In contrast to early retirement modeling that looks for all the worst cases and failure modes, our actual life the past almost four years illustrates that good things can offset the bad events in life.

Financial planning for early retirement is pretty straightforward. Figure out how much you plan on spending in early retirement then save up till you have between 25 and 33 times your annual expenses in your investment portfolio. We initially planned on spending $32,000 per year plus a large lump sum for the three kids’ college tuition. Using the 33x multiplier (which represents a 3% withdrawal rate), that means we needed $1,056,000 plus another $100,000 to cover tuition, or roughly $1,150,000 in total investments. That’s about what we started with four years ago but now we have a lot more.

The Good:

We plan for the worst and hope for the best. Fortunately, the past four year have been very positive. Maybe we used our luck making machine. Or maybe we aren’t as lucky as we think. We’re earning more than we thought and spending about what we expected, and future expenses don’t look too bad.

More Work, More Money

When I quit working in 2013, we expected Mrs. Root of Good to join me in early retirement within six months. Then her employer decided to be really really nice to her so she kept working longer than expected. Her employer met her requests to take a paid five week summer sabbatical in 2014, and again agreed to a paid sabbatical of twelve weeks in 2015. The sabbaticals were on top of a 40 hour work week with negligible overtime, four weeks paid vacation, two weeks of holidays, and unlimited sick leave. After returning from the second sabbatical in 2015, Mrs. Root of Good submitted her resignation and tried to retire.

Unsuccessfully as it turned out. Her employer offered a flexible work from home arrangement where she officially works from home for four 10 hour days per week. The boss gave her a **wink wink, nod nod** and said she just needed to work enough each week to make sure nothing fell through the cracks as they worked toward replacing her. She generally worked Monday-Wednesday for six to eight hours per day and some Thursdays, probably averaging 30 hours per week. While still collecting full time pay! This part-time-for-full-time lasted about six months before Mrs. Root of Good finally called it quits and promoted herself from part time work to full time retirement.

Mrs. Root of Good’s extra two years of work netted us around $120,000 after taxes and work-related costs in my estimate (she was earning $70,000 gross per year and we paid nearly zero federal income tax but we stilled owed payroll tax plus state income tax). Toss that $120,000 on the pile and watch it grow!

Who knew you could make money blogging?

I always wanted to do something “internet-y” and finance related while working but never found myself in a professional role that fit that desire. About two weeks after retiring, I started looking into this whole blogging thing. Mr. Money Mustache had a pretty sweet site so I figured maybe it would be fun to do something similar. I spent the weekend reading and googling and youtubing all about how to start a blog. How great is it to be able to jump into a new exciting project head first when you don’t have to deal with work all day?!

Two days after I started the intense blog research I figured out enough to register the Rootofgood.com domain name, set up my hosting service, and then I sat staring at that blinking cursor waiting for me to start typing. The first couple of words I typed were “HELLO WORLD” (of course). My little homage to all things programming/internet-y. Then I deleted it and got down to business (first ever real blog post and ALL THE BLOG POSTS EVER).

Almost four years and three million pageviews later, this blog is a little dynamo. Root of Good currently receives an average of 50,000 to 60,000 visits per month. In late 2015 I started offering Early Retirement Lifestyle Consulting. Since conception, the net profit from the blog and related activities was:

- 2013 – near zero

- 2014 – $12,000

- 2015 – $29,000

- 2016 – $31,000

- 2017 – roughly the same as 2016

Toss another $72,000 on the pile plus whatever we earn this year.

Though not all early retirees start a blog, many early retirees have a side hustle. Some early retirees turn a hobby into something profitable. Others retire from full time work while keeping the door open to very part time, flexible work arrangements by only accepting those projects or clients that fit into their early retired lifestyles. I did both when I started a blog for fun that turned profitable within the first year and I started consulting an hour or two per week (less when the weather is nice outside).

When planning for early retirement many years ago, I occasionally used a “part time income in retirement” line item for forecasting purposes. At the time I used a tiny annual income for this part time work. In one model, I assumed I might earn $6,000 per year doing something one day per week for $15 per hour. This was based on a little side hustle related to engineering data collection that I had some success with during college. But more generally, $15 per hour represents a pretty broad swath of potential jobs and hustles, and eight hours per week isn’t a huge impediment to otherwise enjoying one’s leisure time throughout the week. I could mow lawns, start a handyman business, repair appliances, run errands for the elderly and disabled, or drive for Uber (which wasn’t a thing when I was completing my early retirement models and forecasts).

The very part time work for $15/hr was more of a Plan B “what if” scenario. Adding $6,000 income per year to supplement withdrawals from an investment portfolio means you can get by on a smaller portfolio using the four percent rule.

As fate would have it, I’m blowing that $15/hr threshold out of the water (ER Lifestyle Consulting rates are currently $125/hr and I’m considering raising those given the demand). Total earnings from my side hustles are running in the $30,000 per year range right now. And I don’t think I’m putting in eight hours of effort per week. Life is good as is the financial solvency of my early retirement plans.

Spending is in line with budgeted amounts

We started out budgeting $32,000 per year for 2014 and increased it to $32,400 in 2015 to account for inflation. In 2016 we bumped the budget to $40,000 in light of all the extra side hustle income and better than expected investment results.

Actual spending since 2014 remained pretty close to our annual budget:

- 2014 – $34,352 (vs $32,000 budget)

- 2015 – $23,802 (vs $32,400 budget)

- 2016 – $38,979 (vs $40,000 budget)

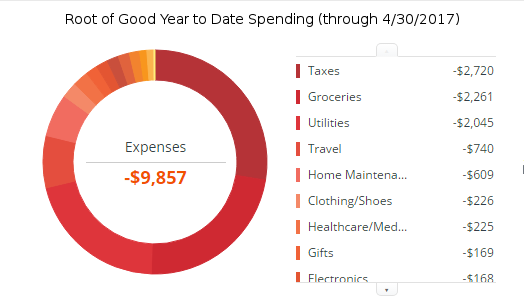

- 2017 year to date through April – $9,857 (vs $13,333 budgeted)

We were over budget in 2014 by a few thousand dollars but under budget all other years so far. That underspending comes in the face of an almost $9,000 major renovation in 2014, an $8,000 minivan purchase in 2016, and paying for the bulk of a $10,000 nine week trip to Europe in 2016 and 2017 (along with several other multi-week or multi-month trips in previous years). In other words, we have a rather robust spending plan to fund a whole lotta living and the budget seems to be working out perfectly fine.

And this is with three kids! They are now age 5, 10, and 12 years old. I’ll admit that we’re still a year away from the oldest starting the typically more spendy teen years, but so far we haven’t noticed a significant spike in spending as the kids get older.

Since we’ve already replaced the exterior siding and the windows, and we’re in the middle of replacing the roof right now, we don’t have a lot of major home improvement projects planned for the near future, so spending on the home should remain modest. We just replaced the car last year, so that should last us quite a while too. Those big house-related capital replacement costs are amortized and included in our annual budget.

Another area that can bust a budget is healthcare and dental expenses. We’ve been fortunate to spend very little in this category other than a few doctor’s visits and routine dental checkups (plus a few minor procedures at the doc and dentist). We haven’t used up our whole healthcare/dental budget in any year of retirement.

We track all our monthly spending in Personal Capital. It’s a free, easy to use, and automatically pulls transaction data from credit cards and bank accounts so you don’t have to spend any time inputting transactions manually (or maintain another spreadsheet!). Review of Personal Capital. It’s also a great tool to consolidate and track your brokerage accounts, IRA’s, and 401k’s so you can track your asset allocation and keep an eye on mutual fund expenses automatically. Tracking spending is in my opinion the best way to stay cognizant of where your hard earned money goes and what expense categories are dominating your budget.

