summer trip to Europe. We finished booking the last two bus/train tickets from Munich to Prague and Prague to Berlin at the end of April but the charges posted to the credit card in May (so I’ll report on them next month). Here’s a preview: who knew you could buy five double decker bus tickets for the 4.5 hour ride across Germany from Munich to Prague, Czech Republic for €38 (USD$41)?

I paid our quarterly estimated taxes using credit cards in order to meet minimum spending requirements and to snag some big sign up bonuses on our pair of Chase Sapphire Reserve cards, so I’m including the $34 transaction fee for credit card usage here in the “travel” expense category.

In cruise news, we booked another cruise! As I mentioned in last month’s financial update, a very helpful Root of Good reader emailed me about an incredible deal over the 2018 Christmas holidays (yes, over a year away). It was a price mistake but before the cruise line corrected the error, we managed to book the family on a seven night cruise out of Miami bound for the Caribbean on MSC Cruises’ new ship, the MSC Seaside. Our total cost will be around $1,400 for two rooms to accommodate five of us. We only had to make a $147 refundable deposit to hold our two rooms, with final payment not due until October 2018. With two kids in middle school, the cruise over Christmas break is very helpful to avoid excessive absences from school.

Restaurants – $48:

$35 for a family meal at the Chinese restaurant to celebrate the kids’ excellent grades. $13 for a box of Bojangles fried chicken and biscuits for the whole family. We also redeemed a few free pizza codes acquired during March (with no additional costs in April).

Gasoline – $42:

One tank of gas for the minivan. We don’t drive a lot.

Cable/Satellite (Internet) – $40:

Now that Spectrum’s done gobbling up Time Warner Cable, we’ve been given a “courtesy upgrade” to a faster, more expensive internet plan. It’s currently $45 per month for the next 12 months at which point it reverts to the regular $65 (or some other crazy figure – but I’ll be at a different provider if that happens). I only paid $40 in April because I paid a bit extra in March during the transition to the new plan.

Gifts – $28:

$15 for some action figures at Walmart for our son’s fifth birthday. $13 at a local discount store for some small birthday gifts for our other daughter and a friend (and some glue for the birthday piñatas).

Healthcare/Medical – $23:

Another dirt cheap healthcare month. I paid a $5 copay to visit my new doctor for a routine physical and to get a prescription renewed (usually an extra charge at my old doc). It turns out he only charged me for a routine physical so the $5 copay will be credited toward a future office visit (or refunded at my request). I had to switch doctors since my new insurance plan for 2017 doesn’t have my previous doctor in the network (but they do have several hundred other doctors within 10 miles of me). I was pleasantly surprised with the new medical practice and might just stay with them!

I also paid $2 for a 90 day supply at the pharmacy. This new insurance is saving us more than the old insurance so far.

The balance of the healthcare/medical spending is one month’s health insurance premiums of $16. For us, the Affordable Care Act works phenomenally well in making our health insurance premiums tiny.

Since the ACA and it’s impending demise is a popular topic right now, it’s worth addressing here. The US House of Representatives passed the AHCA which is the promised “repeal and replace” bill that’s supposed to gut the ACA and Make America Great Again. The US Senate will get a go at making all the changes they want and then they have to vote on the AHCA (as modified) and pass it, then it goes to the House for further sausage making. There’s a good chance the final version of the AHCA won’t look a whole lot like the version of the AHCA just passed.

But if it does, here’s the best summary I’ve seen of the current version of the AHCA compared to the ACA (courtesy of the non-partisan Kaiser Family Foundation). Main takeaways:

- ACA premium subsidies continue through 2017, 2018, and 2019 (so it’s not an immediate “repeal”). Your subsidy declines as your income increases up to 400% of the federal poverty level.

- Starting in 2020 those buying individual coverage get a $2,000 to $4,000 tax credit per person for qualifying insurance (and policies don’t have to be purchased through the official Healthcare.gov Marketplace to qualify for the tax credit). Tax credits vary with age (older = larger credit) but not with income, however there are income limits where the tax credit phases out

- Cost sharing reduction subsidies disappear in 2020 (currently available to those earning under 250% of the federal poverty level – it’s what makes my deductible $100, max out of pocket $1,200, and my copays $5-20)

- In 2018, HSA contribution limits double to $13,100 for family coverage.

- If a state chooses to allow it, insurers can charge more for pre-existing conditions for those that have a lapse in coverage. Possibly much, much more. Maintaining continuous coverage seems to be the way to go to avoid paying a lot more for pre-existing conditions.

- Increase the age banding of premiums so that the premiums paid by older people aren’t capped at three times the premiums charged to the youngest people (under AHCA older people will pay five times what younger people pay – while only getting an extra $2,000 in tax credits)

- No more individual mandate to have health insurance retroactive to 2016

Those are the basics but trust me, I’m leaving a lot out. Medicaid and Medicare are tinkered with too.

The Senate will most likely make significant modifications to the AHCA, so it’s pure speculation as to what we’ll actually end up with once all the sausage is made.

My main takeaway as a 30-something early retiree that will be 40 by the time the ACA premium subsidies goes away in 2020 is that I’ll be paying more for health insurance that will come with higher deductibles and copays. Mrs. Root of Good and I will each get a $3,000 tax credit to use toward insurance that will probably cost $4,000-$5,000 per year per person for a basic plan, and possibly much more if healthy people choose to go uninsured (since the individual mandate will be gone and many people will pay more for health insurance, making it less affordable). I don’t know what the kids’ policy pricing will look like or if they’ll end up on Medicaid (if that’s still an option given the possibility of AHCA-related changes to Medicaid), but I understand they’ll be eligible for $2,000 tax credits too (based on their age) if we purchase individual policies for them.

In conclusion, I’m mentally penciling in an extra $4,000 or so for health insurance and healthcare costs starting in 2020, but also accepting that a lot can change with the AHCA before passage (or it might fail to pass altogether). There might be a subsequent health care bill passed later on in 2018 or 2020 as the political winds change that could put our costs back in line with where they are currently under the ACA.

Entertainment – $22:

Is it weird that I categorize hard liquor as an entertainment expense? We bought a half gallon of vodka and a fifth of tequila (1.75 L and 750 mL, respectively, for those using the far superior metric system). All bottom shelf stuff for making cocktails, although the tequila bottle did come with a red sombrero attached to the lid, so I’m pretty sure it’s high quality stuff. Or at least high octane.

