Here we are days away from the official start of fall. We are fully recovered from our eight week vacation in Vietnam, Cambodia, and Thailand. After we landed in Raleigh, we were immediately busy with back to school shopping for supplies and clothes and several rounds of school orientations now that each of our kids attend a different school. Throw a teenager’s birthday party/sleepover into the mix and it made for a very busy August.

Now that the kids are back in school, the adults of the Root of Good household get to take a breather. Our daily schedule shifts from the summertime routine of waking up, touring temples and palaces, and gorging on street food to the school year routine of waking up, walking one kid to school, then returning home to sip coffee for as long as we want.

Financially, last month was a mixed bag. Our net worth dropped by $34,000 to end the month at $2,078,000. Income was better than average at $3,968 while expenses remained modest at $1,995 for the month of August. Any month where income greatly exceeds expenses is a win as far as I’m concerned. Small fluctuations in the stock market don’t mean anything in terms of long term financial success for early retirement.

Let’s jump into the details from last month.

Income

Investment income totaled $482 in August, mostly interest from a bond fund and money market accounts. Our equity mutual funds and ETFs pay dividends quarterly at the end of March, June, September, and December with some payments arriving at the beginning of the next month. Here’s more on our dividend investments.

Blog income, shown as “other income” in the chart, totaled $2,558 for the month of August. The total blog income is bit higher than average since I deposited some checks that were being held for me at the post office while I was out of town all summer.

My early retirement lifestyle consulting income (“consulting”) totaled $320 for the month of August from 2.5 hours of consulting.

The “deposit income” totaled $625. $319 of the deposit income came from cash back and incentive bonuses from the Ebates.com and Mrrebates.com online shopping portals (some of which was earned from you readers signing up through these links).

If you sign up for Ebates through this link and make a qualifying $25 purchase through Ebates, you’ll get a $10 gift card.

The other $306 of “deposit” income came from a bank sign up bonus I completed almost a year ago. The initial offer was for $500 when you deposit $50,000. I completed the offer but only received $200 at the time (after arguing with the bank quite a bit). Fast forward 6 months later and they miraculously mailed a check for the remaining amount due plus interest. This sudden change of heart makes me think a banking regulator stepped in to make the bank honor their original offer terms.

If you’re interested in tracking your income and expenses like I do, then check out Personal Capital (it’s free!). All of our savings and spending accounts (including checking, money market, and five credit cards) are all linked and updated in real time through Personal Capital. We have accounts all over the place, and Personal Capital makes it really easy to check on everything at one time.

Personal Capital is also a solid tool for investment management. Keeping track of our entire investment portfolio takes two clicks. If you haven’t signed up for the free Personal Capital service, check it out today (review here).

Tracking spending was one of the critical steps I took that allowed me to retire at 33. And it’s now easier than ever with Personal Capital.

Expenses

Now let’s take a look at August expenses:

In total, we spent $1,995 during August which is about $1,300 less than our target spending of $3,333 per month (or $40,000 per year). Like many months, “travel” spending was the largest expense category, however groceries and clothing/shoes were major spend categories for August too.

Detailed breakdown of spending:

Travel – $713:

We spent the first 12 days of August in Thailand. Personal Capital says we spent $315 on the Thailand vacation expenses during August. Add to that the cash withdrawn from the ATM in July and our vacation expenses would go up by a few hundred dollars (but those ATM withdrawals are included in the July financial update where we spent $1,818 on travel during the month).

The Thailand vacation expenses include Grab fares (basically Asian Uber), restaurants, groceries, and admission tickets to the aquarium in Bangkok.

We had already paid for all of our lodging through Airbnb ($40 discount when you sign up through that affiliate link). Our flights back home were free using frequent flyer miles plus a small amount of taxes paid last year when we booked the tickets.

The other major travel expense was $398 for the deposit for two cruise cabins for next summer’s big vacation.

Groceries – $712:

The grocery spending was a little higher than an average month. Probably a lot higher considering we were only in town consuming groceries during 19 days of August!

We got back in town and had to restock our fridge and pantry. In one day we spent almost $300 doing that, including over $100 at the Asian grocery store.

Since we buy school supplies at Walmart along with some groceries, the school supplies got lumped into the “groceries” category as well. Although we didn’t have to spend very much on school supplies this year because we already had many supplies on hand (and Walmart is incredibly inexpensive).

Clothing/shoes – $207:

Back to school clothes and shoes mostly for the kids. I also picked up a few pair of shorts on end-of-summer clearance.

Gifts – $116:

Gifts for our daughter’s birthday. We also bought some Christmas gifts for $21.