College won’t cost as much as we initially budgeted

By most objective metrics, we are wealthy. I assumed we wouldn’t qualify for any need-based financial aid for the kids’ college. I was wrong. I found out the FAFSA financial aid form doesn’t include the home value nor does it include retirement account values in determining financial aid. As a result we look relatively poor on paper due to having over 75% of our financial assets in retirement accounts and a modest adjusted gross income around $40,000 per year.

Upon entering early retirement in 2013, I expected to pay around $100,000 in total just for tuition for 3 kids and almost triple that amount if we cover room and board, books, transportation, and other living expenses.

After crunching some numbers on college costs using a few different assumptions, it looks like the worst case scenario will have us paying around $162,000 total while the best case scenario (which isn’t that far-fetched) has us paying just $31,500. Those are totals for all three kids. The updated forecasts come from better assumptions about scholarships and grants our children might qualify for given their academic achievements to date, along with a better understanding of how financial aid formulas work. When I first retired, our oldest two kids were in second and third grade, and we really didn’t know how well they would do in school once the academics grew more challenging. Several years later and they are doing great!

Great stock market returns

Since I retired early, the stock market has been on fire! As measured by the Vanguard Total Stock Market Index Fund (VTSMX), returns including reinvestment of dividends are:

- 2013 – 33.4%

- 2014 – 12.4%

- 2015 – 0.3%

- 2016 – 12.5%

- 2017 (year to date through May 12) – 7.0%

International investments haven’t performed quite as well over the same period. Our portfolio still managed to swell from around $1.1 million right after I retired up to $1.65 million today. That’s a $550,000 increase in value. About $100,000 of that increase can be attributed to Mrs. Root of Good’s extra two years of paychecks and my blog earnings (after subtracting the roughly $100,000 spent on living expenses during early retirement). That still leaves us with roughly $450,000 of investment gains in the past four years. Thanks Mr. Stock Market!

The returns have been so great that since the start of 2017 I have moved $90,000 from equities into the Vanguard Total Bond Market Index Fund (VBTLX). Those bonds plus the $30,000 we have sitting in money market accounts will provide a multi-year safety blanket should the market decide that the party is over. A six figure low-risk fixed income portfolio will help me sleep at night regardless of market volatility.

Successful travel hacking continues

I’ve been scoring huge credit card sign up bonuses and collecting points and miles from credit cards for over a decade. Upon entering retirement in 2013, I fretted over the eventual end of all these easy bonuses that translate to free trips all over the world, even for our family of five.

It turns out I had nothing to worry about after earning 1,265,000 points and miles from sign up bonus offers in the almost four years of early retirement. This gravy train keeps rolling down the tracks and shows no signs of stopping! Some of the rules of the game have changed (Chase’s 5/24 rule is a key example) but there are still plenty of fish in the sea. So cast your net wide and don’t let all these delicious morsels slip past you. Our credit scores remain a killer 800-something (out of 850 points) and card issuers generally don’t bat an eye at extending us even more credit.

All these free points and miles explain how we’re able to travel the world for weeks or months each year on a modest $5,000 to $10,000 annual budget. Without free points and miles we would be incurring an extra $5,000-$10,000 expense per trip based on the past few trips.

No more work = no more work related costs

I’m sure we save a small amount on lunches out and simpler wardrobes (shorts and polos just don’t cost that much, guys). But the biggest work-related cost that disappeared was our second car. We questioned whether we could cut back to one car and it turns out it’s not a problem at all with our current lifestyle. It’s been almost a year since we dropped to one car and there have been just a few times where it would have been nice to have a second car. But we made it work with just one car.

We walk, we can take transit, Uber is always a few clicks away (though we’ve never used it so far). Postponing or combining trips and smartly scheduling appointments help. We also enjoy spending time at home or within walking distance in the neighborhood, so there are multi-day stretches were our car doesn’t leave the driveway (but our feet still do!).

The money savings are unquestionable – maintaining one car costs half of what it does to maintain two cars. One set of tires, one set of oil changes, one set of routine maintenance, one set of inspections, registration/licensing, insurance, and taxes. The time savings are even more important – fewer trips to the auto shop for repairs and maintenance. It takes less time to check the tire pressure and fluid levels in one car versus two cars.

For us, simplifying saves time and money without being a detriment to our lifestyle. Of course others’ experiences might differ. We only drive about 300 miles per month (unless we’re on the road completing a multi-thousand mile road trip). Many destinations are walking distance in the neighborhood. Our kids aren’t overloaded with after school and weekend activities (though we stay busy!).

The Bad:

I feel like we need a counterpoint to “The Good” so I’m sticking “The Bad” in here.

Health Insurance in a Post-ACA World

The future of health insurance is our biggest unknown going forward. There’s a new sheriff in town and he’s adamant that the Affordable Care Act is horrible and must be repealed and replaced. The replacement bill, the AHCA, recently passed the House and now sits with the Senate for further sausage-making. What will we end up with? Your guess is as good as mine. The following is an excerpt from my April 2017 Financial Update article where I opine about the current health insurance situation in the US:

“Let’s look at the details of the AHCA as passed by the House. Here’s the best summary I’ve seen of the current version of the AHCA compared to the ACA (courtesy of the non-partisan Kaiser Family Foundation).

Main takeaways:

- ACA premium subsidies continue through 2017, 2018, and 2019 (so it’s not an immediate “repeal”). Your subsidy declines as your income increases up to 400% of the federal poverty level.

- Starting in 2020 those buying individual coverage get a $2,000 to $4,000 tax credit per person for qualifying insurance (and policies don’t have to be purchased through the official Healthcare.gov Marketplace to qualify for the tax credit). Tax credits vary with age (older = larger credit) but not with income, however there are income limits where the tax credit phases out

- Cost sharing reduction subsidies disappear in 2020 (currently available to those earning under 250% of the federal poverty level – it’s what makes my deductible $100, max out of pocket $1,200, and my copays $5-20)

- In 2018, HSA contribution limits double to $13,100 for family coverage.

- If a state chooses to allow it, insurers can charge more for pre-existing conditions for those that have a lapse in coverage. Possibly much, much more. Maintaining continuous coverage seems to be the way to go to avoid paying a lot more for pre-existing conditions.

- Increase the age banding of premiums so that the premiums paid by older people aren’t capped at three times the premiums charged to the youngest people (under AHCA older people will pay five times what younger people pay – while only getting an extra $2,000 in tax credits)

- No more individual mandate to have health insurance retroactive to 2016

Those are the basics but trust me, I’m leaving a lot out. Medicaid and Medicare are tinkered with too.

The Senate will most likely make significant modifications to the AHCA, so it’s pure speculation as to what we’ll actually end up with once all the sausage is made.

My main takeaway as a 30-something early retiree that will be 40 by the time the ACA premium subsidies go away in 2020 is that I’ll be paying more for health insurance that will come with higher deductibles and copays. Mrs. Root of Good and I will each get a $3,000 tax credit to use toward insurance that will probably cost $4,000-$5,000 per year per person for a basic plan, and possibly much more if healthy people choose to go uninsured (since the individual mandate will be gone and many people will pay more for health insurance, making it less affordable). I don’t know what the kids’ policy pricing will look like or if they’ll end up on Medicaid (if that’s still an option given the possibility of AHCA-related changes to Medicaid), but I understand they’ll be eligible for $2,000 tax credits too (based on their age) if we purchase individual policies for them.

In conclusion, I’m mentally penciling in an extra $4,000 or so for health insurance and healthcare costs starting in 2020, but also accepting that a lot can change with the AHCA before passage (or it might fail altogether). There might be a subsequent health care bill passed later on in 2018 or 2020 as the political winds change that could put our costs back in line with where they are currently under the ACA.” (end excerpt)

If this bill passes then the near-term damage of this law won’t be horrible. But it’s still a lot of uncertainty in our early retirement financial plan.

A silver lining of the Republican controlled White House and both houses of Congress: tax cuts. I’ve heard mutterings about higher child tax credits and larger standard deductions, which could save us some money on taxes to partially offset higher health insurance costs (or, rather, lower health insurance tax credits versus what we get under the Affordable Care Act). Tax cuts can potentially benefit the economy depending on how they are structured, so it’s possible we’ll see investment gains too.

