April was a blast! It was also an incredibly busy month. We helped out at the kid’s elementary school by chaperoning a field trip and running the school’s spring carnival raffle. I spent four days at CampFI Midatlantic where I presented “How to Develop an Early Retirement Budget”. JD Roth stopped by the house for a few hours before heading up to the camp. The whole family did a staycation for spring break. We assembled a couple more bicycles for us adults. To close out April we threw a big birthday party for our six year old. I’m pretty sure I was less busy when I was working!

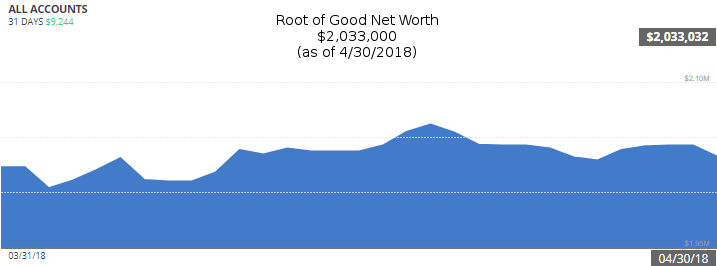

In financial terms, April was a good month. After a couple months of losses, our net worth reversed course and climbed by a modest $9,000 to $2,033,000. Our spending remained low at $1,977 which was just a tiny bit more than our April income of $1,837.

Let’s jump into the details!

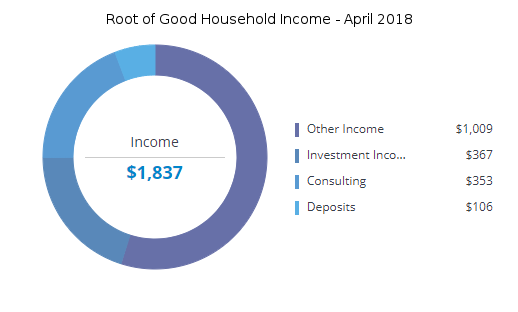

Income

Investment income totaled $367 in April. Our equity mutual funds and ETFs pay dividends quarterly in March, June, September, and December, which means we don’t see much dividend income in April. Most of the investment income was interest on the Vanguard Total Bond Market fund, plus some lingering Q1 dividend income that arrived in the first few days of April. More on our dividend income.

Blog income, shown as “other income” in the chart, declined markedly to $1,009. I had a slow month on the revenue side although the traffic remained consistent month-to-month. May and June will be better months from what I’m seeing in the pipeline right now.

My early retirement lifestyle consulting income (“consulting”) of $353 was slightly lower than in March. That represents three hours of consulting during April which is totally fine with me! The lack of business was a blessing in disguise because I was slammed with other volunteer and personal obligations and didn’t have a lot of time for consulting sessions. How strange to secretly hope to not get any business.

Deposit income of $106 came from a few sources. A class action settlement check for $10 (I bet the lawyers made a little more than that). $67 was my state income tax refund.

The remaining $29 came from the Ebates.com and Mrrebates.com online shopping portals (some of which was earned from you readers signing up through these links). If you sign up for Ebates through this link and make a qualifying $25 purchase through Ebates, you’ll get a $10 gift card. During April, we scored a ton of cash back through those portals from shopping online and from travel bookings.

If you’re interested in tracking your income and expenses like I do, then check out Personal Capital (it’s free!). All of our savings and spending accounts (including checking, money market, and five credit cards) are all linked and updated in real time through Personal Capital. We have accounts all over the place, and Personal Capital makes it really easy to check on everything at one time.

Personal Capital is also a solid tool for investment management. Keeping track of our entire investment portfolio takes two clicks. If you haven’t signed up for the free Personal Capital service, check it out today (review here).

Expenses

Now let’s take a look at April expenses:

April was another moderately low cost month for us. Topping the expense list is the quarterly estimated taxes. The second highest expense is groceries. In total we spent $1,977 during April which is about two thirds of our target spending of $3,333 per month (or $40,000 per year). Detailed breakdown of spending:

Taxes – $600:

My federal estimated tax payment. 2018’s estimated tax payments are due April 15, June 15, September 15, and January 15, 2019. I also used some Visa gift cards I purchased in December 2017 to pay my State of North Carolina estimated taxes.

Groceries – $553:

Pretty average month for groceries. This month our local grocery store Food Lion ran their twice per year sale on store brand items where everything is $0.25 off. I stocked up on a lot of low cost canned goods and non-perishables that should last us till the next store brand sale that will probably be in October. Lots of items were -$.05 to $0.13 after discount (yes, that’s a negative sign; we got paid to take some food off their hands).

