Welcome back to Root of Good, folks! We landed in Poland a month ago and we have been enjoying this new-to-us country quite a bit. We started our trip in Krakow and made our way south to the Tatra mountains and Zakopane near the border of Slovakia.

As I write this, we are in the southwestern part of Poland in the Klodzko Valley very close to the Czech Republic. Over the next few weeks we’ll head north toward Gdansk with several stops along the way.

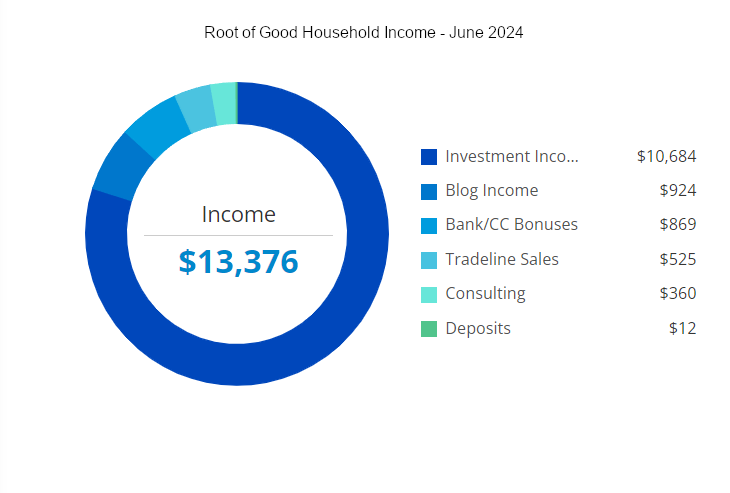

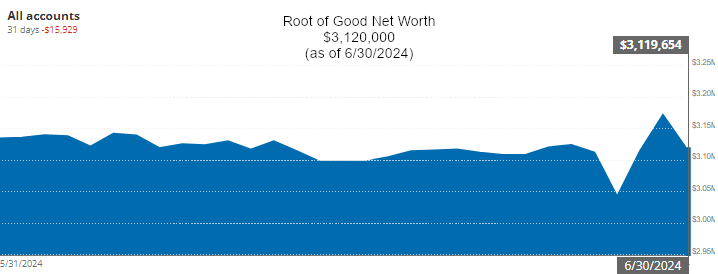

On to our financial progress. June was a good month overall for our finances. Our net worth dipped slightly by $16,000 to end the month at $3,120,000. Our income of $13,376 exceeded our spending of $5,889 for the month of June by a wide margin.

Let’s jump into the details from last month.

Income

Investment income totaled $10,684 in June. Our equity index funds and ETFs pay dividends quarterly at the end of March, June, September, and December. As a result, we had a larger than normal amount of investment income last month. Here’s more on our dividend investments.

Blog income totaled $924 for the month. This represents a slightly above average month of blog income.

My early retirement lifestyle consulting income (“consulting”) was $360 last month. That represents two hours of consulting work during the month.

Tradeline sales income totaled $525 in June. That is a great month for my tradeline sales. I expect the next month or two to be similarly high. I ramped up my tradeline sales a few years ago and discussed it in a bit more detail in my October 2020 monthly post and in my July 2021 monthly post. Most years I make around $4,000 to $6,000 in exchange for lending out my stellar credit history from half a dozen credit cards.

For last month, my “deposit income” was $12. The deposit income came from cash back and incentive bonuses from the Rakuten.com and Mrrebates.com online shopping portals (some of which was earned from you readers signing up through these links).

If you sign up for Rakuten through this link and make a qualifying $25 purchase through Rakuten, you’ll get a $10 sign up bonus (or more!).

My “Bank/Credit card bonus” income was $869 last month. I recently signed up for several US Bank Business Leverage cards and the $750 bonus from the first one posted during June, along with about $119 extra cash back from the spending that I put on the card.

Youtube income was $0 last month. Youtube only pays out when you hit $100 in accumulated revenue. Recently, my Youtube earnings have been slightly under $50 per month on average, so I only get paid every three months.