Have we reached the top in the stock market?

I’ll be the first to admit I have no clue but I know it’s been on a winning streak the past four years. That’s not to say it can’t keep going up for several more years. However, there’s a lower chance of strong continued gains year after year simply because there’s less room to grow when the market is already at high valuations compared to long term historical averages. It’s the exact reason you would have expected big stock market gains in the long term back about 2009 when the market was valued at a third of what it is today. From deep valleys rise tall mountains.

Our portfolio might experience several years of sideways movement or suffer a double digit percentage decline. Either of those scenarios are fairly common in the recent history of investing and it’s most certainly not different this time around. That’s not pessimism speaking but rather realism. It won’t mean the end of everyone’s early retirements but it will certainly mean we will keep a closer eye on expenses and income. However our $120,000 of bond funds plus money market funds will provide a lot of stability for several years in the event of a market downturn.

Spending more on travel

I roughly doubled our travel budget from $5,400 when I first retired to $10,000 today. We didn’t really know how much we would travel since our working lives were filled with work work work and just a few weeks of vacation time each year. Travel is our safety relief valve – when our portfolio fills up to the top, this is where we let out the monetary steam. We spend more on travel. If we have to tighten our belts we can cut back in this area.

We’re also taking advantage of geographic arbitrage by traveling to places where the foreign exchange rate makes everything cheaper. In 2015 that was Mexico (though we would have saved even more by waiting till 2017!). In 2016 that was Canada. 2017 is a perfect time to visit Europe with the euro trading at the cheapest levels of the past decade. If foreign currencies grow significantly stronger (= overseas travel becomes more expensive) then we might knock a few US destinations off our bucket list.

And if our portfolio drops by a half million dollars, we can cut out a huge chunk of spending simply by traveling less or choosing less expensive destinations. I’m sort of looking forward to spending a lazy summer at home at some point in the near future, and a financial reason to skip a summer filled with travel wouldn’t be entirely unwelcome.

Spending more on travel is a good thing because it’s so easy to trim this spending versus other areas of the budget that are more rigid like housing costs or transportation costs.

Almost four years into retirement, where are we now?

In a few months I’ll celebrate four years of early retirement. From a financial perspective we are doing great. We earned close to $200,000 extra that wasn’t anticipated due to starting this blog and Mrs. Root of Good working a couple years longer than expected. Our investments have grown by an even larger sum. And we’re keeping our spending generally at or below budget.

Our living expenses in retirement are funded from roughly $10,000 dividends and interest per year plus $30,000 income from Root of Good. That means we don’t really have to sell any investments on a routine basis for living expenses. Nor do we have to worry about withdrawing investments from IRA’s, 401k’s or my 457 account.

It also means the Roth IRA Conversion Ladder I planned to set up is partially on hold for now. I still managed to convert around $4,000 from traditional to Roth IRA in 2016, whereas my Roth IRA Conversion Ladder plan called for conversions of $24,000 per year. However, I was able to contribute $18,000 to my solo Roth 401k and $11,000 to his and hers Roth IRAs during 2016. Yes, I have a Root of Good 401k plan and I play a shell game by living off the income from Root of Good while shuttling taxable funds into the Roth accounts. You could say I’m “living off my portfolio like a real early retiree” and saving the $30,000 Root of Good income, which is also a legitimate way of describing my early retirement finances if one wanted to downplay the significance of the side hustle income (I don’t). It’s a game of semantics.

The net result is $33,000 of additional Roth assets from conversions and contributions during 2016. In other words, I didn’t follow my original plan but I accomplished a similar goal – increase the amount of funds in the Roth space so I can withdraw the contributions/conversions penalty free and tax free well before age 59.5 should that be necessary.

The unexpected income from Root of Good also means my decision to choose the Roth IRA Conversion Ladder over the competing 72(t) Substantially Equal Periodic Payments method of withdrawal was a sound one. The 72(t) method is extremely rigid in the amounts you must withdraw each year once you start your initial withdrawals. However, I knew going into early retirement that my income needs would vary year to year and there was always the chance I would have earned income (or get bored and go back to some form of work). As a result, I rejected the 72(t) withdrawal method mainly because of the lack of flexibility in withdrawals. I would really hate to be taking $30,000 of 72(t) taxable IRA withdrawals while earning another $40,000 between this blog and dividends and interest.

Now where are we headed?

Things look pretty rosy. I took my financials and dumped them into the wonderful early retirement calculator at cFIREsim.com and determined that we could spend somewhere around $65,000 per year with almost zero chance of running out of money before age 90 even when we make conservative assumptions about income from the blog and other side hustle income. Helping shore up the forecast is roughly $25,000 of expected Social Security income that we’ll start drawing in a little less than 30 years.

I don’t know that we’ll spend $65,000 per year but it’s reassuring to know that money isn’t a real constraint to our lifestyle. We could increase our budget by 50% to cover a lot of unknowns such as higher health care/insurance costs and higher kid-related costs during the teen years.

Four years into retirement and our potential standard of living is approximately double what it was when I quit working. It’s not entirely surprising given the conservatism of the worst case analysis performed under the “four percent rule”. Most of the scenarios modeled in the four percent rule (which is closer to a three percent rule for very early retirees) leave the retiree with several times their initial portfolio value. End result: a growing net worth in real terms for most very early retirees.

However I keep in mind that we might be at the top of a stock market bubble that’s about to burst and that we might see hundreds of thousands of dollars of our net worth disappear in a short period of time. In that case, I’ll have to revisit what we are able to spend. Until then, I’m not gonna worry about money and I’ll keep an optimistic but flexible attitude toward the future.

Any early retirees in the audience that ended up with substantially more than they started with? Or did early retirement lead to new ventures or interests that turned profitable? For those planning on retiring soon, do you have any plans to hustle on the side? Let me know!

Root of Good Recommends:

- Personal Capital* - It's the best FREE way to track your spending, income, and entire investment portfolio all in one place. Did I mention it's FREE?

- Interactive Brokers $1,000 bonus* - Get a $1,000 bonus when you transfer $100,000 to Interactive Brokers zero fee brokerage account. For transfers under $100,000 get 1% bonus on whatever you transfer

- $750+ bonus with a new business credit card from Chase* - We score $10,000 worth of free travel every year from credit card sign up bonuses. Get your free travel, too.

- Use a shopping portal like Ebates* and save more on everything you buy online. Get a $10 bonus* when you sign up now.

- Google Fi* - Use the link and save $20 on unlimited calls and texts for US cell service plus 200+ countries of free international coverage. Only $20 per month plus $10 per GB data.

I loved this post!!! One of the things that scare me if I were to retire today is definitely health insurance as well as the potential for the stock market to go in a free fall after all these bull market years.

That is so incredible how highly valued your wife was at work. Seems like they really went out of their way to show her how much they valued her. I don’t feel like you hear about that all the time anymore.

I would love to be in your position in a couple of years. I’m not quite there yet but I am definitely trying as hard as I can to get there as quickly as possible!!!

Health insurance is the big unknown for us too. Definitely curious to see how it all plays out in the next few months (or years).

There always seems to be that fear of a crash after such a rise in the market. Hopefully, as history shows, over tiem the market will continue to rise for all of us who are invested. Cheers

For health insurance, just bake in $500 – $700/person for a gold to platinum plan and you’re all set! I’ve been buying my own health insurance since 2012, and that’s about the range. It’s also a business expense.

Best, Sam

As always, thanks for all the details Justin! The big picture of how you “do” early retirement so successfully with a family is so easy to see in your posts. As far as college goes, your kids should consider the 3 year plan too. I did it 30 years ago, my daughter graduated in 3 years last weekend and my son is taking a course this summer – prior to leaving for his first undergrad year, to pretty much guarantee a 3 year graduation. High schools and community colleges offer tons of options for kids in HS to earn college credit. Our community college paid more than half the cost of a class – an “early college” scholarship.