Education – $13:

The middle kid’s elementary school Spring Fling Carnival. Admission included unlimited games and we bought a few raffle tickets. This could just as easily be categorized as “charity” since it’s a huge fundraiser for the PTA. So far our K-12 educational expenses have been very modest compared to those reported by some blog readers. No organized sports fees nor band fees certainly helps keep education costs to a minimum.

Electronics – $6:

3 replacement USB cables for charging the kids’ tablets. Put this in the “getting ready for our Europe trip” category of expenses.

The tablets require heavy duty USB cables with higher amp ratings to charge the tablets quickly. Monoprice.com offers good quality cables at a ridiculously low price, even though you do have to pay a couple bucks for shipping. Still cheaper than Amazon (which might sell lower quality cables).

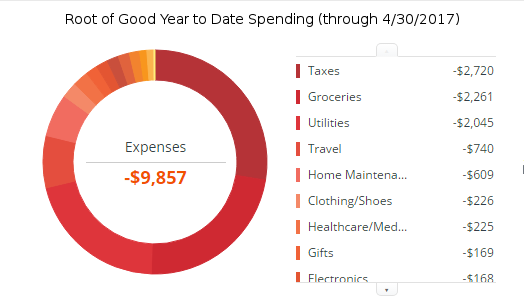

Year to Date Living Expenses for 2017

Through the end of April we’ve only spent $9,857. That’s roughly $3,500 below our annual spending target of $13,333 budgeted for the first four months of the year. So far so good!

The two remaining big cost items for 2017 are the roof replacement and our trip to Europe. The roofing quotes are coming in low enough that it shouldn’t cost more than $1,500 out of pocket beyond the amounts paid by the insurance company.

We’ve already booked and paid for roughly $6,000 out of our $10,000 total budget for our nine week Europe trip this summer. The remaining $4,000 of vacation spending will be concentrated in June through August while we are overseas. The good news is we won’t be spending much to maintain our home or car here in Raleigh while we’re traveling.

Coming up in May, I’ll pay just under $1,000 for our annual homeowner’s insurance and umbrella policy plus our six month auto insurance policy. Even though the insurance and the roof expense will hit in May, there’s a chance we won’t exceed our $3,333 monthly budget by too much.

Monthly Expense Summary for 2017:

- January 2017 – $3,378

- February 2017 – $2,108

- March 2017 – $1,388

- April 2017 – $2,981

Net Worth: $1,805,000 (+$34,000)

Another $34,000 added to the pile. This stock market thingy always goes up, right? It’s starting to feel that way. We broke through another $100,000 milestone now that we crossed into the $1.8 million territory. How long will these gains last?

I’ll be checking our asset allocation soon to see if I need to rebalance any asset classes since the international markets have done well lately. I’m also planning on moving another $25,000 to $50,000 from equities into bonds very soon. That will bring our total cash/bonds position from roughly $100,000 up to $125,000-150,000.

If we get to $150,000 in cash and bonds, that will represent about four years of living expenses without any efforts to curtail spending, without collecting any dividends from the equities side of the portfolio, and without any side income earned from this blog, the early retirement lifestyle consulting, or other ventures I might stumble upon in the future.

In reality, we’ll keep collecting $8,000 or more in dividends and the blog plus consulting will probably bring in $20,000 or more without too much effort. If we can cut spending by 25% then we won’t need to pull more than $3,000 to $5,000 from our fixed income reserves, which means the cash and bonds could get us to Social Security age (contrary to popular belief, retiring in your 30’s doesn’t mean you won’t collect a fat Social Security check at age 67). That’s why the next stock market correction doesn’t worry me at all – we’ll be just fine for many years without needing to sell any equities at sharply reduced prices. In other words, I don’t think we’ll ever run out of money.

Still enjoying this rising market? Are you taking any defensive measures to protect against losses, or staying the course (as you probably should!)? Now that tax season is over, any new tax strategies you’re implementing in 2017?

Want to get the latest posts from Root of Good? Make sure to subscribe on Facebook, Twitter, or by email (in the column to the right) or RSS feed reader.

Root of Good Recommends:

- Personal Capital* - It's the best FREE way to track your spending, income, and entire investment portfolio all in one place. Did I mention it's FREE?

- Interactive Brokers $1,000 bonus* - Get a $1,000 bonus when you transfer $100,000 to Interactive Brokers zero fee brokerage account. For transfers under $100,000 get 1% bonus on whatever you transfer

- $750+ bonus with a new business credit card from Chase* - We score $10,000 worth of free travel every year from credit card sign up bonuses. Get your free travel, too.

- Use a shopping portal like Ebates* and save more on everything you buy online. Get a $10 bonus* when you sign up now.

- Google Fi* - Use the link and save $20 on unlimited calls and texts for US cell service plus 200+ countries of free international coverage. Only $20 per month plus $10 per GB data.

Wow, you guys eat really good. I want to come to party over there, lol. Congrats on the positive income in April. I wish these gains last forever, but they won’t. Let’s just continue to ride the wave.

Eating well on a budget. We really don’t try to cut costs other than maximizing value in whatever we’re buying. And love trying new stuff to see if we can replicate the “pros”. Free entertainment/hobby. Or actually I guess it’s a hobby that pays us.

Congratulations on another great month of low spending and net worth increase.

I have been thinking a lot about your dividend collection strategy as I contemplate my own early retirement withdrawals starting later this year (after my severance, deferred compensation and paid out PTO run out, offset partially by unemployment income).

Although I suppose it’s just splitting hairs when we are talking about a nominal budget on your 1.8M net worth, I think I have come to the conclusion that we will be reinvesting dividends when we retire early. I do plan to have some separate funds in cash or consumer products (we own 55k of PG stock, and while it isn’t quite bonds, these stocks do very well when the overall market gets bad or fear increases). I figure that even having those dividends reinvested for a short period of time, the value will go up 77% of the time (in line with how often the stock market goes up). I will divest actual shares when I believe that we need to shave a little off the top in order to have more of a safety margin for the inevitable market declines.

I think overall continuing to reinvest dividends will have a marginally positive effect on our portfolio in early retirement. As for the earned income tax credit qualifications, I think that I may consider selling all of our “gains” next year and reinvesting some or a lot into BRK-B in order to perhaps qualify for the EITC in 2019. I figure if I lock in enough gains when our overall income is low, we will be taxed at 0% for one year on these gains and show much less investment income in subsequent years.

I think we will have some income in early retirement given that my wife is already lining up swimming lessons for little kids in our spendy neighborhood. It isn’t much income, but it would count towards the EITC as a self employed individual.