Here is the Youtube channel for the curious. It’s random travel videos, birds, kids, and a couple of DIY videos. There are only a few main videos that bring in most of the traffic (and revenue!).

If you’re interested in tracking your income and expenses like I do, then check out Empower Personal Dashboard, formerly known as Personal Capital (it’s free!). All of our savings and spending accounts (including checking, money market, and more than half a dozen credit cards) are all linked and updated in real time through Empower Personal Dashboard. We have accounts all over the place, and Empower Personal Dashboard makes it really easy to check on everything at one time.

Empower Personal Dashboard is also a solid tool for investment management. Keeping track of our entire investment portfolio takes two clicks. If you haven’t signed up for the free Empower Personal Dashboard service, check it out today (review here).

Tracking spending was one of the critical steps I took that allowed me to retire at 33. And it’s now easier than ever with Empower Personal Dashboard.

Expenses

Now let’s take a look at June expenses:

In total, we spent $5,889 during the month of June which is about $2,500 more than our regularly budgeted $3,333 per month (or $40,000 per year). Insurance and travel were the highest two spending categories last month.

Detailed breakdown of spending:

Insurance – $2,635:

Our annual homeowners insurance bill of $1,335 came due in June. Due to inflation, the premiums have skyrocketed by almost 100% compared to a few years ago.

Our six month auto premium has also gone up quite a bit. I believe most of the increase is due to adding our two teen drivers. The six month premium was $1,300 at this renewal.

As our teens gain additional years of driving experience, the insurance re-rates them to a lower risk category. So the current premiums should be the highest they will ever be since our oldest kid will soon have two years of driving experience and get a rate reduction as a result.

Travel – $1,813:

Our travel spending of $1,813 represents everything we’ve spent in Poland for the 23 days of June that we spent here.

I didn’t break down the travel spending in fine detail, but I have a rough estimate of where that $1,813 travel spending went:

- $413 – rental car and gas

- $50 – parking

- $100 – Ubers while in Krakow

- $400 – restaurants

- $500 – groceries

- $350 – tickets to attractions, national parks, museums, and castles

We are spending more freely than we usually do. If something looks mildly interesting we’ll pay to go see or do it. Not too much disappointment so far with this approach. We’ve taken a similar approach with restaurants. Dining out and takeout are cheap enough that we can enjoy restaurant food without breaking the budget.

Get free travel like us

If you are interested in getting free travel from your credit card like I do, consider the Chase Ink Unlimited or Chase Ink Cash business cards (my referral link). Right now, the Chase Ink business cards offer an above average $750 to $1000 worth of Chase Ultimate Rewards points that can be redeemed instantly for $750 in cash. I just signed up for another new Ink card to snag one of these great bonus offers.

Chase is pretty liberal when it comes to “what is a business”. If you sell stuff on eBay or Craigslist or do some odd jobs occasionally then you have a business and could get a credit card as a “sole proprietor”.

I use the 75,000 Chase Ultimate Rewards points by transferring them to my Chase Sapphire Reserve card (also offering a 60,000 point sign up bonus right now). With the Sapphire Reserve card, I can get 1.5x the points value by booking cruises, flights, hotels, or rental cars through their travel portal. Or 1.25x value by reimbursing myself for groceries. That turns the 75,000 points into $1,125 of free travel or $937.50 of free groceries. For example, I used 165,000 Chase Ultimate Reward points to pay for the $2,475 in taxes, fees, and gratuities on two of my fall cruises. Or I can transfer those Ultimate rewards points to over a dozen travel partners’ airline/hotel programs like United, Southwest, or Hyatt.

Capital One VentureX card

Another favorite travel card in my wallet is the Capital One Venture X card. The Venture X card is a “keeper” for me. First off, it comes with a $750 sign up bonus after spending $4,000 in the first three months. The bonus is paid in the form of 75,000 bonus points that you can redeem against any travel purchases from anywhere. Then you earn a solid 2 points per dollar spent forever! The other big perk is airport lounge access. You can get yourself plus unlimited guests into Priority Pass lounges. And you plus two guests can get into Plaza Premium network lounges and Capital One Lounges.