I am getting ready to end full-time work in June. I can’t imagine not having some kind of side hustle. We have plenty of travel plans – but there are a lot of hours in a week! It’d be hard not to earn some kind of money!

Re: the 3 year college plan – that’s a distinct possibility. I did that in college and managed to earn 2 degrees (one in Spanish, the other in engineering!). Between APs, college release during HS, testing out of courses and summer school before university started, I actually started my “freshman” year a few credits short of being a junior. Our kids will probably end up taking a lot of APs in high school most likely so that alone should earn them most of a year of college credit.

That’s part of my “best case” financial model for college – each kid might only spend $10,000 or so to get a bachelor’s degree.

My bachelor’s degree (finished 14 years ago) cost me about $10k. I got a 29 on the ACT, which enabled me to go to a junior college for two years for free, and I finished my last two years at a university. My MBA and Ph.D. cost about another $10k in total since graduate assistantships waive most of the tuition and provide a small stipend as well. My wife’s bachelor’s degree, which she completed in three years, cost her about $10k as well.

It’s beyond me how people can go into debt for $50k or more for a bachelor’s degree. Being focused on going to an out-of-state university is a big factor in that.

William. You say your bachelors cost you about $10k 14 years ago. How can a kid rack up $50-60k in debt? I can tell you it’s EASY to do that considering the massive inflation in college costs which by the way have more than doubled since 2002. My son just applied to five colleges/universities here in Virginia – all public. Their costs all come in around $27-$28k per year…. that’s tuition, room and board, books, etc. Without the ancillary stuff (let’s say we whack it way back and save on all of it) the cost for tuition and room/board is about $24k. Multiply that by 2 years and it’s $48k…. 4 years and we’re at $96k. My son nailed his SAT (94th percentile). I put him in community college during high school… our county paid for over half of that and perhaps when all is said and done he’ll save a semester or more. His “aid” (from every school he applied to) was unsubsidized student loans – 4 years will be about $25k worth. The rest? No grants. Scholarships? We shall try but no guarantee certainly. So as of now it’s all on me and whatever my kid can do on his own… He just got a summer job – it’ll help a little. He can try to be an RA or something but tons of kids have the same idea – not everyone gets to do that… If I choose to pay zero where’s the rest of the money come from? So I have a nasty choice to make. I want him to have skin in the game and a $25k loan accomplishes that. I’m probably going to have to eat a lot that I don’t want to ($60k? Do I hear $80?). I WILL NOT let him leave with $50k in debt but that’s my choice… I’ll throw assets at it. if I didn’t feel that way I can easily see how a kid like mine could be saddled with a nightmare of debt. And to top it all off, states across the nation are significantly cutting funds for public colleges – I think only North Dakota isn’t. Costs will go from $27k now and go higher still. My kid’s community college classes were over flowing… it ain’t like it used to be – not when everyone and their brother tries the same strategy.

GO4ITUSA,

Things have definitely changed, and it seems like you’re in a tough spot. That being said, the university where I completed my bachelor’s has increased their tuition, but only by about 50% since I was there. So I could get that same bachelor’s degree for under $20k including textbooks and fees. Remember that I paid nothing whatever for the first two years in junior college. Also, I lived out home throughout my education; no ‘room and board’ often cuts the cost of attending a university by around half. In Virginia, it seems that this holds true as well. Is it not possible for your son to commute to a university to save $40-50k? Alternatively, you might be able to purchase a home with 4-5 bedrooms, get 3-4 roommates for your son, and have the mortgage payment, utilities, and maintenance split in full among the roommates. I’ve known many people who did this quite successfully; some sold the property after their child graduated, but most kept it as a permanent source of income.

Local college is William and Mary… didn’t have the engineering program for undergrad and it costs a lot more money than places we applied….. I’ve considered buying house a n Blacksburg (VA Tech) but that’s not without risk as well – they ain’t cheap. Add in the transaction costs etc maintenance etc and I didn’t see with any degree of certainty that we’d come out ahead…. with a lot of downside risk … I got around all of this on our first kid who was able to get a full military scholarship at U of Virginia. That still left me with funding room and board ($36k)… moved off campus and split rent etc but not really sure we saved much that way…

I was surprised when I looked into the Pell Grant system as well. If you have an AGI under $50,000 they don’t even take your assets into consideration. This greatly increases the chances of my kids getting large Pell grants. I’m not retiring soon, looks like 8 – 13 years depending on several factors, but I plan on working extremely part time once I leave full time work. I work about 7 – 9 months of the year now, and when I transition to early financial independence I will drop down to 2 – 3 months per year, and still earn enough to cover the vast majority of our expenses. I will continue working as a contractor during nuclear plant outages doing the exact same jobs I do now, just fewer of them.

This ACA thing is such a nightmare. It’s insane how much time I have spent researching, planning, and of course dealing with the system to get coverage and medical care for our family. It will be interesting to see what happens.

Can you imagine what your net worth will be in 20 years or 30 years? Your situation is reminding me of the details behind the trinity study….100% of the time a 4% withdrawal had a positive balance in the account after 30 years, this is what everyone works to, what most don’t read is that the median account ended with 15X the amount it started with.

“Can you imagine what your net worth will be in 20 years or 30 years? ”

It’s crazy. Even if we take out my blog income, at our current spending plus a reasonable assumption for college spending, we’ll have between $2 and 24 million at age 70 according to cFIREsim, with a median value of $7 million. And that’s in today’s dollars. So unless our future looks worse than the great depression and the 70’s stagflation, we should be 100% fine. 🙂

How do you get so many travel points ?

This was a great and thorough post. I’m in my 20s and starting late so I’m nowhere near retirement. You mention Uber wasn’t a company when you were planning which makes me wonder what other services like that will be available in the future to make money off of while in retirement. I wouldn’t worry much about the bubble about to burst. After it readjusts, you’ll be winning even more. Thanks for the value in this post

No clue what the next big thing/app/invention/tech will be. In general I think it’ll be easier to hire people for services and easier to sell your time/expertise on a global market. On the leisure/entertainment/lifestyle side of the equation, it certainly seems having fun is getting cheaper and cheaper. Ebooks, tech gadgets, $10 netflix unlimited subscriptions, cheap smartphones and video games, etc.

H RoG,

The next big thing is “decentralization using Blockchain”. There is an explosion going in valuation of related (Crypto) coins in this space, especially around Smart Contract networks (see Ethereum as an example). You can ride this wave, probably takes a few more years before it is reaching maximum hype, before it consolidates. They also call this “Internet 3.0”.

Study it, and put 10k USD in it, and do not watch for 2 years, and then be happy to have another big plus for your portfolio in Retirement 🙂

cheers from ERE (Hankaroundtheworld)

I admittedly don’t know a lot about the technology (other than on a very fundamental level). Just checked bitcoin’s price and was shocked to see it’s gone up a ton over the past year!

You know things are going well when “Spending more on travel” is included as one of the “bad” things. 🙂

Thanks for the behind the scenes peek. This provides a great deal of hope and optimism for FIRE hopefuls on their way up. Awesome to see that you are much closer to a best case scenario than a worst case scenario. (Although looking at your list of market returns makes me sad that I didn’t have the money to start investing until after 2013 was over…)

Yes, that travel spending isn’t entirely bad, just a negative way we deviated from the initial FIRE plan (negative in a financial sense – highly positive in the “having fun” sense).

I never really considered how early retirement could help so much on the FAFSA and college aid – way to work the system! I’m impressed how you can send 3 kids to college on not much money. Not bad in this world of inflated higher ed costs.

It surprised me too. And motivated me to think about reducing the taxable assets and getting more into retirement accounts.

You folks are knocking it out of the park. Besides the positive sequence of returns, there is no luck involved at all…this is the result of a sound plan perfectly executed. Kudos to you! Everything to the “t” has been schemed and you definitely serve as a good role model for those looking to enter “ER” soon like myself.