As a student of the Berkshire Hathaway annual report, that lists SP500 returns with dividends reinvested, I think 3 years of cash or cash equivalents is more than adequate. Four years is a bit high but I understand why you do it given how large your portfolio is getting and your need for risk is likely going down as time passes.

Do you ever apply for credit card offers that are targeted? We are working on the Amex Biz platinum (100,000 after 5k spend) that we received in the mail and it’s a pretty strong offer as well.

I actually moved the $25,000 into bonds right after posting this today 🙂 Now at $125k cash/bonds which is right at 3 years expenses in very safe short term assets. But 3 years means we’ll collect another $25-30k in dividends in the brokerage account in that time, so we’ll be totally fine for 4 years without selling anything (and obviously it’ll last much longer if we keep making $ from blog/consulting/new ventures).

I’ve done some targeted offers in the past. Amex usually. I think I did a pair of 75k business gold cards 2 years ago.

Look at you, getting a workout and saving money at the same time! Now that is efficiency. Stong month for the investments too. Enjoy the meals and have fun with prepping for the Europe trip.

Ha ha, yep. 40 minutes of intense cardio and strength training in exchange for $100. Not bad at all. I’m surprised some of these CrossFit gyms in the US don’t have “digging dirt” as a workout rotation.

I’m thinking business opportunity here 😉

That’s what I’m thinking! People pay $40-50 to run these Tough Mudder and Spartan races that involve wading through dirty water, thick mud, even live electrical wires that shock you! I could probably charge $20 for the much less tough practice of digging a big hole then filling it back in. Maybe put a little treasure at the bottom of the hole to keep it interesting.

I can totally see that being a financial lecture also.

As they dig the hole: “That’s a Starbucks”…. “Margarita at Chili’s”….. ” Ohhhh! That’s a monthly payment on that ‘free’ iPhone!”

As they fill it back in: “Cooking at home!”….”brown bag that lunch!”…. and as you throw in a shovelful for them “Bam! 401k matching!”

Ha ha, that’s the idea 🙂

I do not envy you having to plan health care costs with the current ruckus going on in Congress. It seems impossible to plan in advance for anything at all! The Senate has said that they intend to start from scratch and write their own bill with the same name and then try to find a compromise in conference after. I have no idea what the Senate bill will look like. No idea whether a compromise could be reached between the two. No idea what that compromise could look like.

On a lighter note: I want to eat all of that food. Looks delicious!

I generally ignore this political stuff unless I’m researching for an article or need to know a specific point of policy or law. Just nuts how much uncertainty there is in the health insurance market right now. Wonder what the insurers contemplating offering ACA plans for 2018 are thinking right now? 🙂

It’s great to see your new post! Congrats on the nice jump in net worth. Your family has a nice little food budget right there! I can’t believe the bday dinner for 30 people and groceries for 5 people were still under $500.

The food looks delicious btw. 🙂

Some of the food budget is from past months. The ground beef was from the freezer, for example, so it’s probably from February or March if I had to guess. And beans, cheesy salsa, regular salsa, etc all bought in previous months (just something I had on hand 🙂 ). And other stuff was bought last minute on some crazy cheap sales. Like the pork carnitas – we bought 2 huge pork shoulders at $.99/lb and ended up with around 12 pounds of pulled pork bbq / carnitas which was way more than enough for everyone. Tacos = very cheap.

But yeah, we do decent sized parties occasionally and it all fits within our ~500/month food budget.

Hah! I also count booze as an entertainment expense. Even if beer does make up a good portion of my caloric intake 🙂

Good call on the new shoes for the trip. I haven’t purchased any new shoes since I quit my job. Now all my kicks are pretty worn and I’ve been looking for a new pair for hiking around in Spain 🙂

Here’s the weird thing (and why you can never fully trust people’s self reported spending 100% 😉 ), I include beer in my groceries budget because in North Carolina, you buy beer at the grocery store, not the state liquor store. So I never feel like splitting my receipts up in order to break out the beer expense to entertainment. As a result, beer = groceries and hard liquor = entertainment. All based on where I’m buying it (due to my laziness).

I feel like we are hanging on to more and more cash. I notice I’m getting slower to invest. In the long run (20 years) I’m sure the prices will go up over what I would pay today, but I can’t help but feeling there has got to be a sale coming soon. =) I don’t want to try to time the market, but gosh it feels pricey.

Yeah, I’m not sure what I would do if I were still accumulating assets for FIRE. Seems pricey to me and I’ve always wanted a reason to shift some assets away from my former 100% equities asset allocation. Today’s valuations seem like the perfect excuse. I carried through on that $25k shift into bonds today. I moved some other stuff around to rebalance but I think it mostly came from international investments which have done particularly well lately. Now I’m at roughly $125,000 in bonds/cash. Which still puts me at 93% equities. 🙂

Hey Justin, I’m never surprised to hear more people doing the consulting with you. Our session last year was really helpful for me (and my peace of mind)!

Speaking of houses, my wife and I just went under contract for a house in Charlotte. Very exciting. We’ll be moving there from Orlando. I’ve been in Florida for over 20 years, so I’m looking forward to the changing seasons of North Carolina. Take care!

Great to hear you got a lot out of the consulting session. I think 80-90% of folks are blown away after the session, about 10% are basically like “yep, matches what we were thinking” and 1 or 2 didn’t seem to get a lot out of it.

Congrats on the Charlotte house. I lived outside of CLT for a few years when much younger. Pretty similar feel to Raleigh overall. Unfortunately you’re moving up here just in time for our Orlando-like summer. But just wait till September – it’ll be beautiful! Or maybe October… 🙂

Raleigh was going to be our next choice if we didn’t like Charlotte when we were visiting. Both cities seem great and have a healthy amount of jobs for software engineers like myself. For now I work remotely so I can move anywhere but I like to have local options too.

I’m ready for Charlotte’s Summer. Can’t be worse than Orlando! And it will be over sooner. 🙂 Looking forward to the Fall though, that’s for sure.

Yeah, tons of software/tech jobs around here. Pay is great, COL pretty moderate. How do you find Charlotte COL vs Orlando?

Weather will be so much better. I’ve been to S Florida a number of times for various meetings and conferences and can’t recall a time I wasn’t sweating 🙂 Though I don’t think I’ve been there in January yet. October, May, all hot in S Florida. Up here it’s usually pretty moderate in those shoulder months. Just watch out for June, July August.

