Welcome back to another monthly update from Root of Good! Here we are halfway between Thanksgiving and Christmas enjoying the last few weeks of the year. As this post goes live, we are days away from sailing on a cruise to South America and Central America where we will celebrate Christmas. We return home just before New Year’s so our 2023 is rapidly drawing to a close!

Even though we didn’t really do any traveling this fall, we still kept busy with other daily routines around home. Looking ahead, 2024 is shaping up to be a busy year for travel, with a few domestic trips planned in the first few months of the new year. In the summer, we head to Europe where we will spend a couple of months road tripping around Poland.

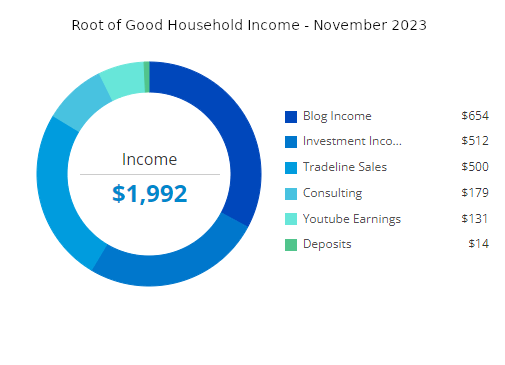

On to our financial progress. November was a great month for our finances. Our net worth skyrocketed by $134,000 to end November at $2,817,000. Our income totaled $1,992, while our spending was a bit more at $2,682 for the month of November.

Let’s jump into the details from last month.

Income

Investment income totaled $512 in November. Our equity index funds and ETFs pay dividends quarterly at the end of March, June, September, and December. As a result, we had a smaller than normal amount of investment income last month. But we should get a huge payday in December! Here’s more on our dividend investments.

Blog income totaled $654 for the month. This is the “new normal” for blog income since I only post on here about once per month.

My early retirement lifestyle consulting income (“consulting”) was $179 in November which represents one hour of consulting. Things are finally picking up in this department in the early part of December, with two new clients booked so far. We’ll see how 2024 goes! I think I will give myself a small inflation raise on my rates for next year. But nothing crazy.

Tradeline sales income totaled $500 in November. It’s nice to see this income stream come back after a few slow months. I ramped up my tradeline sales a few years ago discussed it in a bit more detail in my October 2020 monthly post and in my July 2021 monthly post.

For November, my “deposit income” of $14 came from cash back and incentive bonuses from the Rakuten.com and Mrrebates.com online shopping portals (some of which was earned from you readers signing up through these links).

If you sign up for Rakuten through this link and make a qualifying $25 purchase through Rakuten, you’ll get a $10 sign up bonus (or more!).

Youtube income was $131 in November. Youtube only pays out when you hit $100 in accumulated revenue. Recently, my Youtube earnings have been slightly under $50 per month on average, so I only get paid every two or three months.

Here is the Youtube channel for the curious. It’s random travel videos, birds, kids, and a couple of DIY videos. There are only a few main videos that bring in most of the traffic (and revenue!).

If you’re interested in tracking your income and expenses like I do, then check out Empower Personal Dashboard, formerly known as Personal Capital (it’s free!). All of our savings and spending accounts (including checking, money market, and five credit cards) are all linked and updated in real time through Empower Personal Dashboard. We have accounts all over the place, and Empower Personal Dashboard makes it really easy to check on everything at one time.

Empower Personal Dashboard is also a solid tool for investment management. Keeping track of our entire investment portfolio takes two clicks. If you haven’t signed up for the free Empower Personal Dashboard service, check it out today (review here).

Tracking spending was one of the critical steps I took that allowed me to retire at 33. And it’s now easier than ever with Empower Personal Dashboard.

Expenses

Now let’s take a look at November expenses:

In total, we spent $2,682 during November which is about seven hundred dollars less than our regularly budgeted $3,333 per month (or $40,000 per year). Groceries and insurance were the two highest categories of spending in November.