And I love the shell game you have going with being able to shuffle more taxable assets into Roth accounts! I suppose have less taxable assets will make it all the easier on the FAFSA and scoring there too. On Monday I have a post scheduled to walk through how I plan to pay no tax in retirement. It’s achievable and it gets me excited (gosh I’m a nerd)!

Rock solid, RoG. Thanks for the update!

Yes, that shell game stuff is pretty cool. 🙂 Took me a while to realize I needed to keep on maxing retirement accounts to the extent possible even during retirement. I’ll be okay with near-zero taxable assets and a highly inflated Roth balance.

Great post!

I have to stay that part of the reason your kids are doing well is that you are at home. Greeting them at the end of the day, volunteering in their classrooms, and supervising homework. You are a great hands on Dad.

It helps! I gave up my legal career but now I have 2’kids in elite liberal arts colleges which had acceptance rates of 15%. We chose the colleges based on how big their endowment was, which translates into a lot of grants! Free money! Our last child has straight As and she knows to look for colleges based on how rich the school is. The 3 will have no loans when they graduate!

That sounds awesome – looking for colleges based on their endowments!

I’m sure being home with them helped a lot. We do spend a lot of time with them and watch over the homework pretty closely. And see who they are hanging out with 🙂

This post is the perfect antidote for the naysayers. Thanks for spilling ALL the details and showing people how early retirement can work really well.

But will the naysayers actually read any of this? 🙂

Some will. But they will be reading everything looking for *just one* excuse why the *exact* path you’ve followed wouldn’t work for them. That way, they can dismiss it with righteous indignation about how easy you had it.

What a great post. What great detail. Thank you.

“Plan for the worst and hope for the best” is our approach too. We’re always pretty conservative with our plans (not just finances) and things just always seem to work out better.

The “Plan B” side income is a good idea. I’m going to use that. Even if it’s never required it’s smart to prepare mentally for the possibility of earning additional income during “retirement”.

The earning extra income thing is a nice Plan B. And being open to making a buck is okay even if you’re retired. You get to name your terms of engagement and limit it to whatever you want/need.

Opportunities to make a bit of extra money always seem to present themselves, especially if you have the time to take advantage of them. Its nice to keep it as a Plan B though and not rely on that extra income.

Hi Owen,

I like your approach of “Plan for the worst. Hope for the best”. I adopt such approach as it prepares me fully for the worst case scenario. Things are always unpredictable in life. It’s always good to be ready for worst possible scenario at all times.

Ben

I’m so excited for your increased net worth. It’s amazing how your blog has grown over the past few years and added some cushion to your retirement plan. I just started my blog almost two months ago about personal finance and have found your blog to be an inspiration.

Thanks for sharing the details of your retirement finances! 🙂

Yeah, it’s really taken off the past few years. Not something I anticipated when I first started blogging with zero regular readers. 🙂

Never heard of cFIREsim.com. Thanks for sharing that. Really cool calculator.

I love it. It’s based on the FIREcalc but I like the newer cFIREsim better.

Justin:

Your analysis of college, health care, etc. is simply awesome! Thanks for sharing everything so openly.

You’re welcome! Glad to put it all on paper (er, the screen) and share it.

We left work for a year, and decided not to go back. Once we didn’t have 9-5 job, so many other good options opened up. Plus we weren’t spending as much between work cost, and money spent making up for the fact we disliked our jobs and we’re short on time. I don’t buy into all the “worst case scenario” fear. If everything, and I mean everything, goes wrong….well…we will have to be in the same boat as every other American. Gasp!

There you go – I’d rather be in a Great Depression-type financial event with a paid off home and whatever is left of a $1.x million dollar portfolio AND the propensity to live frugally in general. That’ll be way better than the alternative – high spending, low worth people that would be really screwed!

Great write up and awesome Mrs. Root of Good was able to have the flexible work schedule. Employer loyalty is so limited these days that they are more apt to hire some cheaper just out of college to save a buck mentality so it speaks volumes of her talent. I’m hoping we’re near the top of the market so that it comes down and I can invest more to join you in early retirement. All without hurting all out other early retirement friends out here. Keep enjoying your freedom!

No worries – it’s much better to be investing when the stock market is very low. And market corrections are usually short lived (as in months or years). Us FIREd folks are investing for decades. Lifetimes!

Good summary ROG.

Most blogs I read have only existed during the last ~8 year run up in the stock markets.

The US markets lost ~54% in 08-09. I know you have been moving a small amount into bonds. Have you calculated what another 54% correction would look like? That is certainly a worst case scenario, but it happened just 9 years ago.

You could move to 60/40 or 50/50 and avoid some of the drama. But then, another 08-09 might not happen. Or it might be 30% or 25% down. Nobody knows.

Take only as much risk as you have to.

I lost hundreds of thousands in the 07-09 crash, so I remember very well what it feels like. 🙂 For us, it’s pretty simple – we would lose $750-800,000 or so if it drops by 50%. A big chunk of that drop was just a few months in duration and it recovered relatively quickly.

I’d still be feeling pretty good with $750,000 in equities, $120,000 in bonds/money markets, and a paid off house. 🙂 The blog income is of course icing on the cake. If this did happen, we would probably curtail spending on a lot of discretionary expenses. Maybe spend the summer in Mexico instead of Europe. 🙂

I’ll probably stick some more $ in bonds if the market stays at current levels for a while. I don’t think I’ll ever regret having $100-200k in bonds (3-5 years living expenses). Today’s ~2% dip doesn’t even register in my mind as a worry due to this significant fixed income buffer.

I truly appreciate that fact that you don’t need to sell any investments on a routine basis for managing your living expenses. I have come across people who had to consider withdrawing investments and that’s really painful. It never helps you being a spendthrift during the early years; it’s always a better option to stick to your family budget. It really pays when you reach those golden years!

I wonder what it will feel like to sell $10,000 of something and transfer that money to checking and spend it on something? I’ve sold stuff to pay off the mortgage and sold some to move it to an IRA for tax savings purposes, which is just a way of moving money from one pot to another.

I’m happy with the spending where it is today and if we find ways to spend more and get value then we’ll do that. But as it is, more spending doesn’t seem to bring a lot more value to us.

This is actually one thing that I fear in FIRE. Actually “using” some of the stash to fund a lifestyle. Just doesn’t feel right 🙂 That money is supposed to be there exclusively for growth!

I too have been wondering if the top is in on this long-in-the-tooth bull market. It really sucks for anyone who’s been sitting on the sidelines since 2008. We lost more than a hundred K in 2008, but at the time I thought, “What good timing… I’m only 7 years into a career.” That allowed us to buy cheap for so many years.

I thought the same thing in 2008. “Buying opportunity of a lifetime”. I’m glad I kept plowing money into the market.

Hi, Amazing summary ! Something similar is happening to my neighbor who wants to retire, but her employer is making it very attractive to stay on with incredible flexibility. I like your blog a lot and don’t want this to come off in the wrong way, but do you ever think about whether it will morally OK to accept college financial aid when you don’t actually “need” it , despite what it shows on paper? I am assuming that your state can only provide a limited amount of aid overall, so your kids aid might stop someone else who may really need it – for instance a student whose parents are not savvy enough to have saved for college – which is not the students fault – should that student suffer because you have figured out how to beat the system? Again- this is not meant to be critical – instead it is a reflection of the thoughts I am having myself as I think about how to keep my own income low during the college years (which are coming in a year for me).

I don’t set the guidelines and don’t really know how well off others are (or aren’t) and what choices led them to their current income and net worth levels such that they do or don’t qualify for aid. I know we would be considered lower income if we applied to the Ivy’s (for example) as many of the applicants come from very high income, wealthy families.

The good news (for those concerned about fairness in the system) is that some institutions look deeper into assets and income using another financial aid form (CSS??) that might be more accurate for our financial situation and make us look wealthier to the university.

And as it stands now, I’m not doing a lot to “game the system” but I might look toward that in the next few years.