The Capital One Venture X card does have one catch – a $395 annual fee. But they reward you every year with an easy to use $300 travel discount plus $100 worth of points. Together, that makes $400 they give you annually which completely offsets the annual fee. Another benefit worth mentioning: you can add up to four authorized users for free, and they also get all the benefits of the Venture X card including the valuable airport lounge access. We used this perk to “gift” a pair of Venture X cards with airport lounge access to my brother in law and his wife to use on their family trip back home to Cambodia last April with their two young children.

Since the annual fee is offset in full by travel credits each year, I personally plan on keeping the Venture X card forever since the card benefits are so great.

Electronics – $520:

We had a very unfortunate hard drive failure during May. Four years of photos were wiped out without a full backup of most of them. So we sent the hard drive off for data recovery. I paid $520 for data recovery services and the company managed to recover 100% of our data. Over two terabytes of photos and videos.

We now have at least 2 full copies of all of our photos and other valuable data. And we intend to maintain this level of protection going forward to prevent future data losses.

Utilities – $304:

We spent $147 on our water/sewer/trash bill last month.

The natural gas bill was $25. Throughout the summer, our natural gas bill should be very low since it’s only for heating water. Additionally, usage will be lower since there will only be one or two people living in our Raleigh house during most of the summer.

The electricity bill was $133 in June. The summer cooling season is well underway and our electric bill reflects that. I imagine it will be over $200 for a month or two during the summer given the much higher cost of electricity now due to inflation.

Taxes – $300:

Our $300 quarterly North Carolina estimated tax bill came due in June.

Groceries – $242:

The grocery spending of $242 mostly reflects our spending the first week of June while we were still in Raleigh. Our oldest daughter stayed in Raleigh this summer and we cover her grocery bills, so there is a small amount of spending for her in the June grocery total.

I include our overseas grocery spending in the “Travel” category of expenses. We aren’t as careful about shopping for sales and getting deals while we are buying groceries overseas. And we try a lot of new things. So I lump the groceries while traveling into our overall travel budget.

Healthcare/Medical/Dental – $37:

Our current 2024 health insurance is free, thanks to very generous Affordable Care Act subsidies that we receive due to our low ~$48,000 per year Adjusted Gross Income.

Our 2024 dental insurance plan costs $37 in premiums per month. We picked a plan from Truassure through the healthcare.gov exchange. The dental insurance does a good job of covering routine cleanings, exams, and x-rays plus most of the cost of basic procedures like fillings.

Home Improvement – $29:

Some insect repellent for our trees and shrubs. Purchased shortly before we left Raleigh for the summer.

Cable/Satellite/Internet – $11:

We generally pay $25 per month for a local reduced rate package due to having a lower income and having kids. 50 mbit/s download, 10 mbit/s upload. For the last several years, the cost of the internet service was temporarily reduced to $0 due to the “Affordable Connectivity Program”.

Now that the funding for the Affordable Connectivity Program has ended, we finally got a bill for our internet service. It was only $11 for June since the ACP funding covered a portion of the bill. Going forward, we will pay the full $25 monthly internet bill.

Gas – $0:

No normal gas spending for the month of June. I did buy a half tank for our rental car in Poland. However I included that in the “travel” budget category.

Spending for 2024 – Year to Date

We spent $16,580 for the first six months of 2024. This annual spending is about $3,500 less than the budgeted $20,000 for six months per our $40,000 annual early retirement budget. I haven’t increased our annual budget for inflation in a decade, so at some point I need to revisit the budget numbers. So far, so good! No need to give ourselves a raise if we’re managing just fine within the current budget.

As I mentioned in April, our kids’ college costs are completely paid for by their financial aid so far. So college spending should remain rather modest throughout the rest of 2024 into 2025. And it appears that both of our older children are on track to finish their bachelors degrees in 2025.