Detailed breakdown of spending:

Groceries – $1,190:

The grocery spending is slightly inflated because I bought $400 worth of Walmart gift cards at a discount during November, but I spent some of those during the month as well. We still had a few hundred dollars remaining on the gift card that we will spend throughout December.

Another factor driving grocery spending in November was a big Thanksgiving day celebration. We had a big family gathering at our house this year and cooked a lot of the food ourselves. Many in the family enjoy cooking, so they brought a lot of potluck style dishes too.

Insurance – $736:

I paid our six month auto insurance bill during November. With a teen driver on the policy, the insurance still feels pretty cheap. I always assumed we would pay a lot more for auto insurance for a teen driver. Since she has over a year of driving experience without a wreck, they lowered the premiums for her a bit. Adding our second car in September increased our premiums a small amount as well.

Utilities – $261:

We spent $148 on our water/sewer/trash bill.

The natural gas bill, which provides heating and hot water, totaled $29 for last month. We didn’t use the heat a ton during the billing period included in last month’s bill. However, it’s generally chilly in North Carolina now so we have to use the heat most days.

The electricity bill totaled $84 in November.

Healthcare/Medical/Dental – $176:

Our current 2023 health insurance costs $18 per month, thanks to very generous Affordable Care Act subsidies that we receive due to our low ~$45,000 per year Adjusted Gross Income.

Our 2023 dental insurance plans cost a total of $29 in premiums per month.

I chose a very basic plan for $9 per month for me that covers most preventive care but no fillings. Mrs. Root of Good has a different set of dental needs than I do so we kept the more comprehensive $20 per month plan for her (same as 2022’s plan).

By buying insurance, we should save a couple hundred dollars on my dental care. For Mrs. Root of Good, we will end up saving a net amount of $63 compared to paying cash for the preventive dentist visits throughout the year.

In November, Mrs. Root of Good went to the dentist and the charges after insurance were $129. This included payment for the deductible and co-insurance that was owed from another dental visit six months ago.

Gifts – $130:

Various Christmas gifts for family totaled $130.

Travel – $97:

We didn’t spend a ton on travel in November.

I spent $80 for a discounted $100 Airbnb gift card at the grocery store.

The other $17 in travel spending was the airport taxes for 3 one-way flights on Southwest using points. We are tentatively planning on visiting Phoenix in January for five nights, with a multi-day pit stop in New Orleans on the flight back home. I’ll be earning the Southwest Companion Pass in early January (more on that in a minute), so Mrs. Root of Good’s flights will be free other than $17 in taxes we’ll pay in January. I have hotels booked for free using Marriott points and Chase Ultimate Rewards points. Our main out of pocket cost for the trip will be the rental car which should be $200-300 for five days in Phoenix.

Get free travel like us

If you are interested in getting free travel from your credit card like I do, consider the Chase Ink Unlimited or Chase Ink Cash business cards (my referral link). Right now, for a limited time, the Chase Ink business cards offer an eye-popping 90,000 Chase Ultimate Rewards points that can be redeemed instantly for $900 in cash. Mrs. Root of Good just picked up another new Chase Ink card last month, and I just got my new Ink card in October. The bonuses keep on rolling in the door!

I am guessing the 90,000 point sign up bonus will only last for a few more weeks, so sign up now if you want the higher bonus amount.

Chase is pretty liberal when it comes to “what is a business”. If you sell stuff on eBay or Craigslist or do some odd jobs occasionally then you have a business and could get a credit card as a “sole proprietor”.

I use the 90,000 Chase Ultimate Rewards points by transferring them to my Chase Sapphire Reserve card (also offering a 60,000 point sign up bonus right now). With the Sapphire Reserve card, I can get 1.5x the points value by booking cruises, flights, hotels, or rental cars through their travel portal. Or 1.25x value by reimbursing myself for groceries. That turns the 90,000 points into $1,350 of free travel or $1,125 of free groceries. For example, I booked 3 nights in a $100 per night French Quarter New Orleans hotel for a total of 20,000 Ultimate Reward points. Or I can transfer those Ultimate rewards points to over a dozen travel partners’ airline/hotel programs like United, Southwest, or Hyatt.

