Welcome back to another monthly update from Root of Good! We just got back to Raleigh after a two week cruise to Alaska during the last half of September. Alaska really exceeded expectations with its natural beauty and landscapes.

After a busy summer, we have an equally busy fall travel season as well. We have a couple more days in Raleigh and then we head to the Caribbean for another roughly two week cruise. Weather permitting, of course.

Right now I’m playing the travel agent trying to keep up with rebooking flights, hotels, and possibly cruises as we get hurricane-related cancellations and notifications this week. This is our first real cruise travel hiccup related to a hurricane. I think we’ll end up doing okay without missing out on much of our travel.

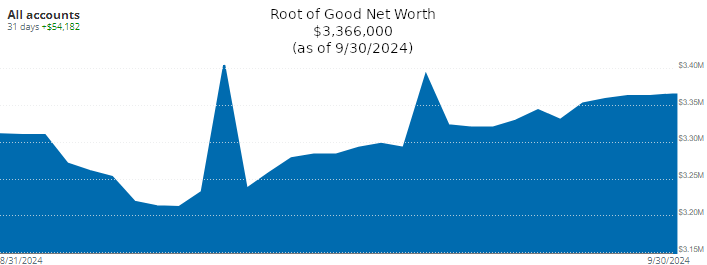

On to our financial progress. September was another great month for our finances. Our net worth shot up by $54,000 to end the month at $3,366,000. Our income of $10,109 was substantially more than our spending of $1,768 for the month of September.

Let’s jump into the details from last month.

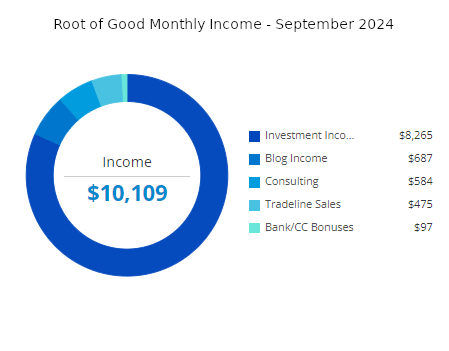

Income

Investment income totaled $8,265 in September. Our equity index funds and ETFs pay dividends quarterly at the end of March, June, September, and December. As a result, we had a larger than normal amount of investment income last month. Here’s more on our dividend investments.

Blog income totaled $687 for the month. This represents a below average month of blog income.

My early retirement lifestyle consulting income (“consulting”) was $584 last month. This represents three hours of consulting work. I’m trying to squeeze in consulting sessions while I’m at home in Raleigh in between cruises.

Tradeline sales income totaled $475 in September. Another good month but not quite as high as August. I ramped up my tradeline sales a few years ago and discussed it in a bit more detail in my October 2020 monthly post and in my July 2021 monthly post. Most years I make around $4,000 to $6,000 in exchange for lending out my stellar credit history from half a dozen credit cards.

For last month, my “deposit income” was $0. During most months I get $10 or $20 from cash back and incentive bonuses from the Rakuten.com and Mrrebates.com online shopping portals (some of which was earned from you readers signing up through these links).

If you sign up for Rakuten through this link and make a qualifying $25 purchase through Rakuten, you’ll get a $10 sign up bonus (or more!).

My bank and credit card bonuses totaled $97 last month. These funds have been sitting in my Citibank credit card cash back account for quite a while and I finally cashed them out.

If you’re interested in tracking your income and expenses like I do, then check out Empower Personal Dashboard, formerly known as Personal Capital (it’s free!). All of our savings and spending accounts (including checking, money market, and more than half a dozen credit cards) are all linked and updated in real time through Empower Personal Dashboard. We have accounts all over the place, and Empower Personal Dashboard makes it really easy to check on everything at one time.

Empower Personal Dashboard is also a solid tool for investment management. Keeping track of our entire investment portfolio takes two clicks. If you haven’t signed up for the free Empower Personal Dashboard service, check it out today (review here).

Tracking spending was one of the critical steps I took that allowed me to retire at 33. And it’s now easier than ever with Empower Personal Dashboard.

Expenses

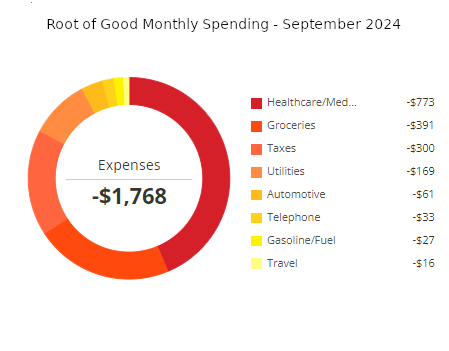

Now let’s take a look at September expenses:

In total, we spent $1,768 during the month of September which is about $1,500 less than our regularly budgeted $3,333 per month (or $40,000 per year). Healthcare and groceries were the two largest categories from last month.