The wildcard spending for 2024 will be some upcoming dental work for Mrs. Root of Good. We still don’t know what this will look like but we’ll find out more in the fall once we return home from our summer trip. At least we’re running $3,500 below our budget, so any large dental expenses won’t make our total annual spending completely out of line for the year.

Monthly Expense Summary for 2024:

Summary of annual spending from more than a decade of my early retirement:

- 2014 – $34,352

- 2015 – $23,802

- 2016 – $38,991

- 2017 – $31,708

- 2018 – $29,058

- 2019 – $25,630

- 2020 – $28,466

- 2021 – $31,740

- 2022 – $29,449

- 2023 – $37,865

- 2024 – $16,580 (through 6/30/2024)

Net Worth: $3,120,000 (-$16,000)

Our net worth dropped $16,000 to end the month at $3,120,000. That’s a fairly modest drop of about a half of a percent of our overall net worth. We are still above the psychologically important $3 million dollar mark.

For the curious, our net worth reported above includes our home value (which is fully paid off). I value the house at $300,000, which is probably what we would net after sales expenses. However, please note that I don’t consider my home value as part of my portfolio for “4% rule” calculation purposes. I realize folks ask me about that every month so I just wanted to state that here for clarity.

Life update

As this post goes live, we will be entering the second month of our summer adventures in Poland. So far it’s going well and not a lot of unpleasant surprises. After the first week and a half in the city of Krakow, we have spent the last three weeks in the countryside in smaller, quieter villages.

Having a rental car makes the trip so much more fun and easier logistically. No planes, trains, or buses to catch. On the mornings that we leave one airbnb or hotel and go to the next one, we leisurely wake up at 8 or 9 am, enjoy a cup of coffee, and pack our gear into the tiny trunk of our Toyota Yaris. We’re out the door by 11 am and usually have one to three hours of driving to get to our next place.

Usually we’ll find somewhere neat to stop for the day or grab lunch along the way. Basically just take it easy and enjoy the scenery throughout the drive. I would call this a luxury but we only paid $17 per day for this really nice (but small!) rental car with automatic transmission.

On our longest drive from just outside of Auschwitz to our castle hotel in Otmuchow, I checked the box on my Google Maps to set the route to “avoid highways”. This turned what would have been roughly two hours of freeway driving into a three hour trip through the rolling countryside at a much slower pace.

Fewer cars zipping by us. Instead, more quaint villages, cows, wildflowers, and farm fields outside our car windows. This was a great choice in hindsight and one we hope to continue if our schedule permits us during our future drives through Poland.

Sometimes you just have to go your own way and choose “the road less taken” (to borrow a concept from Robert Frost).

Well that’s it for this month’s update. I hope you enjoyed the pics from our trip. See you next month!

How is you summer going? I heard it’s pretty hot in a lot of the United States right now!

Want to get the latest posts from Root of Good? Make sure to subscribe on Facebook, Twitter, or by email (in the box at the top of the page) or RSS feed reader.

Root of Good Recommends:

- Personal Capital* - It's the best FREE way to track your spending, income, and entire investment portfolio all in one place. Did I mention it's FREE?

- Interactive Brokers $1,000 bonus* - Get a $1,000 bonus when you transfer $100,000 to Interactive Brokers zero fee brokerage account. For transfers under $100,000 get 1% bonus on whatever you transfer

- $750+ bonus with a new business credit card from Chase* - We score $10,000 worth of free travel every year from credit card sign up bonuses. Get your free travel, too.

- Use a shopping portal like Ebates* and save more on everything you buy online. Get a $10 bonus* when you sign up now.

- Google Fi* - Use the link and save $20 on unlimited calls and texts for US cell service plus 200+ countries of free international coverage. Only $20 per month plus $10 per GB data.

Looks like an awesome trip!

I wonder if you crunch the numbers on solar power every few years. I know electricity was much cheaper for you in NC than it is for me in RI, but with inflation I wonder if it’s creeping up. At the same time, I expect solar panels to get cheaper and more efficient. It seems like they could converge at some point and be worth it.