Southwest Companion Pass deal – time to act now!

I also picked up a pair of Chase Southwest cards during the first part of November. My goal is to receive the sign up bonuses in the first part of January 2024, and thereby earn a Southwest Companion pass that will be valid through December 2025. The Companion Pass is valid for the year you earn it plus the following calendar year.

The Companion Pass basically grants a free flight for your companion when you book flights for yourself (with points OR with cash). This means Mrs. Root of Good is flying free on Southwest for all of 2024 and 2025!

Just remember to NOT complete the spending requirement until after January 1st of 2024 or you’ll miss out on a whole year of Companion Pass benefits.

Note that these cards have an annual fee (but they offer a lot of free points each cardmember anniversary so it offsets about half the annual fee). And you can apply for both cards on the same day if you want.

Referral links if you’re interested:

Chase Southwest Rapid Rewards Performance Business card – 80,000 SW miles ($199 annual fee) – select the “Performance business” card option

Chase Southwest Rapid Rewards Plus card – 50,000 SW miles ($69 annual fee)

For $268 in annual fees, we’ll get ~130,000 SW miles (plus an extra 10,000 mile head start toward the Companion Pass qualification), and the Companion Pass that offers buy-one-get-one-free Southwest flights for 2 years. Just pay taxes on the free ticket (usually $5.60 per one way segment in the USA). That’s about $3,600 worth of free flights for the two of us.

Clothing/Shoes – $60:

Some new shirts and other items.

Education – $18:

Two transcripts that were sent to East Carolina University for $18 total.

Exciting news: our oldest daughter just graduated from community college this fall! She starts at East Carolina University in a few weeks in the online Business Administration bachelor’s program. Financial aid is not finalized yet, but it appears that our out of pocket costs will be $0 after the various grants, with our daughter getting a decent living stipend each semester.

Gas – $16:

A half tank for our new car came to $16. The new car is more fuel efficient so we should spend a little less on gas.

Cable/Satellite/Internet – $0:

We generally pay $18 per month for a local reduced rate package due to having a lower income and having kids. 30 mbit/s download, 4 mbit/s upload. Right now the cost of the internet service is temporarily reduced to $0 due to the “Affordable Connectivity Program”.

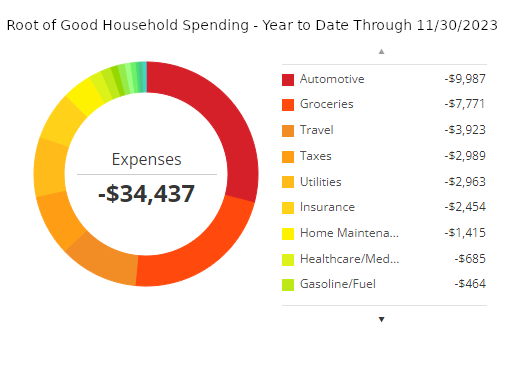

Year to Date Spending – 2023

We spent $34,437 during the first eleven months of 2023. This annual spending is about $2,000 less than the $36,667 we budgeted for eleven months of spending in our $40,000 annual early retirement budget.

It turns out that our new car purchase didn’t throw our annual spending off by very much. We’re still running a small budget surplus with only two months of spending remaining in the year.

December is almost half over at this point, so I don’t foresee any unexpected expenses arising before year-end. So we should finish off 2023 slightly below our annual spending target of $40,000 per year.