I have a similar net worth to Mr. Root of Good but I have ZERO qualms about positioning our assets and lowering our income to maximize college financial aid for our children. We’ve got six years before the first one enters college, so I’m just now getting familiar with the forms and rules. While I agree with Monica that it’s unfortunate that students are dependent on the spending/savings decisions of their parents, I consider it highly immoral that, when it comes to financial aid, it appears that parents are basically penalized for doing the “right” thing and saving for college on behalf of their children.

Consider two families with the exact same income, but one family lives paycheck to paycheck, buying new cars every couple of years, etc. Meanwhile the other family lives frugally and diligently saves in a 529 for 18 years. Come financial aid time, the latter family will be expected to use those 529 funds for tuition and college expenses, while the former family is “rewarded” with a larger aid package. It’s the ant and the grasshopper, with an aid system that rewards the grasshopper.

That aspect, coupled with insane tuition inflation over the past several decades, inspires me to do all I can to maximize financial aid by making sure that most of our assets are in retirement accounts/home equity.

That’s pretty much how I feel. And to extend it further, you could have a 50 year old couple that just retired with a pair of pensions paying more than what I can withdraw from my portfolio plus a fat seven figure retirement account but with zero taxable assets. They would be much “richer” than we are in terms of spending power but we would probably end up paying more for college with some small taxable brokerage accounts plus a moderate income.

The formula also penalizes those with smaller families and awards those with larger families, especially those with kids spaced close together (like our oldest 2 kids).

Plenty of inequity baked into the formula.

Agreed about the inequity in aid formulas. I don’t want to go too far with straw man arguments, but you might recall the stories from the 2012 election about Mitt Romney’s $102 million IRA. For the FAFSA, it’s plausible that someone with a nine-figure IRA balance and nine figures of home equity would be considered flat broke, assuming minimal income and assets held in taxable accounts. While that’s a very unlikely situation, the current rules clearly benefit families who minimize assets in taxable accounts, even those who are truly wealthy based on their tax-sheltered retirement savings.

I’ve thought about poor ole Mitt. He probably could get some decent financial aid for his kids! 🙂

@David: Actually I do not think the scenario you painted of the 2 families with the same income is not entirely correct. FAFSA only reduces parental assets including 529 plans by 5.64%. Retirement accounts will not be counted. Income is the main factor. Maybe some schools don’t follow the FAFSA formula though. So I’m not that the spendthrift family would really benefit from not saving as much as you might think.

@Justin: I think that FAFSA would consider pension as income

FAFSA definitely considers pensions as income. And because it’s not “earned income” you can’t lower it by contributing to traditional IRAs or 401ks etc. This happens to be my little predicament at the moment

Right, pension would be income and go on the FAFSA. I was thinking in hypotheticals. A couple with $45,000 pension income now and $50,000/yr more at age 60 (different pension rules for the two spouses) plus a $2 million IRA (yet no taxable investments) versus me with $40,000 blog/investment income plus $300,000 taxable investments. I would look richer on the FAFSA than the couple with a pension even though they are roughly twice as wealthy as me in terms of future annual purchasing power.

@Andrew — I had thought that the 5.64% per year applied only to the parents’ taxable accounts, with a much higher reduction rate for 529 savings. But from some quick online searches, you appear to be correct. (There’s an expectation that other student assets will be reduced by 20% a year). Still, our kids will be in college for seven years total, assuming they both graduate in four years (one year of overlap). Ignoring compounding/investment growth, our expected family contribution would include nearly 40% of our 529 assets over those seven years. Going back to my hypothetical example, if the frugal family had $100k in a 529 account, their EFC over the course of seven years would by $40k more than that of the spendthrift family that lacked 529 savings. Again, I’m in the early stages of all of this, but it seems like making 529 investments should come last, after maxing out on 401(k)/IRA investments and paying down mortgage debt.

But kids can have trouble if they are poor as most colleges and universities don’t practice need-blind admissions and don’t guaranteed to meet demonstrated need, and unfortunately there are a few (although shrinking) number of fields where you really need to have attended a specific (usually pricey) school. Many state universities, while need blind, have high tuition and offer little in the way of grants, saddling poorer students with excessive debt.

Agree!!

I don’t think working the college system to your advantage is a bad thing mainly because the aid is tiered. My kids received zero state or federal aid but always got that nice little letter saying, “hey, if we had more aid, we’d help you out, but we don’t, so sorry. How about a hefty loan?” Thus even if you want to consider that they are “taking” money out of the available pot, they aren’t taking it away from folks on the bottom whom without aid could never consider college but instead they would be lowering the pool so those nearer the top who can (at least theoretically) afford college wouldn’t receive some help. While I would have appreciated some aid for my kids, I never planned on getting any because of our income. Do I feel that Justin should “pay” his fair share? Maybe, but then again if I’m not going to be angry at a high income multimillionaire having lived their life and made their choices and taken their risks just cutting a check to pay for their kid’s college like it’s a utility bill, why should I be mad at a frugal person finding a way to get their kids into college with aid, especially if they are good kids with a good shot at being good citizens. Now, if a large part of the population were all going FIRE and undercutting the system, I’d be more willing to change laws to minimize that impact, but we are talking a tiny fraction of the population. It’s like how many folks really take advantage of all the travel hacks put up on this site? I’d bet it’s a small overall percentage or the companies couldn’t remain in business, so the impacts are minimal to the overall system IMHO.

Question about this: “My kids received zero state or federal aid but always got that nice little letter saying, “hey, if we had more aid, we’d help you out, but we don’t, so sorry. How about a hefty loan?””

Are you saying you filled out the FAFSA and it said you should get X amount of aid, but when they doled out the financial aid, there just wasn’t enough to go around so you got nothing? Just curious how it works, since I assume we would get whatever aid the FAFSA says we should get, and didn’t want to get shocked by a big fat $0 financial aid award come college time.

I’ve tried to answer this twice already, so if you get multiple answers from me that’s why.

Short answer, you get what you are supposed to get. I suspect since my children attended state schools and aid was state handled, that this was a plus up based on folks who qualified and didn’t attend leaving more money in the state coffers to be redistributed up the aid ladder for that year. I suspect that we “qualified” for the aid because we had unsubsidized loans, but the probability of us receiving any actually benefit was next to nil, and it’s kind of insulting to get a letter telling you that you qualify for aid but the money has run out so better luck next year.

With respect to FAFSA, as I recall they determine your family burden and then the school makes up the difference in a variety of ways, scholarship, grants, work-study, etc. which can vary from school to school in the mix they offer. The only place I think folks get a real surprise is when you include external scholarships. Say the school costs $25K, your family burden is 5K, the school offers grants and scholarships for $20K. However your child has gotten five individual $1000 scholarships from the local community. You think you are not paying a dime (e.g. $20K in aid, $5K in external scholarships), but suddenly the school drops their aid to $15K to ensure you still pay your “burden”. I did not personally experience this so didn’t dig into it, but I know folks who did. This happens, the school is only on the hook to ensure you don’t pay over your burden. So that’s one thing to be aware of and seek ways to mitigate (e.g. have the checks sent to your family and not the school).

That’s sort of what I’m afraid of. We get plenty of need based aid, then one of the kids lands a scholarship and the need-based aid is taken back dollar for dollar. Oh well, I guess we could have worse problems. 🙂

Having gone through this, the other thing to be aware is not every school will meet 100% of required aid. And we found that some of the aid was qualifying for loans. Not all the aid was in the form of scholarships and grants.

Oh yea! We received “financial aid” alright – in the form of unsubsidized federal loans…. they classify a loan as “aid.” My kid has above a 4.0 GPA…. and a 1340 SAT (94th percentile in math). The “aid” is $5500 starting the first year and I am to pay the difference out of pocket (call it $20k)…. that covers tuition, room and board, books, and other crap…. He will work this summer and we’ll cut costs where we can but it’s gonna hit.