Of course, there are a lot of local variables. Some of them can make solar NOT worth it.

Solar panels are a real pain if there’s a roof leak or if the roof needs to be replace. That the reason most people are reluctant to have those installed.

Looks like they have an older roof, so probably a ground-level system would be better.

When I got them, I was told that they protect the roof. However, my roof was in good shape, so it hasn’t been an issue.

That is a big concern of mine. I spend $$$$$ installing a system and either the install causes a leak (“installer says it’s not their fault bc roof was already old!”) or a leak springs up later.

I’ve seen a lot of ground-mounted systems here in Poland and I would be more tempted to install one of those. Maybe even DIY the frames for it. We have a decent sized south-facing back yard with lots of clearance away from trees, so it could work well. Just don’t know if I want to devote the real estate to a solar setup or deal with another system to maintain.

I think I looked 1-2 years ago (possibly when you mentioned it here in the comments, ha ha ha).

Eventually it’ll probably be worth it from a pure math standpoint. Whether I want the hassle, I don’t know. Just paying $200 in high months and $75 in low months is pretty easy/lazy vs spending anything out of pocket to try to minimize these bills. And I assume I’d still be paying $20-30/month no matter what to cover the grid connection fees even with $0 energy consumption.

NC also changed the way the electric utility pays for net solar generation above amounts consumed. They will zero out your bill but surplus generation gets paid at 3.4 cents per kWh (“cost avoidance” rate) whereas our retail cost is about 13 cents per kWh. So maybe I have some surplus power to sell at a bad rate in spring/fall when AC usage is nearly zero.

Absolutely beautiful pictures!! Yes, Florida is HOT! Enjoy and stay safe.

I can only imagine how hot it is in Florida. It’s hot even in the winter when we visit for cruises.

That is quite a handsome amount (>$10K) you received from dividends last month. How much per year do you get in total?

Do you have a sole proprietorship or LLC for your blog and consulting businesses? What specific home business deductions do you take — if any?

I assume you need some kind of international permit to drive in Poland. What is the process for getting something like that?

Sorry to hear about the hard drive failure. Which data recovery company did you end up using?

Dividends vary year to year because of my heavy investments in international ETFs. But about $50-60k/yr now in dividends.

Sole proprietorship for business organization so I file schedule C on my 1040. Home biz deductions – home office, a few expenses related to running the blog (mostly technology related). Really not that many to be honest. The solo 401k is the biggest tax break for me.

Process for getting International Driving Permit – AAA handles those in the USA. Pretty simple to get. Visit a local office with 2 passport photos and $20 and they can issue it pretty quick. I did mine by mail for the same amount and it took a couple of weeks to get it back.

Data recovery – I used “$300 Data Recovery” in Los Angeles. It ended up being a bit extra since my hard drive was encrypted and it was larger than 2 TB.

One thing I don’t see in your thorough budget breakdown is the cost of cell phone service. What do you use, and does it work well when traveling abroad? We are planning an extended overseas trip next year and I am pricing out cell service that will work abroad, or just thinking about buying phones and cards in country.

I travel full-time and am staying out of the US this year. I went with US Mobile’s yearly plan ($96 for the year — $8/mo including taxes/fees) to get texts and voice. It’s been working great.

For data, it depends on the countries being visited. We’re going to be in Europe for several months, so I went with MobiMatter’s $40 SIM that includes 35GB and covers all of Europe. It was also good for a full year, whereas most SIMs are good for 30-90 days. I’ve been using 2-3 GB per month.

If you are jumping between countries often, you’ll probably be better off with a regional SIM even though it’s a bit pricier per GB. If you’re going to be in one country for a while, then a country-specific SIM will most likely be better.

That’s a cool setup.

So how does it work? US Mobile gets you the physical SIM and offers voice and texts internationally at no extra charge? Then your data comes from the e-SIM from Mobimatter? And both of those work at the same time in your phone?