Restaurants – $95:

Four of us plus my parents dined at the local Chinese restaurant for $56. The restaurant raised prices over the summer by a dollar per person. Inflation!

I bought a heavily discounted Domino’s Pizza gift card from Raise.com for $39. Here’s a referral link for Raise.com if you want to save an extra $5 on discounted gift cards for places you already shop (affiliate link – they may give me $5 if you sign up).

Utilities – $50:

The water bill was $50 for August which is what we pay for water, sewer, and trash even if we don’t use any of that during the month. I have investigated shutting off the water over the summer but it costs $50 to reconnect and we might be without water for several days if the utility doesn’t show up exactly when we return home.

In previous months I prepaid $600 on the electricity bill to hit the minimum spending requirement on a credit card. I also prepaid our natural gas bill for two months. As a result, August utility charges didn’t include electric or natural gas.

If you want to score some free travel from credit cards, there are several cards currently offering 50,000 points or more. These points can be redeemed for $500 cash or $500+ in free flights or hotel stays. Compare travel credit card deals.

Healthcare/Medical – $31:

Our 2019 healthcare premiums are $31 per month thanks to very generous Affordable Care Act subsidies that we receive due to our low ~$40,000 per year Adjusted Gross Income. The benefit of being “poor” on our tax return.

Cable/Satellite – $30:

$30 for two month’s internet service ($15/month). We qualify for a local reduced rate package due to having a lower income and having kids. 30 mbit/s download, 4 mbit/s upload.

Home Maintenance – $6:

I had to make a replacement key for one of the kids for $3 at Walmart. The other $3 in home maintenance expense was for a gallon of gas for our lawnmower.

Gas – $0:

We didn’t fill the minivan’s gas tank at all during August. Most likely we’ll need to fill up in September since we are almost down to a quarter of a tank right now. I walk and ride my bike for short errands so we don’t drive a ton each week when we are living in Raleigh. One of the benefits of living in the “big” city is proximity to everything.

Total Spending in 2019

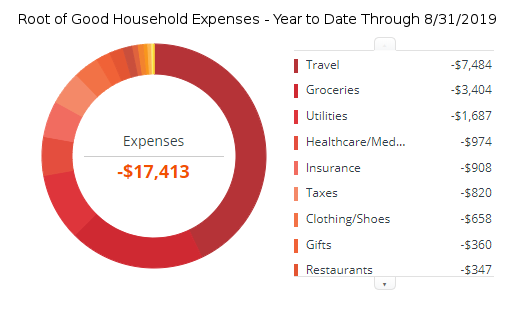

Through the end of August we have spent $17,413 which is approximately $9,000 under the $26,667 budgeted for the first eight months of our $40,000 annual early retirement budget.

Costs have been pretty modest so far this year. In the next few months we will plan our summer 2020 trip and start booking flights and lodging. I already have over $2,000 in Airbnb gift cards so the travel expenses might be next to nothing during 2019 in terms of cash-out-of-pocket.

Looking several years out, we are thinking about big upcoming expenses like:

- buying a new (used) car for our two teen drivers

- college for our oldest two kids (and how to mitigate costs)

I know we’ve only been spending $3,200 per year per kid but those kid costs will increase for several years before they decrease when we get the kids off of our payroll.

Monthly Expense Summary for 2019:

- January – $2,937

- February – $1,537

- March – $2,299

- April – $1,591

- May – $752

- June – $4,343

- July – $1,961

- August – $1,995

Summary of annual spending from all years of early retirement:

- 2014 – $34,352

- 2015 – $23,802

- 2016 – $38,991

- 2017 – $31,708

- 2018 – $29,058

- 2019 (so far) – $17,413

Net Worth: $2,078,000 (-$34,000)

By the middle of August our net worth had dropped by $85,000 before recovering most of those losses during the second half of August. Another bumpy month of stock market fluctuations.

I kept doing nothing to my investments in August (like most months).

However, in early September I sold $30,000 of our bond fund and stuck the proceeds in a money market account. Bonds were at a recent high valuation however yielded about the same as the money market account. With this trade, I reduced the interest rate risk of the fixed income component of our portfolio without giving up much current yield.

So far this gamble has worked out well with bonds dropping about 2% since I sold them. I will move the cash back into bonds if we see bond prices dip a bit more. The bonds are in an IRA so there aren’t any taxes due from the sale and the resulting capital gains.

Update on Life In General

Being back at home is great. While traveling is full of adventure and new experiences, the comfort of home is hard to beat.