Thanks for the feedback. I figured they would offer loans as part of the package but wasn’t sure if that was considered “aid”. I’m okay with letting the kids take on some college debt since college should allow them to earn several tens of thousands more per year above what a high school diploma alone might get them.

…….and I’ll add! The “aid” package I outlined above was the exact same at all five schools we applied to. All five are VA state schools. Tuition/Room/total cost at each of the five was about the same. He’ll be attending Virginia Tech this Fall.

Not all schools guarantee to meet demonstrated need, and meeting that need can include hefty, hefty loans.

Isn’t it amazing how the smarter and/or harder you work at something, the luckier you get? Whether blogging or travel hacking or taking advantage of the ACA rules, most of your “luck” has been due to smart initiatives on you and your family’s part. Well done.

We had some large discretionary expenses that we undertook within the first year or so of my retirement three years ago. Even with that we have a higher net worth than we did three years ago, albeit less of a % increase than yours due to the spending (which were one time events that help us live on the road for 4-5 months of the year) and some stupid market trading moves on my part that have been corrected. And now that I have started SS at age 63 we basically have more than our expenses taken care of by two SS payments and the wife’s pension, not even counting our investment returns. That should enable me to hopefully accelerate our bottom line net worth, as long as the markets do not have a repeat of the late 2000s. Life is definitely good, my friend.

Yeah, it’s funny how luck works when you combine it with effort and skill 🙂

I imagine we’ll be in a similar financial position as you one day – more money than necessary. We’ll never have the pension income, but I figure by the time I’m 67 and drawing SS I’ll need the SS payments even less than I would today!

Appreciate the big picture of your nearly four wonderful years since you waved goodbye to work. Your early retirement has clearly achieved escape velocity, and those of us still in thrall to gravity wish you all the very best, wave a tad wistfully, and dream of a future that sometimes feels impossibly far away.

Join us up here in the rarefied air of FIRE! 🙂

Congrats on coming out further ahead in early retirement than when you started!

Love hearing this kind of insight on the intricacies of what’s taken place in your early retirement. A lot of us are blogging about our game plans and what we expect things will be like, but it’s definitely not the same.

Learning about the pros and cons of what you’re actually going through is fantastic… and it’s good to hear that the cons have been relatively few for you!

— Jim

I spent a lot more time budgeting, forecasting, and planning back when I was working compared to how little time I spend now thinking about it (other than the time devoted to describing it here on the blog 🙂 ).

I’m amazed at the life you have set up! Great job! I would love to have a job where I only had to work 8 hours a week and earned $30,000/year. That’s the life!

I’m really excited to hear about your trip to Europe. I bet you guys are counting down the days!

Yes, the countdown has begun. More like counting down the weeks now but we’re getting ready. 🙂

I could run cFIREsim.com simulations all day- and perhaps I shall. You stole my day! I was surprised at how much of a difference SS made- it totally was the deal breaker/maker for my scenarios. My addiction to high COL areas is the other killer. I wish, I wish I liked small to mid sized towns.

SS is no joke. Probably the most underappreciated safety net even for us rich fat cats aiming for FIRE. For us, we’ll end up with a $25k COLA’d pension basically at age 67 which is almost enough to fund a bare bones budget. That means if we spend all our portfolio by then (in the next 28-30 years) then we’ll almost be okay for life. 🙂

Love your posts, a lot of helpful information and a lot of things to think about.

Recently Mrs FR and I had a conversation about early retirement and what we would do, and my wife told me that she likes what she does and she’s planning to work even after we don’t need to.

What about me though, I know exactly what I would do:

– Adventure traveling on my motorcycle and exploring the world

– More quality time with my family

– Sharing my story with other people and proving that American Dream is alive

Sounds like a good way to spend early retirement! 🙂 My prediction: your wife will grow envious of your freedom and decide working isn’t as much fun as it once was. 🙂

I know exactly what you mean RoG! My net worth increased $500k in the (almost) two years I’ve been “early-retired”.

I only planned for our portfolio to grow about $50k per year (2.5% annual growth outside of expenses), but we absolutely crushed that estimate. It’s surreal!

We pull in roughly $50k/year in dividends, so if the market bubble pops, it shouldn’t be a problem.

Taxes ended up being an absolute dream too!

Great post btw!

The dividend yield for us will cover our budget in most years too, so that’s another layer of defense. Or way to sleep at night.

More frequent articles would be nice. Earn that $30k!!

Enjoy when you do write though.

ha ha, if I wrote more that $$ figure would be higher I bet.

A lot of people worry about what can go wrong in a retirement. We target our withdrawals and savings to be able to handle the worst case scenario. But there is also a probability things can go a lot better than planned. I think you are proof of that!

Probably the biggest surprise for me after quitting is how lucrative the travel hacking can be. It’s easily saved us thousands from our expected expenses. We will be staying in Spain for free thanks to your Airbnb travel hacking tips 🙂

Yeah, the travel hacking is a huge deal for our travel budget. I guess when I say I have a $5000 or $10,000 travel budget people have a certain idea of how far we can get on that. However it’s really 2-3x that budget when the flights and sometimes lodging is free.

Having time to plan these trips equals a lot of cost saving, too. We’re able to find better deals.

Bravo on the first two joint years of ER. You are way above plan and that will continue.

My last day is July 5th, when our joint ER begins at 41. (Wife has stayed at home for five years). I asked for severance as opposed to quitting and oddly it worked. I’ll be getting approximately 40k to exit my career, before unemployment.

Life is good.

#Jealous 🙂

I tried to get Mrs. Root of Good to fish for a severance package and she wouldn’t do it. I think her severance would have been of a similarly large size too.

You hit the nail right at the spot. Early retirement has been demistified. I love the way you detailed everything. Thanks for writing this.

When you calculate your total investments (net worth) do you include your home value and other real estate investments? We currently have our home paid for and the value is about 260,000. We also own two commercial properties that are paid for and leased out with a value of 125,000 each.

I do because my home is a relatively small part of my net worth and I could always sell it and move somewhere else and use the proceeds to rent for well over a decade. However it’s important to note that I don’t use the house value as part of my investment portfolio value that I use to calculate how much I can spend each year (the four percent rule). The house isn’t an investment for me – it’s a place that provides mostly rent-free housing.

So for your rental properties, you can include in your net worth but I would use the cash flow from the properties to help meet your monthly expenses, and not include the value of the properties in your investment portfolio value (if you’re planning on taking 4% of portfolio value for living expenses each year, for example).

I love this post. I’m one year into my own retirement and hearing from folks who are farther down the path does a lot to keep the jitters at bay. I need to learn to cook the way you and Mrs. RoG. The photos you’ve shared of some of the meals you enjoy are mouthwatering. I feel so clumsy and awkward when it comes to cooking. We could easily shave hundreds more each month of our expenses if we mastered this.

I love that I have time to try new dishes now. For example, I spent 4 (!!) hours making tikka masala from scratch this past Saturday. I made a huge amount so we could have leftovers. I think I nailed it because everyone is excited to eat the leftovers for the fourth day in a row. And now I’m thinking about making the recipe simpler so it’s quicker to make next time around. Fun challenges and you get to eat the (hopefully) delicious results. My advice – next time you find something you love at a restaurant, try to replicate it at home. Youtube is your friend as are the many food/recipe sites out there.

Cooking is fairly easy for the intelligent systematic person. You’re starting as half an expert: you already know what good food tastes like! An hour a day of (useful) cooking shows or Youtube videos, and you’ll get there in no time. Just get some decent tools, including a GOOD thermometer (thermapen or such), and pay attention to how various factors impact the outcome. A bit of study and experimentation and you’ll (nearly) master a given dish, then another, then another…

MUCH simpler than being successful at finances and retirement. 🙂

I do alright and don’t even have a thermometer!

I did not have one, but got one a few years back as a gotta-suggest-something Father’s Day gift. I was a decent cook before, but not to the point of touching the meat to know how done it is. This has made a big difference for me:

(1) Not overcooking chicken just to make sure it’s safe. At the same time, setting the finished pieces aside so they don’t overcook while the thicker piece finishes up.