Detailed breakdown of spending:

Healthcare/Medical/Dental – $773:

Our current 2024 health insurance is free, thanks to very generous Affordable Care Act subsidies that we receive due to our low ~$48,000 per year Adjusted Gross Income.

Our 2024 dental insurance plan costs $37 in premiums per month. We picked a plan from Truassure through the healthcare.gov exchange. The dental insurance does a good job of covering routine cleanings, exams, and x-rays plus most of the cost of basic procedures like fillings.

The remainder of our healthcare/dental spending was a $736 expense for a dental procedure last month. We expect to have some more dental expenses coming up soon.

Groceries – $391:

We were only home 13 days during September so our grocery spending was relatively modest. We did come back home and restock our fridge, freezer, and pantry in very early October so perhaps our spending in October will be a little higher as a result.

When we are gone on cruises we don’t spend anything on groceries. So we’re “saving” money when we are traveling for cheap or free on cruises. That’s what I tell myself.

Taxes – $300

Our quarterly estimated state income tax came due during September. $300 went to the State of North Carolina.

Utilities – $169:

We spent $169 on our water/sewer/trash bill last month. I paid our natural gas bill twice in August so we spent $0 on natural gas during September. I paid our electric bill at the beginning of October once we were home, so we spent $0 on electricity during the month of September.

Automotive – $61:

A $61 oil change for our minivan. Our Toyota Sienna is 15 years old at this point. The auto shop recommended $7,700 (!!) in suggested repairs for the car but none of them are very important any time soon. Eventually I’ll have to replace 2 or 4 tires in the next few months or years and the brakes will need replacing at some point.

I was blown away at their ability to find all these suggestions and at their audacity to recommend them for a 15 year old vehicle not even worth $7,700 any longer. In other news, I might be shopping for a new auto shop that is more in tune with my desire to keep this car humming along for several more years without spending almost five figures to do so. Sorry, sales manager!

Telephone – $33:

We use Redpocket Mobile’s annual plan that costs $33 for the annual renewal. After paying for renewals on 2 lines in August, a third line’s renewal came due in September. These are very light on data at only 200 MB per month but we can add extra MB’s of data for a small fee on an as-needed basis. So far these are working well for basic communication around town.

Gas – $27:

My daughter refueled our Hyundai for $27 before picking us up from the airport. Concierge service at its finest!

Travel – $16:

We spent $6 on the convenience fee to pay our $300 quarterly estimated tax bill using a credit card. I get a lot of points and miles from credit card spending so I treat fees like this $6 as a “travel” expense since it earns us so much “free” travel.

The other $10 in travel spending was for 2 pairs of local transit tickets in Vancouver, Canada to get from our airport hotel to the downtown cruise port, then return from the cruise port to the airport two weeks later. Their transit prices were very reasonable given the lengthy ride we took on the train.

That’s all the spending we did on the cruise. Everything was prepaid many months ago. I used points for the hotel and flights other than about $110 in total for the flight taxes. The two week Alaska cruise aboard the Holland America Noordam was about $1,000 out of pocket for us with a “free” casino promo rate, including gratuities. I managed to pay the $1,000 taxes, fees, and gratuities using my Chase Ultimate Rewards points through my Chase Sapphire Reserve card.

A roughly $10,000 vacation ended up costing us only $120 in cash. That’s amazing!

While en-route to and from the cruise, we managed to dine in several airport lounges along the way so we didn’t need to buy any food or drinks on our trip. The Capital One Lounge in Denver even had to-go bags specifically designed to allow lounge guests to pack a snack for later. Very convenient and frugal!

Get free travel like us

If you are interested in getting free travel from your credit card like I do, consider the Chase Ink Unlimited business cards (my referral link). Right now, the Chase Ink Unlimited business card offers an above average $900 worth of Chase Ultimate Rewards points that can be redeemed instantly for $900 in cash (or even more for travel!). I just signed up for another new Ink card to snag one of these great bonus offers.

Chase is pretty liberal when it comes to “what is a business”. If you sell stuff on eBay or Craigslist or do some odd jobs occasionally then you have a business and could get a credit card as a “sole proprietor”.