I’m really looking forward to the cooler fall weather after a hot and sweaty summer spent in Southeast Asia and Raleigh. Cooler weather means more bike rides, hikes, and lounging in my new hammock.

That’s it for this month’s glimpse into the life and times of the Root of Good family. Stay tuned for some more trip reports from Cambodia and Thailand. Until next time, take care!

Are you glad fall is almost here? Any big year-end plans coming up soon?

Want to get the latest posts from Root of Good? Make sure to subscribe on Facebook, Twitter, or by email (in the box at the top of the page) or RSS feed reader.

Root of Good Recommends:

- Personal Capital* - It's the best FREE way to track your spending, income, and entire investment portfolio all in one place. Did I mention it's FREE?

- Interactive Brokers $1,000 bonus* - Get a $1,000 bonus when you transfer $100,000 to Interactive Brokers zero fee brokerage account. For transfers under $100,000 get 1% bonus on whatever you transfer

- $750+ bonus with a new business credit card from Chase* - We score $10,000 worth of free travel every year from credit card sign up bonuses. Get your free travel, too.

- Use a shopping portal like Ebates* and save more on everything you buy online. Get a $10 bonus* when you sign up now.

- Google Fi* - Use the link and save $20 on unlimited calls and texts for US cell service plus 200+ countries of free international coverage. Only $20 per month plus $10 per GB data.

Well done as always Justin! Back to school means the end of vacation for us at Two Teacher Trek. Our big end-of-the-year plan is to have a second child. (Due end of December) We will be delivering here in Saudi Arabia. It is already interesting to see the price difference in health care. (Similar quality but at a fraction of the cost)

That means no could vacations for us until we can get the little one a passport!

And the kid might change the vacation dynamics beyond just needing a passport! 😉

Most likely! We will end up traveling back “home” to Michigan every summer regardless. Also, we usually break it up with a stopover in Amsterdam (Since KLM flies directly into Detroit)

The good thing about living in the Middle East is that it is close to a lot of interesting places! Georgia and Oman are our favorites! (As long as you avoid the drones)

Good point about being in a nice spot to travel to local destinations! Enjoy!

Campfire season is almost over up north!

By mid-October, there’s at least a modest chance of measurable snow falling, and we won’t mind, because we’ll be hanging out near the equator in the aptly-named nation of Ecuador, a two-month trip and our first post-FIRE adventure.

I’ve learned a lot from your family travel posts, and I look forward to reading about future trips with your high schoolers.

We just booked our first repositioning cruise — LA to Shanghai in 30 days next fall. I’ve not spent more than about 5 consecutive days on a cruise ship before, so this could be interesting, but we are excited to see how it goes.

Cheers!

-PoF

Hi PoF,

30 days in cruise will be an unique experience for you and your family. I believe that this will involve the glaciers along the way.

Have a great trip.

WTK

Campfire season about over? Ahhhh the frozen arctic north 🙂 It’s still steamy here during the day and doesn’t get dark till almost 8 (when it’s still not that cool). It’s been a hot September so far.

Have fun with those travels! That cruise sounds amazing. We keep seeing those pop up but we usually can’t take advantage of them since they are during the school year. We’ll save that for when we’re “old” and the kids are out of the house!

Sounds like enough time to get norovirus twice on the same cruise! 😉 LOL!

Keep your hands perpetually embalmed in a thin layer of hand sanitizer and you’ll be okay 😉

Wow that home-made BBQ looks amazing! How long did it take you to make it?

Also love that you’re already planning your 2020 family vacation. Any plans to go to South America?

BBQ – takes maybe 20 minutes to cut it up and get it in the pan. Then roast on low temps for several hours. Usually 4-5+ hrs. Start in the morning and have it for lunch or dinner. Pork shoulder is ridiculously cheap here. $0.99/lb on sale. So we buy a bunch and roast it up!

2020 summer vacation – we’re planning on going to South America (probably Chile and Argentina plus Iguazu Falls). No clue what our schedule will look like but we’re hoping to fly back to the US to Miami in mid-August to go on our cruise, then come home.

I’d love to know more about the decision to buy a car for your teenagers. How do you decide how much to pay, do the girls get a say in the type of car, do the girls have to pay for part of the purchase / gas / insurance / repairs? We’ve got ten years before crossing that road so I’m doing my research 🙂

No clue so far 🙂 Further complicating the decision is whether we encourage the kids to get part time jobs, whether we permit it, or whether we prohibit it. Spending all summer abroad further complicates the part time job/earning an income picture because we aren’t here when they could work a lot.