Based on my research + several COL calculators on the Internet, the COL for Charlotte and Orlando are basically equivalent. That was important for me because my pay isn’t changing just because I move. My personal expenses will be higher but that’s because I’ve bought a much bigger house. Based on what I’ve seen I’d say the houses in Charlotte are a bit nicer for what you’d get with the same price in Orlando.

That’s kind of the sense I have, too from the little time I spent in Orlando.

With income > expenses in retirement, life must be looking pretty great! A couple more years of this combined with halfway decent market returns, and you’ll be able to call yourselves multimillionaires.

We had roots in the sewer line a couple years ago, and spent $400 for a specialist with a videocamera / water jet setup to cut them up. Since then, we’ve flushed some root killer (copper sulfate, I believe) down the nearest toilet every six months. So far, so good!

Cheers!

-PoF

I haven’t looked today but we were within 10% of the $2 million mark at one point in May. Wouldn’t take much to push us up there very soon! I don’t plan on radically altering spending so it’s mainly just pushing our potential withdrawal rate even lower if we ever do get back to relying heavily on our investment portfolio for living expenses. And the net worth is almost completely investments – house = <10% of NW.

Interesting comment on the roots. I'll have to look into that copper sulfate or similar if we continue to have root issues. The plumber mentioned scoping the sewer drain with a camera if root problems recur.

This is the stuff. http://www.homedepot.com/p/ZEP-2-lb-Root-Kill-ZROOT24/100074551 We got ours at Menards. Interestingly, I bought the same compound to kill snails on our shoreline after we had a case of swimmer’s itch that had me seriously considering self-amputation.

Thanks. I think I’ll hold off for now but definitely use it if the roots grow back (if the problem was even roots in the first place!).

Ha that stock market thingy keeps making all the bear look silly. I really wish I could see a pullback a la 2008, I wish I would have jumped in more than I did and allocate more income. I guess I’m just one of those odd ducks with DGI that wants to see the market crash to invest in more dividend aristocrats. Who knows maybe you’ll hit two million before it happens though!

I’m a permabull since my investing horizon is 50+ years. I don’t know what investments will look like 5-10 years out but I bet in 50 years they’ll be much much higher!

That said, it would be pretty awesome for those still accumulating to have a huge dip in the market right now for a couple of years. That wouldn’t bother me too much either since I have several years’ worth of expenses in cash/bonds and I feel like I’m paying premium prices for travel (cruises are double what they were in 2008-2009!) and for home improvement (contractors aren’t hungry like they used to be – they’re too busy building new houses!).

Will you catch an Uber to the airport and home so you don’t have to leave the car parked for the summer? I’ve always wondered how that would play out with my family if we went somewhere more than a week considering the airport parking fees and how far we live from an airport could be a challenge. Love the financial updates. Wish we could pay you to write more blog posts for those that want more tips instead of individualized planning. Ha! You know, spread that $150/hour out over a few thousand readers…who’s down???

We’re maybe 20-25 minutes from the airport. I think we’ll catch a ride with someone or see if someone can drive us there in our minivan then return it to our house. We only have 1 car so it would be nice to have one sitting in the driveway the whole time we’re gone. Otherwise there’s UberXL for the five of us. Maybe $30-35 one way to the airport??

I like your idea about crowd-sourcing payments for the blog. There’s a service called Patreon that lets you do basically that – chip in a recurring amount per month (a buck or two up to any number you want!) to support someone in the arts or creative community. When I get more time on my hands I might investigate that. Higher level contributors get access to higher level goodies (like a complimentary advising session or email some personal finance questions, private email list, private facebook group, members only video chat session, etc).

The only limit is my desire to not work, and enjoy retirement you know. 🙂 Time shall tell.

Thanks for the update, Justin. I am curious where you keep your $100,000 – $125,000 cash bond mix you mentioned….

$35k in 1% money market at the credit union. $90k in VBTLX – Vanguard Total Bond Market Index Fund Admiral class shares. Vanguard says it’s yielding 2.42% these days. I got pretty lucky and made an extra 0.6% of capital appreciation because bond yields dropped slightly since I purchased the shares.

Nice. I’m trying to shift to some bonds too. I am assuming vbtlx is in your tax sheltered accounts vs taxable? Wondering about municipal bonds in taxable. Asset allocation is making my head explode.

Yes, VBTLX in traditional IRA account.

Muni’s might be appropriate in some cases. For me, the muni income would count against MAGI for ACA subsidy purposes, therefore come with an explicit ~12-15% tax rate.

That’s great, especially your groceries budget. We still can’t decrease our groceries + household items like toilet paper, detergents etc lower than $800 per month. It’s to high for me, considering we don’t eat outside.

We were stuck at close to that level for a while when we bought pretty much everything in one place (at walmart). Now we pay closer attention to prices and add an extra grocery store visit during the week.

Use the Walmart app to scan their receipts and if a competitor has the item lower, you get the difference back. That makes Walmart a one stop shop…if they have everything you want there.

So much of what we buy doesn’t qualify for the price match. I used to scan all the receipts in but gave it up. I think I collected a total of like $1.18 from the price tracker thingy. We mostly buy store brand stuff, fresh meat and produce, sale/clearance items. I’m sure if we bought name brand packaged goods we would probably get a ton more $ back but it’s pretty rare that we do that. And that only gives you the best advertised price, however many of the local grocery stores do offers that can’t be matched (like the Buy 4 save $4 stuff at Kroger, or Food Lion’s new “buy $10 in this category and get $3 instant discount” and it’s stuff we’re already buying).

I feel like the extra grocery store visit each week is worth it to have a wider selection of merchandise/brands/varieties and to save several thousand dollars per year without clipping coupons (or scanning those walmart receipts any more 🙂 ). I’ve also grown to love the smaller store size at Aldi – it’s like 1/20th the size of the superwalmart. Forget something – no problem, just backtrack to that aisle and grab it. Only takes 30 seconds since there’s only about 4-5 aisles.

I’m in a very rural Midwest area. I definitely see your point with the extra grocery stop. I only have a choice of 3 other stores besides Walmart….wish we had an Aldi!

We spread our grocery and household items shopping between different stores: Costco, local small shops and Safeway, but we live in Sunny California where price is just ridicules

Are you worried about home insurance premiums increasing after filing a claim? Nice month you had, by the way!

Not much. We just got the renewal and it was up $13 I think – basically inflation because they automatically increase the value insured by CPI.

Long term maybe rates increase but this is our first claim in 13 years I think. And even if they double for three years, we’ll still be in the positive by $2600. And could shop rates to another provider if the rates go up.