At home we generally use Redpocket mobile. A very basic number of minutes and megabytes costs $30/yr from ebay with upgrades if you consume more mins/data (a la carte as needed or upfront for a higher per-year cost). We also end up getting free service occasionally as part of a new phone purchase (Tracfone, Spectrum Mobile, etc)

Abroad we use Google Fi. Just turn it on when we actually need it and pause it when we’re not using it.

Buying in-country is pretty appealing too. I was debating doing that for Poland because we’ll be here for 2 months. Data is super cheap with local SIMs and I’d also get a local phone number. Which would be helpful occasionally for signing up for some services like food delivery and the grocery store loyalty cards. I never did and have been using Google Fi instead.

Thanks for the update, always a good read

Sounds lovely taking your time driving through the countryside.

Enjoy the rest of your trip

Thanks, it’s been nice and relaxing now that we’re out in the country 🙂

Solid month!

I’m curious about the multiple US Bank cards – is it easy to get approved for multiple of these or did you get one and your spouse got one?

With redeeming UR points for cruise taxes, gratuities and fees – that’s interesting! Was there some way for you to redeem these UR through their portal to pay for what was left on your comp bookings? I would not have expected that.

US Bank biz cards seem super easy to get. I rarely get a denial and velocity-wise I can get one per month or two roughly. We just got a pair for me and a pair for my wife in the spring. I did have to call in for my 2nd one to verify my identity but no other problems getting approved.

For Chase UR pts for cruise bookings – I was able to use them to pay the taxes+fees+tips for my Holland America cruises by putting the reservation on hold with the casino reservation folks at Holland. Then called Chase UR travel folks and they were able to call Holland and pull up my held reservation and complete the booking and payment that way. One Chase travel rep said it was impossible to do this but another one was able to do it successfully. It was cumbersome but worth it to avoid spending $2500 out of pocket when I have so many Chase UR pts available.

What company did you use to recover your data from the hard drive failure ? And how are you storing your data for future protection ? Cloud or external storage devices ?

I used these guys: https://www.300dollardatarecovery.com/

Currently have an onsite backup of all data on a second hard drive that is stored away. I’m undecided about cloud-based backup or other methods mainly because I ran out of time before I left home for the summer! The extra hard drive was a cheap solution for the time being. $119 for a 8 TB hard drive and that should cover us for several more years before it fills up.

Lovely! We did just did a three week trip in Spain and had similar experiences. Ah – Poland! A place of my family and we will be going there at some point. I loved the country side pics. Thank you for sharing and writing these posts that show how intentional lifestyle choices can lead this a life of freedom.

You mentioned the “4% rule” and I understand you do not include the value of your home and applying this rule. But looking at your expenses they are way below 4% of your assets. Have you given any thought to increasing your expenses so that you’re giving your family more of a reward for your fortunate financial position?

Have to echo others asking for the company you used to recover your hard drive, might be valuable for us to know if we have trouble in the future.

Regards, LD

We are slowly spending more money. Consciously making the decision to pay more for convenience and comfort from time to time. I don’t have any plans to go out and ramp up our baseline spending any time soon, such as by buying a bigger house or fancier cars.

Data recovery company: https://www.300dollardatarecovery.com/

I’m still trying to get back to Spain for some countryside road trips 🙂 We had a 2020 trip planned but the pandemic happened instead so we saw a lot of the inside of our living room.

Hi Justin,

I believe that you could have included the insurance in your annual expense (budget)?

WTK

I view my spending from an annual basis, so you are right. The insurance comes due mostly in June so that’s when I record the expense. But I know it’s coming and other months have lower expenses as a result.

I am from Kolobrzeg (Kolberg), when you are near the Baltic Sea buy yourself a very reasonably priced Amber rock. You can pay as much as 10 times cheaper anywhere outside of Gdansk.

We’ll take a look when we’re in Gdansk in a few weeks!