Otherwise, Lidl and Aldi continued to get most of our grocery dollars.

To help with the grocery expenses, I picked up some discounted Aldi gift cards at Cardcash.com (sign up through that link and you get $5 off your first purchase). I paid at Cardcash with my Chase Freedom Card through Paypal for another 5% cash back.

Entertainment – $405:

A busy and fun month wasn’t entirely free. But that’s okay. One of my goals when increasing our early retirement budget from $32,000 to $40,000 was to spend more on entertainment/fun expenses. Going into retirement, we budgeted $1,000 for all entertainment/toys/fun expenses. In the updated $40,000 budget, I bumped up that figure to $2,500 per year so we would have plenty of spending money in that category.

Mission (sort of) accomplished! In April we spent $405 on various entertainment-related things. I doubt we’ll hit $2,500 by year end, but we’ll keep on spending money on fun. Entertainment/fun expenses in April included:

- Two new bikes for me and Mrs. Root of Good plus bike helmets and other goodies – $302

- Birthday party for a six year old: pizza, decorations, candy for the piñata, and party favors – $69

- Silent auction fundraiser at the kid’s school – $33

At the silent auction, we won on a pair of tickets to Serenade presented by the Carolina Ballet for $20 (retail price was close to $200) plus $13 for a $20 Chick Fil A gift card. This ballet was much better than the Nutcracker we attended in December.

After 20 years, I’m finally back to bike riding. So far it’s been mostly trips around the neighborhood and running errands to the grocery store, gas station (hmmmm… on a bike? 🙂 ), coffee shop, and other destinations within a couple of miles of home. In May, my goal is to rack up more miles on the city greenways.

Travel – $369:

I bought $400 worth of Airbnb gift cards for $357 at Raise.com when they offered 5-10% off sitewide at different times in April. I’m slowly accumulating Airbnb credit for our summer 2019 trip (destination to be determined).

The other $11 in travel spending was the fee for paying federal taxes with a credit card. I’m working on meeting the minimum spending requirements on my Starwood Preferred Guest Business Card so I can get 35,000 SPG points (which I can redeem for 8-10+ hotel nights in their lower redemption tiers). Paying taxes with a credit card is a great way to meet those spending requirements to get a sweet sign up bonus even sooner! All the credit card offers.

Restaurants – $29:

As part of our staycation during spring break, we went out to eat a couple of times. The first time, we picked up Indian take out ($19) from our favorite spot near the state university, then went on campus and enjoyed our lunch alongside the college students. This was a fun field trip for the kids to see the college campus where mom and dad went to school (and where they may attend one day too!).

Later during the week we used a Groupon at a neighborhood pizza place and paid an extra $10 to cover the extra two lunches not included in the groupon.

Cable/Satellite – $14:

$14.99 per month for 30 mbit/second download speeds and 4 mbit/second upload speeds with no data caps. We qualify for a special rate package for low income households with children.

Gifts – $4:

This was a $4.95 purchase of virtual currency for the Roblox video game. Our son who just turned six has been asking for this for a month so we gave in. The virtual currency lasted about three hours and he managed to get some interesting clothes for his character plus some upgraded zombies for one of the games. Don’t ask me what all that means. He was so excited to be able to get these upgrades and the request for additional Robux has abated so far.

In addition to the $4.95 in-game currency, we gave the little guy $100 in cash. I don’t know how to include that in my Personal Capital expense tracking, but I end up getting cash here and there from random places so it balances out throughout the year. Our son asked to put the $100 plus some other birthday money in his bank account “so it won’t get lost and no one can take it”. Another budding millionaire in the making!

Note on Utilities, Health Insurance, and Gas expenses:

- Utilities were prepaid in previous months to generate spending in order to fulfill the terms of sign up bonus offers on credit cards.

- Health insurance premiums were prepaid in January and February for the whole year. If paid monthly, premiums would be $40 per month thanks to very generous Affordable Care Act subsidies that we receive due to our low ~$40,000 per year Adjusted Gross Income.

- Gas – we don’t drive a lot. We didn’t buy any gas in April (other than $2 worth for the lawnmower but the transaction hit the credit card in May so you’ll see that next month). We started May with over half a tank in the minivan so we might not buy any more gas till June.

Total Spending in 2018

Throughout the first four months of 2018, we spent $8,335. That’s $5,000 less than the $13,333 budgeted for four months of our $40,000 early retirement budget.