Another great article. Nice work using quarterly tax payments to meet the minimum credit card spend requirements. The Wealthy Accountant just posted about this in detail:

http://wealthyaccountant.com/2017/05/05/the-ultimate-credit-card-rewards-hack/

Are you close to the Chase 5/24 rule with this new card? Just curious how far you push the credit card hacking.

Hope we’ll see y’all on the 20th at Umstead for a hike.

Yes, it’s genius. Gocurrycracker first turned me onto the idea. No big deal to pay 1.87% transaction fee for the privilege. I’m earning many hundreds of dollars in CC bonuses thanks to that tax spending. And it’s a tax deductible business expense since I’m paying business taxes with my Root of Good credit card. 🙂

I’m just under the 5/24 rule right now for me, and Mrs. Root of Good is right at 5/24. We don’t do a ton of card signups nor do we do manufactured spend (other than simple stuff like paying taxes through a CC), so there’s a natural limit on how many cards we can get since our routine spending is rather low.

Hope to see you out there on the 20th too! We got really busy the day of the last hike with some kid stuff so couldn’t make it (and it was HOT I recall!!).

Great month and it’s awesome your early retirement lifestyle consulting is getting back to normal/picking up. I’m heading to Raleigh in June (for work of course). Would have been nice to meet up but you guys are probably in Europe by then. Can’t wait to see the European pics. 🙂

We’ll be here the first two weeks of June, so let me know if you’ll be here at that point! Might be possible to grab a beer/coffee or dinner if your schedule permits!

The downside of the ER consulting is, you know, doing the work and scheduling fun activities around it. I have a bad habit of checking the weather forecast before offering available time slots to clients, and I’ve rescheduled consulting sessions to go out and play. 🙂 Worst consultant ever?

Haha worst consultant indeed. Will see if my schedule permits for a meet up error aka picking on your brain.

Digging holes is so much harder than it looks! Any romantic notions I may have harbors about farming were knocked right out of me one sweaty afternoon when I volunteered at a farm and dug holes. It felt like I was digging for long enough to tunnel to China, but I had an embarrassingly shallow hole to show for it.

Four months of your expenses equals one month of ours. If we are having a good month. Damn and fuck and many other curses.

I lucked out. This was THE softest soil I’ve ever dug. It was slightly moist and a nice blend of mostly sand mixed with some clay. I also watched the plumber dig about a quarter of the hole himself and noticed how incredibly easy it was. Otherwise I’m not sure I’d do it for $100. I’ve dug enough holes back in the day for work and at home to know digging out 2 tons of dirt CAN be a ton of work if the ground is baked solid clay or silt. Or full of gravel (like some of our yard).

A pick axe is for digging in hard soil. The shovel is then just for moving away the soil the pick axe broke into chunks.

You’re right of course! I used to use a pick axe when I worked on a land surveyor’s crew one summer (as the grunt…). Digging into hard packed baked clay full of roots and rocks in 95F weather with high humidity isn’t fun at all. In contrast, digging this loose packed sandy clay soil in front of my house in the shade in 70F weather wasn’t bad. 🙂 Seriously, the easiest soil I’ve ever dug in and much easier than most spots in our yard. I think the plumber regretted offering me the $100 off after he saw how loose the soil was.

I’m not good at timing the market so I figure I’ll just keeping plowing money and hope in the future that it continues to go up. With that said I definitely get your strategy and it makes a ton of sense on paper.

BTW…that’s an incredible deal you got on the cruise. I’m sure you all are going to love it!!!

Plowing money into the market worked for me for a decade or more. And I’d still be doing it if I was still working and trying to accumulate more funds.

You guys are doing so well. Great job on the income and expenses. Sorry to hear about all the stuff breaking. It seems to be that way for us too. I’m not looking forward to the next set of problems.

Prop to you for digging that hole. I might have done it in my 20s, but now I’d just pay the $100… I’m very bad at digging…

Great pictures of food too, yumm… I’m making chicken satay with peanut sauce tonight. Good stuff. Maybe I’ll take some pictures to put with next month’s report. 🙂

As for investment, I’m making sure our bond allocation is okay. It was a bit low so most of my new contributions go to the bond funds.

I saw the plumber digging so quickly I figured it must be really soft ground. And it was – like digging in the sand at the beach, though a higher clay content kept the hole from collapsing (till it rained and all the dirt slid in the hole!). Really not a hard effort though I was pooped afterward – it’s one of those chores that uses different muscles you’re not used to using all the time.

What’s your bond target (in dollars or %)?

I dug some holes at our old house and it was ridiculously difficult. The soil was all packed clay.

My target is 20% right now. I might raise it to 30% if the market keeps going up like this.

That’s no fun. Some of our yard is like that. So much work just to get down a foot or two.

Bond target seems reasonable depending on your tolerance for risk. 20% would mean $340,000 in bonds for us. Which equals 8.5+ years of spending before exhausting the bonds. I don’t feel the need for quite that much safety.

Home insurance in TX is about 1200 bucks for me. You pay less than that and get auto and umbrella too?!? Stupid hurricanes.

Yes, it’s pretty cheap living here. We still get hurricanes/tropical storms pretty often but it’s not usually too bad by the time they get 100-200 miles inland (depending on where they’re coming from). Usually just a lot of rain. And we don’t pay for flood insurance (technically outside the 100 yr flood plain). Our umbrella dropped to $102 this year. I don’t know if we’re deemed less risky for some reason or the insurer just had a really great year last year. That’s down from $160 I think.

Technically outside? That sounds pretty close- with heavier rainfall lots of places in the 500 year plain have seen surprising flooding. Was it too pricey? Just think it wouldn’t actually pay up?

I did a bunch of engineering analysis shortly after purchasing (and when my hydrology skillz from college were much fresher 🙂 ) and determined it would take something like a 200-500 year flood to get us (0.2-0.5% chance of a particular rain event occurring within a particular year). I had a surveyor out to determine house elevation and flood plain and map some stuff too.

There’s been a slight bit of development in the watershed feeding the creek we are on, but it’s not that dense (ie runoff quantities not increased significantly) and it’s mostly developed at a max now without zoning changes to allow increased density (and new developments generally have to store most of their runoff on-site in stormwater detention ponds).

And by “flood would get us” I mean flood our crawlspace and probably only cause $5000-7000 worth of damage (furnace, water heater, outside AC compressor maybe). Premiums were pretty high ($1300/yr??) with high deductibles because they wouldn’t give me the updated pricing after they improved the water flow here (increased flowrate in the culverts underneath our property by 10x or so). Maybe that’s changed but I think the fundamental risk-reward is still there. Very low odds we will see water above our lowest finished floor elevation where the real damage will start (flooring, walls, furniture, etc).