FYI I tried the boost credit 101 tl sales and the user I added somehow redeemed and stole hundreds of dollars worth chase points that I had connected to the account. I’m trying to get the chase points reinstated but it seems like its going to be hard to do since it happened a few months ago and I didn’t catch it right away. I also never got the money for adding them as an authorized user too since they claimed that my account wasn’t showing up on their credit report. Has anything like this happened to you?

(edit from the moderator: see comment below indicating the Chase Ultimate Reward points were not in fact stolen, it was a misunderstanding from “figuy”)

Wow, that is crazy! Did you figure out how they accessed the Chase UR points? And how they spent/redeemed them? I’m going to check my Chase UR pts balances right now…

As far as getting paid – I think 100% of my added AU’s have been properly credited. Even had a couple times where I forgot to make a monthly charge to generate a positive balance and I still got credited for the successful AU addition.

false alarm they weren’t stolen, I had a mixup. oops

Man, how can you qualify for business ink card. I’m a blogger and I didn’t qualify. What’s the cheating you do to get them?

I don’t know. Chase never asks for my schedule C or anything. I just use my SS number and apply as a sole proprietor and my own name as my biz name and I’m honest about my actual income/spending. I think it also helps that I’ve had biz cards with Chase for a decade or more, so it’s easy to keep on getting new biz cards since I’m a known entity in their system.

Hmmm that must be it. I didn’t lie at all but it would be my first biz cc. They asked to fax/email my “Certificate of Formation”. Don’t even know what that is so…gave up.

It’s easier when you’re famous and wealthy I guess lol

Glad to see you enjoying Poland! Did you pay extra to rent a car with an automatic transmission? Whom do you use for car rental bookings?

A minor correction, the Frost poem you refer to is entitled “The Road Less Traveled”. And that has made all the difference.

I paid a little bit extra, maybe $18/day on average for automatics instead of $16/day for manual transmission cars. Most places in Europe, the added cost for automatics is even higher so I lucked out this time. I use Kayak to shop for the best deal. In this case, I ended up renting through a third party booking site I found through Kayak, and both 3-4 week rentals ended up being with “Kaizen Rent” which is a Poland-based chain of rental cars. I am more impressed with them than the average big name rental car agency in America to be honest.

Re: Robert Frost – Minor correction to your minor correction but it’s titled “The Road Not Taken” by Robert Frost.

I was referring to the last 3 lines that reference the road “less traveled by” with my sentiment:

“Two roads diverged in a wood, and I—

I took the one less traveled by,

And that has made all the difference.”

It really makes all the difference. 🙂

I assume you use credit card CDW coverage for your rental cars in Europe rather than purchasing it from the rental companies? Did any company require proof of coverage offered by credit card companies? If so, what did you provide? And what do you do with respect to liability coverage?

Yes, Chase Sapphire Reserve for CDW, just have to keep rental periods at 30 days or less. Self-insuring wouldn’t be a horrible deal at our net worth level, since I think the companies often provide some level of insurance for free then we have a deductible of a few thousand dollars (or euros).

No proof of insurance ever required anywhere we went as far as I can remember. I have a pdf saved in my google drive if I ever need to show it to them.

Liability – I believe the rental car companies have to provide this as part of the rental. The credit card also provides it when there is no coverage I believe.

Thanks. Did you make multiple reservations with the same rental car company in Poland as you probably rented for > 30 days?

Yes, we rented for about 3 weeks in June and early July. Then turned in the car for a week. Then had another rental reservation for mid-July to mid-August for almost 30 days. This was helpful to qualify for the credit card insurance, but also convenient to avoid having a car and paying for parking and risking someone breaking into the car or stealing it for that week, while we were staying in the inner city in Wroclaw, where parking is a bit difficult.

Justin, have you looked into doing dental work in Poland or Mexico? There are so many great dentists all over the world at a fraction of US costs. If Mrs. Root needs a root canal, it may be worthwhile to explore the options. Love your blog btw, thanks for sharing!

I’ve looked into it some. It’s not a bad option. If we had less money it might be worth pursuing the route of medical tourism. We’ll probably opt for local treatment. Concerns over complications and follow up treatment are a big deal for us.