We’re deep in underspending territory for the year, which will leave us plenty of wiggle room if unexpected expenses pop up later in the year. We’ll also spend a bit more than usual in May since our homeowner’s, umbrella, and auto insurance policy are all due right now.

Monthly Expense Summary for 2018:

- January 2018 – $1,281

- February 2018 – $3,108

- March 2018 – $2,025

- April – $1,977

Summary of annual spending from all years of early retirement:

- 2014 – $34,352

- 2015 – $23,802

- 2016 – $38,991

- 2017 – $31,708

- 2018 Year to Date – $8,335

Net Worth: $2,033,000 (+$9,000)

After watching our net worth decline by almost $100,000 over the past two months, it’s a reassuring feeling to see the tide turn even if the $9,000 gain isn’t very significant in percentage terms. It’s way better than watching your net worth drop month after month!

We’re really getting into a groove over here at the Root of Good house. I’m approaching the five year mark of early retirement and VERY glad I quit working when I did. Who has time for a nine to five job when there’s so much to life outside of work?

Mrs. Root of Good joined me in early retirement over two years ago and is having a good time so far as well.

Here’s a link to my “Developing an Early Retirement Budget” presentation if anyone is curious (Google Slides file viewable online).

A quick note on Root of Good – I upgraded to a newer version of my blog’s “theme” in early May as you might have noticed. It looks a little different, and hopefully a little nicer! I’ll continue implementing tweaks over the coming weeks.

Looking ahead, we have about a month left in Raleigh before we pack up and head to Freeport, Bahamas for a month starting in June. We booked an oceanfront condo where we can walk right out to the beach and swimming pool. Plans include doing a whole lot of nothing, relaxing by the crystal clear blue water, and exploring the half mile of undeveloped beach in front of the condo.

How about you? Any big summer plans?

Want to get the latest posts from Root of Good? Make sure to subscribe on Facebook, Twitter, or by email (in the box at the top of the page) or RSS feed reader.

Root of Good Recommends:

- Personal Capital* - It's the best FREE way to track your spending, income, and entire investment portfolio all in one place. Did I mention it's FREE?

- Interactive Brokers $1,000 bonus* - Get a $1,000 bonus when you transfer $100,000 to Interactive Brokers zero fee brokerage account. For transfers under $100,000 get 1% bonus on whatever you transfer

- $750+ bonus with a new business credit card from Chase* - We score $10,000 worth of free travel every year from credit card sign up bonuses. Get your free travel, too.

- Use a shopping portal like Ebates* and save more on everything you buy online. Get a $10 bonus* when you sign up now.

- Google Fi* - Use the link and save $20 on unlimited calls and texts for US cell service plus 200+ countries of free international coverage. Only $20 per month plus $10 per GB data.

“We initially met through playing Hearthstone online.”

Reaaaaally?

I did noticed your new mobile theme and was like woah, is this the right place?! Can’t wait for the Bahamas report in June. We haven’t decided on our summer plans. I think escaping to a place with A/C is all I’m asking.

Yes – I used to play hearthstone all the time and was stoked when I saw JD plays too! Haven’t touched it in a year or so though.

I, on the other hand, haven’t touched Hearthstone in an hour or so…

I’m not ashamed to admit: I have a Hearthstone addiction.

I was that way for a year or two. 🙂 I just HAD to complete the daily quests. Totally OCD about that, and did so basically every day for that 1-2 years that I played. I just never stick with a game forever so I’ve moved on. And actually haven’t played any computer games in a month or two, which is something else I’ve noticed about my gaming patterns. I’ll be hardcore into a game then move on to other things for a while.

Great job on the bikes, it’s the best mode of transport out there. Next thing ya know you’ll be rigging up racks for them to carry stuff from the store, then it’s all downhill from there 😉

Literally last night I was window shopping for a rear cargo rack and pannier bags 🙂 Already got a new seat and a water bottle holder. I’ve done a few trips to pick stuff up from the store. Bike = perfect solution for those stores and other destinations within 1-3 miles that take a little too long to walk to conveniently 🙂 And that 1-3 mile range is pretty much everything I ever go to around town! Just wish a couple of big local streets had bike lanes or sidewalks to make biking more feasible around here (working on it at the political level 😉 ).

How did you get bikes so cheap? They always fall apart on me.

Walmart online 🙂 Once I did some digging, I found out most of the brand name bikes in the lower end price ranges were built by the same company (mainly Pacific Cycle). If you go to Dick Sporting Goods for example, you get a similar bike as Walmart plus the pleasure of paying a bit more.

We’ll see how well they hold up. So far so good.