In the meantime, I’m on the hook for any losses but I don’t have to deal with an insurance company. And if it was a 500 year storm and we did receive substantial damage there’s a good chance FEMA will line up at our door to hand us free government money (or cheap loans) or the city would buy us out using fed grant money.

We’ve had a few major rain events from tropical storms and hurricanes and the worst I’ve seen (5-7″ rainfall over a few hours and more rainfall over a longer stretch) is still about 5-7 feet from overtopping the road and flowing into our crawlspace (finished floor elevation another couple feet up). Without getting into the math/physics (which I’d have to go redo 🙂 ), the water flows faster as the levels rise, so we could take on a good bit heavier rains and more sustained rains before we get flooded (with small losses) and even more to actually cause significant damage to the house. I did move my car to a higher elevation just in case since that’s an easy risk mitigation 🙂

My quote for flood insurance was $4,847 because they said I was in a flood zone. With 30+ acres I do have some low places. Had to get a form from the county government with proof of elevation where the house was built (not in a flood zone). Never flooded during the 3 hurricanes in 2004 but still they came back with a price of $2600 which would have been in addition to my $1392 homeowners insurance. Needless to say I do not carry flood insurance. With those rates there are a lot of people here in Florida who have no insurance at all.

You crack me up, because this is just the kind of nerdy, over the top investigation that I would undertake. Interesting to hear your background work and thought process. My view based on your analysis? You are going to sustain some moderate damage at some point, but you’ve prepared for it.

Based on a 0.2-0.5% annual chance of flooding estimate, the cumulative probability we’ll experience a flood is 6-14% during a 30 year period.

Risk = 1-(1-.002)^30 = 6% chance with .2% annual chance of flooding (if we’re in 500 yr flood plain)

r = 1-(1-.005)^30 = 14% chance with .5% annual chance of flooding (if we’re in 200 yr flood plain)

My conclusion is we have a small chance of suffering some damage, but any damage is likely to be minimal ($7000 or so) which wouldn’t really be covered much by flood insurance in any event (from what I recall of coinsurance/deductibles). It would take a pretty severe rain event over a prolonged period of time to do significant structural damage (ie our house gets washed away). Maybe a direct hit from a slow moving Cat 3-5 hurricane that doesn’t dissipate during the 130 mile march inland to Raleigh and it stalls and keeps dumping water on us. Or hovers off-shore and stalls and keeps its strength as the rain bands keep hitting us (more likely since these guys weaken significantly and lose moisture once they get over land).

In any event, the likely damage estimate times the cumulative probability puts the price tag of this risk of flooding at a low level (probably $1000 total over 30 years).

La comida mexicana se ve muy bueno! Podemos venir a comer en tu casa?

Hooray for another excellent month! See, no one believed me when I said your costs go down in retirement–even with kids! But you are living proof that it’s true! Clearly if their costs don’t go down, they’re not doing it right 😉

¡bien hecho!

Mi casa es tu casa. Ven aqui and join us! 🙂

I’m pretty sure our core costs went down though our overall costs are probably higher due to more spending on travel. I still feel like we’re living a typical $100k/yr lifestyle on a $40k budget thanks to paying attention to where the money is going.

Sorry to hear about everything breaking all of a sudden. It happens like that for me too…one day everything breaks! Argh!

Great month otherwise! Looks like you guys are living the dream, and I see no reason why that can’t continue in the future! Very inspiring RoG!

We’re doing pretty well ourselves; the net worth just keeps climbing!

It’s like our stuff is conspiring against us. Everything goes perfectly for several months, then I realize it’s way too quiet and smooth. Then everything goes boom in a relatively short period of time. I know these different events are uncorrelated (but maybe the weather? temperature? humidity?), just strange.

Increasing quantities of money in the portfolio help me to not worry about this stuff too much. 🙂

The S&P 500 was up by about 1% in April. Your portfolio was up by about 2%. Not sure what’s in your portfolio, what areas led to your out-performance?

I don’t track individual holdings’ performance, but I’m guessing that it was my international investments. I just rebalanced yesterday and international stuff was overbalanced, so I sold some of them.

Just got the statement on my homeowners insurance $1392 plus I have to be a member of the Farm Bureau at $45 per year. Florida is really impossible when it comes to the cost of insurance and I can’t shop around as no other company will insure me ( land + cattle).

Having a bad year as well with multiple unplanned expenses. C’est la vie.

We’re with Farm Bureau too. I think annual dues are just $25 here. How much do you think land plus cattle add to the policy? We are probably pretty cheap to insure since we don’t have any pets and no swimming pool (or cattle!). Good credit history, no points on our driving record, no claims on homeowner’s till just now.

Cattle adds $170 to the policy. Not sure about the land. No other insurance will cover you if you have over 5 acres. I had Citizens Insurance before I was able to secure Farm Bureau, No cattle allowed and insurance was $2600.

Interesting. Never considered having acreage would make you uninsurable to some insurers.

Another great monthly report. I am amazed at the low spending, thanks for setting the bar high, or wait, would that be low?

I like to think I’m setting the bar pretty high. But I know what you mean.

Couple of things….First another great month…congratulations…And many thanks for the timely blog on your roof. I began having estimates for roof repairs and one of the estimators concluded we had “an event” and suggested I call my insurance company. I did and sure enough like you there was SOME coverage. And like your claim it is paid in two parts. Unlike you there is no way our roof can be replaced for $4-8K….I received two estimates….one for $25K…..and another for $12K. Roofing in this neck of the woods is a crazy business. It became apparent to me at this point that additional quotes would be fruitless. And that I would be replacing this roof myself. I began getting material pricing and will be ordering this week.

As for the “Healthcare Act” changes….these may actually benefit myself and others. If my accountant is correct these tax credits apply to those that purchase health insurance. And are awarded even if you owe little or no federal tax. So for someone over 60, even if you owe no federal tax the Fed writes you a check for $4K or $8K for a couple….which is right around $666 a month to buy insurance. And you don’t have to buy on a designated site to be included. And in your case it would provide a credit of right around $10K which should put a dent in insurance premiums. What am I missing?

Wow, those roofing costs are crazy! I didn’t even call some of the companies that are known for very high prices. No point when I know I’m looking for a roofer on the lower end of the range.

Would your insurance not pay enough to cover even the lowest quote? Wonder if you can tell the insurance to keep their check and let them hire a contractor to fix your roof within their own allowance amount?