Monthly Expense Summary for 2023:

- January – $3,423

- February – $1,675

- March – $1,679

- April – $1,566

- May – $2,976

- June – $1,536

- July – $2,064

- August – $2,615

- September – $12,714 (we bought a new used car)

- October – $1,513

- November – $2,682

Summary of annual spending from all ten years of early retirement:

- 2014 – $34,352

- 2015 – $23,802

- 2016 – $38,991

- 2017 – $31,708

- 2018 – $29,058

- 2019 – $25,630

- 2020 – $28,466

- 2021 – $31,740

- 2022 – $29,449

- 2023 – $34,437 (Year to Date through November 30, 2023)

Net Worth: $2,817,000 (+$134,000)

Our net worth recovered remarkably in November to end the month at $2,817,000. This represents a $134,000 (!!!) gain from the October net worth figure. That’s a huge amount of money to gain in one month, but doesn’t really change anything with our current spending. That’s all long term money. I’ll leave it in the portfolio to keep on growing. And to insulate against future months of six figure losses!

For the curious, our net worth reported above includes our home value (which is fully paid off). However, please note that I don’t consider my home value as part of my portfolio for “4% rule” calculation purposes. I realize folks ask me about that every month so I just wanted to state that here for clarity.

Life update

As 2023 draws to a close, I am feeling grateful for another good year of early-retired life! It took us a decade to save and invest our way toward this lifestyle. And now I’ve enjoyed a whole decade of being retired. That feels pretty great!

This year brought a lot of changes. Our son graduated from elementary school and started middle school in the fall. Our middle child just graduated from high school this past spring and will graduate from community college next spring (at age 17!). Our oldest daughter just graduated from community college this week and is starting at a four year university in January.

Onward and upward, right?

The kids’ changing schedules mean our schedules change, too. Our days used to have two built-in daily walks – one in the morning to walk our son to the elementary school and one in the afternoon to pick him up. Now he carpools to middle school in the morning with a friend. We opted to continue the morning walk routine to keep getting some exercise. We manage about two miles around the neighborhood and through the park each morning (other than a few days where it was literally freezing outside). Plus a shorter afternoon walk to pick him up from the bus stop.

All this walking is good for us. It makes exploring various ports, cities and hiking trails less exhausting since we are accustomed to walking a few miles a day already.

A few days after this post goes live, we’ll be hopping on a plane to Miami where we’ll spend the rest of December on a cruise destined for South America, Central America, and the Caribbean. On Christmas Day, we will be docked at an island about thirty miles off the coast of Honduras. We’ll check off a few new countries and enjoy the warmer weather in the tropics along the way.

Okay folks, that’s it for me this month. Happy Holidays!

Who’s ready for some fun over the winter break??!!

Want to get the latest posts from Root of Good? Make sure to subscribe on Facebook, Twitter, or by email (in the box at the top of the page) or RSS feed reader.

Root of Good Recommends:

- Personal Capital* - It's the best FREE way to track your spending, income, and entire investment portfolio all in one place. Did I mention it's FREE?

- Interactive Brokers $1,000 bonus* - Get a $1,000 bonus when you transfer $100,000 to Interactive Brokers zero fee brokerage account. For transfers under $100,000 get 1% bonus on whatever you transfer

- $750+ bonus with a new business credit card from Chase* - We score $10,000 worth of free travel every year from credit card sign up bonuses. Get your free travel, too.

- Use a shopping portal like Ebates* and save more on everything you buy online. Get a $10 bonus* when you sign up now.

- Google Fi* - Use the link and save $20 on unlimited calls and texts for US cell service plus 200+ countries of free international coverage. Only $20 per month plus $10 per GB data.

Part of me feel sorry that you are traveling so much. Must be incredibly hectic, considering all the logistics, packing/unpacking, transportation, lodging issues, arrangements to make for your house while you’re away, etc.

Ah, a peripatetic life is not for everyone. But glad to see that you seem to be enjoying it, at least so far.

Yeah, sounds to me like Justin and his wife are traveling exactly as much as they want to.

My preference seems to be somewhere between yours and Justin’s.