I volunteer at my kid’s elementary school every week. It’s so much fun to get to know their teachers and friends. If you’ve got the time, you should do it too!

Keep crushing it, Justin. Looks like camp FI was a blast.

That’s cool! We help out where we can and it’s been a pretty busy year for volunteering so far.

Very amazing what you guys are consistently doing. Managing to keep your expenses so low, while having a high net worth. I heard you on the chooseFI podcast, and have been a reader ever since.

Cheers! Keep blazing the trail for those of us still trying to escape the 9-5!

I’m always on the lookout for places to spend more money but seem to come up empty handed a lot 🙂 I’ll keep looking though.

Great job on the budget as always! I’m always optimistic about our future since we have two kids that will cost more and more to feed the older they get. Still, even with them both being toddler’s we still can’t seem to beat you guys on food. One of these months though…

I’m curious where you picked up two disassembled bikes and helmets and such for $300?

Got the bikes from Walmart online. The kids’ bikes last month were $89+tax with free shipping and ours were $129 each. Bike helmets I bought at two different times and they were on clearance for $5-8 each. They feel pretty solid and the adult bikes have decent components (shimano shifters and a nice wider seat for cruising for example).

“The piñata was a smashing success.”

I smirked and tried not to drop my cereal when reading this part.

As always, great recap – thanks for sharing.

On your question, we’ll be visiting O.H.I.O! 3-4 times in the next month or so for Mrs. BD’s family weddings, outings, and other events. – Mike

I was very proud of that piñata/smashing comment 🙂

OHIO! Only spent a day driving through there eating chili and visiting the Air Force Museum, but fun times for sure!

Hey Justin,

Based on this note , would you share it with your readers. I think based on experience being out of corporate work, perhaps people would find some good tips applicable to them.

I’m curious how much of that budget speech was linked to the ‘side hustle’ which we know it’s been getting some beating in the blog-sphere. To be honest, I agree with majority of that criticism.

I polled the attendees to see if they wanted to hear about side hustles and how that fits into early retirement finances or about developing an early retirement budget and the budget topic was more popular. I didn’t really address the income side of the equation (as you can fund your expenses from portfolio, rental income, other passive income, or side hustle income). I’ll drop a link to the presentation in the main article above (but here it is too!)

Site redesign threw me for a minute there! I had to double check that I was in the right place 😉

I need to get on those discounted Airbnb gift cards. We travel as a group often enough that Airbnb is usually our lodging of choice. Do you know how often they have those sales to get the extra 10% off?

I see the Raise sales maybe 1-2x per month with 5-10% off (on top of the normal 4-5% discount on airbnb). I also have an alert set at slickdeals for “airbnb” and they seem to have those about once every 1-2 months at 10% off usually through ebay.

I’ll echo what others have said, Justin; the new layout looks great.

Regarding the Visa gift cards you used, I assume you are paying (as do I) the fee that Visa charges upfront, which is usually about $6.95 per card. In my case I buy them at Krogers when they do 4x the gas points for purchasing them, which translates to about $14 in gas per each $100 gift card I buy, plus the 6% cashback on my Amex card for the Kroger purchase of the card and groceries. I hate paying fees for a gift card but it is worth it in the case of both the Visa and Mastercard versions since they can be used anywhere. A couple of caveats for your readers, though:

1. both Visa and MC will charge an inactivity fee after twelve months of non-use, so make sure they are used within a year, and

2. the upfront fee is the same regardless of the amount of the card (e.g. $25, $50, $100, …) so you are better off staying away from the lower value cards

Or an alternative would be the Amex gift cards which never have an inactivity fee.

That’s a smart move on the gift cards at kroger. I’m getting 5% back with the chase freedom this quarter at grocery stores, so I might have to top off my $1500 in this quarter’s spend in that way 🙂 And get the 4x gas points too (though with the ~10-15 gallons of gas I use each month, I won’t save much there).

And great point on the Visa GC’s experiencing an inactivity fee after 12 months of inactivity. I think a $1 purchase resets that clock, but definitely something to pay attention to.

I’ve been out on a two week road trip in Michigan’s upper peninsula and it’s been lots of fun and super low cost.

Our next trip is actually going to bring us close to you. We’re spending a few nights in Chapel Hill while my hubby presents at a conference. I’ll have lots of time to kill. Any recommendations of things to do there?

Exploring the University is fun – lots of 200 year old buildings around campus. Fun on the main college street – Franklin St. We used to live there but honestly, most folks went to Durham or Raleigh for fun stuff and shopping 🙂 Lots of free museums in Raleigh.