As for health insurance, you are right in your understanding of the way the AHCA as proposed would work. Not sure it’s an upgrade for most of us early retirees. I can’t recall if you were buying a policy off-exchange, but if so the AHCA WOULD be great news for you since I believe the AHCA tax credits can be claimed even if you’re not buying insurance through the exchange (just can’t take them as an advanced tax credit). But unless your incomes are rather high (like over 400% of the fed poverty level), you’ll probably end up paying much more under AHCA vs. ACA. $8k won’t go far to offset premiums of $15k+/yr for a married couple age 60+. As it stands now, a married couple will pay right around $6000/yr maximum after ACA subsidies for the “2nd lowest cost silver plan” and less if they choose a cheaper silver plan or bronze plan. And that’s assuming they have the max AGI of $65,000 (just below the subsidy cliff at 400% of FPL).

There will definitely be winners and losers, and wealthier 60+ year olds with AGIs over $65000 will win under AHCA as proposed since they’ll still get $8k/yr to help with insurance vs. zero now. But with the change in ratio of premium costs from 3:1 for oldest to youngest to the new 5:1 ratio, age 60+ premiums will be 5x what they are for a 20 year old. So it’s still not certain that getting that $8k subsidy will offset the potential increase in premiums for older folks.

My income tax is complex and when I met with an Obamacare rep she was totally overwhelmed. I have rental property and investments. She plugged the numbers one time and it threw us into Medicare….She ran the numbers again and terrible plans with high deductibles and a high out of pocket. We decided to keep our “grandfathered plan” and it suits us well. And our premiums are not $15K a year. And we receive no subsidy now….so $8K….sounds pretty good. We’ll see how it turns out….

In this situation you’ll do much better under AHCA. I actually like that you can take the tax credit even if you don’t go through the Healthcare Exchange. That would be a good “fix” to the ACA if they weren’t so dead set on repeal and replace. Assuming your grandfathered plan provides some reasonable form of real insurance, you should get subsidies too even if you’re not buying on the exchange (but that’s not the way it works unfortunately).

Love these posts! Thanks for all of the details and congrats on another great month! Its good to get the perspective of someone who is living the FIRE dream that most of us are still chasing. Looking forward to hearing about the big Europe trip!

Mmmhhh…not sure I read it from anyone above: great kids, congratulations for the good grades! And enjoy them: with mine grown and in serious stuff, I miss those days of walks, LAN partys, etc….

Thanks. We are proud of them. Most of the time 🙂 We hear good things about them from external parties, so that’s a good sign we’ve done most of the right things.

Congratulations on another fantastic month, Justin! This April our family went far more frugal than we ever have before – taking a lot of cues from your monthly updates about what you’re doing to keep costs down.

The result is that we saved over 75% of our income last month. Our net worth is behind yours by about $100k, but the run-up in April was certainly a welcome addition to the portfolio. I haven’t done the math but we probably made closer to 60% of what you made — a lot of our net worth is in our primary home and a rental property. We’ve only got total exposure in the equity and bond markets of about $1.2 million.

I’m seeing the FIRE lifestyle getting closer and it’s great fun to look forward to. I enjoy my job well enough, but it isn’t what I’d choose to do if I had more free time and no need for the paycheck.

As far as what we’re doing for 2017. Right now we have a VUL life insurance policy that I am considering cashing in. It has a cash value of $42,000 and since I’ve made 37,000 in contributions, only $5k of it would be taxable. We don’t need the insurance anymore. My thinking is to roll that into 529 plans for my kids. We already max out all other shelter-able accounts every year. If I roll that into 529s I can deduct from my state taxes up to $25,000 of it this year which will offset the extra federal expense. (the rest will carry over to next year’s return). This gets us much closer to fully funding college for the 5 kids, a goal that I’m determined to shore up before pulling the FIRE trigger.

Wow! Sounds like you’re on a great path going forward. Definitely put “ditch the VUL” on your calendar/task tracker and get that done. Seems like a no-brainer if you don’t value the insurance component of it, especially if you can retain the tax advantages (and then some) via the 529 account.

One question Justin that you may have researched. If you get a family policy under the AHCA, do you get the credits for each person in the family. (I have 5 kids, so I’m thinking that we might get a pretty big credit).

I seem to recall that there’s a limit in the AHCA for tax credits for # of people (maybe 5??) or max credit per household $14000?? It didn’t impact it and I wasn’t thinking of you when I read the summary 😉 Check out that link to the Kaiser Family Foundation’s comparison chart since I’m sure it’s covered there. But that’s a total crock to limit it in this way. Why not give the tax credits for all the kids in the family. It’s not like big families have it any easier than smaller families, and I don’t think we want to go down the path of disincentivizing having kids via tax policy. But I guess we do it to a certain extent with other tax policies (Earned income tax credit, for example).

Fairly new to your site, do you carry any debt? Also do you add your home to your net worth?

No car loans or mortgage. Some student loan debt but it’s on an income based repayment plan and will be partially forgiven eventually, so I’m carrying it at a $20,000 liability on my balance sheet. No credit card debt other than the few thousand $ we charge on the card each month and repay in full.

House value is on the net worth statement though it’s probably very conservative. $150k value on the balance sheet and most homes in the ‘hood are selling for $170-220k depending on size and condition (we’re average size and condition).

We just had to get our roof and gutters redone. Not a fun expense but it always does feel good to get stuff like that taken care of. I live in your area and we had http://www.briancreechroofing.com/ do ours. It was just under six grand for us and they did a good job. Even came back out a couple times to touch up some things. How are you getting insurance to pay for so much? Mine wouldn’t offer anything.

For now I’m staying really heavy in stocks. I’m a little nervous though as it feels like a correction is coming. I am fighting with myself to not go 50/50 stocks and bonds. If a big crash does hit I could make a killing buying up all those stocks and going back to 90/10.

Fantastic work being “retired” and still covering all your expenses with your income.

Thanks for the recommendation. I already had them on the schedule to come out this Friday and considered cancelling since I’ve got a ton of quotes already. Think I’ll go ahead and get a quote from them. So far I’m impressed with the quotes – half are in a very tight range around $5000-6000 so I feel like I’m getting good prices and not getting ripped off.

That snake looks a lot like a copperhead which is venomous.

Similar. Head shape is totally different though. Stripe pattern is similar. It’s a Northern Water Snake. Non-venomous.