I use the 90,000 Chase Ultimate Rewards points by transferring them to my Chase Sapphire Reserve card (also offering a 60,000 point sign up bonus right now). With the Sapphire Reserve card, I can get 1.5x the points value by booking cruises, flights, hotels, or rental cars through their travel portal. For example, I used 165,000 Chase Ultimate Reward points to pay for the $2,475 in taxes, fees, and gratuities on two of my cruises. Or I can transfer those Ultimate rewards points to over a dozen travel partners’ airline/hotel programs like United, Southwest, or Hyatt.

Capital One VentureX card

Another favorite travel card in my wallet is the Capital One Venture X card. The Venture X card is a “keeper” for me. First off, it comes with a $750 sign up bonus after spending $4,000 in the first three months. The bonus is paid in the form of 75,000 bonus points that you can redeem against any travel purchases from anywhere. Then you earn a solid 2 points per dollar spent forever! The other big perk is airport lounge access. You can get yourself plus unlimited guests into Priority Pass lounges. And you and two of your guests can get into Plaza Premium network lounges and Capital One Lounges.

The Capital One Venture X card does have one catch – a $395 annual fee. But they reward you every year with an easy to use $300 travel discount plus $100 worth of points. Together, that makes $400 they give you annually which completely offsets the annual fee. Another benefit worth mentioning: you can add up to four authorized users for free, and they also get all the benefits of the Venture X card including the valuable airport lounge access. We used this perk to “gift” a pair of Venture X cards with airport lounge access to my brother in law and his wife to use on their family trip back home to Cambodia last April with their two young children.

Since the annual fee is offset in full by travel credits each year, I personally plan on keeping the Venture X card forever since the card benefits are so great.

Cable/Satellite/Internet – $0:

We usually pay $25 per month for a local reduced rate package due to having a lower income and having kids. 50 mbit/s download, 10 mbit/s upload. I didn’t pay the September bill until early October so there will be 2 months’ worth of charges of internet on my next monthly update.

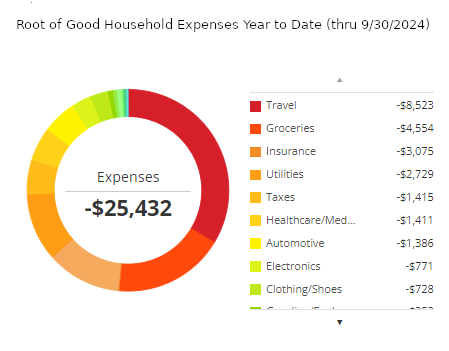

Spending for 2024 – Year to Date

We spent $25,432 for the first nine months of 2024. This annual spending is about $4,500 less than the budgeted $30,000 for nine months per our $40,000 annual early retirement budget. I haven’t increased our annual budget for inflation in a decade, so at some point I need to revisit the budget numbers. So far, so good! No need to give ourselves a raise if we’re managing just fine within the current budget.

We’re running under budget for the year so far. However we have some upcoming dental expenses that could increase our expenses up to or beyond our annual spending target. The good news is that our HSA has grown over the years to a present value just over $100,000. So if we need to, we can cover a large dental or medical bill out of the HSA account without paying any taxes on the withdrawal.

The rest of 2024 will see relatively modest baseline spending other than the annual property tax bill that went up significantly this year. Perhaps we’ll start booking some more travel for the spring and summer before year end as well.

Monthly Expense Summary for 2024:

- January – $1,828

- February – $1,746

- March – $3,525

- April – $1,719

- May – $1,875

- June – $5,889

- July – $3,735

- August – $3,348

- September – $1,768

Summary of annual spending from more than a decade of my early retirement:

- 2014 – $34,352

- 2015 – $23,802

- 2016 – $38,991

- 2017 – $31,708

- 2018 – $29,058

- 2019 – $25,630

- 2020 – $28,466

- 2021 – $31,740

- 2022 – $29,449

- 2023 – $37,865

- 2024 – $25,432 (through 9/30/2024)

Net Worth: $3,366,000 (+$54,000)

Our net worth shot up by $54,000 to end the month at $3,366,000. This marks a new all time high net worth for us. I’m always expecting a big drop after a huge runup like this, but so far we’ve been lucky. Who knows how high it’ll go?

We’ve been on the road a lot so I don’t really pay attention to the portfolio day to day. Fortunately index funds do really well on their own if you just let them sit there for a decade or two. The fact that you can totally ignore your investments and travel around the world and still make money long term is incredible.