I got burned with gift cards from Raise.com and other gift card sites. Someone used them before I attempted and I never recovered the money because it passed 2 months or something like that. Just be aware

Good point. That’s happened to me once but it was within the 45 day guarantee at cardcash. I like Raise even more because they cover you for unauthorized use 1 year after purchase!

Your bagel is overloaded with lox. That’s too much. 🙂

Interesting about your blog income. Maybe people sign up for more credit cards when the weather improves? Our blog income always drop in the summer.

I like the upgrade too. It seems a little nicer. I need to work on my site too.

Nice job on volunteering. I’ve been coaching soccer this year and it’s fun.

We have a few trips this summer – Iceland, Boise, and California. A lot of driving, but should be fun.

Enjoy your last few weeks of school!

That’s Mrs. Root of Good’s bagel. Or should I say she stuck a little bit of bagel underneath her pile of smoked salmon 🙂

Hey big spender! Those are some nice numbers your sporting here!

As usual, your spending is incredibly low! Congrats on great month.

I’m always shocked by how little you guys spend on a regular basis — We spend about 3x more out in here the HCOL West coast. 😉

Raleigh is nice and cheap. 🙂

Nice on riding a bike again! Um, what did you get at a gas station on your bike??

Your food looks A M A Z I N G, BTW! Spring rolls & sushi – who is the awesome cook?

I knew someone would ask 🙂 I had to pick up a gallon of gas for our lawnmower. I figured it’s a half mile up there all on neighborhood streets with minimal traffic so why not go on bike and save $.15 in gas and get some exercise.

Me and Mrs. Root of Good both make sushi and spring rolls. The spring rolls especially are a good multi-person job because you can set out all the ingredients in bowls and assemble together. Hang out in the kitchen and make good stuff!

Looks like a fun month all round in the root of good household.

Impressed with your bikes, are you getting to use them? I do fancy a bike, but realistically go nowhere that is suitable to bike too.

I’ve ridden mine quite a bit to run errands and recreationally with the kids. We have a ton of stores, restaurants/cafes, the library, and our kid’s school within 0.5-1.5 miles and I can ride on sidewalks or relatively quiet neighborhood streets all the way. We also have a park with a 1/2 mile bike path around it inside our neighborhood.

How are you calculating your net worth? Does it include your house and cars? Or just cash and money in the market

The $2 million net worth includes about $1.8 million in the portfolio plus the house which is just under $200k. I don’t include the car but it’s only $6k or so.

I did a double-take the other day when I was on your blog on my phone! I was so used to the green! The new layout looks pretty cool though! I hear Google is ranking pages based on mobile speed, so hopefully that helps? Not that you guys aren’t ahead in the ranking by a lot anyway :)!

I like the layout on mobile so far but I’m not sure if the images are lining up correctly (or it might just be my phone 🙂 ).

So far I’m seeing a slight reduction in search traffic after the upgrade to HTTPS (which coincided with the theme upgrade). I’ve read that it’s temporary and once Google completes re-indexing after a couple weeks I should see a slight to moderate traffic bump.

I noticed that you typically have a very low “gift” line item. What do you give for gifts at birthday parties that your kids are invited to? We are starting to get a lot of invites to parties.

We usually buy several “generic” gifts during after Christmas sales. $10 toys that are normally $20, gift baskets/packs, etc. So far we haven’t been hit with a ton of b-day parties but I imagine it’ll happen soon!

Nicely done! That Bahamas vacation sounds amazing and that’s a really good idea to stock up on Airbnb credits while you can get a good deal on them.

How often do those Airbnb deals pop up? I feel like anyone who travels a lot can get some great use out of them!

I replied to someone else right as you posted this comment, so copy/pasting:

“I see the Raise sales maybe 1-2x per month with 5-10% off (on top of the normal 4-5% discount on airbnb). I also have an alert set at slickdeals for “airbnb” and they seem to have those about once every 1-2 months at 10% off usually through ebay.”

Hi Justin, great post! Random question–do you have a recommendation for a smoked salmon retailer? Kroger is really pricey, but I’m not sure where else to go for decent quality smoked salmon and love it! Thanks for continuing to inspire us all here:)

Kroger seems to be the highest priced for smoked salmon around here. Aldi and Lidl are pretty reasonable. I think it’s $3.50-$4 for a 3-4 ounce package (somewhere around $16/lb). I don’t do Costco because they are significantly more expensive for most things, but smoked salmon was an exception. At our local one, you could buy a 1 lb package of smoked salmon for $13-14 which is just a tiny bit cheaper per pound. I still don’t know if it’ll save you any money because that’s a LOT of smoked salmon to eat at one time before it goes bad (does it even go bad quickly? Our 3-4 ounce packages are always gone so fast!).