So to summarize, I don’t know! 🙂

I’m thinking $5k-ish for buying a used car 7-10 yrs old. A small sedan probably. Sure, the girls get a say as long as they pick the most cost-effective vehicle 😉

Hi Justin,

Nothing beats better than having a rest at home.

Enjoy the upcoming cooling fall.

WTK

I’m content – no need to go anywhere any time soon! I thought about a weekend beach trip but that seems like too much work 🙂

What a fun summer and wow what an outstanding job on the expense front! I just tried applying for some more credit cards after unfreezing my credit reports and got 3 denials from chase, bank of america and capital one – all 3 for opening and closing too many accounts in the last couple of years. I’m taking that with pride and it still isn’t stopping us from getting free tickets to Hawaii this winter and a half paid van rental while we are there. Thanks for sharing and inspiring all of us!

They still haven’t caught on to me 🙂 I keep at it consistently as soon as I finish hitting the sign up bonus on 1 card. Then move on to the next! Haven’t tried BoA in 5-10 years though.

We took our family of five along with my parents to the local Chinese restaurant for $56.

That price is ridiculously low for 7 people. We spend that much for 2 adult and a kid. The west coast price is killing me.

What will you get for your teen drivers? A Volvo? 😉

Kaisorn pointed out that she didn’t go with us so it was actually six of us (they billed it as 5 adults and one kid). And it was weekday lunch which is $9/each (plus I had a $1 off coupon per person). Dinner prices are $12-13 each (plus tax and tip of course). But their sushi is shockingly good given the price and the main courses are good – lots of seafood like big shrimp, fried and baked fish of several kinds, ribs, octopus, mussels on the shell, etc.

My colleague here at work is about to have his daughter start driving. One thing he found out is that it is more expensive to insure girls vs. boys now, the opposite of what it used to be when I was growing up! The reason- girls are more likely to be texting and driving!

Oh no! My oldest 2 kids are girls! I’ve heard the premiums aren’t too bad with our insurer.

Another dirt-cheap month as usual! Nice job Justin! It always amazes me how little you guys spend. Out here on the West coast it feels like everything is about 2x what you pay.

Like that pork shoulder! I’ve never seen something like that go for less than $1.99/lb. Pretty amazing to see your reports every month!

Oh wow – I think pork shoulder is usually priced below that for full price around here. Kind of a low grade cut of meat (due to lots of bone and the thick fat layer – lots of waste byproduct).

I have read that people have difficulty using theirAir BnB gift cards to make the second half of their payment . Are you aware of this? Have you ever had any trouble?

Yes – that is an issue. I just pay in full with gift cards at time of booking.

I was just wondering how do you manage if you’re called for jury duty etc. while you are out?

Being out for that long, won’t that result in a non-response to them?

I doubt the sheriff will come to arrest me for not showing up for jury duty.

But if so, I’ll tell the judge “I’m sorry I wasn’t in the country for several months. I was temporarily living in Asia/Mexico/South America/etc and here are copies of the flights to/from that far off region of the world”. Should keep me out of the slammer!

Wow, that’s some pretty reasonable spending – looks similar to mine, but I’m single (eep!). I’m really interesting in how my spending will change when I’m retired myself…

Well we get a lot of economies of scale since there are five of us. 🙂

Great post!! Jealous of your lifestyle. Does your net worth of $2,078,000 include your house equity? Curious if you feel house equity should be included in net worth calculations.

Yes, the NW includes our house.

I include the house in our NW but that’s just the net worth. If you’re asking “does the house get included in the portfolio value you use for the 4% rule?” then the answer is no. Your house reduces expenses (assuming no mortgage) but doesn’t generate income to live on during retirement.

What I find most unfair about FIRE community blogs is that they make so much money from blogging that it’s definitely not FIRE. It’s active income and that makes me think I cannot follow that route and have to keep working because you’re making your money from your work that is blogging

We have almost $2 million in investments and could easily pull $70,000/yr out of there forever yet we spend only $30-40k/yr.

Math checks out – we definitely don’t need any of this blog income to prosper in early retirement!

True however it helps you psychologically. You don’t even spend what you earn and that must give you a giganteus piece of mind that I wouldn’t have to confidently pull the trigger…but I get it. Thanks

Not a money related question, but how do you wrap your meat to freeze it? I recently cooked some extra pork also but it didn’t taste very good after I thawed it. I just threw it in a ziplock bag.

FoodSaver vacuum sealer. Costco has the best price.

Thank you!

Drop all $2m in $NLY and earn 10%. I wish I had $2mil to drop in ther. I’m only at $25k. Not enough to live on hutnita better than 2% bonds.

I won’t be attending FinCon