For the curious, our net worth reported above includes our home value (which is fully paid off). I value the house at $300,000, which is probably what we would net after sales expenses. However, please note that I don’t consider my home value as part of my portfolio for “4% rule” calculation purposes. I realize folks ask me about that every month so I just wanted to state that here for clarity.

Closing thoughts

First off, thanks to all of you who realized I am located in North Carolina and reached out to check on me after seeing that a big nasty hurricane rolled through our state. We’re all fine here in Raleigh since we are a couple hundred miles east of where all the major damage occurred.

Almost two weeks later and it’s still pretty ugly in the mountainous western portion of our state, but fortunately the central and eastern parts of our state were mostly unaffected. However, in the western part of the state, crews will be working for months to get all the water, sewer, electricity, telecoms, roads, and bridges rebuilt. To illustrate just how bad it is, the major freeway between North Carolina and Tennessee, Interstate 40, won’t reopen for a full year!

Natural disasters help put your struggles in perspective.

This week we have been scrambling to rearrange our travel around Hurricane Milton. The hurricane is on the verge of blowing across the state of Florida as this post goes live and all reports indicate the damage will be severe.

At some point I realized that I was more concerned about finding a flight to Florida to get on my cruise while millions of people in the direct path of the storm are way more worried about the loss of their homes, businesses, and even their lives.

So I took a step back and said “well, it would be nice to go on this cruise we were looking forward to but the losses we are facing from this storm are nothing compared to what the residents of Florida are facing”.

And that’s where we are. Hoping we still get to travel to Florida later this week to get on a cruise. But well aware that if we don’t make it, then we’ll still be way more fortunate than a lot of others that are facing much greater losses.

That’s it for me this month. See you in November!

Who’s ready for some cooler weather heading into fall? I can’t believe Halloween is almost here!

Want to get the latest posts from Root of Good? Make sure to subscribe on Facebook, Twitter, or by email (in the box at the top of the page) or RSS feed reader.

Root of Good Recommends:

- Personal Capital* - It's the best FREE way to track your spending, income, and entire investment portfolio all in one place. Did I mention it's FREE?

- Interactive Brokers $1,000 bonus* - Get a $1,000 bonus when you transfer $100,000 to Interactive Brokers zero fee brokerage account. For transfers under $100,000 get 1% bonus on whatever you transfer

- $750+ bonus with a new business credit card from Chase* - We score $10,000 worth of free travel every year from credit card sign up bonuses. Get your free travel, too.

- Use a shopping portal like Ebates* and save more on everything you buy online. Get a $10 bonus* when you sign up now.

- Google Fi* - Use the link and save $20 on unlimited calls and texts for US cell service plus 200+ countries of free international coverage. Only $20 per month plus $10 per GB data.

Great pictures of the cruise, Justin. Really enjoyed the pics of Alaska. Maybe I can convince the wife to take one of our cruises there, but we probably will stick to the warmth of the Caribbean all the time. And that sushi bar looked very good one the ship as well!

We tend not to cruise during the JASON months, with November being the only month we might chance, specifically for the hurricane issues you cited. We do have back to back cruises in mid Nov but they are out of New Orleans this time instead of our usual Port Canaveral location, and so far they have been spared the effects of Milton after dodging Helene. Glad to hear Raleigh suffered no ill effects from the hurricane and you should be okay this week as well. We dodged anything except some wind here in the far western side of East TN, but the folks near the TN-NC border are enduring a nightmare. Most have seen the pictures of tourist spots like Chimney Rock or the city of Asheville; our hearts go out to them. And for those who don’t travel in this part of the country, I-40 is one of the busiest interstates for E-W traffic. To be shut down that long is going to be incredible.

Safe travels and happy cruising!

Beautiful photos from Alaska. We took a family vacation there several years ago and we all really enjoyed it. I am surprised you did not see any bears in Kodiak .

Sun in Sitka and Kodiak! Looks like you had great weather, which can be make or break for these cruises. You also were some of the few to take the longer route to Kodiak and Anchorage via boat. There are lots of things worth seeing beyond the usual weeklong inside passage route.

We were in Anchorage for 10 years before relocating to NC and we still miss it. The Iditarod sign you saw in Seward was marking where the 1910 sled dog rescue mission started to get the diphtheria serum to Nome. That inspired the Iditarod race, which started in the 70’s and has a ceremonial start through Anchorage and officially starts an hour north in Willow.

Hi Justin,

How much did the two week Alaska cruise cost per person?

WTK

Now I guess the big question is now – if the “free cruise” gravy train dries up, will you guys start spending your own money on more cruises? 🙂