The bikes will be money well spent. My family bicycles as our main form of transportation most of the time (unless it’s really far). It saves gas and miles on our car, is great exercise and we enjoy the time together. How much better could it get?! Hope you guys have fun on your bikes!

Nice! In terms of trips taken, we probably walk more than we drive and the bike will replace some walking trips and extend our non-motorized transit range a bit too. I spend so little on the car and gas that I doubt I’ll see my expenses change much.

Nicely done as always. Our big summer plans is I head to Greece for three weeks with students. I get paid to go on a free trip to Greece. We will also head to NYC for a quick trip and then we plan on going to the Caribbean for a last hurrah before we start our family (at least I hope). Plus, I teach four classes over the summer and am trying to finish a book. Should be an entertaining summer.

Wow, sounds like a busy summer coming up! That Greece trip sounds awesome! Get paid to go to Greece – why not?!

The food pics, I love the food pics! Once again, if I’m ever in your neck of the woods, I’m inviting myself over for dinner! 😛

Looks like another great month! Love the CampFI pictures and so cool that J.D stopped by your place!

Come on down, y’all! 🙂

Do you qualify for food stamps & medicaid? When I was in grad school making $25-$30k we qualified for both, given our 5 kids. I’m curious to hear your thoughts on whether you’ve looked into this.

I should elaborate. Some states have an asset test for both programs. Others do not. With sizable assets, we qualified for both programs in one state but not another. I’m not sure the status of NC, but it begs the question why you don’t move. The dollar values we’re talking here are tremendous – easily on the order of $25k/year.

What prompted this whole thought process was your proud exploitation of the low income internet program. I don’t fault you for that since you’re abiding by the rules and tend to agree with your utilization of the program. The natural follow-on question is why you wouldn’t consider a free $25k/year handout (free food + free healthcare (zero premiums, zero deductible, zero anything)) from the government for moving your family across state lines. If the former is ethical but the ladder is unethical, I’m curious to hear why.

The lower cost internet program also offers much crappier speeds vs their regularly priced 200 mbps coverage 🙂 . I’m fine with the lower speeds since it’s still more than enough bandwidth to do everything we need. I’m also pretty sure the internet company is simply offering a discounted price and doesn’t get taxpayer subsidies for offering the lower priced service. It’s a form of price discrimination (using that in the strict economics textbook definition and not suggesting anything sinister with their motives other than profit maximization) – lower income households are unlikely to pay the $70/month for the regular priced plan but will pay a lower price ($15) for a lower service level.

I imagine almost everyone not streaming multiple 4k Netflix streams would be more than fine with our 30 mbps service, but they won’t offer the $15/month plan because it cannibalizes their $70/month plan sales.

Just my hypothesis without looking into it.

As for the ethics – I’ll leave that to the professorial types 😉 The internet company advertised the program. We qualified with zero need to modify anything with our finances. We switched over to the lower priced plan. Done deal.

I’d gladly accept a $25k/yr fire hose filled with free government money if they were aiming it at me and didn’t have any hoops to jump through to get it. Fortunately the system is wise enough to deny me those benefits!

I’ve helped others in need apply for food stamps (SNAP) so I’m somewhat familiar with the NC system. There is an asset test with extremely low limits (something like $2000 plus a car and maybe a house??). Needless to say we are well over that threshold! I seem to recall our income was high enough to basically reduce any food stamps we would get to $0 or close to it. And as I understand it, the application process and maintenance requirements are somewhat burdensome. In other words, it would waste a lot of my time for a small marginal benefit.

For medicaid, I don’t really know how it works other than NC falls under the old plan where adults basically can’t get it in general at our income/asset levels (no ACA medicaid expansion, in other words). But our kids are on it or some form of it (NC Health Choice maybe??). When I fill out the ACA info each fall, it tells me whether the kids qualify or not, and the state of NC eventually sends me a letter stating whether they qualify. Some years they didn’t, others they did (or some did, some didn’t).

I don’t really know why this is the result. In terms of value, the medicaid only saves us a couple hundred per kid vs the regular ACA insurance (basically 2 free dental exams per year at our regular family dentist) since the ACA plan is so generous and gold plated ($125 deductible). Hopefully the medicaid/NC health choice costs the taxpayer less than a huge ACA subsidy – but I’ll leave that to the policy wonks to work out, and gladly accept whatever plan they offer the kids (or no plan at all and we’ll figure things out!).