(2) Cooking salmon to a proper medium is a glorious thing

(3) Getting the proper water temperature to make happy yeast when baking bread

… and others I am sure.

But, in regards to the original poster: having this advantage when learning to cook would have saved me plenty of bad meals from overcooked or re-cooked meats.

Nicely done! We all think of the negatives and “what ifs” and here you are kicking ass!! The healthcare debacle is one that will be ongoing for everyone in the FIRE community…I’m curious to see what will happen and thankful I’m still working so it all has a chance to smooth out. Looking forward to hearing about your trip. 9 weeks of travel?! That in itself is worth all the hustle that got you to FI. 🙂

Yes, this is a “trip of a lifetime” that we could take basically every year forever. Pretty wild when you think of it, but “this is what we saved all that money for” is what I keep telling myself.

Still far from retiring, but great to hear it worked out that well. Interesting aspect on planning for retirement, but still leave with so many aspects still being unknown or affected by changes. As it comes to the when is a good time to retire, we might never know what lies truly ahead of us.

True enough. You make a plan and then you stay flexible as the plan plays out over the years and decades.

You’re doing awesome. Congrats!

You guys made a ton more money than expected and I love it. Make hay while the sunshine, right?

The stock market can’t keep going like this. Everyone expects lower return in the years to come. That’s okay, though. We’ve been on an awesome run.

I’ve retired almost 5 years and our net worth doubled. It’s pretty crazy. Our expense went up too, though. When I quit, our budget was bare bone. Now we spend a bit more. I’m pretty sure we can hold at this level.

Same here. I think we went into retirement planning on spending like we did when we were saving and working. Now we’re realizing we can spend a lot more and not risk going broke. Took a few years to loosen the purse strings. And we’re wealthier now too, of course 🙂

For anyone wishing for a good approximation of a historically safe withdrawal rate based on the current (over)value of the stock market, MadFientist has a great tool. Just go to Mad Fientist and click on laboratory, calculator and Safe Withdrawal Rate.

Great summary, and congratulations again! It’s an inspiration to see how you’ve continued success. I’m hoping to mark my path to FI and find my niche.

Btw, that college photo looks like the walkway between old campus and cross campus at Yale. Can’t really tell b/c many other campuses use a similar layout of arch including Duke.

Hehe, many borrowed tuition dollars went into my prior education…was it worth it? Still trying to figure that out.

I think that is a pic I took on the University of Chicago campus a few days before I retired early. I’m a weirdo that considers walking through college campuses a form of tourism (and they have a sweet mummy museum on campus too). But they do all look the same. Probably because they’re imitating European college campuses 🙂

It is! Modeled after Heidelberg. Lots of merit scholarships FWIW 🙂

I have a question with the FAFSA process…so it seems (or what I got from the post) that early retirement is beneficial for college affordability? Since the house and retirement accounts are not counted, retirement makes sense if the timing is right. My husband and I bring up the topic of children sometimes and we’re trying to figure out a good outline of the next 20-30 years. Stuff like FAFSA will alter our plans.

Thank you for the compelling read. I’m new here and I just subscribed.

Yes, if you have a paid off house and most assets in retirement accounts combined with a very small income, you’ll be sitting pretty for the FAFSA formulas (assuming they are static for the next couple decades 🙂 ).

From my reading, it sounds like Roth Conversions count towards AGI and therefore factored into FAFSA calculations. I’m a ways out from it, but might make sense to do bigger conversions leading into the last year or two of high school, to really reduce AGI.

Roth conversions definitely add to AGI which counts in the FAFSA contribution. And yes, if you can do bigger conversions 1-2 years before college then keep them modest during the college years it will help your FAFSA results.

Are the schools that you are considering (I realize it’s still at least a few years away) need blind, and do they guarantee that they will meet demonstrated need? Even at state schools this is becoming much less common than it was even ten years ago. While a few years back, your formula would have been foolproof and brilliant, do you have any concerns that colleges will be less likely to offer admission to your children if they are perceived as needing large amounts of aid? Or is the situation in North Carolina different?

This article describes some of the changes at occurring in many states: https://www.nytimes.com/2017/05/25/opinion/sunday/the-assault-on-colleges-and-the-american-dream.html

And these discuss how few schools are truly need-blind, although UNC appears to still be on the list- I guess you picked the right state! But things are, sadly, changing fast and for the worse for college aid : http://www.huffingtonpost.com/bev-taylor/need-blind-admissions-is-_b_5615698.html https://www.usnews.com/education/best-colleges/paying-for-college/articles/2016-09-19/colleges-that-claim-to-meet-full-financial-need

I haven’t spent a lot of time looking into it. My oldest is 6 years out. We’ll probably apply to NC State and UNC Chapel Hill at a minimum (and possibly Duke, plus a handful of reach schools that might offer fat aid packages). Both offer a ton of solid degree options that lead to well-paying careers. Both are $9,000/yr for tuition. NC State is an easy 12-15 minute drive from our house.

As I laid out in my “cost of college” article, we could cut costs, such as by having the kids live at home during college. Or they could do the 2+2 community college and bachelor’s degree. So far they’re on the path to having four semesters of calculus and differential equations knocked out by the time they finish high school (aka all the math you need for many engineering degrees). And a bunch of other college level coursework.

We’ll see where they end up and figure out the financial aid picture when we get there. I understand that we might not get 100% of the financial aid that the forms say we deserve. That’s okay, we’ll just pay out of pocket. And in terms of need-blind admissions, it’s not too big a concern. A top 25/50/100 school gets you just about as far as a top 10 school in many fields, especially if you go on to graduate education afterward.

Sounds like you have a great plan, and that North Carolina really supports its state universities and students. And that your kids will graduate college before they are done with high school, which is outstanding.

ITA that (Wall Street and BigLaw excepted) any decent school will do, and NC has several, including its flagship. Even in endlessly status-conscious NYC more and more kids are opting for SUNY and CUNY, especially for anything science related.

As always, great to hear your thoughts and obviously well thought out plans.

And it’s still possible to get into Wall St and BigLaw from local state schools like UNC Chapel Hill. The MBA program and Law school are both top 25-ish and I know a lot of classmates that ended up in Biglaw. I had a ton of interviews with biglaw even with a very average GPA (only got a little bit of interest though, and one offer to go to NYC for a second round of interviews but it was patent BigLaw). It’s tougher for sure – they’re looking at only the top 10-15% of the class and require Law Review whereas if you’re coming from a top 8-10 school they’re looking pretty deep down in the class rankings.

I didn’t realize till I looked, but NC State’s engineering program is top 25. Right below Harvard. In my career field an NC State degree gets you further than a Duke degree (and it’s about 1/8th the price).

Healthcare remains the biggest issue. Very expensive, but I am almost twice as old as you. The biggest surprise about retirement is my income. I always planned on making less money in retirement. Between my pension, social security and my retirement savings my income is higher than it ever was when I was working. Who knew!

At least the higher income will offset some of the additional healthcare costs. And you’re fortunate to be close to Medicare age (assuming you’re almost 2x my age). Costs should drop a lot at that point and you’ll get a lot more cost stability versus what I would expect under AHCA should it pass.

Here your income report clearly pictures that your decision on early retirement was absolutely right. Your crystal clear explanation n every aspect of life like health, earning and others is much helpful for the followers.

This was a great update! I’m totes-jelly of your blog success. Market has treated me well too. It’s a good thing because, hindsight 20/20, I pulled the plug too early and got really lucky. I always expected to work part time as a consultant for a few years but it was never needed.

Keep devouring your prey RoG!

Well Done!! Great post! Love how simply it’s all coming together. The ACHA thing really scares us and we’re not quite sure how to take it yet. Hopefully someone will figure something out. It’s kind of shocking how much your assets have grown.

That being said, what are you thoughts on taking a little more risk and stopping a little before your official “number”?