It’s not too bad but sometimes I admit it’s hectic and we need a vacation from vacations 🙂

We now have an adult daughter that housesits for us most of the time, so it’s pretty easy to leave the house.

Packing – I have a great packing list and leave some stuff permanently packed since there’s no point in unpacking it. And have 2 of some things (toothbrush charger, toiletries) that just stay packed all the time. Gotta have systems!

I always look forward to reading your monthly summaries. You guys are living the good life! I’d be curious to read about your investment allocations in a future post. Enjoy your upcoming cruise!

Glad to see that you had a nice November. We also took advantage of the Southwest credit card companion pass deal and got a couple nice trips out of it. Looking forward to hearing about your upcoming cruise.

It really helps not having a mortgage or rent payment!!!!! I whish I had that too but this is becoming further and further away dream for most

What a fabulous life you lead! I wish everyone would read your Blog and learn that a great life doesn’t require working until 50 or 60 or 70!

I get that the subsidies are meant for low income individuals, but can’t blame you, it’s the way the system is made up! You live a great live for $40,000 a year, and sure know your way around card hacking and such. I always wonder how to hit those spending requirements for $6,000, I don’t know how I would even hit that to get the bonus. Thankfully bank interest rates have been high enough to pull in over 4 figures a month.

Thanks again for a fun post, Justin!

~35,000/~2,800,000 is approximately 1.25%. On one hand, this is most impressive. On the other, it’s puzzling–because your drawdown is way beyond very safe.

You’re already enjoying luxuries like international travel, so I wonder: Do you have unique spending aspirations for the future (philanthropy, generational wealth, etc.)? That could be an intriguing topic for a future post.

Hope it’s not philanthropy. This is another trendy FIRE moves that really pisses off everyone just starting…If you like to do that just keep to yourself. But these days it’s just a way of saying “oh I’m wealthy beyond my 4% needs”…urrr

Well, something good needs to be done with unneeded funds eventually.

If a retiree has no satisfying plans for their unneeded funds, then those funds have no value.

Going this way there will always be funds left. This would be a good topic on giving to charity even during your spending years.

I have 3 kids and they will receive a windfall some day. That is the plan anyway. We’ll see if I can spend it all first!

Well done and thank you. You and your family’s adventures have been a true inspiration for me and my family. You will never know how much your blog has meant to me as I complete my third year of early retirement. The road was not always so easy but with the information you shared here, we smoothed out many of the bumps and uncertainty along our journey. We will be forever in your debt. Happy Holidays and Happy New Year.

Thanks for the kind words! Hope your early retirement continues to go well for you for a long time!

> We manage about two miles around the neighborhood and through the park each morning (other than a few days where it was literally freezing outside…

It has been said that there is no such thing as bad weather – just bad clothing. Get some earmuffs and warm pants and come on out! I write this as I get ready to put on my wet-weather gear for my daily walk down Lake Boone Trail to Windemere Beaver Dam Park. It is supposed to rain ALL day.

@Mike

Adjusting to regular cold weather is easy, but what are your solutions for muddy trails?

We do bundle up but I’ll take 70 degrees with a very light breeze (in the shade) over 28F degrees and a stiff wind and no sun. 🙂 Lately the strategy is to wait till later in the day when the sun is higher in the sky and it’s well above freezing. Not as motivated to head out at 7 am when it’s still dark and frost on the ground!!

@Resis I hike to higher ground! 🙂

Congrats on the 10 years of retirement!

I’m curious if you weren’t laid off to start your retirement, how much longer do you think, you would have worked? Would you have targeted a certain $ amount over your FI number? I know it’s harder to decide to start retirement by a decent paying job than let your employer make that decision for you.

I’ve thought about “how much longer would I have worked” some. My guess is probably 2-3 years. Another year to get a little past my “number” then another 1-2 years of being indecisive about actually quitting. I think it would have been INCREDIBLY difficult for me to pull the plug and quit a perfectly good, well-paying, not particularly demanding job.