Would I move to get $25k/yr in free money? I don’t think we would get anywhere near $25k in additional benefits from moving, but maybe I’m missing something here. As is, we only spend $6-7k/yr on all food expenses (some of which are wine/beer and therefore not SNAP-eligible). That’s the max benefit for food stamps. Any additional medical coverage has a tiny benefit to us given the already available cheap and reasonably good medical coverage we enjoy.

Thanks for the thoughts. In a heavily subsidized obamacare world, you indeed are correct that the difference between free health insurance and almost free health insurance is pretty trivial. And you also are correct that groceries aren’t very expensive, so I think your answer is very logical.

Once you get to assets of a few million and income of zero, weird things happen with income-based need programs. Suddenly, your post-retirement income makes you look impoverished when assets are ignored, as in several states. It creates some weird distortions and incentives.

That’s certainly true about the low income, high assets. They could easily test for assets using a surrogate income-based measure like the EITC passive income test. Make more than $3000 in dividends, interest, pension, or IRA withdrawals? No public benefits for you! Seems like an easy enough test to apply to weed out all of us freeloaders.

Another program we qualified for but turned down was WIC. No asset test and the income limits were rather high for a family of 5. But horribly complicated rules on the free food you get and it’s just not worth that much. Combine that with a huge time investment to apply and attend mandatory classes on nutrition and it was a definite “NO” for us. Too much like work 🙂

WIC is the most inefficient, ridiculous program. Huge administrative overhead, a million hoops to jump through, a bloated number of employees, all so BigAg can have a tax write-off to give away unhealthy food.

Wise to avoid- it truly is work, for minimal return. But hey, it keeps otherwise unemployable people employed- I think it’s actually a jobs program haha.

After watching several of my less fortunate in-laws participate in WIC then drop out of it due to frustration, I couldn’t agree more. Kind of a dumpy program. I think the food they offer is sort of good health-wise versus straight up junk food, fast food, sugary cereal, snack bars, white bread, etc. I recall it was lots of “whole” ingredients like canned or dry beans, canned tuna, peanut butter, cheese (actually, our favorite whole milk mozzarella is just about the ONLY WIC eligible cheese at our local grocery store which is hilarious since it’s kinda top shelf stuff 🙂 ), milk, whole grain cereal (kix, whole grain cheerios I think), and I think some fresh fruits/vegetables (could be wrong on that one though). My in-laws got so much of this, more than they wanted to eat and they passed some on to us.

But I agree – it’s a make-work program to keep people busy and an agricultural aid program, more than a nutritional program. I feel sorry for the folks that actually need the nutritional assistance. In that regard, the SNAP program with the EBT is so much more efficient. But I guess the objection to the SNAP is that the recipient might buy junk food instead of specific nutritious foods required with the WIC vouchers.

The WIC program actually helped my budget and my own and my kids’ health when I was a young and pregnant mom of little ones over 20 years ago. I learned a great deal about health and nutrition from the seemingly ridiculous classes. Yes the workers might not be the friendliest, and process of it all is tedious, but WIC is worth it for many low income moms and young families. Go here to see all the benefits: https://www.fns.usda.gov/wic/about-wic-how-wic-helps

It is great to be educated about the programs available for lower income friends, family members, and others we know who are going through a rough patch. We can offer constructive help that can improve their quality of life.

That’s good to hear your perspective. I’m sure it’s providing a valuable benefit for a lot of people. It just seems to be very cumbersome. But when you need help, it’s better than nothing I suppose! I wouldn’t hesitate to refer someone in need to the program if they qualified.

Food stamps are a federal program run by the states. All states have the same income and asset limits. Medicaid is a state program with combined federal and state dollars and income/asset levels and eligibility varies from state to state.

My experience with food stamps is different from what you say. One state allowed it despite large assets. Another didn’t.

The amount of food stamps is standardized: https://www.cbpp.org/research/food-assistance/a-quick-guide-to-snap-eligibility-and-benefits

Asset tests vary by state: https://fns-prod.azureedge.net/sites/default/files/snap/BBCE.pdf

We got around $1k/month for my family size. Add to that free healthcare easily valued at $2k/month (no premiums, no copays, no costs at all even if you go to the ER for a scraped knee), the combined handout is $3k/month for the two programs.

My only observation is that, post FI, if one lives in a state with an asset test and moves to a state without an asset test, there is a substantial handout available, particularly when kids are involved.

Pretty sure the food stamps (SNAP) benefit is reduced by 30% of your income till the benefit amount hits zero. So for the typical early retiree with some income, they would end up losing a good bit of the SNAP benefit due to the income. Perhaps you received the full $1000/mo since your income was zero?