Congrats on another great month. I can’t wait to see the photos from your European vacation. I have some family in Europe and am tentatively planning on visiting in early winter. Scanning for cheap flights now and remembering to update my passport in the meantime.

Hopefully you’ll find cheaper flights off-season. We booked using points because flight costs were crazy for our summer travel dates.

I’m still way jealous of those roof replacement costs. I am still getting estimates (why don’t contractors call people back in NH??). Good to know your low/high-end quotes, though, as a comparison point. Sounds like you guys are getting excited about Europe! Looking forward to seeing your pictures!

One roofer that came out said my roof is a roofer’s dream. Just two flat surfaces, no dormers or valleys or two roofs meeting at an angle or anything complicated. There’s a porch and a shed and even those are pretty simple, straight forward. Relatively little risk of screwing it up or water getting through given the simplicity.

However, I’ve heard from a lot of people with similarly low prices here in Raleigh area. $20,000 for a roof would be a high end job on a large house with garages and outbuildings, like 4000-5000 square feet probably.

I’m still getting insurance through my work place (mega corp), but have been very close to pulling the plug and getting it through the market place. I did the numbers and working part time, keeping our income at ~40k we would have gotten a great plan. Now that is obviously all up in the air.

But, my child has a pre-existing condition, so I wonder if it makes sense to get the plan, and leave my current workplace plan, so that I can maintain continuous coverage. Not sure if there will be some sort of grandfathered clause. But, my fear is if in 3 years, when I’m ready to ‘retire’ I won’t be able to get insurance on the market place due to the pre-existing.

Do you know if continuous coverage counts even as I transition from workplace to marketplace? Or, would that then give them the option to reevaluate and charge us more.

Thanks!

I think continuous coverage is continuous coverage. Whether it’s employer provided or purchased as an individual (exchange or not) still counts as continuous coverage. I’m pretty sure that’s how it works under the proposed AHCA, but it’s subject to change. Stay tuned and I’ll be following this too. Probably put out a post on it once something is finalized and passed (for now it’s a lot of speculation over what MAY happen).

agreed, it could look a lot different by the time it actually passes (assuming it even does). Thanks, and I’ll look forward to that post.

Either way, I think it is going to force me to save a little more before I pull the plug.

Wait and see seems to be the order of the day. No clue if it’ll pass and I’m doubtful it’ll look just like it does now once the senate gets a go-round and sausage is made.

Hi Justin, thanks for your monthly updates …. if I ever move back to Canada or the States? your tips and can do attitude will definitely help out …. especially seeing you handle everything with a family, house and car …. so your monthly reports show how things can be done with a family and a bit of travel too … and helps build my confidence in this FI thing … the blog business is a nice side gig to buffer things …. over here there is a lot of teaching ops to fill in the gaps if need be … I am still in the midst of figuring out how to do what you do while living in China … been over in Asia since the 90’s now … our networths are comparable … but I still choose to work and do churchy stuff and outreach etc … with all your free time … do ever do volunteer ops like at food kitchens, street missions, sunday school stuff, or other charities and the like …. etc etc etc … God Bless, China 🙂

I try to stay involved in the community and at the kid’s school. Volunteering when necessary. Right now I’ve been appointed to the local parks commission that’s handling the master planning and redevelopment of our neighborhood park, so that will keep me a little busy through the rest of 2017. Honestly, I keep pretty busy with 3 kids, our vacation schedule, and other pursuits and don’t have a lot of down time. Maybe that will change in the fall when our youngest is in school all day. Not sure I’ll pursue volunteering as a first course. Probably do something business-related (maybe volunteering??) or work on the blog or something related to that.

Sounds great, a lot of retired folks over 50 like my parents do a lot of volunteer work for the church and local community… it is good I think for the ER FI community to volunteer *time and know how too…your tech…website know how would be priceless for whoever …whatever charity …you decide to help…God Bless, Beijing

I’m surprised Spectrum jacked up your price! I got the courtesy upgraded speed, but they haven’t mentioned anything about the price changing. 😀

I had just finished a $35 for 12 months promotion and as a result I defaulted back to $45/month. When I made a service change to try to lower the price, I couldn’t go back to the TWC $45/month plan (“I lost grandfathering” they told me) and the cheapest Spectrum plan was then $65/month. Eventually they helped me out with the $45 plan.

Podcast 60 … Podcasts on Index Funds vs Mutual Funds …..worth listening ….

Podcast 59 Andrew’s personal story … school teacher retired at 41 and writer for Globe and Mail

9 Rules of Wealth You Need to Know, with Andrew Hallam | Afford Anything Podcast (Ep. #60)

Andrew Hallam: Millionaire on a Teacher’s Salary | Afford Anything Podcast (Ep. #59)

Your really enjoying your life by eating what you want and by spending time playing with your kids and finally you seem to be so brave enjoying even with the 3-4 feet long. And finally I wanna Congratulate for what you have got in this month. 🙂

Hi Justin,

Who knows this bull market could run another 4 years or 1 week. No one knows anything. Did you change your allocation based on high valuations/market timing or when you hit 1.8 million? All that food looks so yummy! 🙂 Looking forward to your articles covering your trip in Europe.

Just taking a little profit off the top. Last time we were deep in a recession I told myself how nice it would be to have a large cash buffer to wait out the next big recession.

My husband and I are looking for the best way to invest so we can retire in the next 3 years. We have close to $1M with no debt. Kids are grown and we have sold most of our furniture other than a bed and a desk. What would be your best advise for us?

I’m a big fan of establishing an asset allocation and filling it out with low cost index funds.

Thank you and that makes sense. So once we are retired would use suggest we stay all in 100% invested in low-cost index funds are tied to the S&P 500? Or what percent should we allocate out to Possibly other more predictable streams of income like bonds or treasury bills? Finally, do you believe we should be looking at real estate investment rental homes?

Hi Monica,

There is a free forum dedicated to index fund investing and many other helpful subjects regarding finance and investments. Check out bogleheads.org. The easiest and most popular portfolio is the three find fund portfilios:

bogleheads.org

https://www.bogleheads.org/wiki/Three-fund_portfolio

Go ahead and post your questions there.

You saved me the effort 🙂 That’s what I was going to suggest – Bogleheads is a great site (both the wiki/FAQs and the forum).

Thank you for the wealth of information Justin. God bless!

Hi Justin! I’m so excited to find another person who also retired at 33! I just started my first blog a month ago (https://33andretired.wordpress.com/) to share my outlook on living a full life and would love to learn how to set up my WP page to get the most out of it! Looking forward to learning from you! 🙂