I’m facing that dilemma at around 80-90% FI and trying to figure out what’s “next” when likely we hit our number in the next ~18 months. It would obv be much easier if my employer made that decision for me like you but I have a fairly cushy WFH job that’s hard to imagine giving up given that between my wife’s part time hobby job and kids activities, we can’t do the extensive travel that you do even if I was retired, probably 3-4x 7-12 day trips a year max.

I guess I’ll keep padding the portfolio and do some lifestyle inflating until things turn south with the job.

I’d just keep piling the $ away if the job is as cushy as you say. Or consider downshifting to half time role if possible. Or find a new McJob that lets you do WFH half time. Mrs. Root of Good shifted to a roughly 24 hr workweek (for full pay! ha ha) for about six months before quitting completely. Still didn’t eliminate the work-related stress because the job is always there in the background.

Hi, I am your reader far from Asian. Thank you for your sharing, your sharing gave us the strength and courage to step into early retirement. and I can feel the peace and kindness of your family.

Welcome from the other side of the world! 🙂

Look forward to hearing about the cruise. It sounds like an interesting itinerary!

I have a question about your blog income, is this from the ads? Also, what hosting provider do you use and how did you build the site?

Yes, ads. Hosting is a small independent shop that I wouldn’t necessarily recommend (nothing wrong with them, just don’t know much about them after they transferred me to a different subsidiary of theirs). “How to build the site” – that’s a broad question. I learned what I know from reading articles on “how to blog” “how to set up wordpress blogs” and watching a lot of youtube videos. In a nutshell, you buy hosting, register a domain name, set up wordpress, add a “theme” which is what the blog looks like, add plug-ins, tweak, then start writing!

Thank you for sharing. Good work on the kids education and moving up in the world.

Hi Justin, Happy New Year! Long time reader, first time poster. As a fellow NC resident, I was wondering if you can expand on the decision for your daughter to continue her education at ECU. I understand the out of pocket cost is zero at ECU, but with NC State and UNC in your back yard and at 9-10k in-state tuition, I would expect them to be very attractive options. Especially since it would only take 2 years to complete her Bachelors degree. Apprciate any insights you can share.

I agree with this comment. Sending your children to the best possible college that you can afford is important.

Out of pocket at UNC/NC state would be close to zero too I bet. They have even more institutional aid available then ECU.

The problem is getting into the university 🙂 It’s harder than ever to gain admission to UNC/NC State. Not as easy as ~25 years ago when I went to both of those schools. Both kids are still trying for UNC or NC State, so we’ll see what happens this year!

Thank you for the response. That makes sense. I saw 40%-50% acceptance rates for UNC/NC state for in-state freshman class and that doesn’t look crazy competitive. I know UNC strives to have representation across alll NC counties so it’s easier to get in from some areas in NC than others. I guess transferring after completing community college is a different situation than those freshman stats indicate.

Acceptance rates also vary by discipline. And at NC State at least, you have to apply for a specific major. So engineering is 10x more selective compared to, say, English, as a major. I would imagine some engineering disciplines drop below 10-20% acceptance rate for transfer students.

What contributed to the slow down in tradeline sales? Was it lack of availability of AUs or something else? (just starting to do this too)

I believe it’s lack of AU’s buying tradelines. I don’t know if the economy slowed down or what. My theory is that higher interest rates meant fewer people are applying for new credit. Therefore lessened demand for tradelines.

I’m so jealous of your car insurance! Ours is literally in one month what yours is for six months. It’s that high in all of metro Atlanta. We have a 17 y/o son that is $400 a month for liability only on a nineteen year old car. The premium for us is $300 with thirteen and ten year old vehicles.

Wow! I know ours is pretty cheap. I was honestly shocked at how cheap it was when I added our oldest daughter 1.5 years ago. I think insurance on me when I was a teen was probably 2x or more what we pay for our kids now (and adjusting the 1990’s insurance rates up for inflation it would be more like 5x the cost!!).