I received a phd stipend of 25-30k/year while in grad school. With 5 kids that put me under the poverty line. In this region, there was no phase out of benefits.

The second chart you provided is for the TANF program. If you are eligible for TANF, then you are categorically eligible for food stamps. I am referring to food stamps as a standalone program not linked to the TANF requirements.

But the food stamp benefit will still be calculated based on income, right? So you might get much less than the ~$1000 max for a family of 7.

Correct. Income will lower and or make you ineligible for benefits.

Do you have youtube video of your presentation. share link if possible

Unfortunately I don’t. The microphone died at the beginning of the presentation and they didn’t realize it. So I don’t think they ever produced the video.

Congrats on a successful April 2018! I had a such a great time at CampFI. Particularly enjoyed your talk and chatting with you one-on-one! And thanks for the compliment – I will show this to my mother-in-law! 🙂

All the best,

Karsten/ERN

You know you don’t have to prove anything to your mother in law, right? 😉

Take care, and enjoy your early retirement! Hopefully we’ll meet up again some day. Perhaps on a transatlantic cruise? 🙂

Nice site update, Justin! I like the clean layout and it looks like you’ve got a few more ads running so hopefully that helps the bottom line. We use Adthrive as our bulk provider on our site – you gotta have 100k visits/mo. to qualify for their platform, but if you have those views, we’ve found the RPM to be pretty good for generic placement (We’re in the home space where they are known for being good – typically around $20/1000 eyeballs – might be better in Finance).

Very inspirational April! It’s nice that the markets have been a little more stable. I personally think with the economy good but not rocket-to-the-moon good and the fact that inflation is largely in check, we’re going to get more growth in the equity markets before we get some major pain a few years out. It’s good to be a capitalist these last few years.

So remember I was planning to FIRE on June 1? I got all ready to do it, notified my boss, and he came back with a counteroffer of a very flexible work arrangement that the company would suit to my schedule. He said, “Hey – why don’t you try it.. if you hate it you can still leave anytime. But this might help us and you at the same time.” The way they’re structuring it makes me eligible for some benefits paid at end of year that I would otherwise miss out on by leaving in June (annual bonus, 401k profit sharing). It also lets me largely dictate my own work schedule so that I can meet some health, family, and travel goals. I’m pretty excited about it.

Thanks for the tip on Adthrive. I looked into it but I’m not quite at the 100k visitor mark. I’m working with a similar provider (Mediavine) that offers similar RPMs and it’ll probably be more relevant advertising (still waiting on approval to roll that out). It’ll be an upgrade from what I’m currently running with Google Adsense’s “smart” ads that are only spitting out a pitiful $2 RPM lol.

Congrats on that offer at work. The same thing happened to Mrs. Root of Good when she put in her notice. She dropped to almost a half time schedule with work from home 95% of the time (1-2 days/month to go into the office). Every Friday she had off, and it was a “just get the work done and don’t worry too much about clocking in 9 to 5” kind of arrangement with a wink, nod, and handshake. She stuck with it for six months to help with transitions at work, then finally put in her final (real!) notice the moment she saw her annual bonus post in the bank account in January 🙂 I think that arrangement is perfect if you can get it, and just work it till it no longer makes sense from a financial/lifestyle point of view.

Your trip to the Bahamas is going to be fun. We have our first ever “big” trip starting in July, 4 months in Australasia and Asia. I’ve been reading your travel posts to get some tips.

Hopefully it’ll be a blast. I know it will be relaxing but maybe we’ll be bored??

Enjoy your 4 month trip! I bet it’ll be a blast!

Great post 🙂 Although I’m kind of devastated now because I NEVER thought to look on Raise for AirBNB GC’s, and I freaking love AirBNB. We’re going to Ireland for a month later this summer, so 30 days or so of AirBNB stays I could have gotten a discount on :facepalm: good to know for next time though.

And Roblox… I get it. I mean, I don’t get it, because it’s so weird. But my kid is a Roblox junkie so…

A very helpful blog reader emailed me to tell me about 20% off airbnb gift cards back in December 2016 and we were literally in the middle of looking for 9 weeks (!!) of airbnbs for Europe. Total score! I bought $5800 worth of them and saved over $1000. I didn’t use all of them for Europe so the remainder paid for a part of our Bahamas rental this summer.

Hi Justin! Love all of the post keep it up! Do you sell any merchandise? I would love to buy a Root of Good Shirt or coffee cup.

Not yet, but that’s a great idea. I’ll have to look into it!